截至东部时间4月15日下午4:50,全球加密货币市场总市值收缩了1.07%,降至2.65万亿美元。比特币在当天早些时候触及86,450美元的日内高点后,回落了约0.8%。以太坊(ETH)紧随其后,下降了1.16%,而卡尔达诺(ADA)在前十名加密货币中录得最大跌幅,兑美元下跌了2.64%。

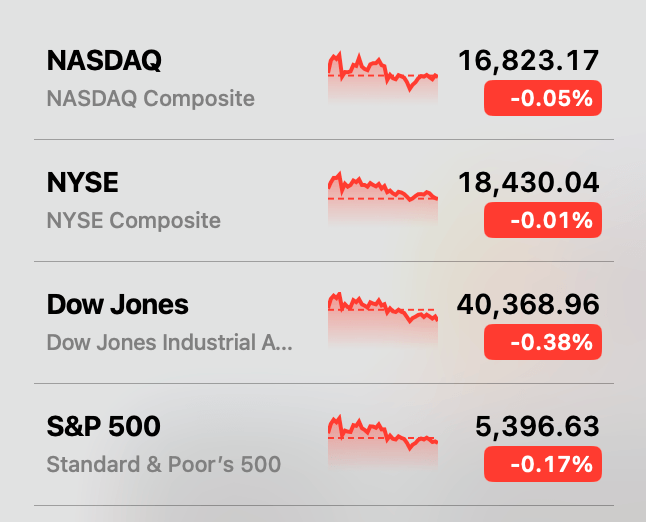

股市小幅下跌,主要指数的跌幅在0.05%到0.38%之间。花旗集团和美国银行的季度报告已发布,但两者均附带了对美国经济状况的警示。美国银行首席执行官布莱恩·莫伊尼汉表示:“鉴于未来经济路径上关税和其他政策的不确定性,有很多事情可能会发生变化。”

在加密衍生品市场,市场下行导致总计1.7672亿美元的清算,数据来自coinglass.com。其中,约1.0586亿美元来自多头头寸,仅比特币多头就占了1865万美元。MANTRA的OM成为当天表现最佳的加密货币,因该项目在周末的事件后上涨了23%。

Toncoin(TON)紧随其后,尽管涨幅较为温和,达到了3.67%。相反,PI在过去24小时内录得最大跌幅,下降了10%。相比之下,黄金上涨了0.60%,目前一盎司交易价格为3,229美元。周二的活动描绘了传统市场和数字市场的谨慎情绪,即使是适度的收益和宏观经济的不安也能迅速波及各类资产。

随着交易者消化新数据,清算扰乱了投机性押注,今天的涨跌互现表明市场在不确定性中仍在寻找信心。在特朗普的关税时代,波动性似乎仍然是目前唯一的常态。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。