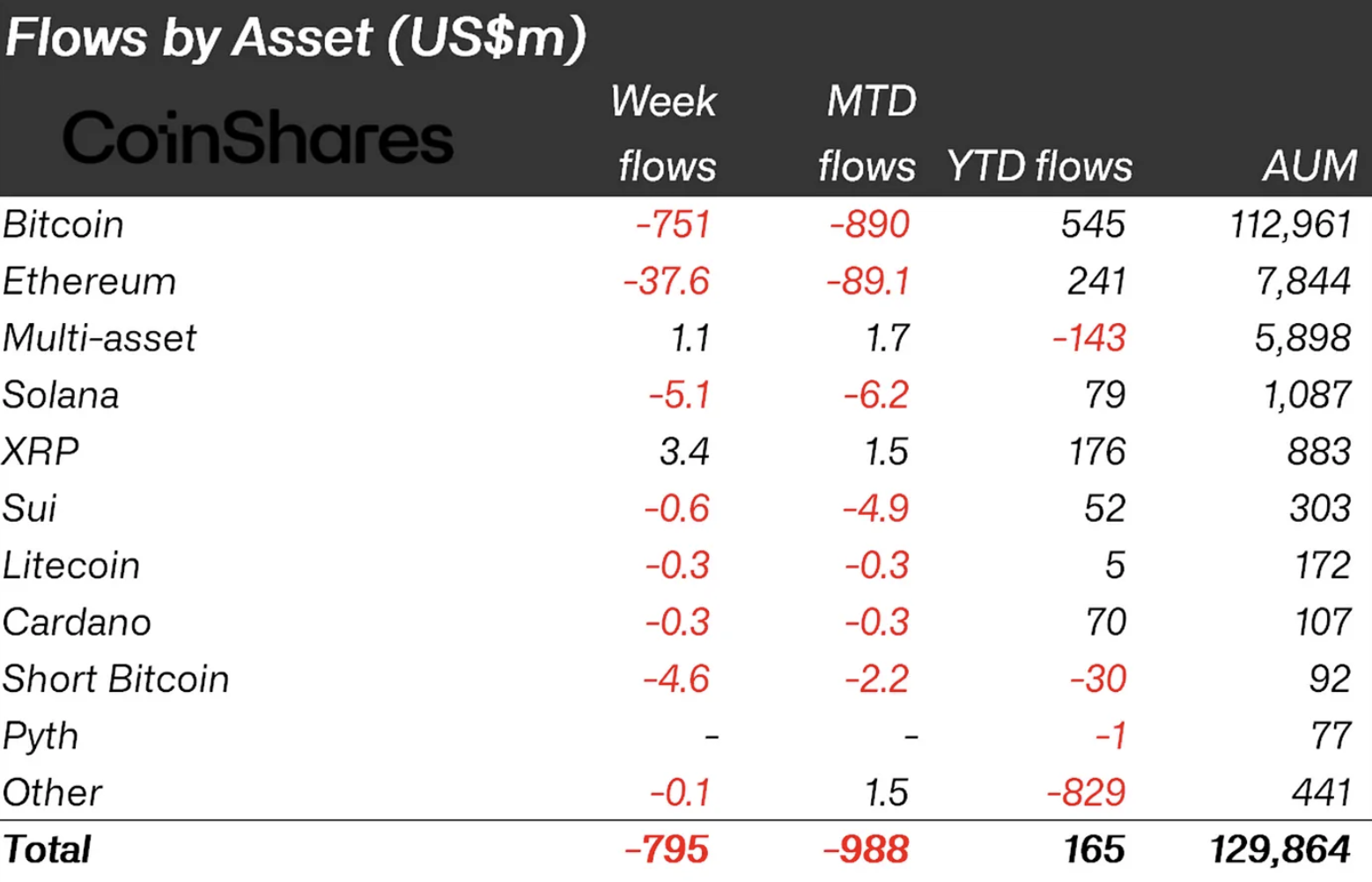

尽管数字资产投资领域连续第三周失去资本,流出金额达到7.95亿美元,使得本月迄今的流出总额接近十亿美元,但仍有一些资产成功逆势而上——在这份短名单的最上方是XRP,它吸引了340万美元的流入,而几乎所有其他资产都在流出。

这种分歧通常不会如此明显,尤其是在像本周这样负面情绪几乎无处不在的情况下。

相关  2025年4月14日 - 08:53 XRP:死亡交叉会发生吗?

2025年4月14日 - 08:53 XRP:死亡交叉会发生吗?  Arman Shirinyan

Arman Shirinyan

热门故事 突发:策略宣布大规模比特币购买 亿万富翁雷·达里奥发出不祥警告,比特币重回8.5万美元 瑞波支持者Kitao接近富士董事会席位 柴犬币(SHIB)仍然可以增加零,XRP超过2美元:但这还不够,比特币(BTC)死亡交叉被取消?

各国的资金流出都在下降,各大提供商的资金流出也在下降,几乎所有主要资产都在下降,只有少数小型山寨币例外——但XRP不仅避免了损失,还在净流入方面领先所有非比特币代币,正如CoinShares所报道的那样。

来源:CoinShares

在美国仅从加密ETP中撤出7.63亿美元的这一周,这一表现尤为突出。

相关  2025年4月14日 - 00:01 柴犬币(SHIB)仍然可以增加零,XRP超过2美元:但这还不够,比特币(BTC)死亡交叉被取消?

2025年4月14日 - 00:01 柴犬币(SHIB)仍然可以增加零,XRP超过2美元:但这还不够,比特币(BTC)死亡交叉被取消?  Arman Shirinyan

Arman Shirinyan

更大的市场叙事变化不大。自2月初流出开始加速以来,该领域已撤出72亿美元,这几乎抹去了年初以来的所有净收益,使得年初至今的资金流入仅为1.65亿美元。

相关  2025年4月13日 - 14:49 XRP价格上涨面临多头的关键考验:详情

2025年4月13日 - 14:49 XRP价格上涨面临多头的关键考验:详情  Tomiwabold Olajide

Tomiwabold Olajide

比特币 (BTC) 再次承受了最大的压力,流出金额达到7.51亿美元,其次是以太坊,流出金额为3760万美元。索拉纳 (SOL)、Sui 和莱特币的表现也不佳,均出现亏损,甚至做空比特币的资金也出现流出——这表明看跌押注也在被解除。

相关  2025年4月14日 - 09:30 令人担忧的新比特币 (BTC) 模式暗示反弹可能是虚假的

2025年4月14日 - 09:30 令人担忧的新比特币 (BTC) 模式暗示反弹可能是虚假的  Gamza Khanzadaev

Gamza Khanzadaev

尽管面临压力,管理下的资产总额实际上有所上升——这并不是由于资金流入,而是由于在临时关税回撤后,市场获得了一些喘息空间,价格在周末前回升,使总额回升至1300亿美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。