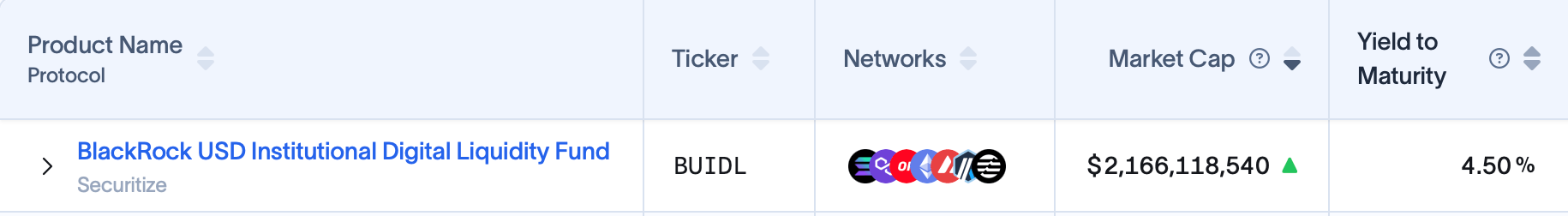

代币化国债在过去一周内增长迅猛,根据rwa.xyz截至2025年4月10日的指标,市场总额达到了54.9亿美元,比上周增长了8.7%。黑石集团的美元机构数字流动性基金(BUIDL)已突破20亿美元,今天的市值为21.66亿美元。

自2025年4月4日以来,BUIDL增长了11.13%。

在4月4日,黑石的BUIDL市值为19.49亿美元,但在几天内,BUIDL的估值飙升了11.13%——这证明了其在代币化金融中的吸引力。然而,Franklin Onchain的BENJI在同一时期内从7.08亿美元小幅下降至7.06亿美元,反映出需求的短暂波动。

Ondo的USDY基金从5.85亿美元小幅上升至5.86亿美元,与BUIDL相比增幅微小。Hashnote的USYC面临更大的压力,自4月4日以来从6.27亿美元收缩至5.57亿美元,下降了11.18%。与此同时,像Janus Henderson的JTRSY和Openeden的TBILL Vault等小众竞争者则逆势上升,其走势与BENJI和USYC的降温趋势形成鲜明对比。

这种重新配置标志着投资者优先事项的转变:区块链驱动的机制吸引传统金融工具,以其灵活性和吸引力。到4月10日,rwa.xyz的数据显示,大约有17,628名投资者在代币化国债中进行了投资,吸引他们的是平均年到期收益率为4.36%——这一数字在这个动荡的领域中低语着稳定性。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。