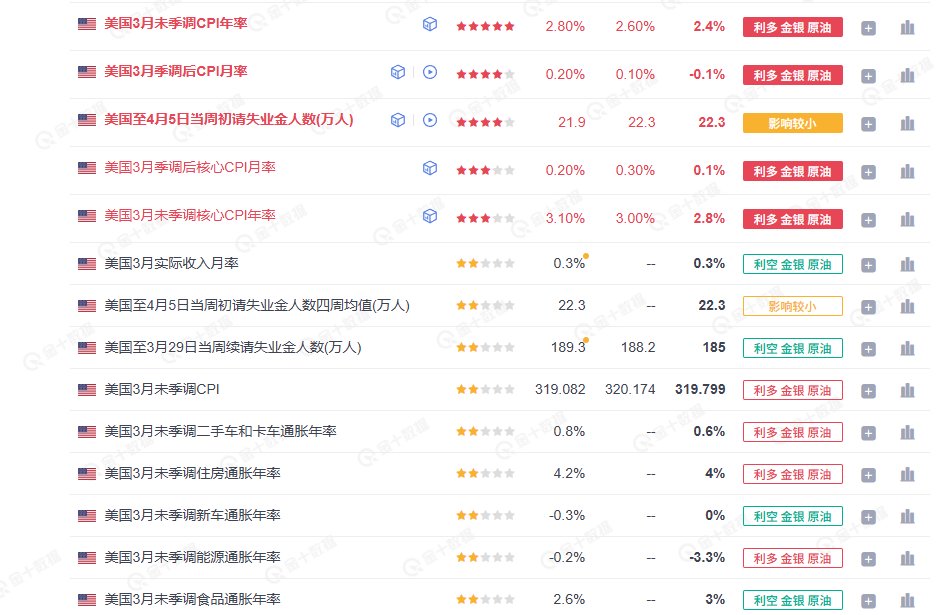

今天的 CPI 数据有点一言难尽了,首先整体通胀都是下行的这是好事,包括名义 CPI (CPI年率)或者是核心 CPI 都是下降的,说明了即便是在叠加中国 20% 关税的情况下,美国的通胀是已经获得控制了,或者可以说如果没有外界干扰美联储是能看到通胀回到 2% 的路径。

但是 CPI 的月率竟然变成了负值,就说明了通胀变成了通缩,这个数据就不是很友善了,因为当通缩发生的时候,一般都意味着购买力下降,需求不足,通常伴随着就业走弱、库存上升、制造业萎缩等情况,说人话,通缩代表的就是经济出现了下行的情况。

而且对于美联储来说,通缩比通胀还可怕,因为通缩就意味着债务负担加重,资产价格下行以及投资与就业全面收缩。

所以市场加大了对六月降息的预期,也相当于加大了对美国经济下行的预期,所以风险市场都出现了下跌。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。