作者:Frank,PANews

作为以太坊Layer2扩容方案的领军者,ArbitrumDAO被寄予厚望,不仅在于其技术实力,更在于其庞大且活跃的去中心化自治组织(DAO)。通过ARB代币持有者的集体智慧,引领协议走向更广阔的未来。然而,近期一场围绕DAO成员选举的风波,却将一个长期潜藏在DeFi治理深水区的“幽灵”——投票贿选(投票市场)推至台前。

事件的核心在于,一个名为LobbyFinance(LobbyFi)的平台,使得用户能以极低的成本(仅5ETH,约合1万美元)获取了价值高达650万美元的ARB代币投票权,并成功影响了一次关键的委员会成员选举结果。这一事件犹如打开了潘多拉魔盒,不仅暴露了“一枚代币一票”治理模式的脆弱性,更引发了对DAO治理合法性、安全性和未来走向的深刻担忧。这究竟是一次孤立的“黑天鹅”事件,还是预示着DAO治理模式系统性危机的冰山一角?

5 ETH撬动650万美元投票权,选举风波背后的资本“幽灵”

2025年4月初,ArbitrumDAO正在为其新设立的监督与透明度委员会(OversightandTransparencyCommittee,下称OAT)进行成员选举。这场看似寻常的社区治理活动,却因一笔“小额”交易掀起了轩然大波。

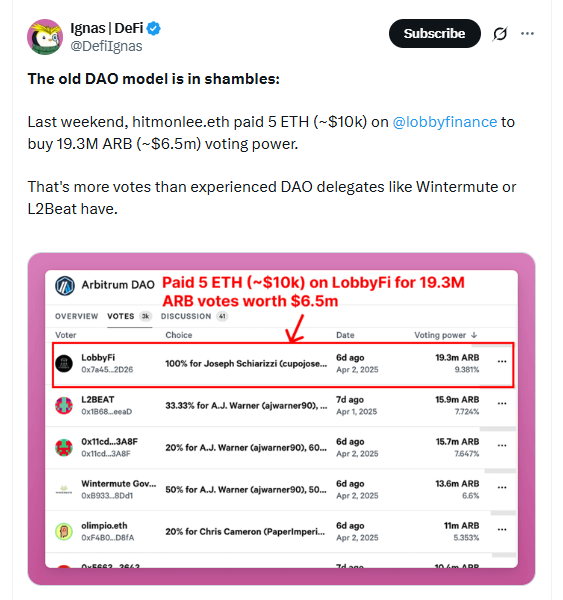

据DeFi研究员@DefiIgnas披露,一个名为hitmonlee.eth的地址通过LobbyFi平台,花费了5 ETH(当时约值1万美元),购买了多达1930万枚ARB代币的投票权。这1930万枚ARB代币,按当时市价计算,总价值约650万美元。更令人咋舌的是,这笔购买来的投票权数量,甚至超过了Wintermute、L2Beat等在ArbitrumDAO中深耕已久、拥有大量社区委托的老牌知名代表所掌握的票数。

hitmonlee.eth并没有将这些选票分散投出,而是将其全部投给了OAT委员会候选人之一JosephSchiarizzi,一位DeFi领域的开发者和专家。这笔巨额选票的注入,对选举结果产生了决定性影响,最终帮助Schiarizzi成功当选OAT委员会成员。

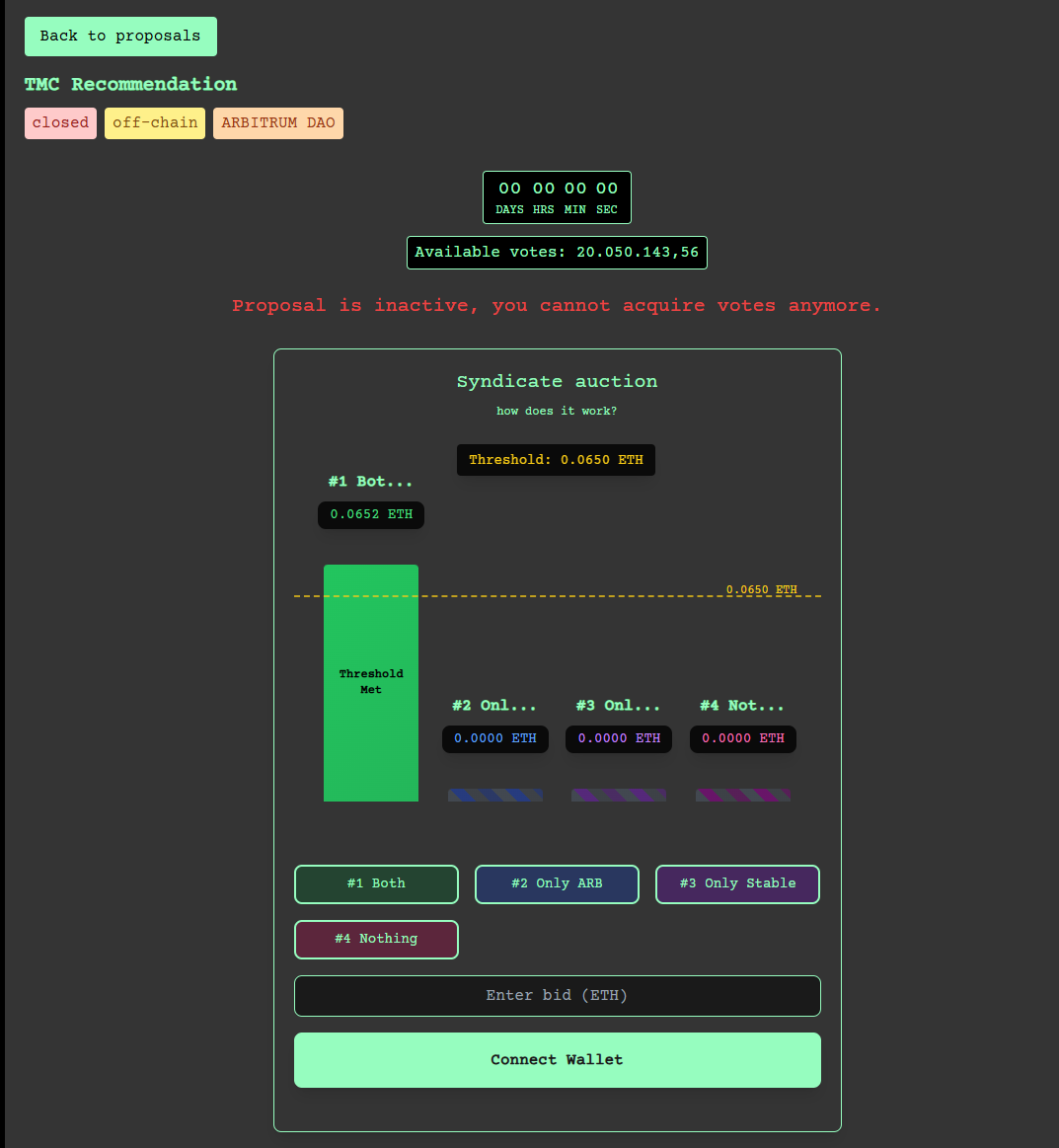

此次事件的核心推手是LobbyFinance(LobbyFi)。LobbyFi的定位是一个治理影响力平台,或者更直白地说,一个“投票权租赁市场”。其运作模式是持币这可以将代币投票权委托给LobbyFi,以此来获得一定的出租汇报。投票权的销售可以通过拍卖形式进行,价高者得;也可以通过平台设定的固定价格(“即时购买”)进行。

在Arbitrum OAT选举案例中,hitmonlee.eth正是利用了5ETH的“即时购买”选项。LobbyFi声称其运作是透明的,会披露可供购买的提案投票权及其价格,并给予市场反应时间。然而,这种机制的本质是将治理权力商品化,允许短期资本以远低于直接购买等量代币的成本,来获取巨大的治理影响力。

选举风波背后的经济动机

此次事件之所以引发巨大争议,还在于其背后失衡的经济激励。OAT委员会成员的职位并非虚名,而是伴随着实际的经济回报。据估算,该职位在12个月任期内可获得约47.1ETH的报酬(约合每月7500美元),外加可能高达10万ARB的奖金(按当时价格约18.7ETH),总潜在收益约为66ETH。

这意味着,hitmonlee.eth仅花费5 ETH的成本,就可能帮助其支持的候选人获得了潜在价值高达66ETH的职位。这种巨大的利益差,无疑为投票购买行为提供了强大的经济动机。

最终受益者@CupOJoseph本人也公开承认,当前的投票购买“定价过低且风险很大”,认为“从DAO中获取1万美元不应该只花费1千美元”。这番言论,看似撇清了自身参与贿选的嫌疑,但也从侧面印证了当前体系存在的漏洞。

这并非LobbyFi上唯一的低价交易。据@DefiIgnas爆料,此前曾有2010万ARB的选票以不到0.07ETH(当时价值低于150美元)的价格被购买。如此低廉的影响力成本,使得DAO治理的大门似乎正向着资本敞开。

官方讨论提案社区意见不一,DAO治理或已被监管关注

Arbitrum的投票风波在社区内引发了轩然大波,也迫使Arbitrum基金会和DAO成员开始正视投票市场带来的挑战,并积极寻求应对之策。

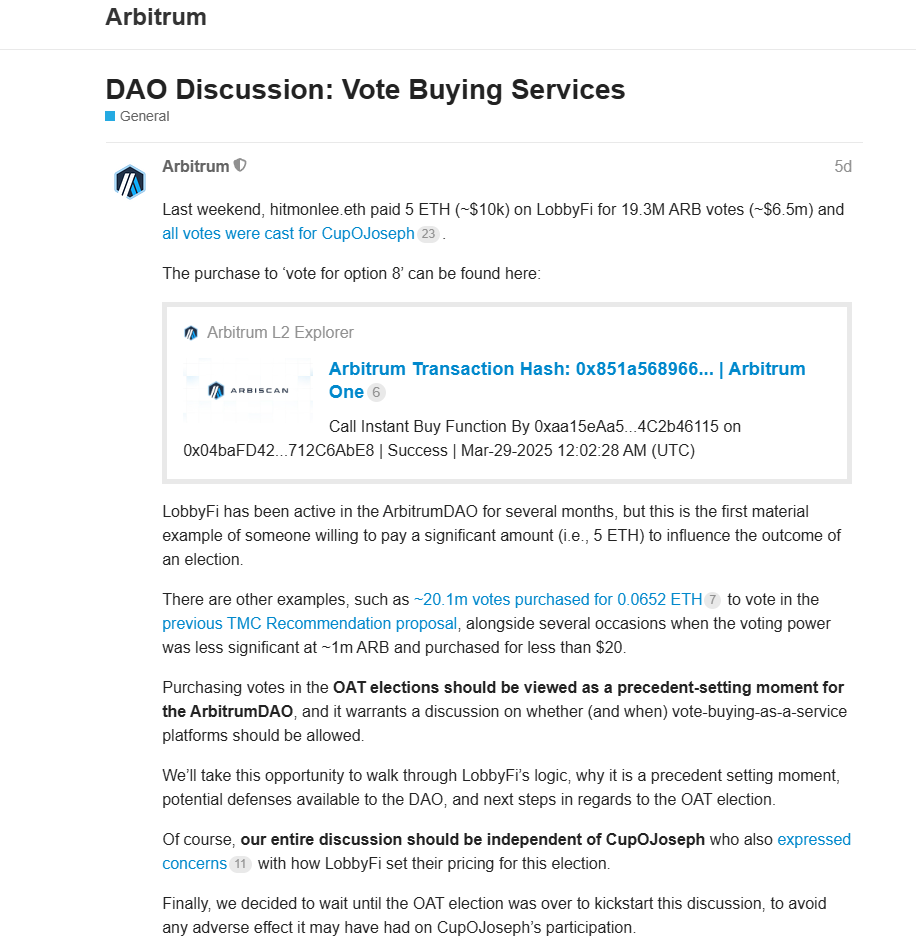

事件发生后,Arbitrum基金会迅速在官方治理论坛上发起了题为“DAO讨论:投票购买服务”的公开讨论。基金会承认这是一个“开创性时刻”,但并未立即采取单方面禁止的强硬措施,而是选择将问题抛给社区,依旧希望通过集体讨论找到前进的方向。

根据新提案的内容,LobbyFi已在ArbitrumDAO中活跃了几个月,但这是首次有人愿意花钱影响选举结果的案例。

社区内部的观点呈现明显分化,少数强硬派主张对投票购买采取零容忍态度,提议直接取消或忽略被识别为购买的选票。

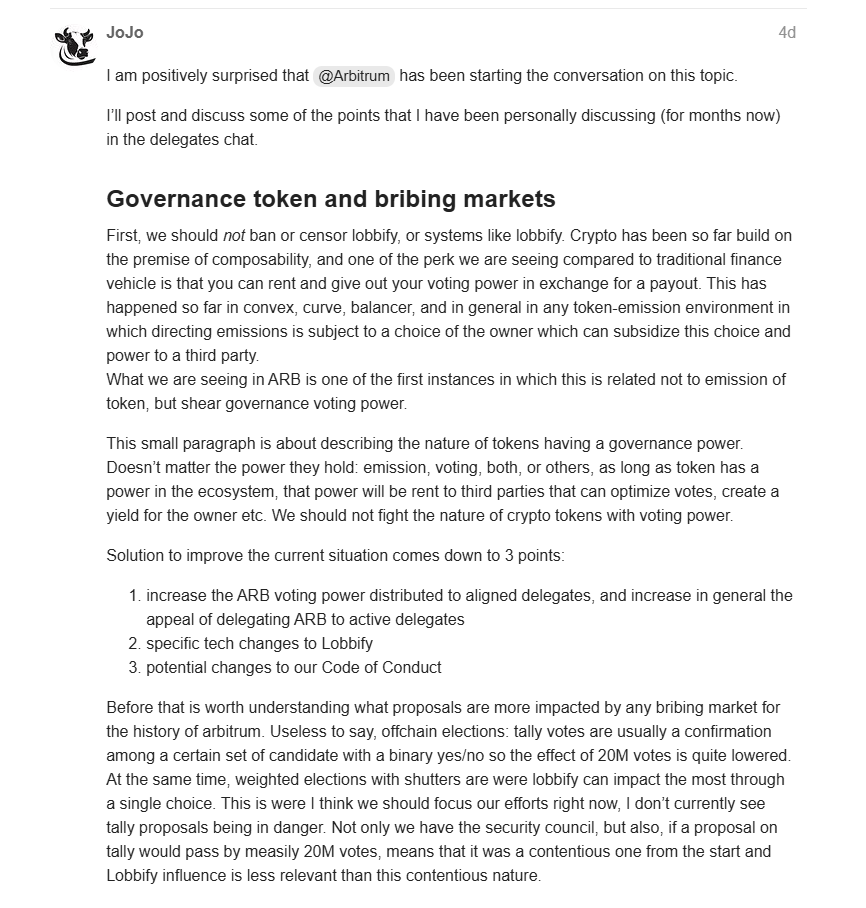

还有一些观点认为,在代币加权治理体系下,投票购买是市场力量的体现,难以完全禁止,强行禁止只会将其逼入更隐蔽的角落。他们认为,像LobbyFi这样的平台,至少提供了一定的可追溯性,可能优于无法追踪的私下交易。甚至有人认为LobbyFi激活了原本沉睡的投票权,增加了整体参与度。

更多讨论聚焦于如何从根本上解决问题。核心思路是降低投票购买的吸引力,同时提升“诚实”治理参与的回报。

值得注意的是,DAO治理的乱象和漏洞也可能引来监管机构的关注。根据Katten的一份报告显示,美国SEC和CFTC等机构已经开始对DeFi和DAO进行审查。SEC在其2017年关于“TheDAO”的调查报告中就明确指出,某些DAO发行的代币可能被视为证券。CFTC对OokiDAO的诉讼案中,法院裁定DAO可以作为“非法人协会”承担法律责任,甚至暗示投票的代币持有者可能需要承担连带责任。SEC对MangoMarkets案的调查也首次将目光聚焦于治理代币本身。如果DAO治理被普遍认为易受操纵且缺乏有效控制,无疑会增加其被纳入现有金融监管框架的风险,甚至可能影响治理代币的法律定性。

潘多拉魔盒已开?DAO治理沦为资本猎场

Arbitrum的投票风波并非孤例,它揭示的是DeFi领域DAO治理普遍面临的深层危机。LobbyFi等投票市场的兴起,正将“一枚代币一票”这一DAO治理基石的内在矛盾暴露无遗。

DAO的核心理念是去中心化和社区自治。理想状态下,决策应基于社区成员对协议的理解和长远利益的考量。然而,投票市场的出现,使得治理影响力可以直接用金钱购买,决策的天平开始向资本倾斜。

更极端的案例是BuildFinanceDAO的“政变”:2022年2月9日,一名用户通过在公开市场购买足够的BUILD代币,获得了DAO的控制权,随后通过提案赋予自己铸造新币和控制金库的权力,最终卷走了约47万美元的资产,并使原有代币价值归零。

2022年,BeanstalkFarms则遭遇了闪电贷攻击,攻击者在单个区块内借入大量治理代币,通过紧急提案,掠走了1.82亿美元的储备金。这些案例都凸显了DAO治理机制的脆弱性,而投票市场无疑为潜在攻击者提供了更便捷、更经济的“武器”。

ArbitrumDAO的投票风波,如同一面棱镜,折射出当前DAO治理模式在效率、公平与安全之间艰难寻求平衡的困境。“一枚代币一票”的简洁性背后,是资本对去中心化理想的潜在侵蚀。LobbyFi等投票市场的出现,是市场自发寻求效率和收益的产物,但也确实为治理操纵打开了方便之门,带来了严峻的挑战。

目前来看,没有一劳永逸的解决方案。彻底禁止投票市场可能难以执行,且可能将问题推向更隐蔽的角落,完全放任自由市场则可能导致DAO沦为资本的游戏。这场风波对所有DAO参与者敲响了警钟:去中心化治理并非一蹴而就的乌托邦,它是一个需要持续设计、迭代和博弈的复杂系统。如何在保持开放、无需许可的Web3精神的同时,构建起足够健壮、能够抵御资本侵蚀和恶意攻击的治理护城河,将是未来一段时间内整个DeFi领域必须面对和解答的核心命题。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。