原创|Odaily星球日报(@OdailyChina)

作者|Wenser(@wenser2010)

3月底,据Fortune消息称,稳定币发行商 Circle 已聘请投行启动 IPO 筹备工作,计划于 4 月下旬向 SEC 公开递交上市申请;4月1日,Circle 正式向美国 SEC 提交了 S-1招股说明书,计划以 CRCL 股票代码登陆纽交所。正在市场认为此举或许意味着,“特朗普上台后的加密 IPO 第一股”再无悬念之时,短短数天之后,随着特朗普关税贸易战的正式打响,有市场消息称 Circle 将推迟 IPO 进程。由此,在特朗普上台立志建立加密友好政府之后的加密 IPO最终花落谁家,悬念仍在继续。

Odaily星球日报将于本文结合稳定币市场现状、美国加密监管趋势以及Circle 估值体系与其他潜在IPO加密项目予以对比分析。

悬念一:Circle 能否夺得“首个稳定币概念股”桂冠?

先说结论,Circle 大概率能够夺得“首个稳定币概念股”的桂冠的。

理由如下:

1.主要竞争对手无意采取“上市 IPO 发展路线”。此前,在 Circle 提交 IPO 申请招股书后,USDT 背后发行商 Tether 首席执行官 Paolo Ardoino 发文称,Tether 不需要上市。(Odaily星球日报注:值得一提的是,Paolo 的推文配图为其本人与华尔街铜牛的合照,颇有些“我不需要去找华尔街投行们聊上市,而是华尔街投行们需要我”的强势意味)

Tether CEO 的霸气发言

2.Circle 稳居稳定币发行商第二席位。根据 Coingecko 网站信息,USDC 目前市值高达601.4亿美元,仅次于市值高达 1440亿美元的 USDT,排名加密货币行业市值第6位。

3.Circle 的合规体系完善,堪称“最为合规的稳定币发行商”。据了解,Circle 在美国注册为货币服务业务(MSB),并遵守《银行保密法》(BSA)等相关法规;其在美国 49 个州、波多黎各和哥伦比亚特区拥有货币传输许可证;2023 年,Circle 获得新加坡金融管理局(MAS)颁发的主要支付机构许可证,允许其在新加坡运营;2024 年,Circle 获得法国审慎监管和决议管理局(ACPR)颁发的电子货币机构(EMI)许可证,使其能够根据欧盟《加密资产市场监管》(MiCA)法规在欧洲发行 USDC 和 EURC。可以说,USDC 是为数不多的在美国、欧洲乃至亚洲地区都采取合规运营的稳定币之一。

因此,按照目前的 IPO 申请文件提交进度以及 USDC 的市场地位、其他竞争对手表现态度而言,对于“首个稳定币概念股”,Circle 应该势在必得。

下一个问题是:Circle 主营业务是否能成为 IPO 后的市值支撑?答案还需要从 Circle的 IPO 招股书中寻找。

悬念二:Circle 的 USDC 稳定币是一门稳赚不赔的好生意吗?

同样先说结论,目前来看,Circle 的运营状况并不是特别乐观。

此前,我们曾在《“第一稳定币”USDT市值创新高,揭秘Tether背后的千亿商业帝国》一文中对稳定币赛道霸主 Tether 的具体情况及商业模式进行了详细分析;在《7大加密吸金机器盘点:年利润140亿美元,它才是加密世界终极“税官”》一文中,我们也对 Tether 这一年利润近140亿美元、员工数不足200人的“吸金机器”进行了人效比分析,Tether 的“高利润、小团队”使其荣登榜首。

但 Circle 的 IPO 招股书显示,其经营状况显然与 Tether 存在较大差距:

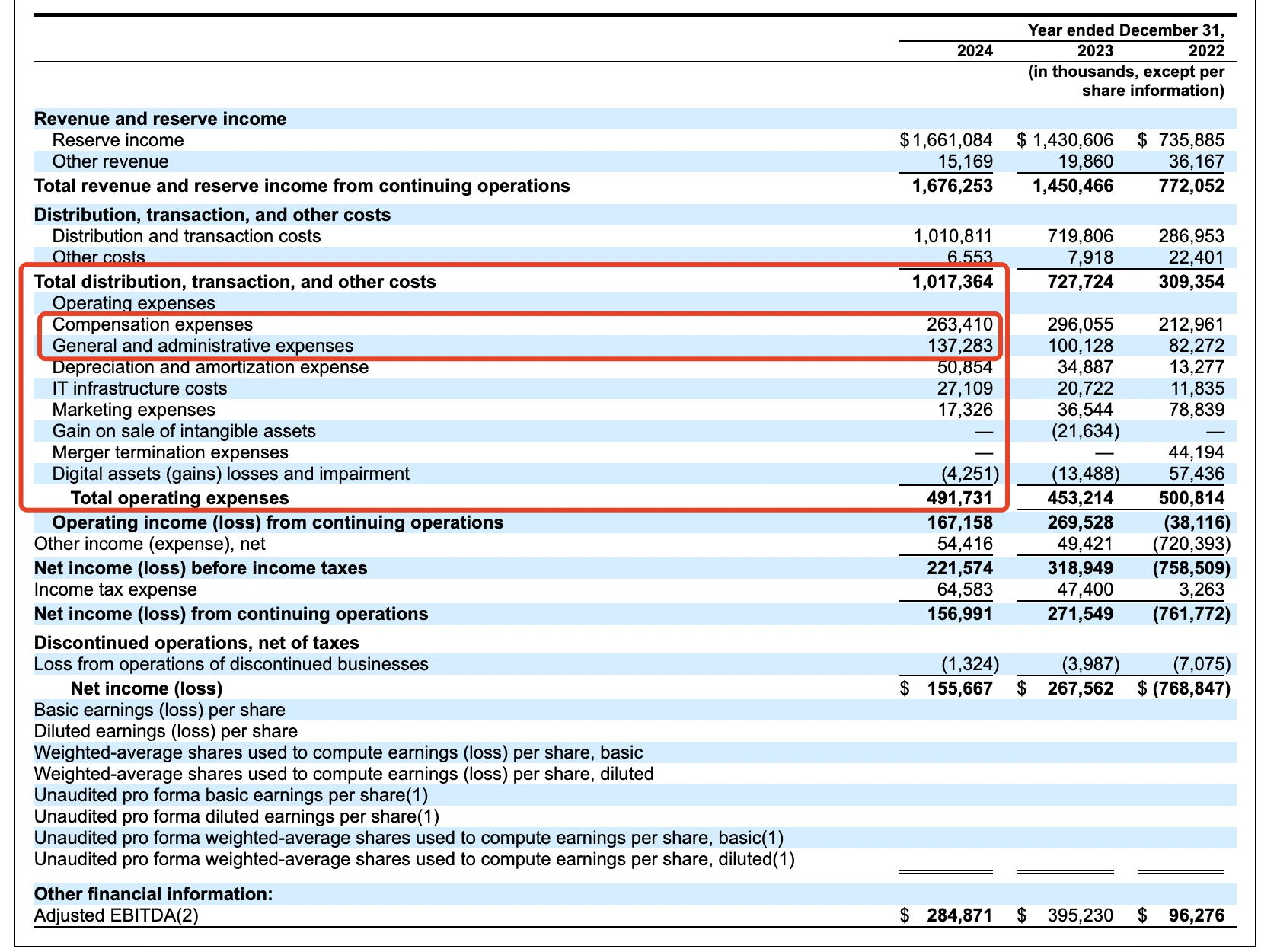

具体营收方面:2024 年,Circle 报告收入为 16.8 亿美元,高于前一年的 14.5 亿美元,同比增长 16.5%;然而,其净利润从 2.68 亿美元下降至 1.56 亿美元,同比下降 42%。部分原因是支付给合作伙伴的 9.08 亿美元的分销成本(包括 Coinbase、Binance)。

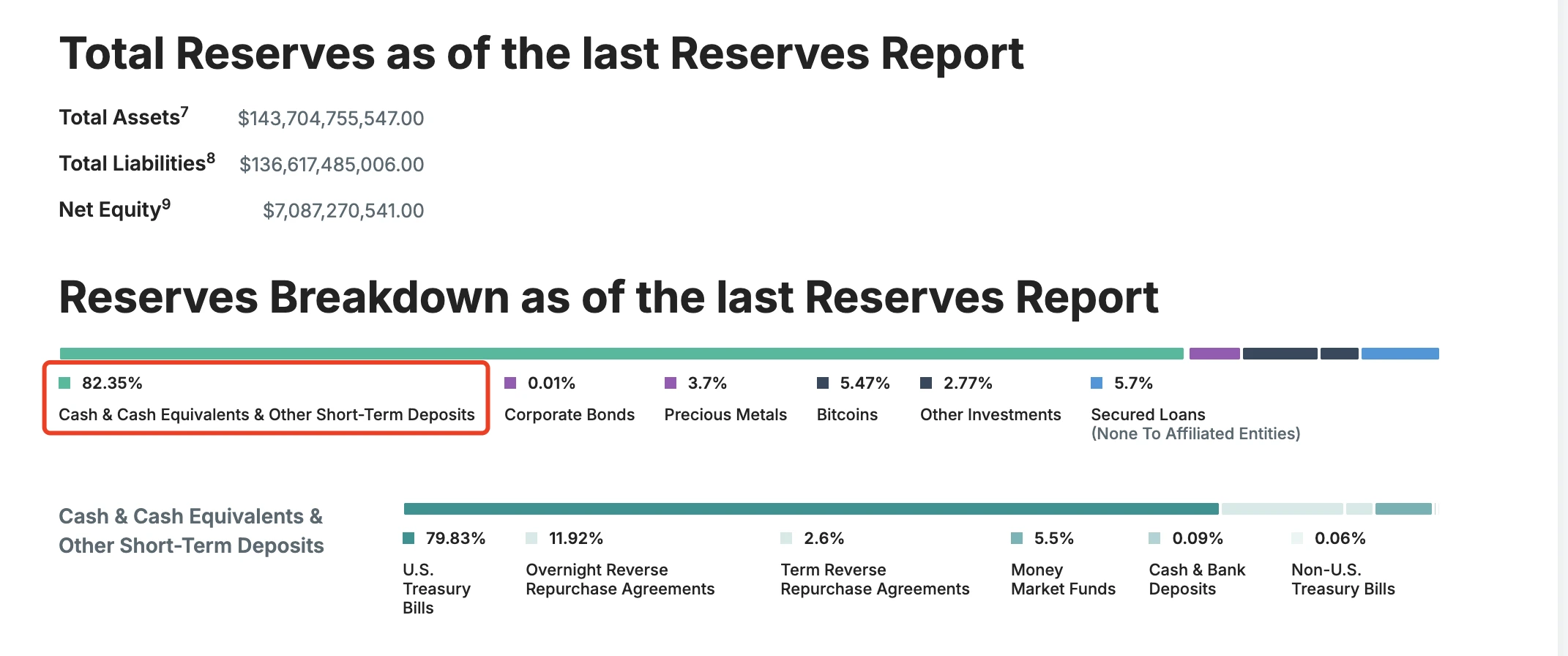

储备资金方面:USDC 的储备金约 85% 投资于美国国债(由BlackRock的 CircleReserveFund 管理),约 20% 存放于美国银行系统的现金存款;与之相比,USDT 的储备金更为多元化,其中还包括 5.47%的 BTC。

管理人员成本方面:根据招股书信息,Circle 每年花费超2.6亿美元的员工薪酬以及接近1.4亿美元的行政费用;折旧和摊销费用 高达 5085万美元,IT 基础设施费用也高达 2710万美元,市场营销费用为1732万美元左右。不得不说,Circle 在支出这方面的名目远复杂于 Tether。

Circle 近三年经营数据

此外,值得注意的是,Circle 的收入来源远不及 Tether,其 99%的收入来自储备利息,约为16.61亿美元;其交易费和其他收入仅为1516.9万美元。

换言之,现阶段,Circle 做的是“存款吃利息”的生意,而非如同 Tether 那样能够“一样业务吃两头”——既能够赚取储备生息收益,又能够借助资金赎回收取对应服务手续费。要知道,跨境支付的市场规模高达 150万亿美元,而现在,这块市场主要由更为去中心化、更不受监管钳制的 USDT 占据。

与之相对的是,Circle 目前仍然受到 Coinbase、Binance 这些“合作伙伴”的钳制。

悬念三:与 Coinbase 的暧昧关系是否还会继续?

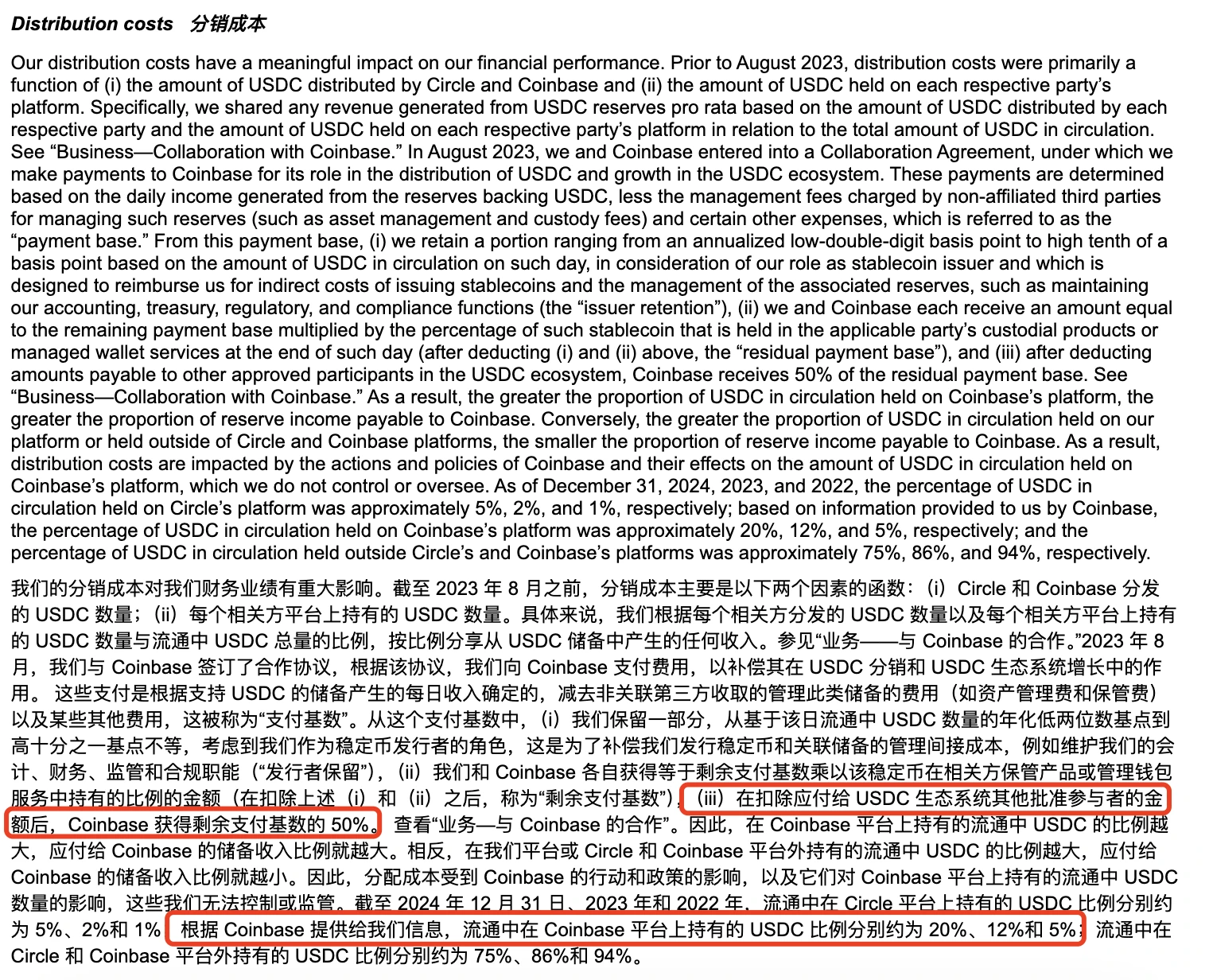

Circle 背后公司全称为 Circle Internet Financial, Inc.,最初由 Jeremy Allaire 和 Sean Neville 于 2013 年创立;USDC 的治理由 Circle 和 Coinbase 共同成立的 Centre Consortium 管理。然而,随着监管环境的变化,2023 年 8 月,Circle 花费 2.1亿美元股票收购了 Centre Consortium 中 Coinbase 的对应股份,全面接管了 USDC 的发行和治理,但二者50%:50%的分成协议仍然延续至今。

Circle 招股书中分销成本信息

2024年,Circle 向 Coinbase 支付的 9.08亿美元的分销成本中,根据 Coinbase 此前发布的 10-K 表格年报来看,其中 2.24亿美元以质押收益的形式奖励给了用户 (持有 USDC 可获得 4.5% 的收益,此前曾有用户反馈APY甚至高达12%左右),剩下约 6.86亿美元归属于 Coinbase 本公司。

@0x_Todd 领取到的真实收益及对应界面

目前来看,此举或许可以理解为 Circle 与 Coinbase 为了扩大 USDC 流通市值及市场占有率采用的“阳谋”——话又说回来,如此高的稳定币生息利率,也让人很难不怀疑,Coinbase 与 Circle 是否是为了给 IPO 做铺垫,不得已而为之,为市场散户上演了一出“高息揽储”的戏码。

此外,享受 Circle 高昂的分发福利的不止 Coinbase 一家,Binance 也在列。

招股书信息显示,2024 年 11 月,币安成为 Circle 稳定币生态系统协议下的首个获批参与者。根据合作协议,币安需在其平台上推广 USDC,并在财政储备中持有一定数量的 USDC;Circle 向币安支付 6025 万美元的一次性预付费用,并同意按币安持有的 USDC 余额支付月度激励费。激励费仅在币安持有至少 15 亿枚 USDC 时支付,同时币安承诺持有 30 亿枚 USDC(特定情况下可例外)。该合作分为市场推广和财政储备两部分,均为两年期。若币安提前终止市场推广协议,仍需履行一年的降低费率付款和推广义务。双方可在特定情况下提前终止协议。

看得出来,在拉拢盟友扩大市场基本盘方面,Circle 深谙高举高打的要义。

此外,近一年以内,Circle 在 Solana、Base 生态也动作频频,仅在 Solana 生态,据 Odaily星球日报不完全统计,2025年以来已累计发行超32.5亿枚 USDC,共计13次,单次发行量多达 2.5亿枚。

不完全统计

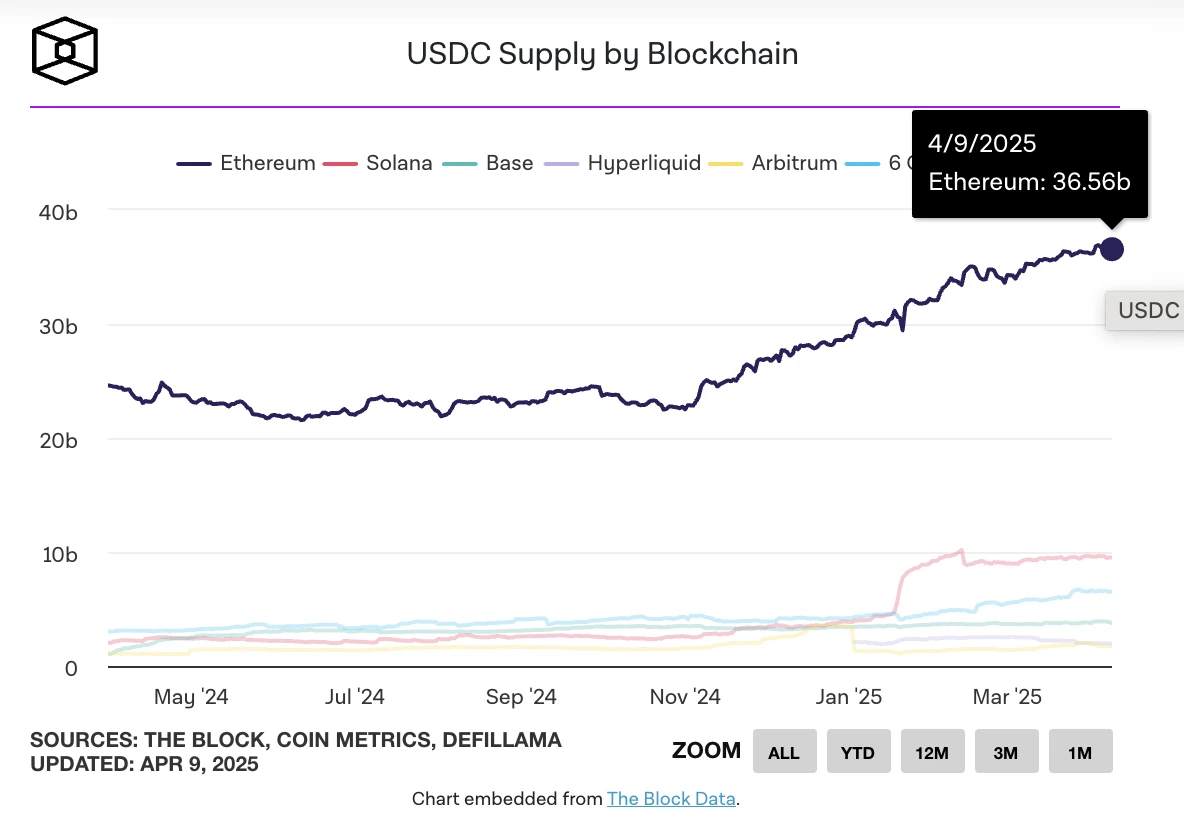

3月26日,USDC 链上发行量突破 600亿美元之际,据 TheBlock 统计,其中:

以太坊发行量约为 360 亿枚;

Solana 约 100 亿枚;

Base 约 37 亿枚;

Hyperliquid 约 22 亿枚;

Arbitrum 约 18 亿枚;

Berachain 约 10 亿枚。

TheBlock 统计 USDC 各链发行量

截至目前,USDC 流通量保持在 600亿美元左右,根据 DefiLlama 数据,目前稳定币总市值约为 2335.35亿美元,7日降幅约为 0.58%;USDC 市场占有率约为 26%。

由此,我们可以阶段性地得出结论:Circle 的后续发展仍然离不开 Coinbase 的支持,同样,其或许仍将继续向 Coinbase “上供” 50% 左右的分发收入。

悬念四:Circle 是否会受到美稳定币监管法案影响?

在招股书中,Circle 提到了潜在的监管立法方面的风险,如美国监管机构或立法要求发行资金量超100亿美元的稳定币发行商必须是银行或与银行有附属关系。

招股书风险披露部分信息

根据现有信息来看,美国稳定币监管法案最新相关进度如下:

2025 年 2 月,美参议员 Bill Hagerty 等人提出了《美国稳定币国家创新指导与建立法案》(GENIUS Act),旨在为支付型稳定币建立联邦监管框架。该法案规定,市值超过 100 亿美元的稳定币发行商将受联邦储备委员会(FED)的监管,而较小的发行商可选择在州级监管下运营;所有发行商必须以高质量的流动性资产(如美元、国债)1:1 支持其稳定币发行,禁止算法稳定币的发行。

同一时间,美众议员 Maxine Waters 提出了《稳定币透明度与问责制以促进更好的分类账经济法案》(STABLE Act),要求所有稳定币发行商必须获得联邦许可,并由美联储进行监督;该法案强调消费者保护,要求发行商持有与发行量等值的储备资产,并遵守反洗钱(AML)和KYC规定。

作为稳定币合规标兵,Circle 在这方面做出必要的风险披露理所应当。而尽管此前有消息称“Tether 正与美国立法者合作以影响美国对法定货币的监管方式”,但 Circle 在 Coinbase、BlackRock 等盟友的照拂之下,应对监管压力应该问题不大。

所以,这方面的风险处于相对可控范围。

悬念五:Circle 估值几何?

尽管 Circle 的 S-1 文件中并未给出具体的 IPO 募资价格,但根据二级市场交易来看,目前其估值约为 40-50亿美元左右,股权结构分为 A 类(1 票/股)、B 类(5 票/股,上限 30%)和 C 类(无投票权),创始人保留控制权。上市还将为早期投资者和员工提供流动性。

相较此前上一轮融资时 90亿美元的高点估值,受限于稳定币市占率以及近期市场行情的下跌,该数据已经腰斩,但仍有一定盈利空间。

与之相比,Coinbase 今日股价暂报 151.47美元,市值暂报 384.55亿美元;相当于 Circle 的8-9倍左右。

此外,由于特朗普政府掀起的关税贸易战,美联储降息预期或许影响 Circle 的营收,这一点也应当考虑在内。

后续 Circle 的多元化业务能否支撑起对应估值,仍然有待时间验证。

笔者个人认为,相较于使用场景更为灵活的 USDT,USDC 只有与美国银行相关业务结合才能迎来更大的发展空间。此前美国银行Custodia Bank 和 Vantage Bank 曾于以太坊网络联合发行了首个基于无需许可区块链的美国银行支持的稳定币 Avit,此举或许昭示着下一轮稳定币竞争的日益白热化。

Circle 如果想要确保自己的“稳定币老二”的地位,或许还需要学习借鉴 Tether 在 BTC储备、赎回手续费等方面的创收经验。

最后,提一个Circle IPO 招股书中的“彩蛋”——Circle 官方提到了自己是一家“远程办公为主的公司”,存在更高的运营和网络安全风险,结合2月发生的 Bybit 15亿美元资产被盗一案以及此前以朝鲜黑客组织 Lazarus Group 为代表的黑客导致的种种安全事故来看,这一风险预警或许并非空穴来风,而是诸多加密项目都需要提前考虑到的风险诱因。

Circle 官方披露远程办公风险

最后,Odaily 作者个人预测,Circle 仍将早于 Kraken、Chainalysis 等加密公司进行加密 IPO,毕竟,对于运营成本居高不下、叙事单一的稳定币公司而言,通过 IPO 触达“圈外韭菜”更为紧迫。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。