在2024年以高点结束后,加密货币市场在2025年第一季度遭遇重创,比特币(BTC)在3月底的价格比1月1日约93,500美元的价格低了近12%。然而,与1月20日——唐纳德·特朗普就职日——的峰值略高于109,000美元相比,3月底BTC的价值下降了超过30%。

以市值排名第二的以太坊暴跌了45%,而索拉纳在季度末下跌了34%。其他山寨币的情况也是如此,它们受到的打击比BTC更为严重,这从后者的市场主导地位的增加可以看出,从1月1日的53.54%上升到第一季度末的62.8%。同样,股市,包括标普500指数(-4.9%)和纳斯达克(-10.27%)等主要美国股指,也经历了一个令人遗忘的季度。

在第一季度,许多观察者将传统和替代资产市场的动荡归因于贸易战的恐惧。当时,许多经济学家警告称,如果美国总统唐纳德·特朗普兑现他的关税承诺,将对美国及其贸易伙伴造成严重后果。

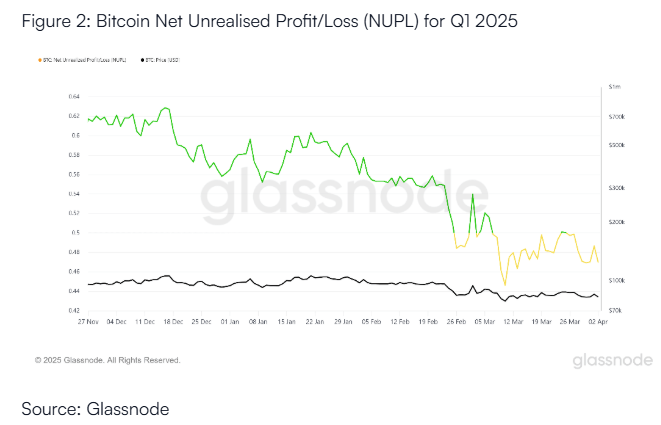

与此同时,AMINA的分析将BTC的放缓归因于用户情绪的减弱,这一指标是通过分析BTC的净未实现利润/损失(NUPL)图表得出的。报告中解释道:“该指标越高,链上未实现的收益就越多;而它越低,损失就越多。”

如图所示,NUPL呈下降趋势,尤其是在1月20日之后,并在3月10日触及今年的最低点。

“在第一季度,NUPL呈下降趋势,在3月10日达到0.446的低点。此时,未实现的损失超过了未实现的收益约24%,反映出投资者的挫败感日益加重。这清楚地表明,市场参与者感受到压力,因为价格难以获得动力,”AMINA的研究报告指出。

除了不断增加的未实现损失外,BTC的积累速度放缓,尤其是大型实体的积累。数据显示,这一指标在第一季度的平均值仅为0.1,表明几乎没有积极的积累,而中位数为0.07则表明,不仅整体购买疲软,而且大多数日子的积累甚至低于已经较低的平均水平。

“简单来说,市场并没有心情去积累更多比特币,反映出整个季度的谨慎情绪,”报告总结道。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。