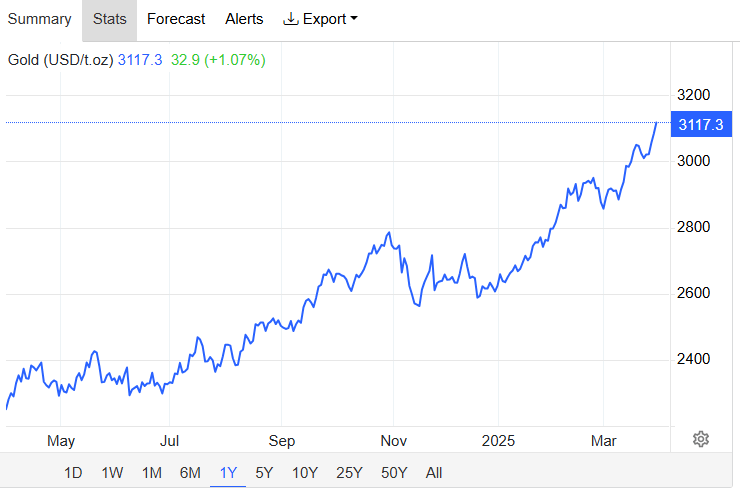

在美国总统唐纳德·特朗普所称的“解放日”前夕,黄金价格达到了每盎司3,117美元的新里程碑。这一消息传出仅几天后,贵金属的价格就突破了3,100美元的关口,进一步激发了黄金支持者的乐观情绪。

在贸易战恐惧的背景下,黄金的吸引力促使高盛上调了其年末价格预测。路透社报道,该投资银行将其预测区间从3,100-3,300美元上调至3,250-3,520美元。

高盛将这一变化归因于亚洲中央银行的积极购金,预计这一趋势将在未来三到六年内持续。它还提到,黄金交易所交易基金(ETF)的资金流入强于预期,也是上调预测的另一个原因。

投资者对黄金态度的明显变化与他们对比特币(BTC)的看法形成了对比,尤其是在特朗普于1月20日就职后。尽管黄金的最新里程碑使其年初至今的涨幅达到了22%,但比特币从特朗普就职日接近109,000美元的高峰滑落至3月31日的83,000美元以下,意味着它在2025年第一季度结束时大约下跌了23%。

一些人将数字资产视为避险资产,而这一季度的表现使得批评者更加坚定地拒绝比特币是数字黄金的观点。每当特朗普威胁或对美国主要贸易伙伴施加关税时,比特币似乎都在动摇,这为他们的论点增添了可信度。

然而,尽管与传统资产似乎存在这种相关性,比特币支持者坚持认为,加密资产在第一季度的表现并未削弱其数字黄金的地位。比特币.com新闻采访的专家对此表示认同,包括Trust Machines的首席运营官Rena Shah。

Shah表示,尽管黄金可能保持了其避险地位,但比特币是“你永远不会出售的唯一资产”。这位首席运营官还指出,自比特币ETF推出以来,比特币持续优于其他资产。

“比特币作为一种较年轻的资产类别,相较于传统的ETF(如黄金)表现出色。无论你是将比特币作为对市场不确定性的对冲,还是在等待合适的再入点,比特币正在发展,提供比黄金更多的价值,”Shah说。

非洲加密货币交易所VALR的首席营销官Ben Caselin表示,各国和中央银行将比特币纳入其国库的前景标志着国家层面博弈论的开始。Caselin还提到,各国储备黄金的行为表明比特币的未来将更加光明。

“我们不能排除这些动向是由于围绕比特币的博弈论,黄金的上涨可能是比特币收购爆发的前兆,”Caselin说。

Velar的首席执行官Mithil Thakore告诉比特币.com新闻,他不同意比特币失去数字黄金地位的观点。相反,他认为比特币在感知和实际采用方面变得“比以往任何时候都重要”。为了支持这一观点,Thakore指出了机构对比特币的采用及其证明的持久力。关于黄金兴趣上升对比特币的意义,Velar首席执行官表示:

“对黄金的 renewed interest 实际上支持了比特币的价值主张。这两种资产都在应对宏观经济不稳定、通货膨胀担忧以及对法定货币体系日益增长的不信任。”

Satlayer的联合创始人兼首席执行官Luke Xie表示,黄金的上涨可能是暂时的,受到“全球不确定性下短期避险资金流入的推动。”这与比特币形成对比,比特币的价值主张“基于其有限的供应、去中心化的网络和不断增长的采用”。

Xie还强调,比特币的黄金地位因技术进步而得到提升,而这并不是黄金所能具备的。

“从本质上讲,比特币并没有失去其‘数字黄金’的地位,而是在技术进步和像BTCfi这样的战略举措的推动下不断演变,这些都强调了其在现代投资组合构建中的互补和优越角色,”Satlayer的首席执行官说道。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。