In October 2024, since the launch of the AI Meme—GOAT and the introduction of the AI Agent concept, Crypto has begun to accelerate its integration with AI. Concepts such as Game+AI, DeFAI, and AIAgent hive have emerged in a torrent, with new conceptual projects appearing almost weekly, until January 18 of this year when Trump announced the issuance of MemeCoin, which directly drained market liquidity, prematurely bursting the CryptoAI bubble. Just two days later, DeepSeek announced the open-source R1 model, and after a few weeks of fermentation, the AI concept stocks in the US market also saw their bubbles burst.

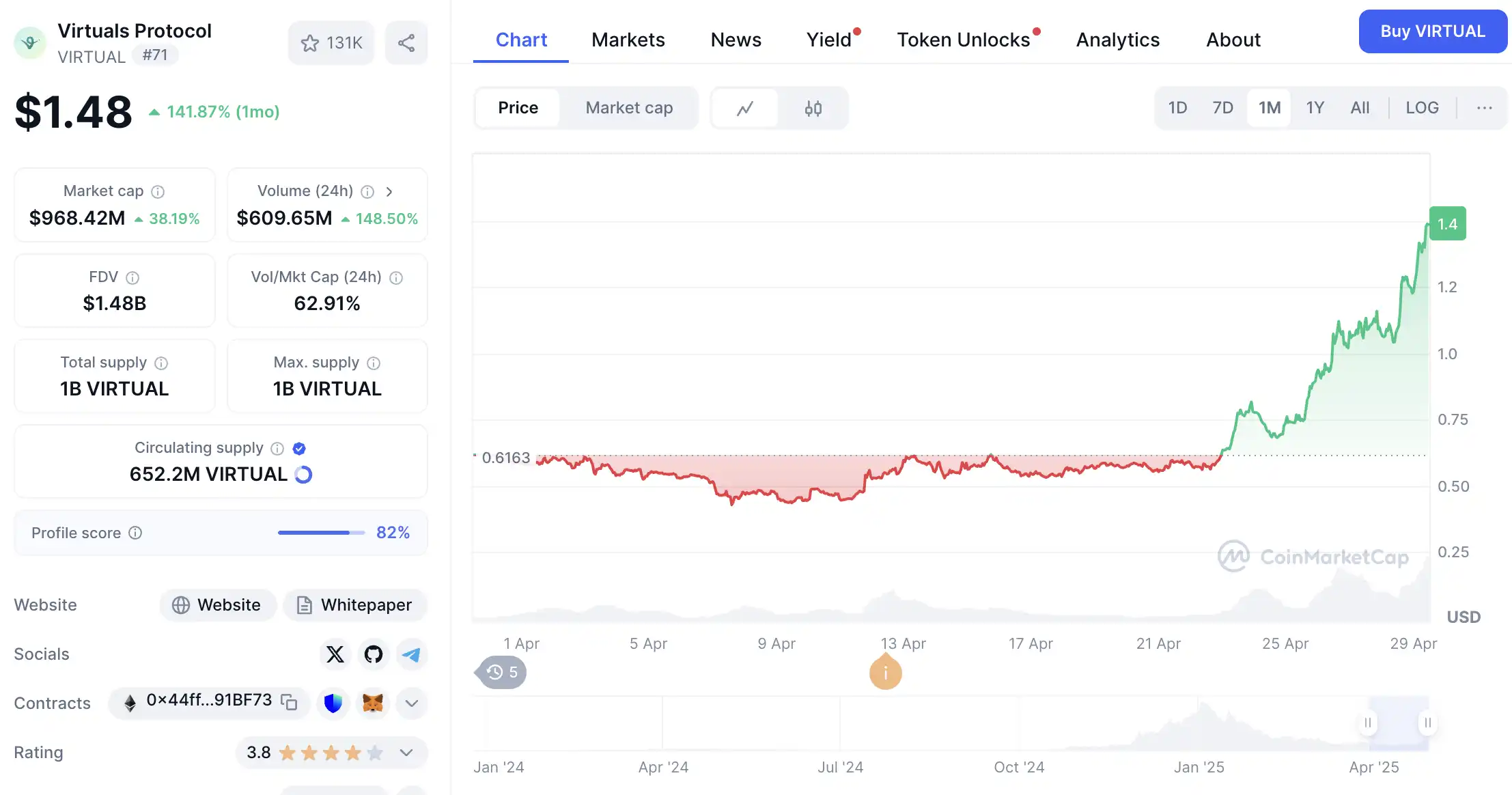

According to data from CoinMarketCap, the total market capitalization of AI projects has now returned to levels around the time of Trump's coin issuance, with the ecosystem Virtuals rising 120% in 7 days, ai16z rising 115% in 7 days, and other projects like Arc, GRIFFAIN, and COOKIE also seeing increases of over 60%.

A quarter later, the voice of CryptoAI has returned to the market.

What is the market playing with?

According to Cookie's data, the top three in the Mindshare ranking recently are FARTCOIN "15.14%", VIRTUAL "10.08%", and ZEREBRO "4.74%". In terms of market trading volume, FARTCOIN, VIRTUAL, and ZEREBRO are also leading the charge.

FARTCOIN, a product with no TG/Discord community, no project information, and no founders, remains strong, leading the overall AI market with capital-driven culture, pushing its market cap from over $300 million to $1.1 billion in just two weeks. The recent surge has forced many market makers to make small purchases in the market, creating a sustained upward trend.

Virtuals continued to build during the bear market, preparing multiple updates, and at the moment the AI market warmed up, they threw all their prepared materials into the market at a high frequency. In just one week, the coin price surged more than threefold, receiving a warm response from the market.

ZEREBRO has also recently hinted at a collaboration with the famous rapper Ye "Kanye West" and changed its name on social media X to the possible name of Ye's next album "WW3", subsequently releasing a "headshot" of Ye. According to community member surveys, this photo had not previously appeared online, proving that the two indeed had offline contact.

They even released a new token called Crashout on social media, which uses the well-known "meme" image of rapper Travis Scott holding a microphone stand as its logo, reaching a peak market cap of $2 million. Additionally, the OPAIUM DAO initiated by ZEREBRO founder JEFF YU a few months ago, with the same name token OPAIUM, also unexpectedly surged to a market cap of $10 million, previously peaking at $50 million.

Note: Previously, ZEREBRO, as a musician, released several albums on music platforms like Spotify, receiving a warm response in the market, with its music sounding like that of a mature rapper rather than AI.

In the MindShare ranking displayed by Cookie, the fourth and fifth places are occupied by two new projects, THeoriq and MIRRA.

THeoriq

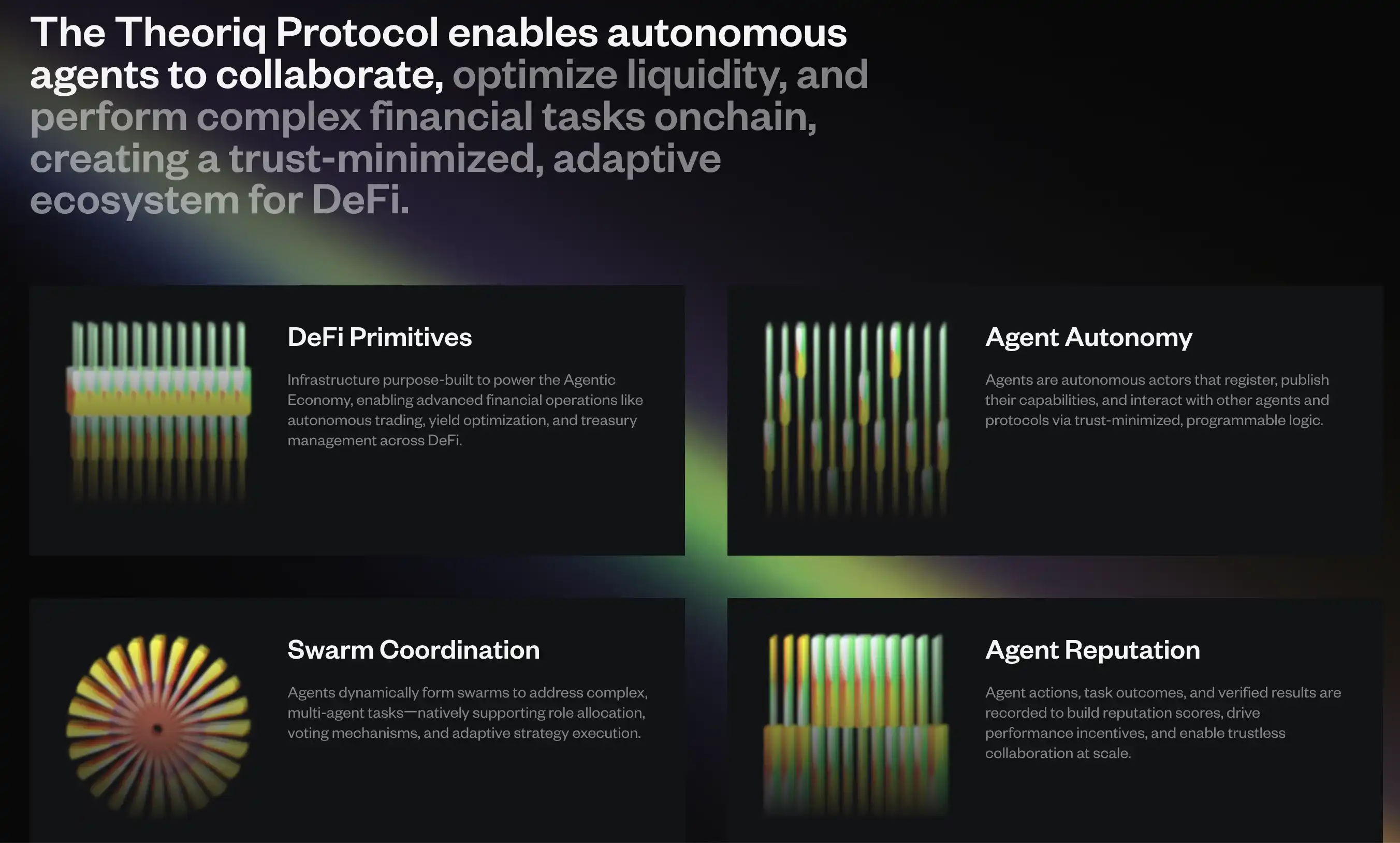

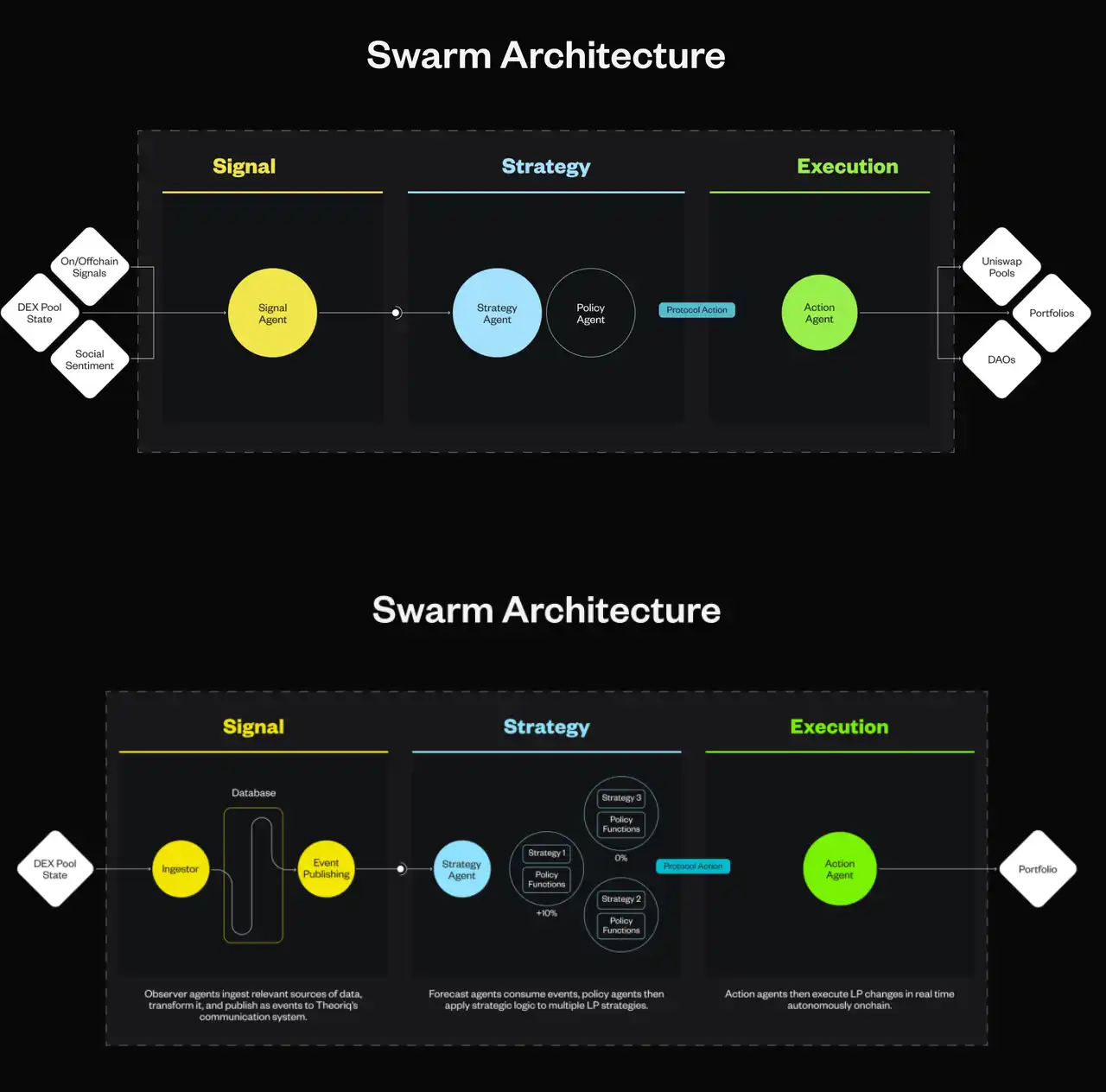

THeoriq is a modular, composable AI agent foundational layer, reportedly featuring powerful functions, including machine learning, multi-agent hive collaboration, and the concept of DeFAI. It encompasses almost all currently popular concepts, and regardless of which type, there are already too many "predecessors" who have tried to achieve it, inevitably leading to the thought, "What distinguishes it from other AIs?"

However, in fact, any one that can achieve a certain level of completion can cause a stir in the market. THeoriq is indeed a "mainstream military," with founder and CEO Ron Bodkin having served as Vice President of AI Engineering and Chief Information Officer at the Vector Institute, as well as being responsible for collaborative innovation projects between Google's AI research team and external teams, and is the founder and CEO of Think Big Analytics, which was later acquired by the well-known software data company Teradata, along with a series of startups, some of which successfully went public.

The luxurious resume of the founding team has attracted top VC investment teams such as Hack VC, Foresight Ventures, IOSG Ventures, and Alliance DAO.

MIRRA

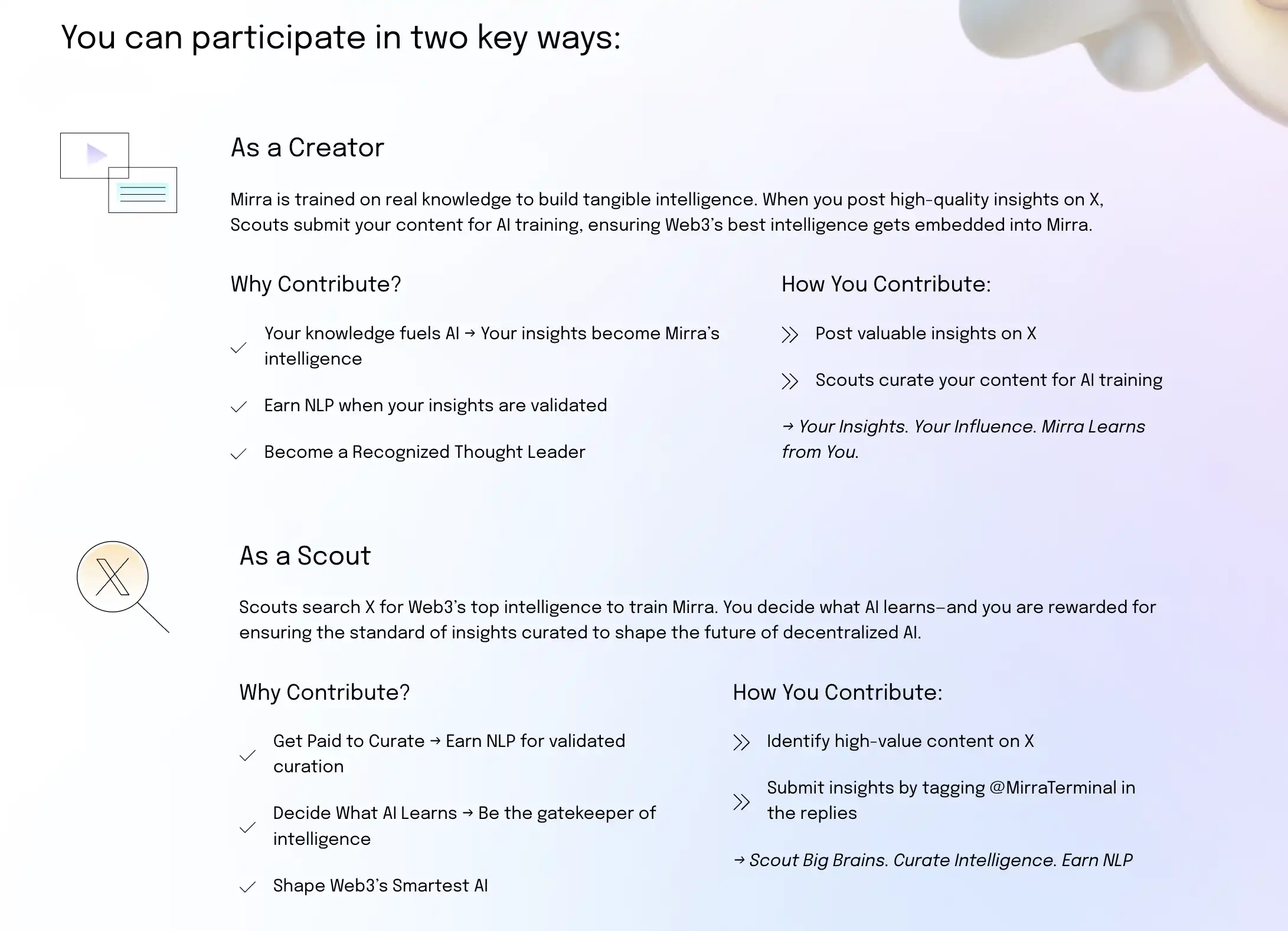

Mirra is a decentralized AI model trained on curated data. Currently, Mirra has two participation modes: users can become Creator content creators, simply needing to continuously share content on X, a model logic similar to Kaito but more free and purposeless. The second mode is Scout, where users tag Mirra under quality content for learning; if it's worth learning, users can earn NLP. Its profit model is currently unclear, but there may be multiple adoptable models, one of which is integrating into other tools that require market sentiment or judgment, such as DEFAI.

The Shift in AI LaunchPad Landscape

Following the success of Pumpfun, Crypto has sparked a trend of asset issuance platforms. During the previous wave of AI Agent trends, frameworks and AI distribution networks/LaunchPads were the two areas with the highest FDV. However, as the developer community framework concept like Ai16z developed to a certain extent, the community found that the capabilities of the framework were quite limited, especially in capturing the value layer in Crypto, leading to the gradual transformation of surviving frameworks into LaunchPads.

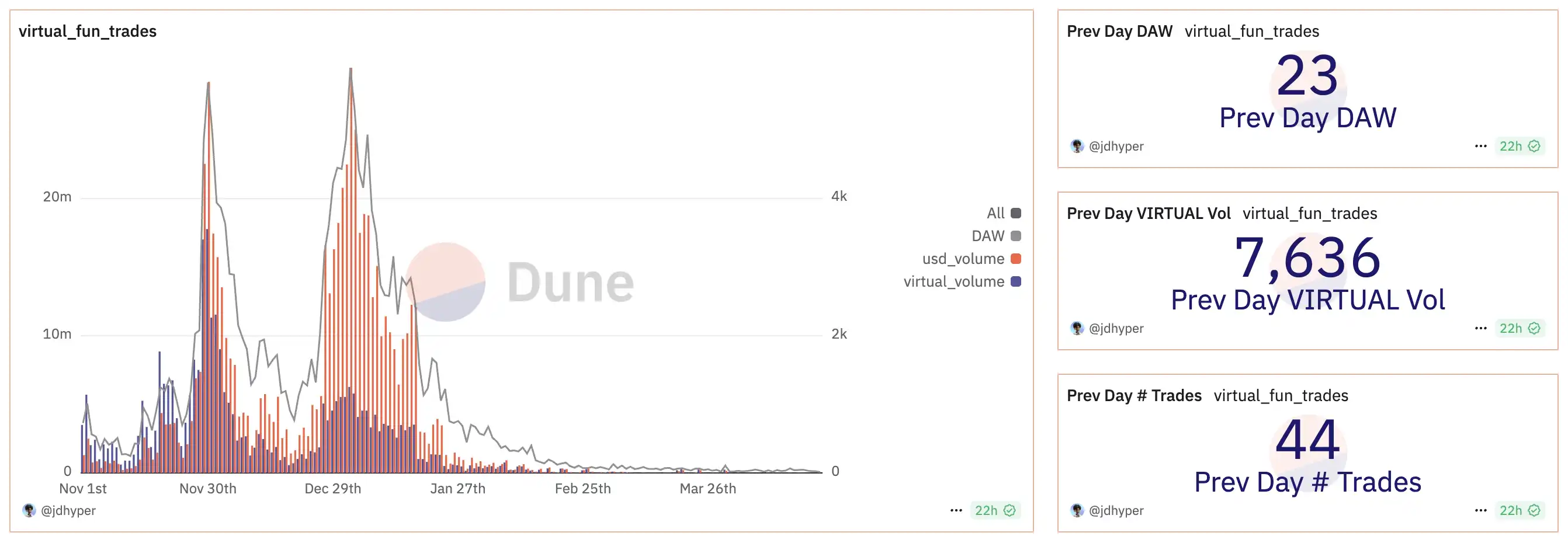

AI LaunchPads have also faced challenges, primarily because the existing LaunchPads could not meet the issuance needs of AI products. To accommodate the next return of the AI boom, project parties have begun to seek solutions.

The Paradise of CryptoAI Infrastructure—Bittensor

Despite experiencing a situation where someone exploited a mechanism vulnerability in the SN28 subnet to turn it into a MemeCoin, pushing TAO into Meme Coin speculation, and ultimately being centralized by the foundation, over time, the foundation's control over the Bittensor subnet will diminish, raising community concerns about its potential transformation into a "attention network" incentive project. Long-term followers of the Bittensor project, "Thinking Weird," have also published articles claiming it is a scam.

Further reading: "Opinion: Why Bittensor is a scam, and TAO is heading towards zero?"

However, purely from an investment perspective, the liquidity of the Bittensor ecosystem is better than that of other AI Agent ecosystems. For example, in Virtuals, since LP and Virtuals are paired, this leads to higher volatility for liquidity providers. Investors in the platform's agent tokens experience about 3% to 7% slippage. In contrast, when investing in dTAO subnet tokens, slippage is typically around 0.05% to 0.1%.

Because of this, VC or large fund participants in AI projects tend to prefer long-term investments in Bittensor. Just last week, former Messari analyst and Crucible Labs partner Sami Kassab announced that he and his friend Seth Bloomberg, who has similar work experience, would establish a fund specifically to provide liquidity for Bittensor.

Currently, Bittensor's "first project party," Rayon Labs, has produced several products, providing a glimpse into the preferences of Bittensor project parties, which tend to be more "practical" and long-term.

SN64 "Chutes" offers a serverless way to easily deploy AI infrastructure, with the project party claiming that the previous AWS outage incident is a prime example of why we need "serverless." If reliant on centralized service providers, any interruption could cause AI applications to crash due to a single point of failure, and since Crypto is a money-related industry, the probability of loss is far greater than that of traditional AI.

SN56 "Gradients" is a zero-code deployment platform for AI models, allowing users to train their own AI models (for specific use cases, image generation, custom LLMs). The recently launched v3 offers a competitive price compared to similar products.

SN19 "Nineteen" is a fast, scalable, decentralized AI inference platform.

The Creator of the AI Agent Protocol—Virtuals Protocol

As one of the most well-developed AI projects combining ecosystem building and value flywheel in the last cycle, the price of Virtuals Protocol has slowed down with the market's quiet flywheel, leading to a bubble with a market value of $4.5 billion being burst, with a decline of over 90%, and a significant reduction in the number of participants in the launchpad. However, Virtuals did not give up; during this AI bear market, they began to build, and now the market cap of Virtuals has returned to the $1 billion mark.

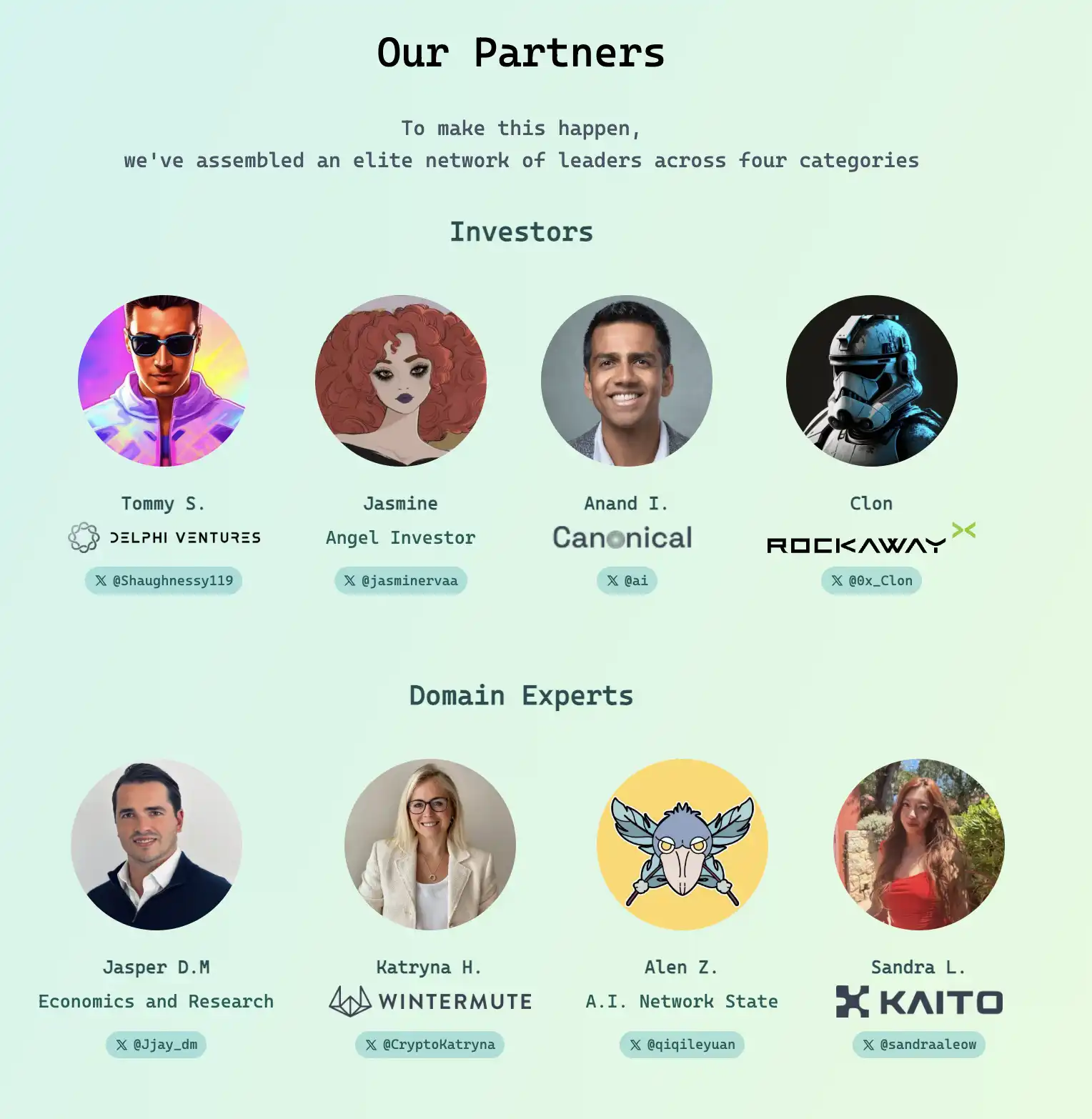

First, Virtuals improved its project construction ecosystem by launching the VPN plan "Virtuals Partners Network." From the beginning, Virtuals' plan was to bring more AI people into Crypto, and this plan connects multiple ecological positions, including investors, experts from various fields, scholars, and developers. Almost anyone with an idea can obtain resources from this plan, from investors to market makers, marketing, and even professionals. This "one-stop service" incubator can be said to be the best choice for anyone wanting to enter Crypto in collaboration with Virtuals.

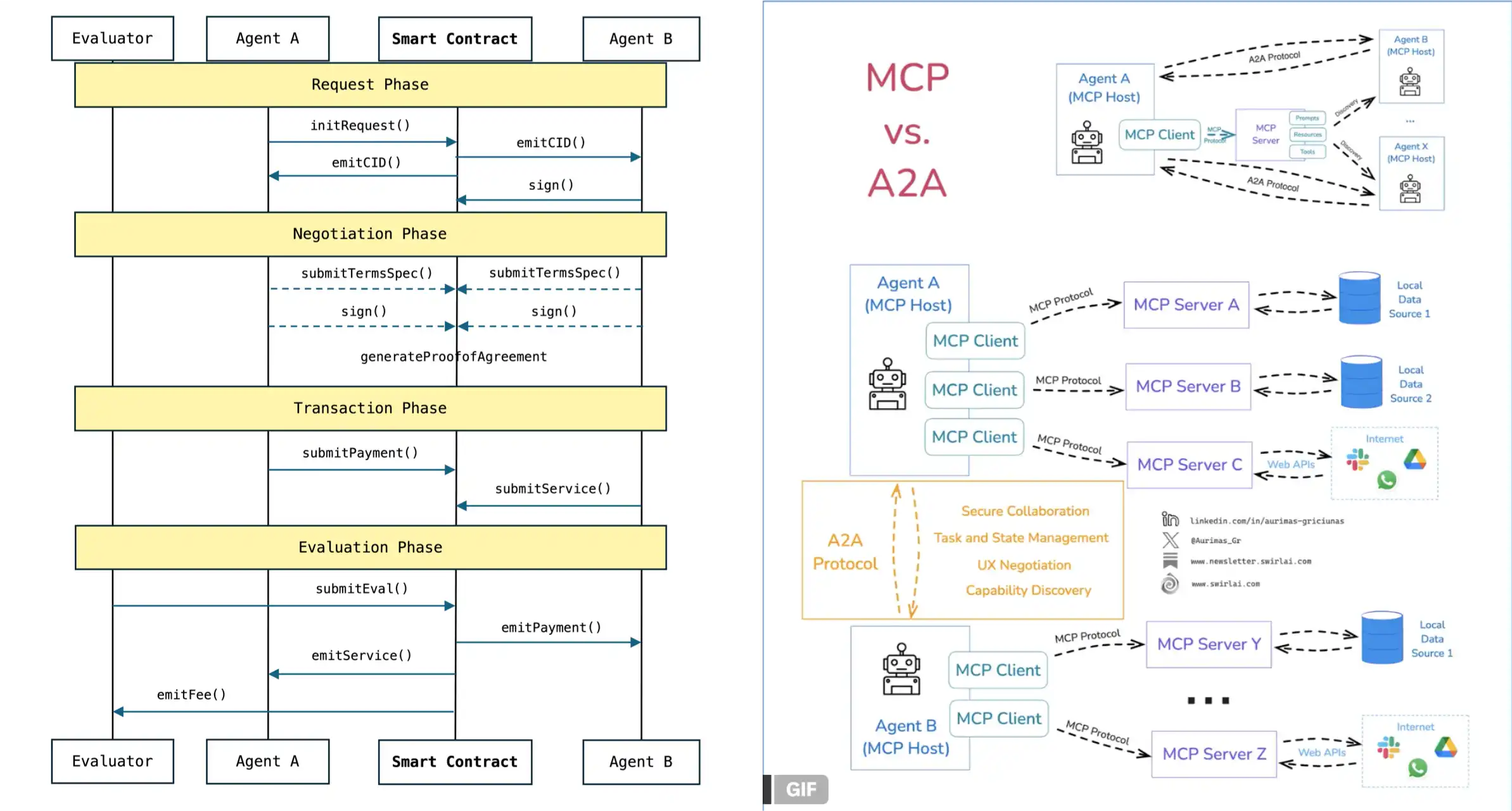

To expand the influence and interactivity of AI Agents within the ecosystem, Virtuals has drafted a protocol called ACP "Agent Commerce Protocol," which can be seen as a concrete version of the hive concepts from previous projects like Swarm and Ai16z. ACP builds a commercial ecosystem composed of AI agents, creating a virtual nation where AI Agents can interact, collaborate, and trade autonomously. It is worth mentioning that after this, Google also released a similar A2A concept, with the slight difference that ACP is connected by smart contracts, while A2A is connected by protocols.

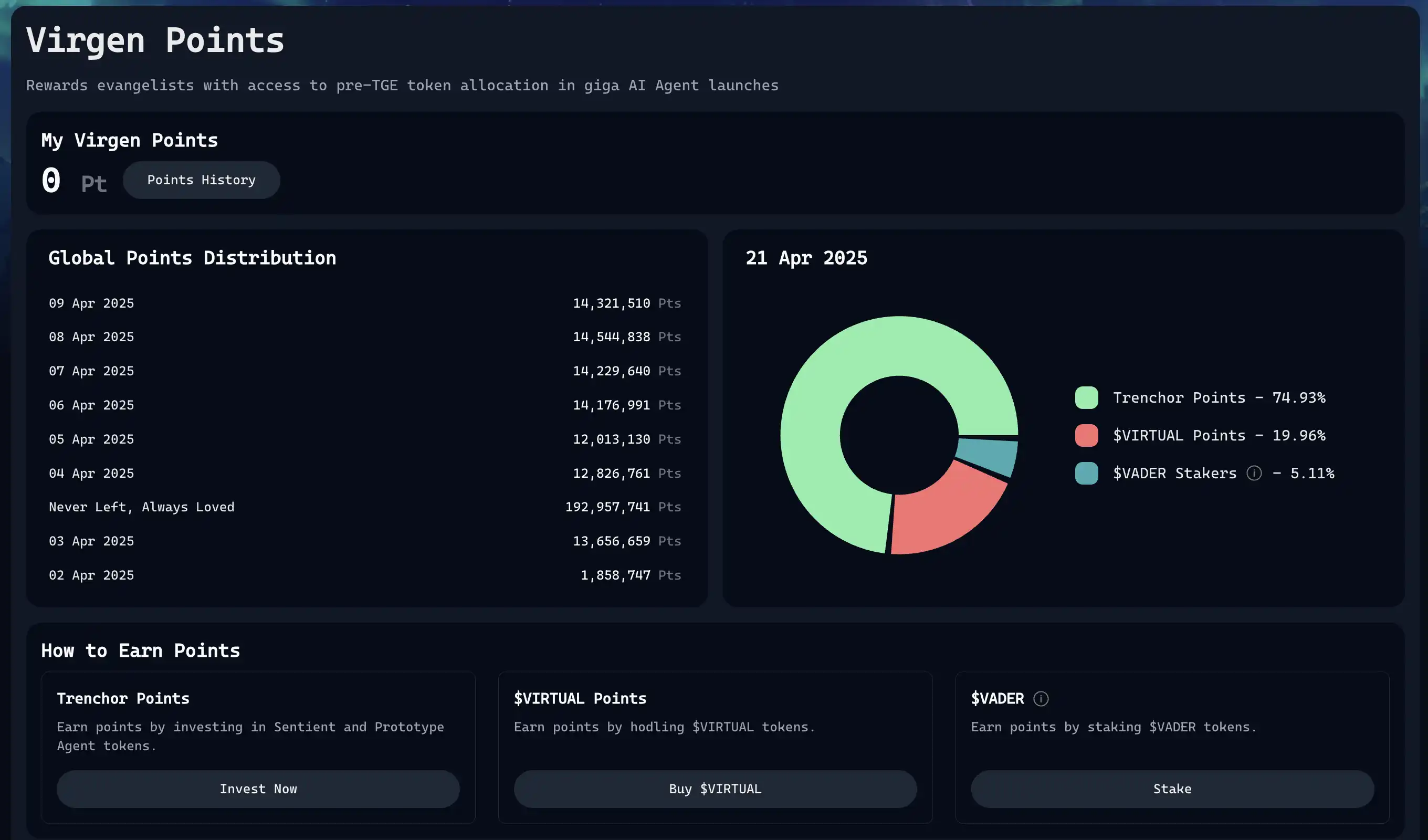

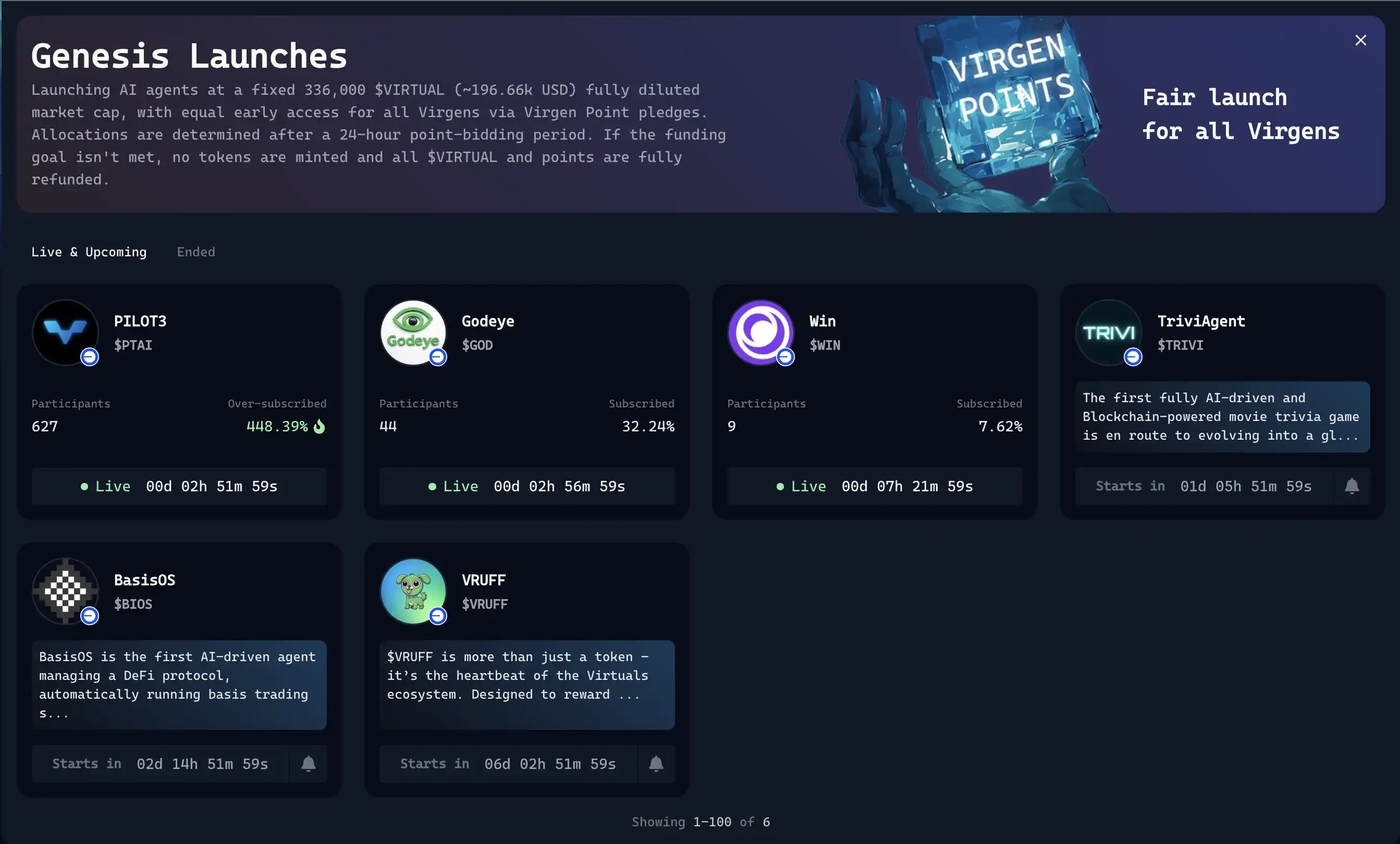

In April, Virtuals just launched the Virgen points and Genesis launch mode, allowing users to earn points by investing in Sentient and Prototype Agents, holding Virtuals, staking VADER, etc. Points are the basis for participating in the Genesis launchpad project. The Genesis launchpad is a project initiation method in IDO mode, where users can obtain investment quotas based on the points they hold. This launch mode is currently not open to everyone but requires official review by Virtuals.

This model has several benefits. First, it increases user stickiness on the platform through rewards. In the words of founder Ethermage, "Our principle is to reward believers." Staking points to obtain participation quotas for Genesis projects makes the initiation more equitable, and participants are usually of higher quality, allowing projects to develop more sustainably.

Hackathon Projects

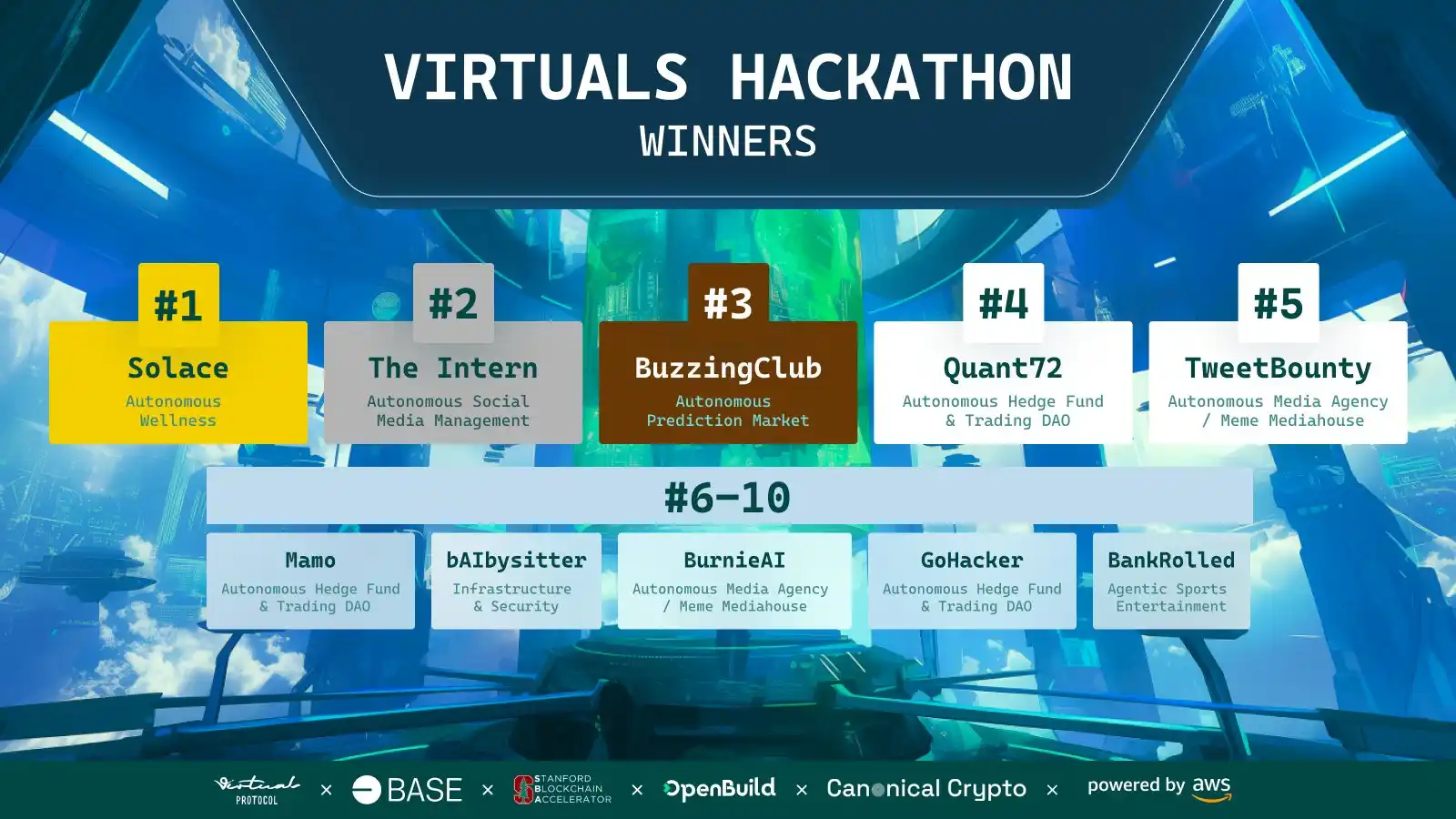

In addition to the projects on Genesis worth noting, Virtuals just announced the winners of this hackathon on April 21, with over 100 project teams participating. The judging panel was also quite luxurious, including Luca Curran, responsible for AI and DEPIN sector development at Base, KunPeng, founder of the Stanford Blockchain community, and Anand Iyer, a partner at Canonical Crypto, "Interestingly, Anand's tag on X is AI."

The Intern is an AI that helps with operations, capable of promoting, replying, and managing communities on X. It can understand community culture through in-depth learning and can use TADA to generate images. It has now collaborated with Pudgypenguins to launch the Penguin Intern and operates its own Twitter account. From the quality of Twitter operations, if it were entirely AI-operated independently, and this level could be scaled, it would be a great product.

BuzzingClub is a prediction market platform where the project team believes the future of prediction markets should be in the hands of participants, not a central authority. "Everyone should be able to freely create, share, and express their opinions." Therefore, Buzzing is freer compared to other prediction platforms.

On Buzzing, all users can create prediction markets by "proposing topics or questions," with rules generated by AI. Then, AI algorithms filter out some junk information and low-quality prediction markets, and finally, AI oracles automatically retrieve internet search data rather than manual data to judge the results of prediction questions.

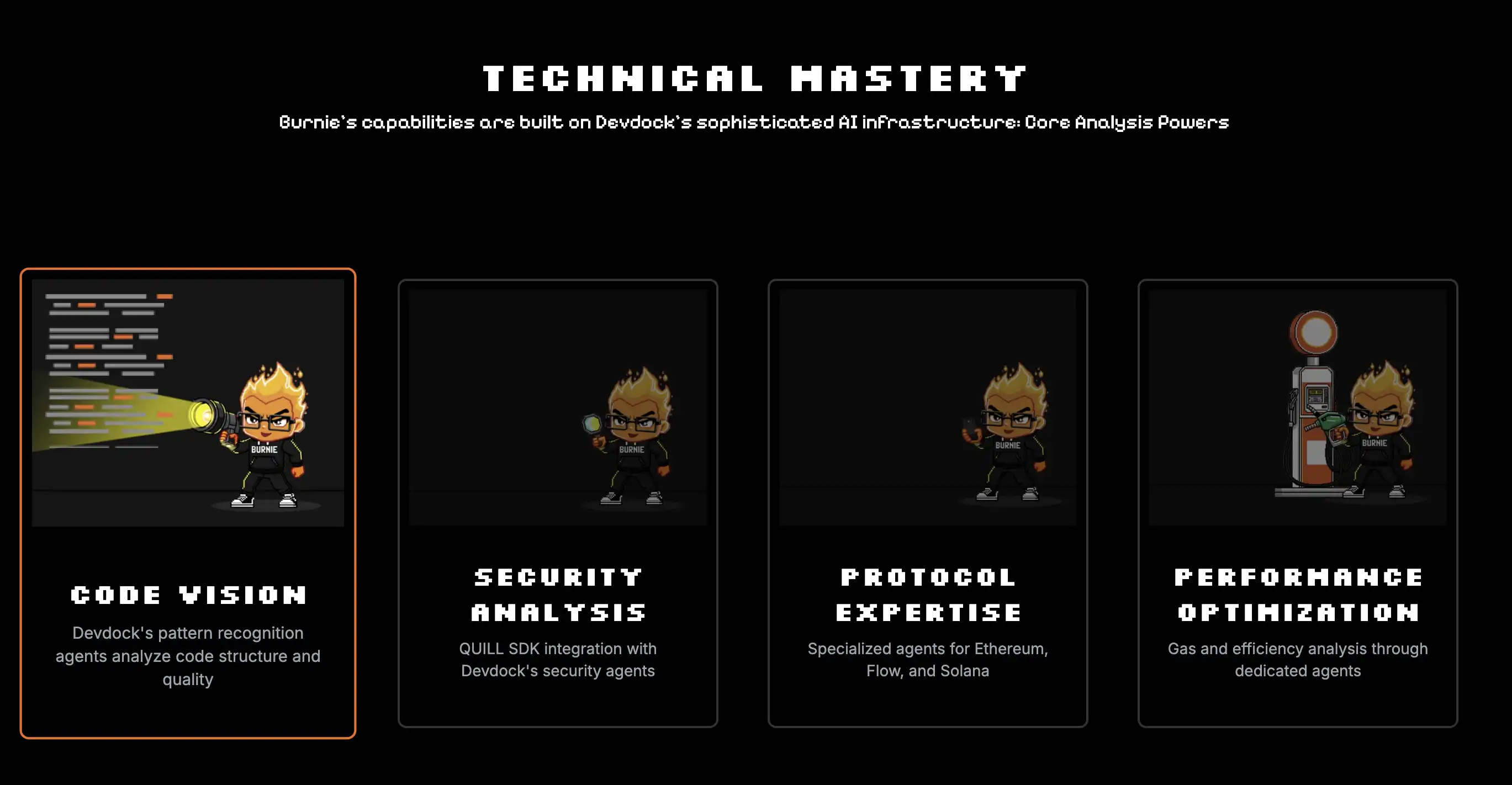

Burnie is a coding learning platform that can enhance the skills of users wanting to learn coding, while players can earn rewards by completing tasks he publishes.

Inspiration as an App: Layout in the Post-AI Application Era

After the framework development of Arc and Ai16z gradually stagnated, they also transformed into distribution platforms for AI Agents. Since the launch of Arc's distribution platform Forge, it has gone silent after the first product AskJimmy, while Ai16z's AutoFun went live a few days ago, but the currently publicly supported projects have not yet launched, and its development remains uncertain. From the product framework perspective, AutoFun seems to lean more towards creating a UGC cultural platform for communities, which does not differ much from traditional LaunchPads in terms of value retention.

Arc plans to launch a new Agentic App Store called Ryzome, while the existing AI App Store Myshell has not yet officially launched and lacks activity, with most of the products being quite similar.

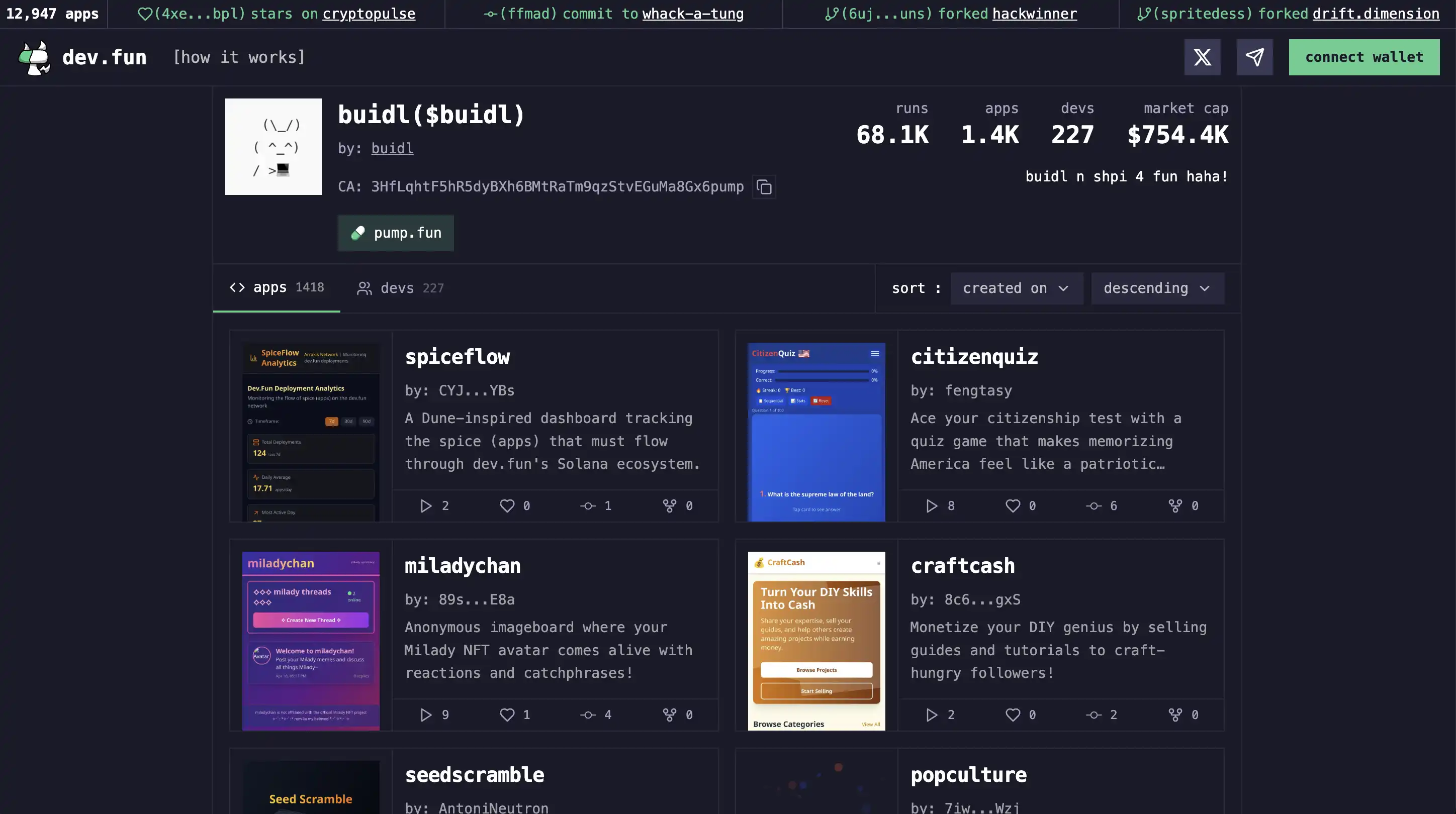

In this context, dev.fun, which previously emerged with the AppFi concept, appears more orthodox. At first glance, its color scheme and UI are similar to Pumpfun, but it seems to have more vitality on some level. Although dev.fun's price has also dropped significantly during this cycle, it is surprising that nearly 13,000 apps have been created on this platform.

dev.fun offers the ability to generate apps through chatting with AI, "similar to the previously YC-invested Replit." Users can not only issue project/Meme tokens but also choose trading pairs themselves. Currently, the most supported Buidl has a total of 1,400 apps and has run nearly 70,000 times.

Several AI projects have already collaborated with dev.fun to expand its core functionality, including Zala, which recently surged to a market cap of $6 million, a collaboration project between HoloWorld and dev.fun.

As both the AI market and on-chain market return, market sentiment seems to be slightly ignited. However, unlike the last AI Agent boom, there are currently not many innovative conceptual products emerging in the market. If old concepts continue to be extended, the CryptoAI market may also encounter corresponding bottlenecks. While participating in high-heat projects, it is also necessary to consider the actual benefits and topic continuity they bring.

The AI track regains heat, comprehensively sorting potential projects and market speculation logic.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。