三月的最后一天,对于第一季度的预期确实没有和想象中的一样,其中最大的失误就是对于关税的误判,这也导致了很多之前打算的动作都没有做,陷入到了尴尬的地步,但对于四月开始的难度上升,仍然保持着对市场的敬畏,其实今天就是很好的例子。

早晨六点就有信息提醒我美股股指期货低开,然后一直到美股开盘后都是一个低走的趋势,美国投资者对于关税导致的通胀上升以及经济衰退的概率选择了提前避险,本来 Bitcoin 也是要走这条路的,在北京时间18点前几乎跌破了 81,000 美元,但随着 18 点左右一条信息,川普家族正式进入 $BTC 的挖矿领域,就又将市场情绪提升了一些。

连带提升的还有 BTC 的价格,毕竟 BTC 还是一个稍微小众的市场,小众不是在于市值,而是在于流动性,在长期持有者重新开始吸筹的时候,短期投资者的情绪就能改变 BTC 价格的走势,这也是我觉的四月开始难度会加大的原因。

现在是事件驱动的市场,而美股的事件和加密货币的事件也有很大的不同,但总归方向都是一致的,而且更重要的是,驱动的事件是否会带来流动性的改变,如果会,那么可能就是反转,如果不会,可能仍然就是反弹。

这次的川普家族挖矿事件并不能带来事件的反转,最多就是一个反弹,更重要的还是要看北京时间四月三日以后的关税政策,到底是挥起的棒子,还是砸下的结果,虽然白宫已经释放了很多新闻,如果是民主党,我可能就信了,但现在不但是共和党,而且还是善变的川普,白宫释放的信息是不是真的会发生,还真说不好。

四月的坑还不止是一个关税,关税是影响通胀,通胀影响降息,降息的预期并不是现在,所以关税带来的影响并不是立刻就会发生的,更多的是投资者预期的情绪,但月中发布的 GDP 数据,确是会立刻就影响投资者情绪的,目前美国的很多分析机构都已经开始提升了美国在2025年经济衰退的概率,这个市场的难度,仍然在上升。

回到 Bitcoin 本身的数据来看虽然价格波动但并未引发投资者太大的关注,换手仍然是短线投资者为主,长期投资者还是保持无动于衷,但毕竟目前还没有实际对市场利空的出现,多数的投资者还是在保持观望。

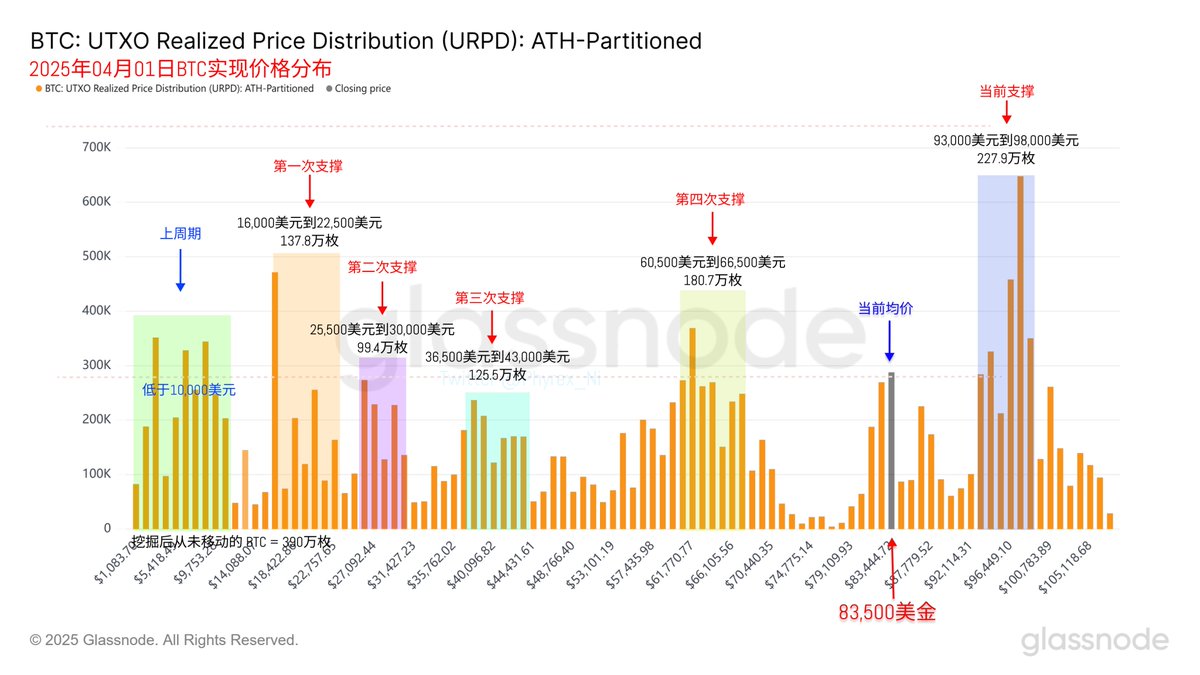

暂时 93,000 美元到 98,000 美元的投资者还是没有大幅离场,所以对于目前价格的压力也并不大,83,000 美元的筑底还在尝试进行,到美股闭盘前纳斯达克和标普都已经大幅回升,已经回正,而 Bitcoin 也修复回川普挖矿的价格。

仍然要注意,反弹和反转的关系。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。