四月的第一天,市场的情绪经历了反复的考验,虽然 Bitcoin 为首的加密货币在最近两天的表现不错,但周二美股的反应并不是非常的友善,盘前股指期货就小幅下降,开盘后也是低开,在公布了 PMI 的数据后美股出现了小幅的反弹,但反弹并不是非常有力,而且关税仍然是考验着投资者的耐心,在美股闭盘前三大股指都出现了回撤,这也代表了市场对于关税的不确定性。

不仅仅是关税的问题,今天 GDPNow 给出的最新美国2025年第一季度的预期是 -3.7% 这是从 -1.8% 大幅上升,翻了一倍都多,虽然说 GDPNow 的数据并不是每次都会准确,但这种幅度的 GDP 数据如果是真的,那么美国的经济很有可能真的会出现问题。

相比关税来说,GDP的数据会更麻烦一些,而关税最终的结果还并不清楚,今天以色列取消了对美国的关税,上周印度降低了美国关税的55%,这都可以看作是关税获得的收益,但对加拿大,墨西哥和欧洲的关税,仍然是影响市场的重点,北京时间的4月3日凌晨5点,川普就会正式公布关税的问题。

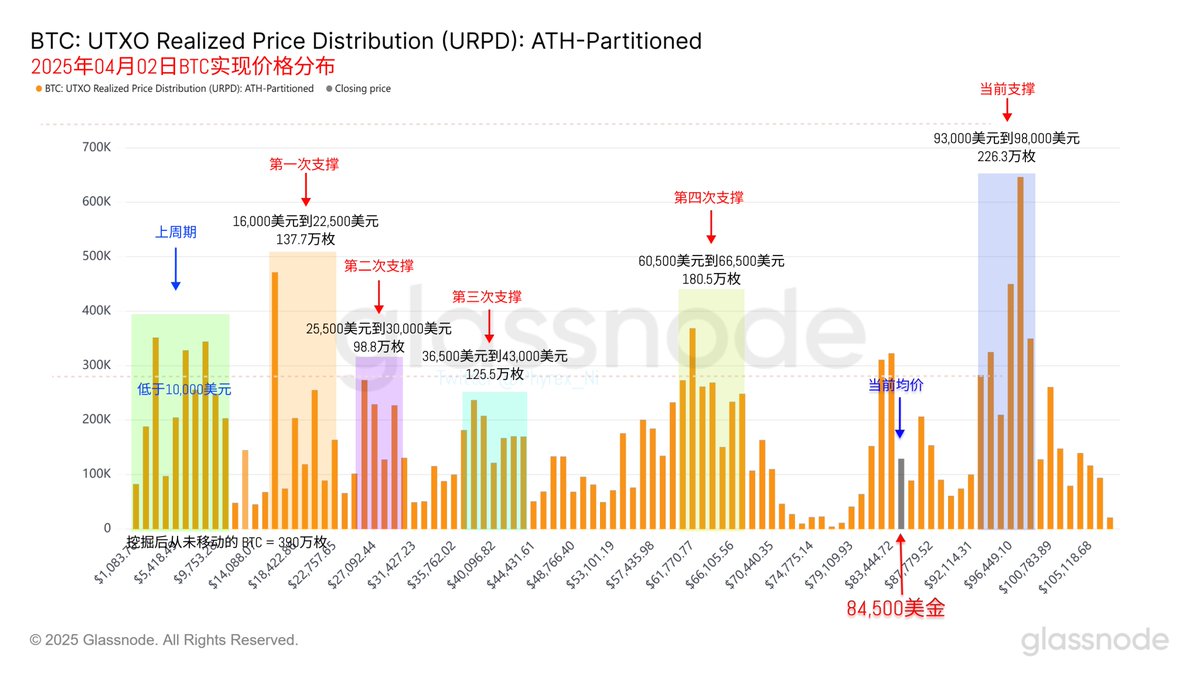

回到 Bitcoin 本身的数据来看,换手的投资者略微有些增加,并且还是集中在短线投资者中,估计是上涨的价格让很多投资者选择止盈离场,但更多的投资者还是持仓成本在 90,000 美元以下的投资者,虽然不至于恐慌,但这部分的投资者估计是为了避险关税而离场。

总的来看现在投资者的情绪还是较为正常,并没有出现任何恐慌的迹象,都在安静的等待 4月2日的到来,93.000美元到98,000美元之间的投资者还是在保持着少量的减持,对价格的影响也不大。

小伙伴们仍然需要注意的是目前并不符合反转的趋势。

本推文由 @ApeXProtocolCN 赞助|Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。