作者:Weilin,PANews

在3月举办的DC Blockchain Summit上,美国怀俄明州稳定币委员会(Wyoming Stable Token Commission)执行董事Anthony Apollo主持了一场特别的炉边谈话,嘉宾是该州州长兼稳定币委员会主席Mark Gordon。Apollo正式宣布,怀俄明稳定币WYST已在多个区块链网络进入测试阶段,Apollo表示,这是美国首个由公共实体发行的、由法币支持并完全储备的稳定币。

该稳定币委员会计划在公开可见的区块链上推出WYST,包括Avalanche、Solana、以太坊、Arbitrum、Optimism、Polygon和Base。这些初步、无价值的测试代币已与代币发行合作伙伴LayerZero合作进行部署在测试网上。

尽管如此,这个计划在随后遭到了共和党高层政客的质疑,引发对怀俄明州建立CBDC(央行数字货币)的担忧。

怀俄明州率先试水,全美首个公共实体稳定币

怀俄明州稳定币委员会于2023年3月成立,法律依据是《怀俄明稳定币法案》。任务是发行完全由州法律和财政责任支持的稳定代币。其使命是通过区块链创新增强金融透明度,同时推动经济增长。

在官方声明中,委员会指出,LayerZero的OFT(Omnichain Fungible Token)标准以及在安全智能合约开发方面的丰富经验,提供了一个强大、可扩展且合规的解决方案,满足了委员会立法要求提供多链稳定币的需求。

作为初步测试的一部分,由LayerZero支持的第三方跨链桥Stargate在Ethereum和Avalanche测试网之间进行了一次WYST的演示交易。WYST作为OFT的架构意味着它可以通过任何兼容的接口进行桥接——Stargate只是其中一个例子。

在炉边谈话中,州长Gordon强调了怀俄明州对透明和创新的承诺,并指出区块链技术在创建安全高效金融生态系统方面的潜力。“我们很高兴能在首都分享怀俄明州的州领导力愿景,” Gordon指出。“我们在区块链和数字资产立法上的前瞻性方法,使怀俄明州不仅成为其他州的榜样,也成为联邦政府的典范。”

Gordon补充道,WYST具备多项优势:包括必须以现金与美国国债超额抵押,以降低“脱钩”风险,以及将国债利息用于州教育基金,从而实现财政回馈。WYST预计将测试至2025年第二季度末,并计划于同年7月正式推出。

根据委员会官方网站,这两位负责人背景中,金融与区块链经验兼具。Mark Gordon自2018年11月起担任怀俄明州州长,已签署了超过30项涉及加密货币、区块链和数字资产的立法。他曾任怀俄明州财政部长(2012–2019年)。Anthony Apollo则于2023年9月被任命为稳定币委员会首任执行董事,拥有丰富的传统金融(KPMG、EY)与区块链行业(ConsenSys、Rensa)经验。

值得一提的是,支持比特币国家战略储备的Cynthia Lummis也是怀俄明州的参议员。

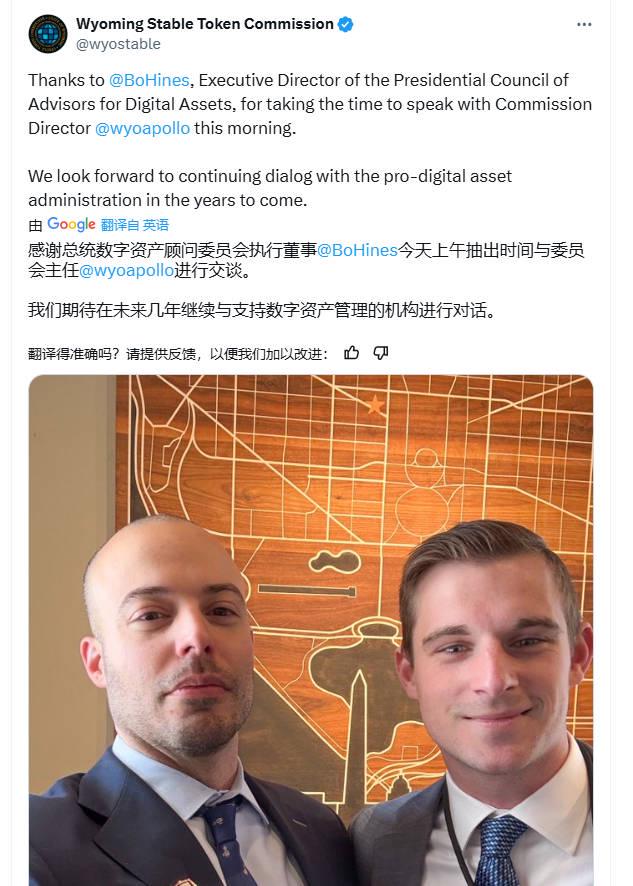

3月27日,怀俄明州稳定币委员会的X平台账号还晒出了该委员会执行董事Anthony Apollo与总统数字资产顾问委员会执行董事Bo Hines的合照,配文表示“我们期待在未来几年继续与支持数字资产管理的政府进行对话。”

稳定币还是CBDC?委员会遭共和党同僚抨击

尽管委员会强调WYST并非由中央银行发行,本质上不同于中央银行数字货币(CBDC),但在美国共和党圈层,这个项目受到了一些敏感的对待。

3月27日,在WYST计划公布最新进展后,美国众议院多数党鞭、共和党人Tom Emmer罕见地公开批评自己党内同僚的举措。

“我尊重怀俄明州民众的投票,然而,我个人强烈反对任何政府发行其货币的代币化版本,”Tom Emmer 对媒体表示。“在联邦层面,这将被视为中央银行数字货币。”

中央银行数字货币(CBDC),即国家法定货币的数字版本,近年来已成为共和党政客们最忌惮的“怪兽”。共和党州长和总统特朗普都致力于在美国禁止CBDC的发展,因为它们被认为对用户隐私构成了威胁。CBDC不同于去中心化的加密资产,由中央机构发行和管理,具备资金冻结与追踪能力,被认为缺乏抗审查性,且可能被用于政府干预个人财务。

对此,Apollo坚决否认WYST与CBDC划等号。他表示,自己也反对国家支持 CBDC的概念,但WYST是一种完全不同的产品。“怀俄明州非常重视隐私,”Apollo表示。“我们将制定规则,明确规定我们能收集什么、不能收集什么,如何处理这些数据,以及如何根据这些数据采取行动。”

“Wyoming 不是中央银行,”Apollo补充说。“我们没有发行任何现金。”

不过,Apollo也坦言,公众和立法者频繁提出“WYST是否等同于CBDC”的质疑。在怀俄明州内部,这个问题也备受关注。就在几周前,州长Gordon刚刚签署一项禁止CBDC在州内开发的法案,明确表达州政府对“受控数字货币”的反对立场。

加密立法先锋州:主动拥抱比特币,今年已提出4项相关法案

怀俄明并非首次因区块链立法引发关注。过去十年,它不断推进数字资产领域的友好立法。自2019年以来,州议会已通过30多项相关法案。今年,支持加密货币的议员又提出了四项核心议案:

HB 201:州资金投资比特币

由共和党众议员Jacob Wasserburger提出,允许将最多3%的州财政资金投资于比特币,意在使怀俄明在联邦可能接受比特币前抢占先机。尽管该法案最终未能通过,Wasserburger表示仍将继续推动相关教育和立法工作。

HB 256:设立区块链特别委员会(未通过)

HB 264:禁止CBDC

由众议员Daniel Singh提出,旨在禁止州机构接受CBDC支付,也不允许使用纳税人资金构建CBDC基础设施,明确表达怀俄明对CBDC的抵制立场。

HB 308 加密前沿法案

与加密货币相关的最后一项主要法案是 Singh 提出的另一项法案。HB 308 将授权州检察长“调查涉及区块链或加密货币的特定的联邦越权行为”。该法案与 Singh和 Wasserburger的目标一致,即增强州在没有联邦层级干预下运营数字货币的能力。然而,该法案尚未被众议院考虑引入。

目前来看,尽管WYST的测试部署存在一定的争议,但在州级层面,该计划具有一定的试水意义,也对美国联邦政府在CBDC和稳定币监管上的路径选择提出了挑战。

一方面,怀俄明用行动证明:稳定币并非只能由私营机构掌控,地方政府同样可以构建具备合规性和公共责任感的数字货币产品。另一方面,项目的推进也让人不得不思考:公共稳定币和CBDC的边界到底在哪里?

未来几个月,WYST将继续在测试网上运行,并逐步接受外部审核与公众评估。它能否成为全美第一个州级“链上美元”的成功范例?这将不仅影响怀俄明,也可能影响美国数字货币发展的整体方向。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。