作者:1912212.eth,Foresight News

3 月 31 日,比特币日线图已四连跌,从 8.7 万美元滑落至 8.1 万美元。以太坊则更显惨淡,日线图再次七连跌,从 2100 美元附近跌至 1800 美元。Solana 则在 130 美元附近上下徘徊,一众山寨币跌多涨少。据 CoinMarketCap 数据显示,恐惧指数 24,仍为极度恐慌。

据 coinglass 数据显示,全网未平仓 24 小时爆仓总计 2.13 亿美元,多单爆仓 1.63 亿。最大一笔爆仓发生在币安的 ETH/USDT 上,价值 1330.84 万美元。

市场自去年 12 月创下顶部之后,连续 3 个月下跌,散户情绪低迷,未来行情还会好起来吗?

比特币现货 ETF 连续 10 日净流入,但速度趋缓

近期比特币现货 ETF 数据表现较为亮眼,自 3 月 14 日以来,其净流入连续 10 日超过净流出,更是于 3 月 17 日、18 日与 20 日净流入均超过 1 亿美元。不过在 3 月 21 日起,其净流入均未再超过 1 亿美元,3 月 28 日,现货 ETF 净流出 9300 万美元,终结了 10 日连续净流入。

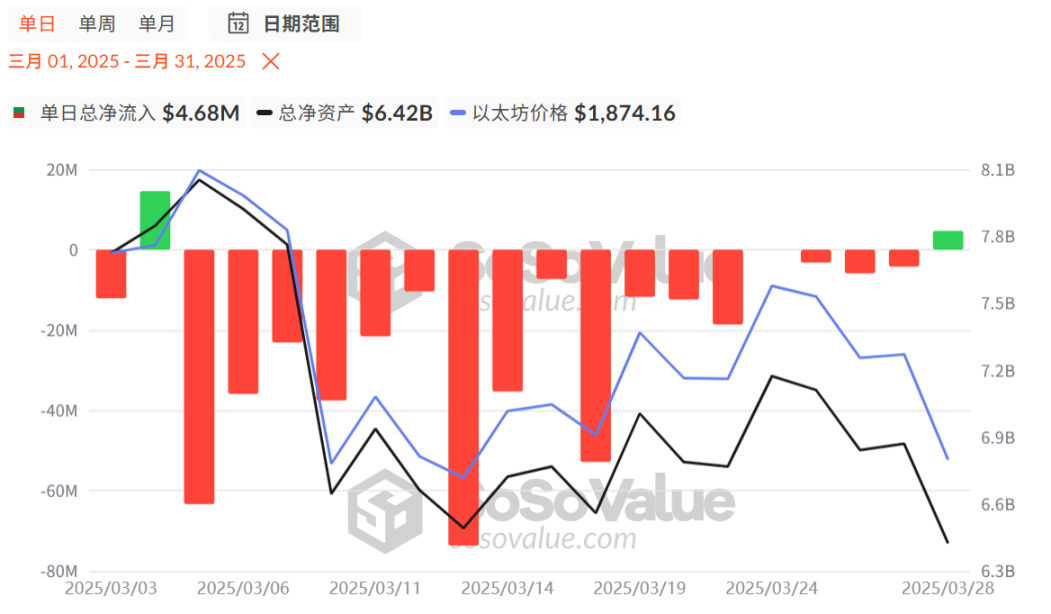

以太坊现货 ETF 方面对比比特币则显得非常悲观,本月以来,只有 2 日实现净流入,其余均未净流出。其币价表现也可想而知。以太坊的萎靡表现也在很大程度上拖累了一众山寨币表现,尤其是 L2、再质押等赛道。

市场避险 4 月 2 日美关税政策

3 月 31 日,日本股市大跌 4%,韩国股指跌幅扩大至 2.3%,美国期货早盘也出现下跌。随着 4 月 2 日美国关税政策即将揭晓,市场的不确定性将达到新的高峰。据央视新闻周六报道,当地时间 3 月 28 日获悉,美国总统特朗普计划在未来几天公布新的关税,他表示对与其他国家达成关税协议持一定开放态度,但他暗示任何协议都将在 4 月 2 日关税措施生效后达成。

花旗在最新的报告中,总结了三种主要情景并给出相应的市场影响,一是仅宣布互惠关税,这种情景市场反应较为有限;二是互惠关税加增值税(VAT),美元指数可能立即上涨 50-100 个基点,全球股市也可能下跌;三是除了互惠关税和增值税外,还包括行业性关税,这种情景下市场反应或更为剧烈。

在标普 500 遭遇 2020 年以来最糟糕一季度开局后,分析师纷纷警告后续下跌的潜在可能性大于上涨,还有分析指出未来关税和报复行动是关键,「4 月 2 日」市场反应将很大程度上取决于关税的时机,特别是行业关税以及其他国家对互惠关税的反应速度。

以比特币为首的加密市场,与美股表现越来越紧密,因此作为首当其冲的风险资产,也会在政策公布前后面临巨大波动。此外,4 月 4 日晚,美将公布失业率、非农就业数据,接下来鲍威尔将发表主旨讲话。密集数据和政策来袭,部分市场投资者选择离场观望。

后续行情

Bloomberg Intelligence 大宗商品策略师 Mike McGlone 分析为市场现在应该关注 ETH 价格走势,因为 ETH 与市场上其他风险资产的价格之间存在明显联系,若标普 500 指数中的股票持续疲软,ETH 可能会进一步下跌。同时,Mike McGlone 认为重回 2000 美元水平的 ETH 可能会为风险资产指明方向,然而如果比特币无法恢复稳定的价格增长可能会加剧山寨币陷入亏损,尤其是头部山寨币将继续走弱,甚至引发 ETH 在今年晚些时候回落至 1000 美元价格水平。

Coinbase 首席策略研究负责人 David Duong 则表示,4 月 2 日市场反应会相对平静,但这里的警告是,没有人对此做好准备,主要是因为有太多的变量需要跟踪,太多的路径需要考虑。这让我们面临一些极端可能性,特别是在特定行业的表现以及对经济的更大影响方面。然而,随着财报季很快将成为下一个主要关注点,市场在 4 月中旬之前不会准备好采取重大观点。

Real Vision 创始人 Paoul 则转发全球流动性 M2 与比特币价格走势图,并表示市场处于底部区间。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。