整理:Jerry,ChainCatcher

上周加密现货 ETF 表现

美国比特币现货 ETF 净流入 1.96 亿美元

上周,美国比特币现货 ETF 四日净流入,总净流入 1.96亿美元,总资产净值达 943.9 亿美元。

上周 3 只 ETF 处于净流入状态,流入主要来自 IBIT、FBTC、HODL,分别流入 1.72 亿美元、8680 万美元、500 万美元。

数据来源:Farside Investors

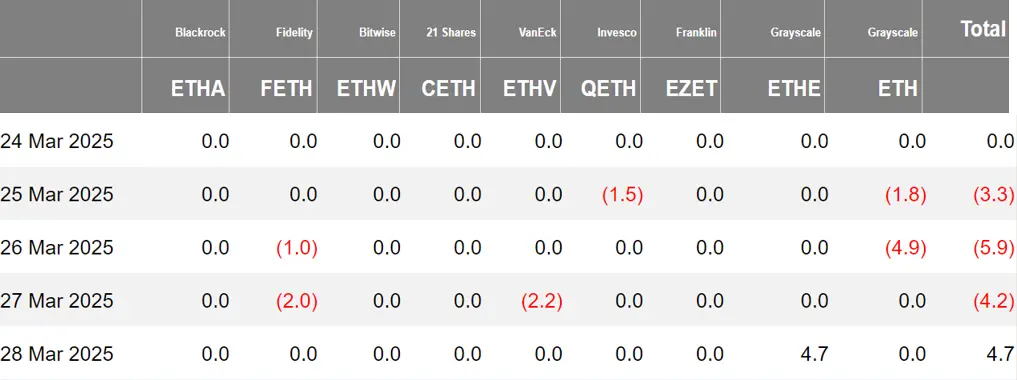

美国以太坊现货 ETF 净流出 840 万美元

上周,美国以太坊现货 ETF 三日出现净流出,总净流出 840 万美元,总资产净值达 64.2 亿美元。

上周流出主要来自灰度 ETH,净流出 670 万美元。共有 4 只以太坊现货 ETF 未有资金流动。

数据来源:Farside Investors

香港比特币现货 ETF 净流出 12.67 枚比特币

上周,香港比特币现货 ETF 净流出 12.67 枚比特币,资产净值达 3.62 亿美元。其中发行商嘉实比特币持有量维持为 357 枚,而华夏降至 2240 枚。

香港以太坊现货 ETF 无流动,资产净值为 3808 万美元。

数据来源:SoSoValue

加密现货 ETF 期权表现

截至 3 月 28 日,美国比特币现货 ETF 期权名义总成交额为 7.97 亿美元,名义总成交多空比为 0.91。

截至 3 月 27 日,美国比特币现货 ETF 期权名义总持仓额达 91.2 亿美元,名义总持仓多空比达 2.40。

市场短期对比特币现货 ETF 期权的交易活跃度上升,整体情绪偏向看跌。

此外,隐含波动率为 50.94%。

数据来源:SoSoValue

上周加密 ETF 的动态一览

贝莱德已在欧洲市场上线比特币 ETF:IB1T GY 与 IB1T FP

贝莱德已在欧洲市场上线其比特币 ETF,具体信息如下:

iShares Bitcoin ETP

代码:IB1T GY(德国 Xetra 交易所)和 IB1T FP(泛欧交易所)

费用:0.25%,至 2025 年 12 月 31 日前减免至 0.15%

注册地:瑞士

ISIN:XS2940466316

对此,彭博高级 ETF 分析师 Eric Balchunas 评论称,贝莱德将其备受瞩目的 IBIT 带到了欧洲。流动性+低费用+品牌效应=在任何地方都具有强大吸引力,尽管欧洲对“辣酱型”ETF 大多免疫。看看它的表现会很有趣。关注这个领域。

Cboe BZX 交易所已向美 SEC 提交申请,拟上市富达 Solana ETF

据美国证券交易委员会(SEC)文件披露,Cboe BZX 交易所已向 SEC 提交 19b-4 表格申请,提议根据 BZX 规则 14.11 上市并交易 Fidelity Solana ETF的股份。

资管公司 Calamos 的三只比特币 ETF 筹资已超 1 亿美元,暂不考虑以太坊产品

据 CoinDesk 报道,管理逾 413 亿美元资产的 Calamos Investments 表示,将继续专注于其已推出的三支比特币保护型 ETF,筹资已超 1 亿美元。该公司认为以太坊缺乏足够流动性及对冲工具,尚不具备开展相关产品条件,同时明确排除涉足 Meme 币 ETF 的可能性。

Canary CEO:山寨 ETF 申请旨在对具有潜力且市场需求尚未满足的资产进行布局

Canary Capital CEO Steven McClurg 表示,该公司最近提交的“创新型”加密交易所交易基金(ETF)申请,是经过深思熟虑的策略,旨在布局具有潜力且市场需求尚未满足的资产。

Steven McClurg 表示:“如果你是像贝莱德这样的大型机构,你可以承担风险。而像我们这样的中小型公司,不会随意行动,除非我们真的觉得能成功。我们对时间和资金都非常谨慎,确保所有决策都具有可行性。”并认为很多提案明年可能会获得批准。

纳斯达克向美 SEC 提交 Avalanche ETF 的 19b-4 表格

关于加密 ETF 的观点和分析

彭博社:美国 ETH 现货 ETF 连续 13 天净流出,创推出以来最长流出周期

据彭博社报道,直接投资于 ETH 的美国交易所交易基金遭遇了自 2024 年 7 月推出以来最长的流出记录。9 只 ETF 已连续 13 天净流出,资金流出总额约为 4.15 亿美元。

相比之下,美国的比特币 ETF 已从投资者需求减弱的时期中反弹,截至 3 月 21 日已连续 6 天实现净流入。

渣打银行在上周的一份报告中将 ETH 的年底目标价下调了 60%,至 4,000 美元,理由是担心以太坊的可扩展性。

该银行在一份报告中表示,以太坊“在其自创的 L2 框架内基本上已经商品化”,这让人对其长期竞争优势产生了怀疑。

调查:美国金融顾问对加密 ETF 需求激增,57% 计划今年增加投资配置

据 CoinDesk 报道,在拉斯维加斯举行的 Exchange 会议上,TMX VettaFi 的研究负责人 Todd Rosenbluth 和高级投资策略师 Cinthia Murphy 分享了一项针对美国金融顾问的调查结果,显示加密货币交易所交易基金(ETF)正受到广泛关注,57% 的顾问计划今年增加对加密 ETF 的投资配置,仅 1% 表示将减少配置。

Murphy 指出:"去年,投资加密货币可能被视为一种声誉风险,而如今,没有任何一位顾问能不对加密货币展开基本的对话。"

调查显示,顾问们特别青睐加密股票 ETF,这类基金投资于与加密行业有直接关联的上市公司,例如 Strategy(前身为 MicroStrategy)或特斯拉(Tesla)。Murphy 表示:"加密股票 ETF 更容易理解,也更容易上手,这或许解释了它的流行。"

此外,现货加密 ETF 和多代币基金也正在吸引越来越多的兴趣。22% 的受访者计划将资金分配给现货加密 ETF,例如现货比特币(BTC)或现货以太坊(ETH)ETF;另有 19% 的受访者对持有多种代币的加密资产基金表现出兴趣。

The ETF Store 总裁:Ripple 案结束意味着 XRP ETF 即将得到批准

The ETF Store 总裁 Nate Geraci 在社交平台上表示,Ripple 案结束意味着现货 XRP ETF 的批准显然只是时间问题。预计贝莱德、富达等都将参与其中。

XRP 目前是按市值计算的第三大非稳定币加密资产。最大的 ETF 发行者不会忽视这一点。

此前消息,Ripple 同意放弃交叉上诉,美 SEC 将保留 1.25 亿美元罚款中的 5000 万美元。

彭博社分析师:XRP ETF 或于未来几个月内推出,预计 XRP 期货 ETF 会率先获批

据 The Block 报道,彭博社分析师 James Seyffart 表示,XRP ETF 可能会在未来几个月内推出,并且很可能会首先看到 XRP 期货 ETF,由于美 SEC 决定撤销 Ripple 诉讼案,因此 XRP ETF 在 2025 年获得批准的几率上升。

Ripple 首席执行官 Brad Garlinghouse 在接受 Bloomberg TV 采访时透露, XRP ETF 可能会在 2025 年下半年推出,目前大约有 11 份不同公司的 XRP ETF 发行申请文件正在等待美国证券交易委员会批准。”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。