MARA Holdings, Inc.(纳斯达克代码:MARA)与巴克莱资本、BMO资本市场、BTIG、坎托尔·菲茨杰拉德、古根海姆证券、H.C. Wainwright和瑞穗证券达成协议,作为此次发行的销售代理。

销售可能会通过纳斯达克或其他交易平台以市场价格进行,代理商将从销售的总收益中获得高达3%的佣金。MARA Holdings,之前称为马拉松数字控股,是全球最大的比特币挖矿运营商之一。

来源:bitcoinminingstock.io

该公司已调整其战略,倾向于拥有和运营更多的挖矿设施,表示希望直接控制能源来源,以降低运营成本并改善利润率。目前,约70%的产能为自有,最近还投资了可再生能源项目。

扩大比特币持有量的举措是MARA更广泛战略的一部分,旨在巩固其作为上市公司中重要比特币持有者的地位。该公司已经成为仅次于迈克尔·塞勒战略的最大企业加密货币持有者之一。

股票销售的时机和定价将取决于市场条件,发行可能随时暂停或终止。投资者已被警告比特币价格波动的风险以及MARA对有利市场条件的依赖,这对其战略的成功至关重要。

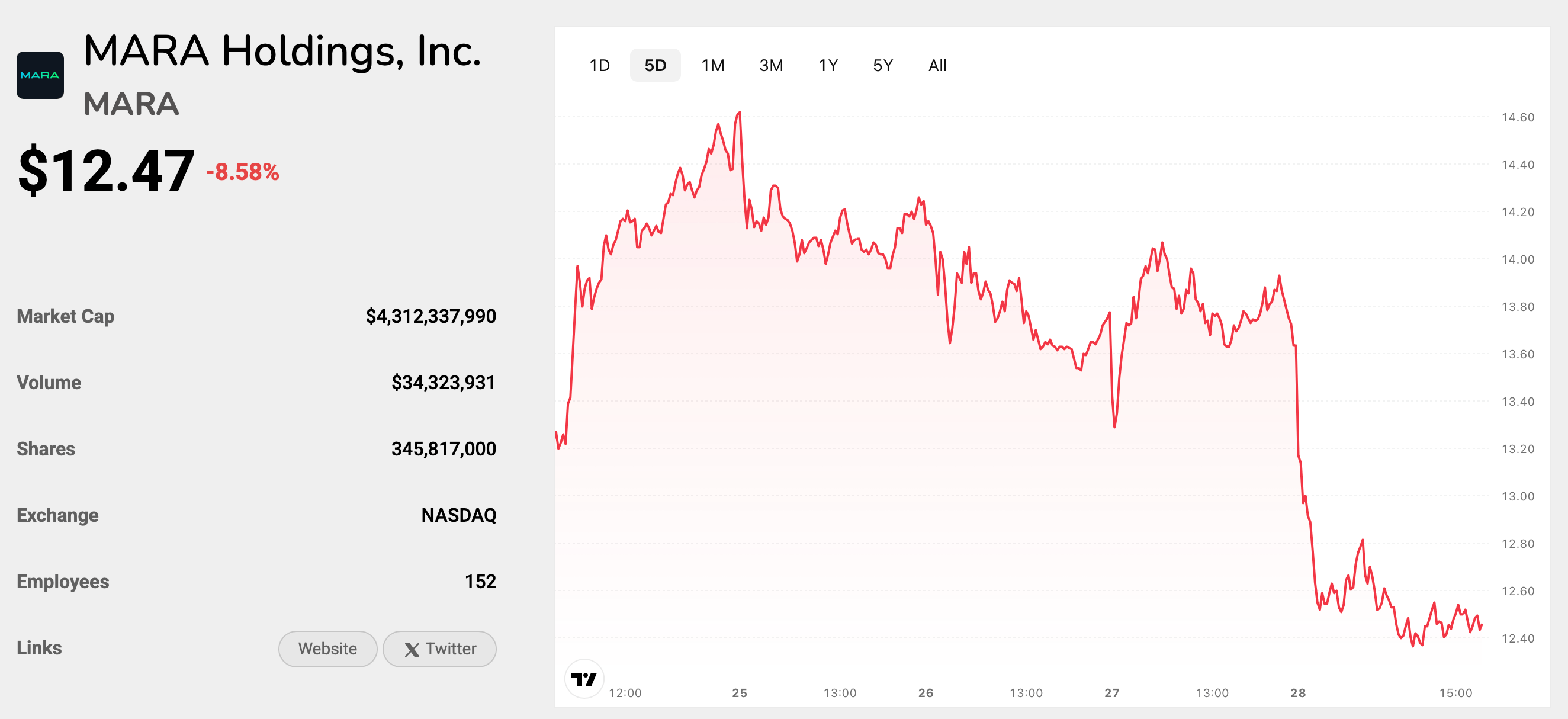

截至2025年3月28日,MARA Holdings的股票在纳斯达克收于12.47美元。该公司的股票表现反映了与数字资产投资相关的更广泛市场波动。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。