在1小时图上,比特币处于明显的下行趋势,从最近的高点$87,481下跌。卖压加剧,成交量在下跌过程中增加,确认了看跌的偏向。支撑位在$82,000附近,而阻力位在$84,000左右。交易者可以考虑在小幅反弹时做空,以$84,000作为无效化的关键水平。如果比特币以强劲的成交量突破这一阻力,趋势可能会反转。

BTC/USD 1小时图,来源于Bitstamp,日期为2025年3月29日。

4小时图进一步强调了看跌情绪,从$88,772急剧下跌。市场形成了一致的低高点和低低点。阻力位在$85,000到$86,000之间,而支撑位保持在$82,000。高成交量的红色蜡烛表明卖压更强。任何反弹尝试都需要克服$86,000的阻力,才能改变动能。

BTC/USD 4小时图,来源于Bitstamp,日期为2025年3月29日。

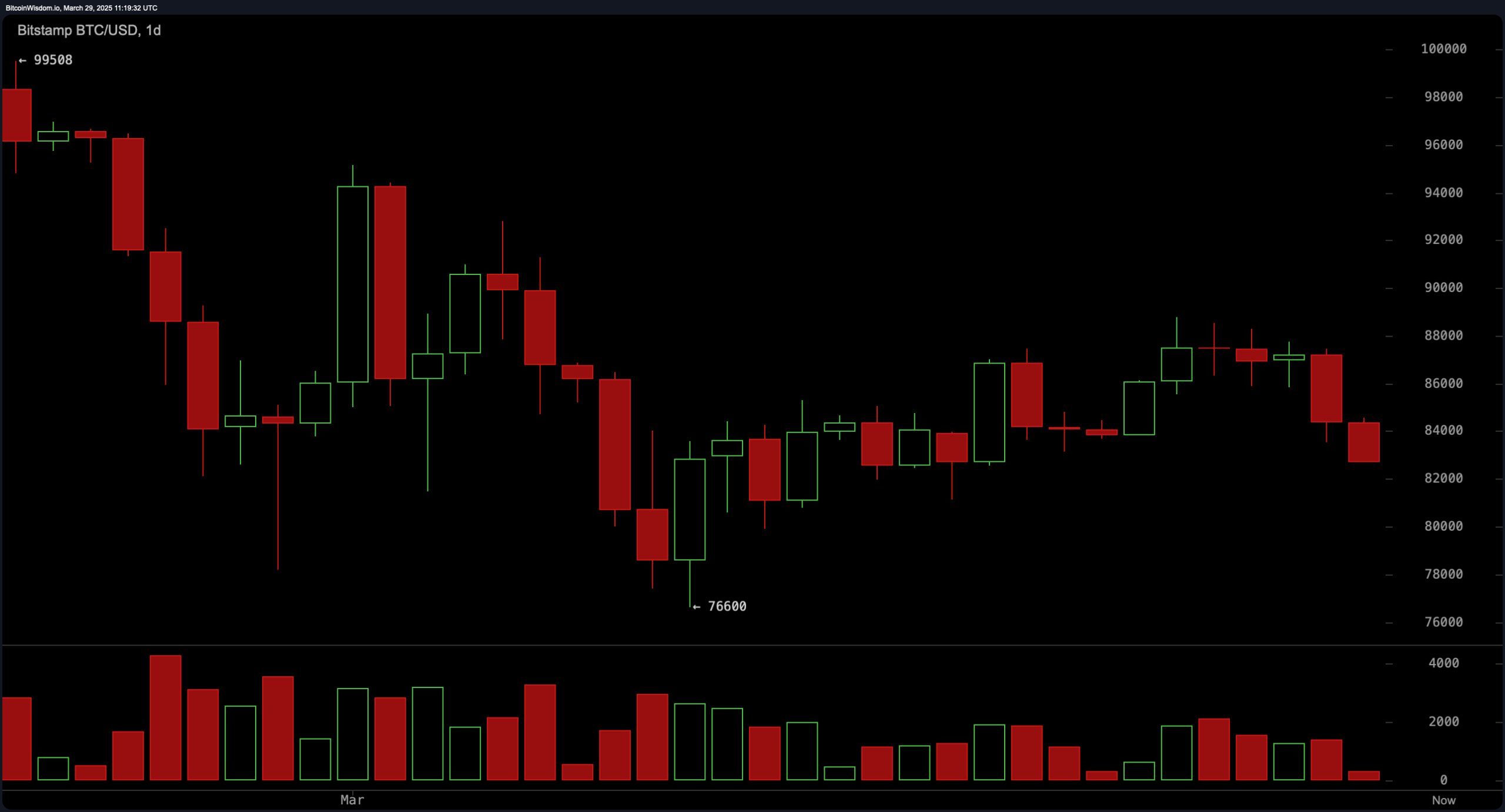

在日线图上,比特币自高点$99,508以来显示出持续下跌。关键支撑位$76,600保持完好,而阻力位在$88,000到$90,000之间。看跌结构依然显著,成交量的激增主要出现在红色蜡烛上。交易者可能只会在比特币成功突破$90,000时寻找买入机会。否则,可能会预期进一步下跌。

BTC/USD 日线图,来源于Bitstamp,日期为2025年3月29日。

振荡器呈现出主要的中性前景,相对强弱指数(RSI)为43,随机指标为49,商品通道指数(CCI)为-32,平均方向指数(ADX)为23,均显示出犹豫不决。惊人振荡器也保持中性。然而,动量指标为-3,954,表明下行压力,而移动平均收敛发散(MACD)为-831,提供了买入信号,暗示价格可能稳定。

各个时间框架的移动平均线(MAs)与看跌叙述一致。10、20、30、50、100和200周期的指数移动平均线(EMA)和简单移动平均线(SMA)均发出卖出信号。值得注意的是,EMA(10)在$85,196,SMA(10)在$85,446,进一步加强了即时卖压。长期移动平均线如SMA(200)在$85,809,表明在没有显著买入兴趣的情况下,持续恢复的可能性不大。

斐波那契回撤水平进一步说明了关键阻力点。在日线图上,比特币仍低于50%回撤水平$88,054,暗示进一步下行风险。4小时图显示50%水平的阻力在$85,728,而1小时图强调61.8%水平的$84,517是一个关键转折点。未能重新夺回这些水平可能会导致进一步下跌。相反,突破这些斐波那契标记可能会触发短期看涨反转。

看涨判决:

如果比特币能够在强劲的成交量下突破$85,000和$86,000的关键阻力水平,短期内可能会出现看涨反转。移动平均收敛发散(MACD)发出的买入信号为潜在的上行动能提供了一线希望。在多个时间框架上,持续突破50%斐波那契回撤水平将进一步支持看涨的观点,目标在$88,000到$90,000之间。

看跌判决:

在1小时、4小时和日线图上,持续的看跌动能,加上不断形成的低高点和低低点,表明进一步下跌的可能性很大。移动平均线显示出明确的卖出信号,而振荡器缺乏看涨的信心,比特币可能面临额外的压力。如果跌破$82,685的支撑位,可能会加速损失,价格可能会向长期支撑位$76,600靠近。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。