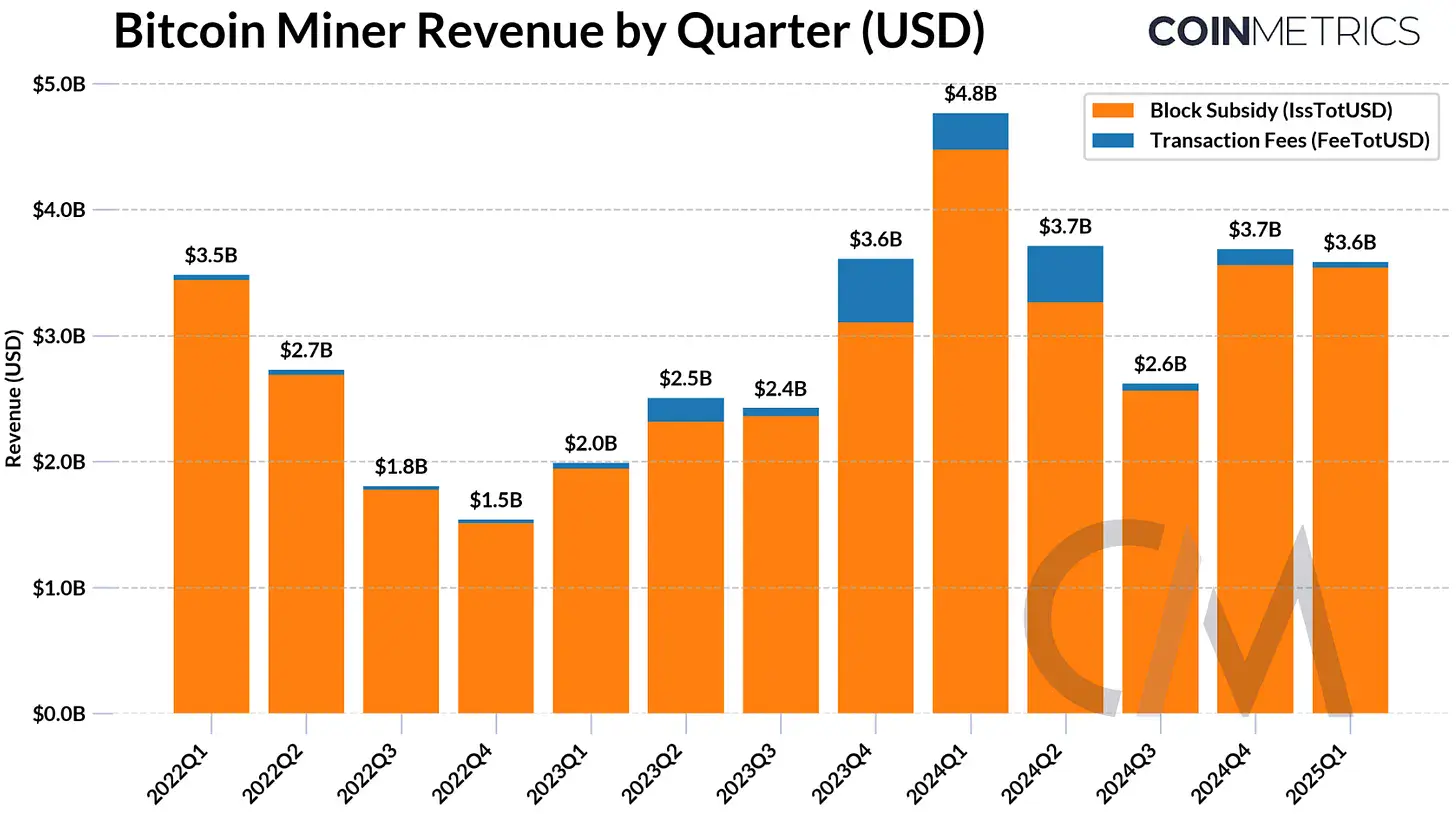

Coin Metrics’ Q1 2025 State of the Network report highlights stabilized bitcoin mining revenues following the 2024 halving, though persistently low transaction fees—under 2% of total income—continue challenging long-term incentives. According to the report, total miner revenue hit $3.7 billion in Q4 2024, a 42% quarterly increase driven by improved operational efficiency and bitcoin price recovery. Coin Metrics data shows the 30-day average hashrate rose to 807 EH/s in early 2025, reflecting sustained network growth.

The report notes mining operations are increasingly adopting energy-efficient ASICs and relocating to regions with cheaper renewable energy, such as Texas and parts of Africa and Latin America. Larger, well-capitalized firms are diversifying revenue streams, with Coin Metrics citing examples like Core Scientific’s pivot to hosting AI data centers using 200 MW of existing infrastructure.

The report notes mining operations are increasingly adopting energy-efficient ASICs and relocating to regions with cheaper renewable energy, such as Texas and parts of Africa and Latin America. Larger, well-capitalized firms are diversifying revenue streams, with Coin Metrics citing examples like Core Scientific’s pivot to hosting AI data centers using 200 MW of existing infrastructure.

Coin Metrics’ research highlights concerns around hardware centralization, estimating that Bitmain-manufactured ASICs—including the S19 series—power 59%–76% of Bitcoin’s hashrate. This reliance creates supply chain vulnerabilities exacerbated by geopolitical friction. The report details delays in Bitmain hardware shipments to U.S. miners in early 2025 due to Chinese import tariffs, illustrating risks tied to concentrated manufacturing.

Bitcoin’s use as a medium of exchange remains limited, per Coin Metrics, with its role increasingly skewed toward store-of-value applications. However, layer two (L2) solutions like the Lightning Network and sidechains such as Stacks aim to revive transactional utility. While Lightning Network channels declined to 52,700 in Q1 2025, stable channel liquidity (4,500–5,000 BTC) suggests improved efficiency, according to the report.

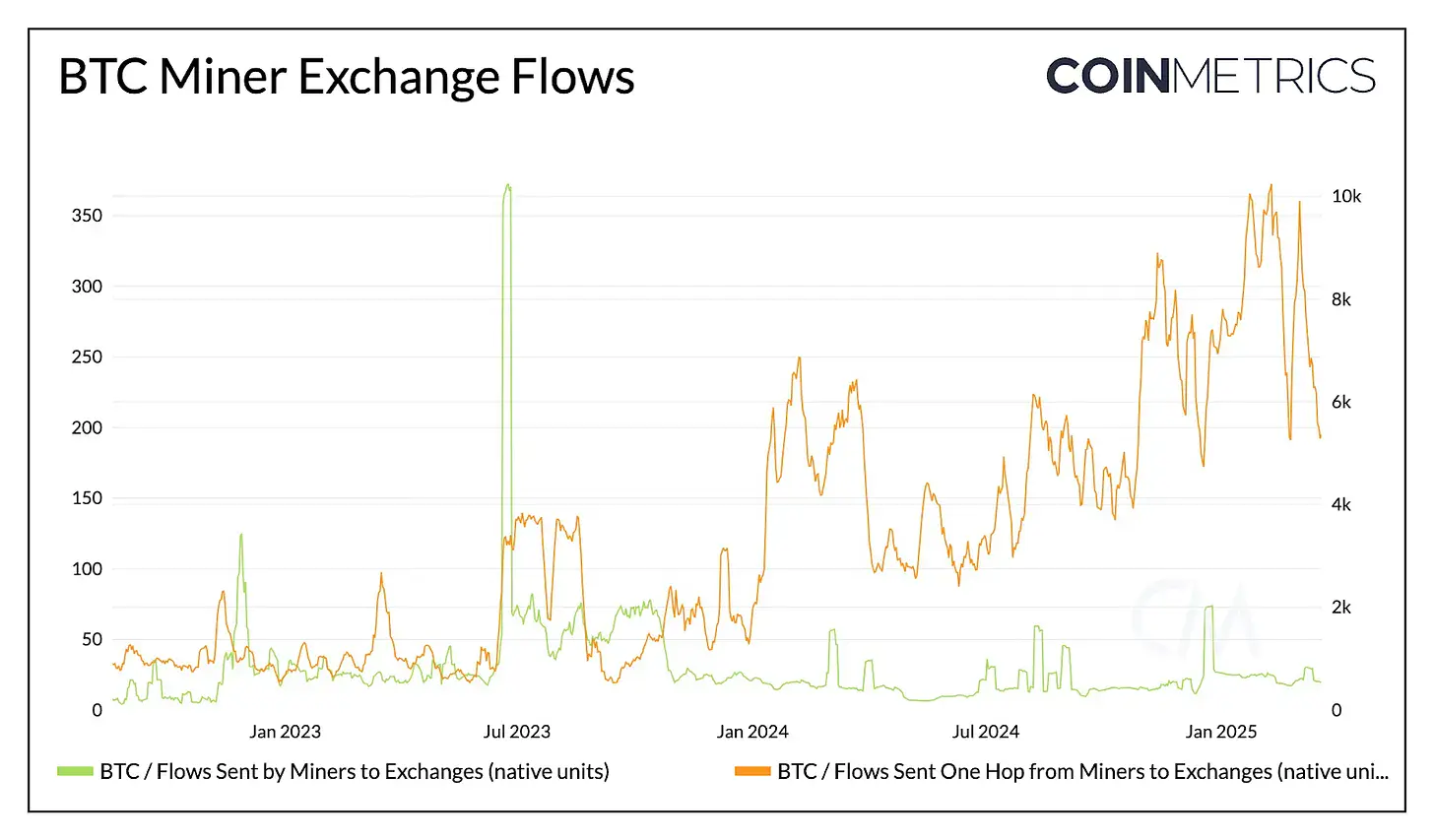

Coin Metrics exchange flow data indicates steady sell pressure from miners, with direct (0-hop) transfers to exchanges remaining stable and indirect (1-hop) flows rising gradually. Smaller miners appear to liquidate holdings incrementally, while larger operations optimize treasury management amid volatility.

The report concludes that sustaining miner incentives as block rewards diminish will likely require higher transaction fees driven by L2 adoption and competition for block space. Coin Metrics emphasizes ongoing risks to network decentralization from hardware centralization and geopolitical disruptions, urging continued adaptation across the mining ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。