In the 1-hour chart, XRP demonstrated a resilient short-term uptrend from $2.38 to $2.50, marked by successive bullish continuation candles and increased green-volume activity. The price held above key Fibonacci retracement levels, especially 0.382 at $2.456 and 0.500 at $2.441, signaling strong buyer interest in that range. A pullback to $2.44–$2.45 may present scalping opportunities, while momentum appears to support a push beyond $2.505, with a short-term price target set between $2.55 and $2.60. This range offers traders a tightly managed entry with a stop at $2.44 to minimize downside risk.

XRP/USDC 1H chart via Binance on March 24, 2025, at 11:42 a.m. Eastern Time.

On the 4-hour chart, XRP broke out cleanly from $2.22 to $2.59 before entering a consolidation phase. The downtrend from the $2.59 high to $2.35 appears to have reversed, as evidenced by rising lows and consistently higher closes. Volume contraction during pullbacks and expansion on green candles underpins the bullish narrative. Notably, the price action is climbing into the 0.236–0.382 Fibonacci resistance zone ($2.451–$2.505), and a sustained breakout above this level could indicate mid-term upside toward $2.70. Entry zones between $2.45 and $2.48 remain viable if the structure holds.

XRP/USDC 4H chart via Binance on March 24, 2025, at 11:42 a.m. Eastern Time.

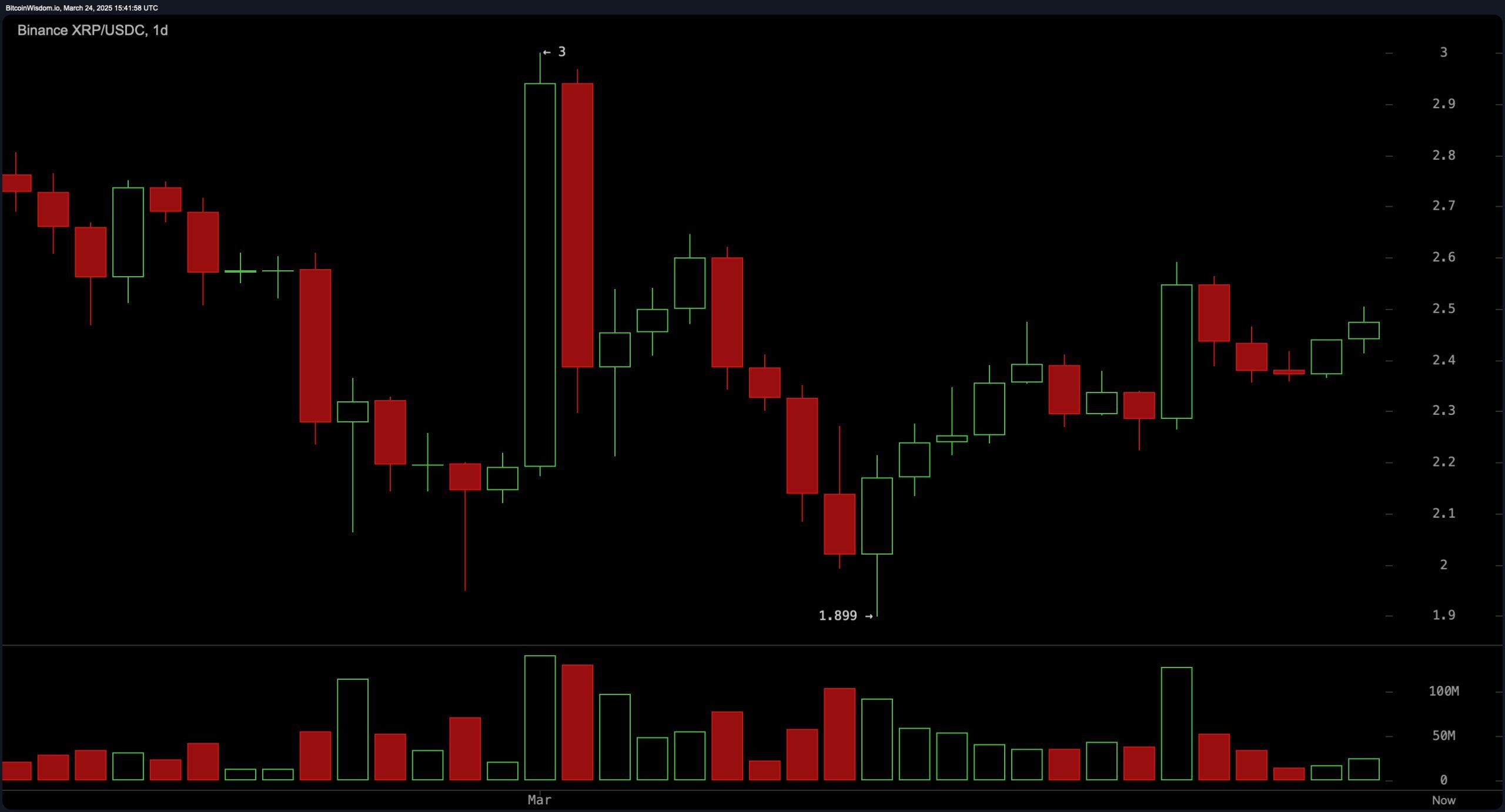

The daily chart illustrates a broader bullish accumulation pattern following a sharp impulse near $3.00, which was quickly met with profit-taking. However, a resilient support base around $1.90 has held firm, with the current structure showing higher lows and price consolidation near the 0.500 Fibonacci level of $2.45. Volume surges at key support zones signal strategic accumulation, with breakout potential above $2.60. Traders should monitor a close above this threshold, backed by volume, as a signal to target the $2.90–$3.00 region. A stop-loss placed near $2.25 would align with recent structural lows.

XRP/USDC 1D chart via Binance on March 24, 2025, at 11:42 a.m. Eastern Time.

Turning to oscillators, market sentiment remains broadly neutral. The relative strength index (RSI) is at 53.09557, indicating balanced momentum. The Stochastic at 76.66354 also suggests a neutral trend, avoiding overbought territory. Meanwhile, the commodity channel index (CCI) is positioned at 76.37764 and the average directional index (ADX) at 13.73979, both reflecting weak directional strength. The awesome oscillator prints a marginally positive 0.04447 reading, maintaining neutrality. A bearish note is struck by the momentum indicator at 0.12116, which currently flashes a negative signal, while the moving average convergence divergence (MACD) level at −0.00306 indicates positivity.

Analyzing moving averages (MAs), the bullish tilt is more prominent. The exponential moving average (EMA) and simple moving average (SMA) across 10, 20, 30, 50, 100, and 200 periods show predominantly bullish signals, except for the simple moving average (SMA) at 100 periods, which reflects a sell due to current price action trading below its level at 2.52428. The 200-period exponential moving average (EMA) and simple moving average (SMA) at 1.92033 and 1.73529, respectively, confirm a long-term bullish structure. These indicators together support the continuation of an upward trajectory, contingent on volume and price confirmation above $2.60.

Bull Verdict:

XRP is exhibiting a structurally bullish setup across all timeframes, underpinned by consistent higher lows, supportive volume behavior, and favorable signals from nearly all moving averages. If price action maintains above key Fibonacci levels and breaks through $2.60 with volume confirmation, XRP could be primed for a rally toward $2.90 and a potential retest of the $3.00 threshold. The technicals suggest accumulation is underway, favoring a bullish continuation.

Bear Verdict:

Despite the optimistic structure, XRP remains 27% below its all-time high and faces notable resistance near the $2.60 zone. Oscillator momentum is neutral-to-weak, with the momentum indicator flashing a sell signal. Should the price fail to sustain above short-term support at $2.45 and fall below $2.35, the structure could unravel, triggering a pullback toward the $2.20–$2.10 region. Without a strong volume to support a breakout, bearish pressure may resume.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。