比特币ETF吸引1.66亿美元,以太坊ETF连续第12天流出

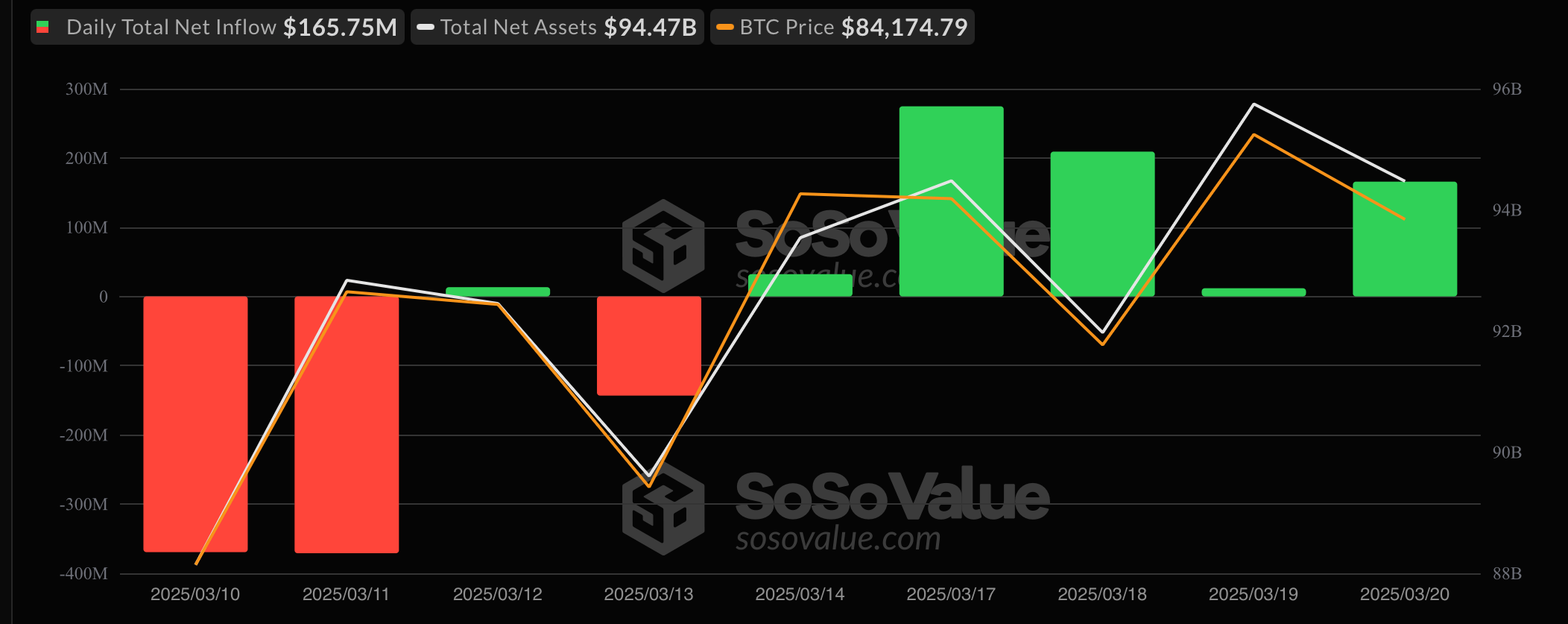

在一场显著的强劲表现中,比特币交易所交易基金(ETF)在3月20日(星期四)继续吸引资金流入,总额达到1.6575亿美元。这标志着现货比特币ETF连续第五天出现正向走势。相反,以太坊ETF则继续下滑,净流出1241万美元,延续了连续12天的流出趋势。

当天的资金流入主要受到黑石集团的IBIT推动,增加了1.7214亿美元。其他显著的流入包括Vaneck的HODL,流入1190万美元,富达的FBTC流入919万美元,以及灰度的BTC流入522万美元。

尽管有这些增益,某些基金仍然经历了小幅流出。Bitwise的BITB流出1740万美元,灰度的GBTC流出798万美元,富兰克林的EZBC流出731万美元。然而,这些流出不足以抵消比特币ETF整体的积极趋势。

以太坊ETF继续面临挑战,黑石的ETHA流出896万美元,富达的FETH减少345万美元。这些变动导致以太坊ETF资产持续下降,收盘时为67.9亿美元。

持续流入比特币ETF表明投资者对BTC的兴趣和信心恢复,随着美联储公开市场委员会(FOMC)会议传递出积极情绪,第一大加密货币的价格达到了85000美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。