一句话总结:short squeeze、季节性因素、情绪触底、养老金再平衡、散户持续买入、货币现金待发可能推动反弹

截止3月20日高盛交易台的数据:

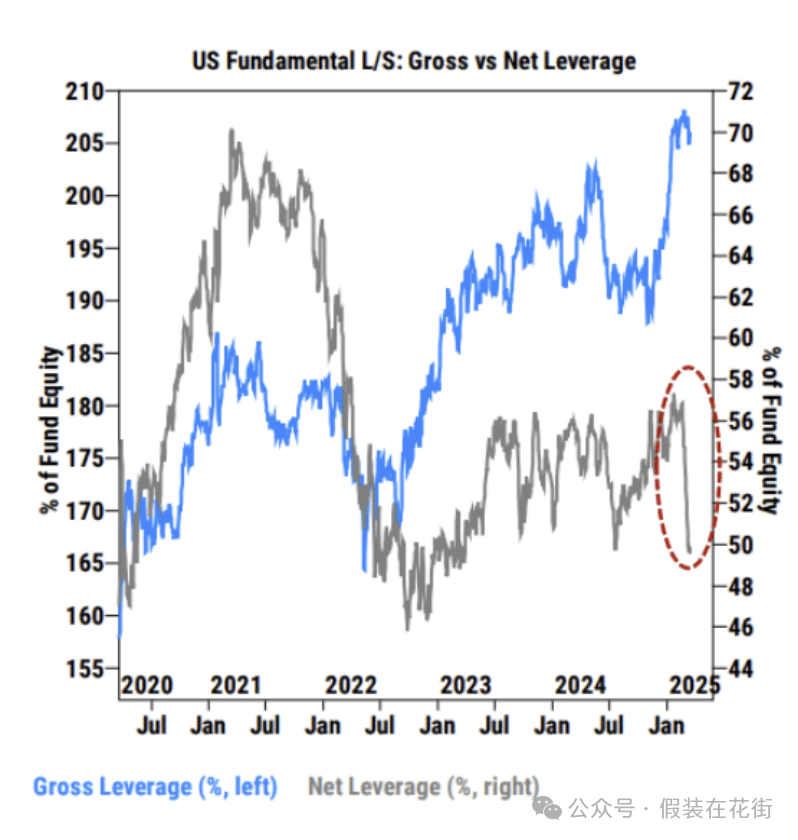

美国基本面对冲基金净杠杆率(上图灰线)急剧下降至两年低点75.8%;

但总杠杆率(上图蓝线)还是高达289.4%为五年来最高水平,这显然是因为空头上升;

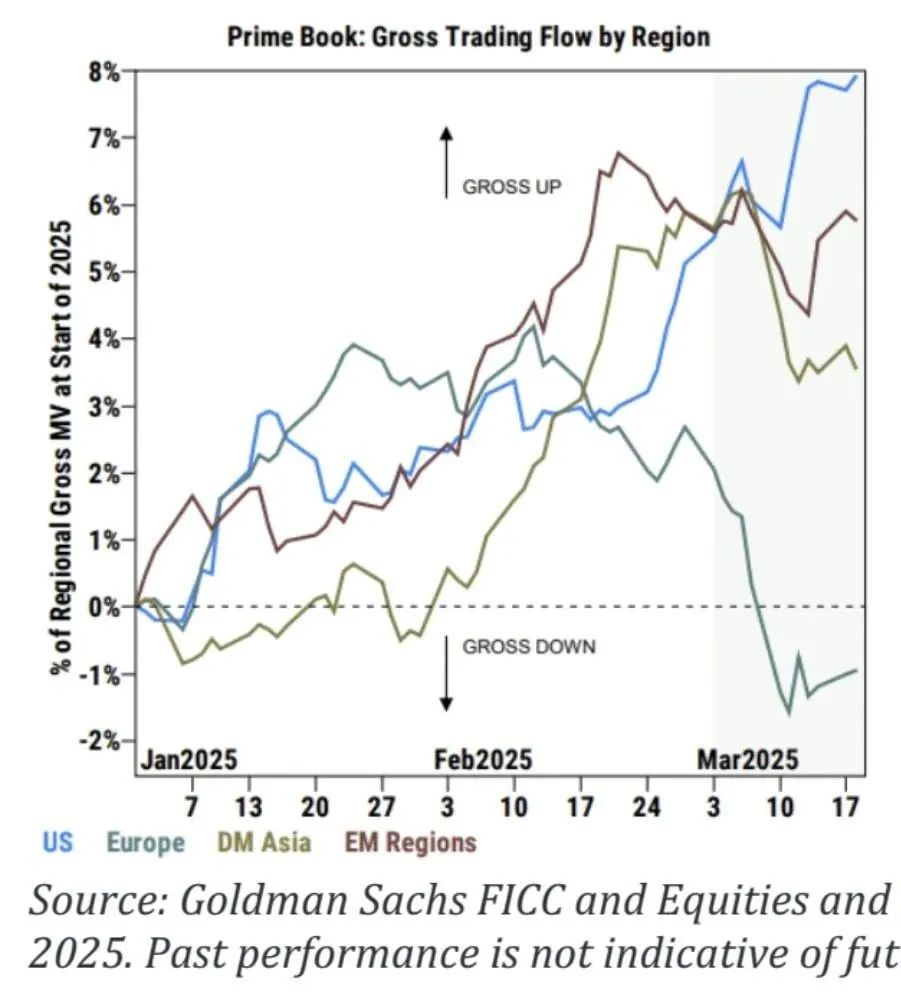

上图显示,基金们的总杠杆率3月份在美国大幅上升了2.5%,在世界其他地方去杠杆;

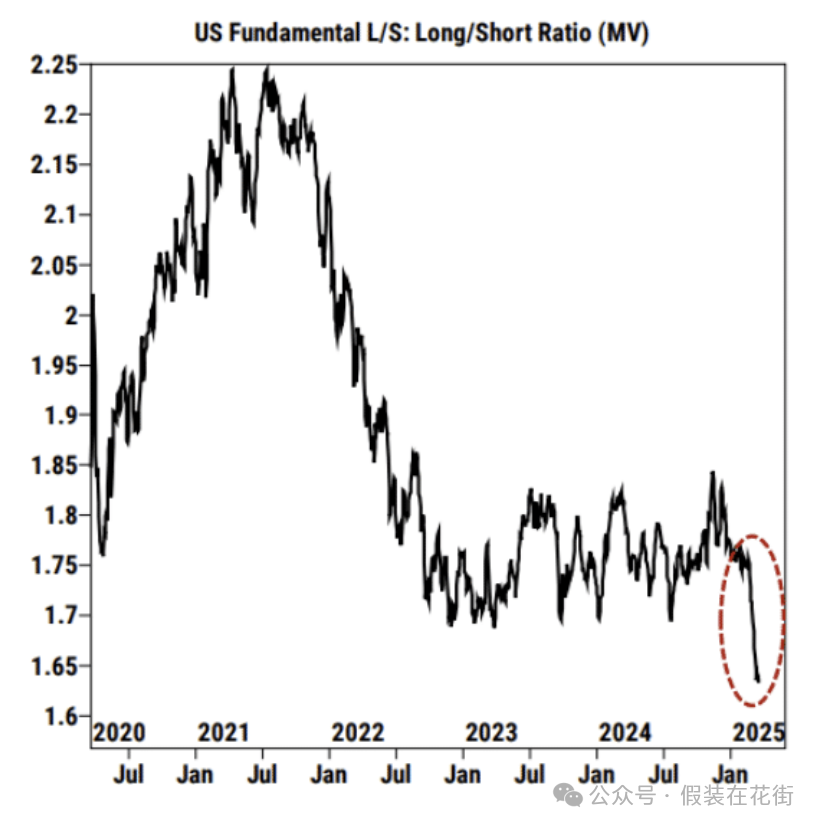

多/空(市值计)比例降至五年多以来的最低水平1.64;

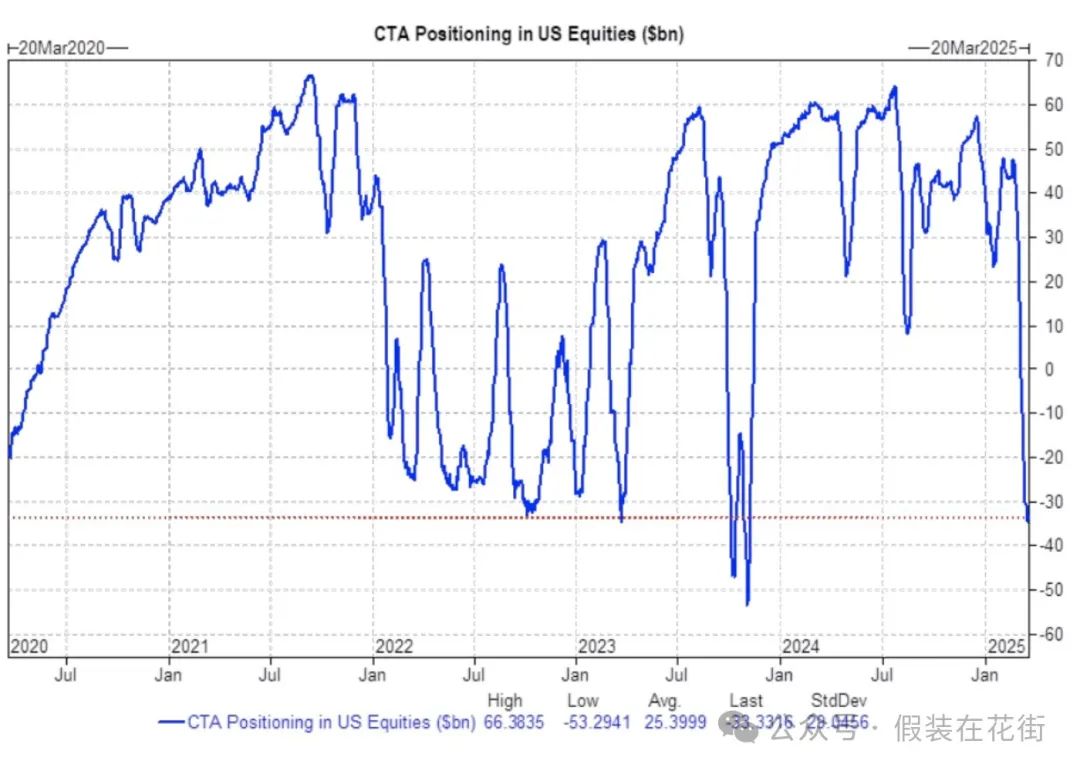

CTA资金时隔一年半首次净做空美国股票;

CTA资金时隔一年半首次净做空美国股票;

以上显示高杠杆已经去了一些,但对在关税实施前仍有去杠杆的空间,我们距离反转很近。

总杠杆率上升是因为杠杆空头增加,这可能是好事,数据可以看出来对冲基金不愿意过多削减多头,而是依赖于外部融资的杠杆空头对冲,市场出现异常波动时融资方可能发出margin call导致空头被迫平仓或抛售其他资产补保证金,也就是short squeeze的概率大大上升,如果资金选择后者也就是抛售其他资产则可能放大市场的异常波动。

但注意,这里不意味着必然的上涨而是说如果上涨了会有short squeeze助推。

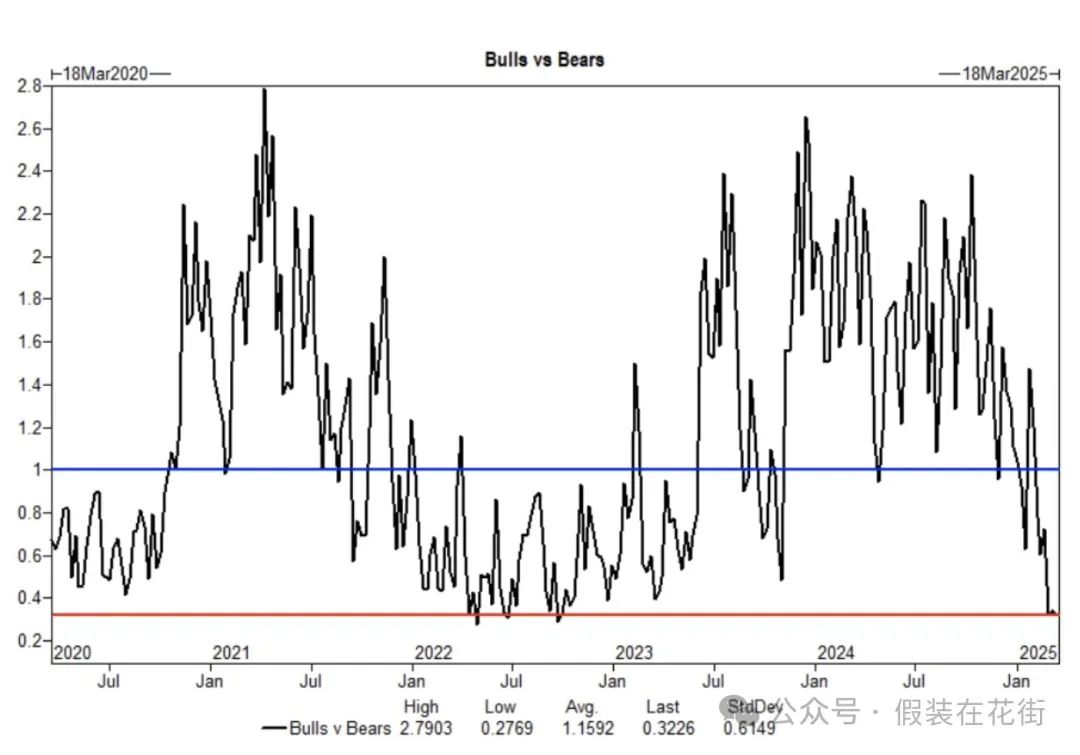

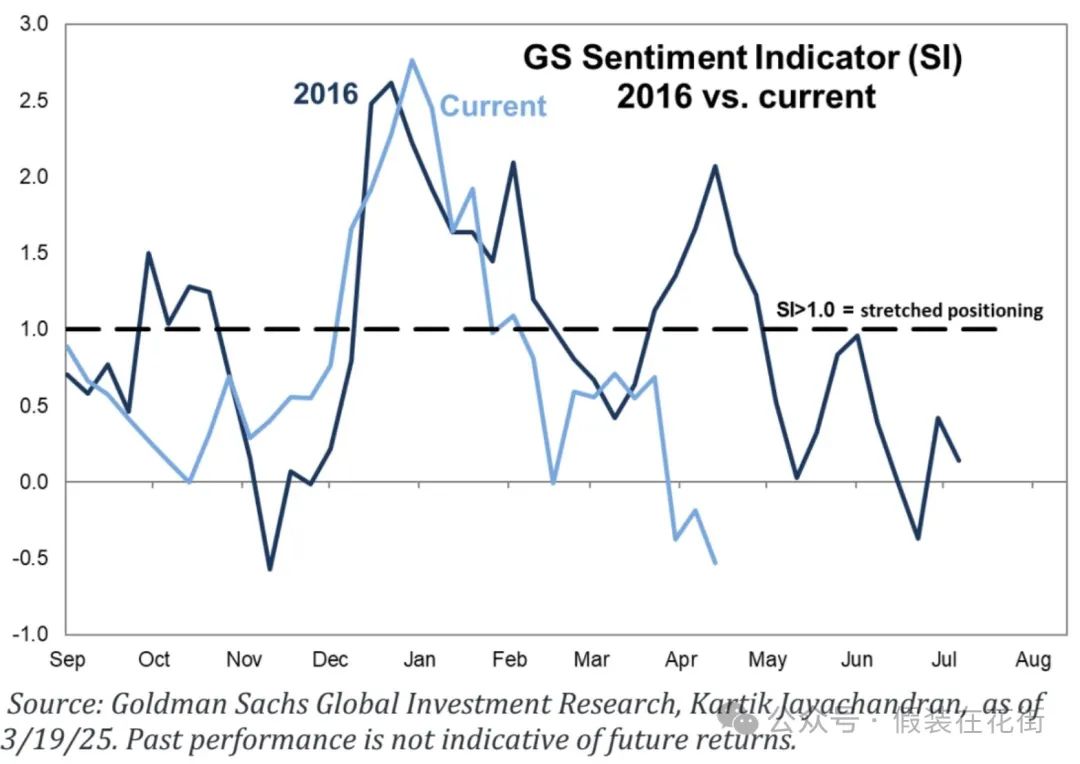

市场情绪跌至谷底,市场已回到“好消息即好消息”的环境,情绪或有回暖可能:

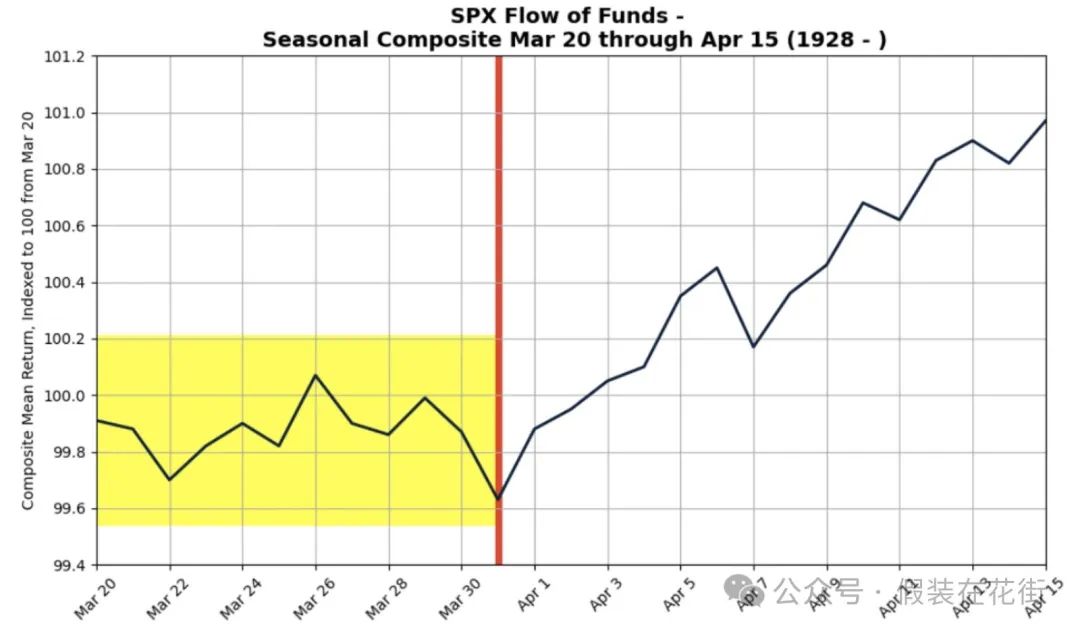

季节性利空走向末尾:

根据1928年以来的数据,3月下半月通常波动较大,今年也不例外。

但标普500指数在3月20日至4月15日期间平均上涨0.92%,在3月末至4月15日期间平均上涨1.1%。

这表明4月可能存在季节性反弹的潜力,但幅度有限。4月2日后,若无重大意外事件市场可能趋于稳定。

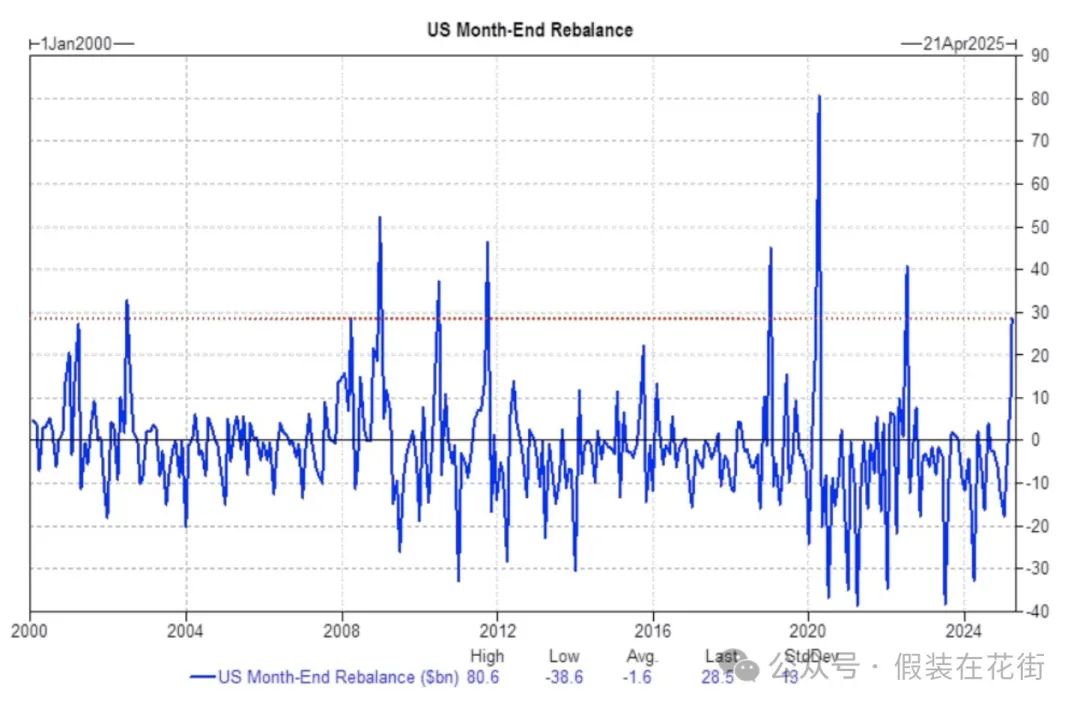

美国养老金预计在季度末买入290亿美元美国股票,位列过去3年绝对值估算的89%分位,自2000年1月以来91%分位。此举可能为市场提供一些支撑:

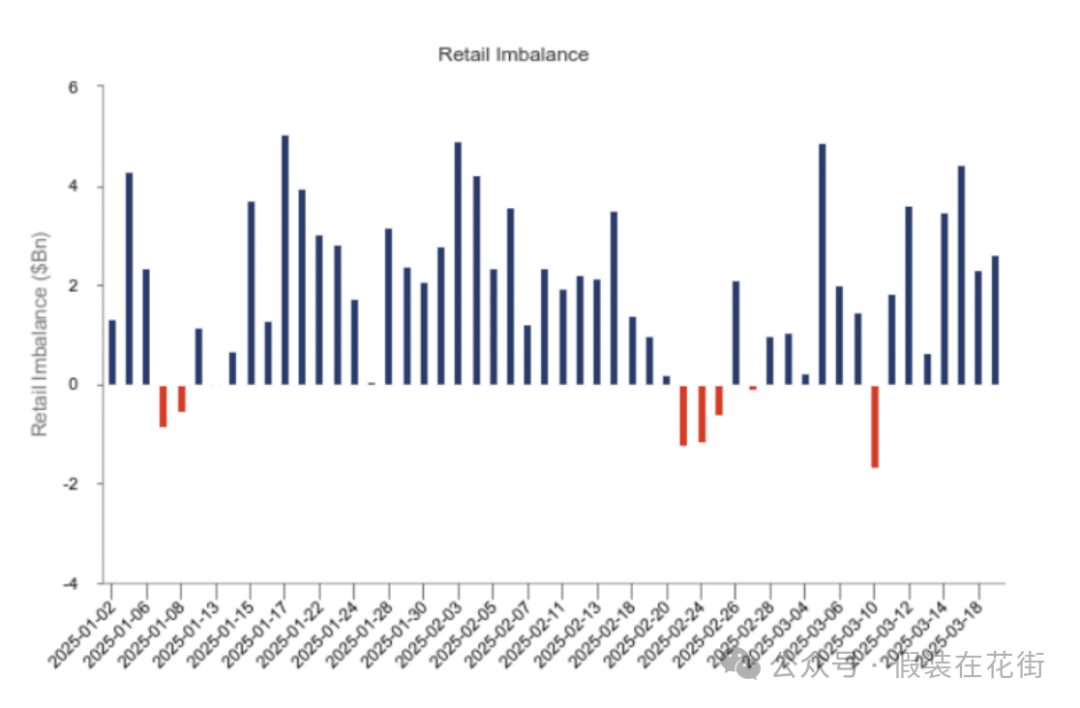

尽管市场出现波动,散户投资者的参与率依然保持稳定,2025年至今散户投资者仅在7个交易日出现净卖出,净买入量累计达到1.56万亿美元。

此外货币市场基金(MMFs)的资产规模持续增长美国达到8.4万亿美元,这些资金代表散户及其他投资者的现金储备,一旦市场情绪改善或投资机会显现,这些资金可能迅速转化为股市买入力。

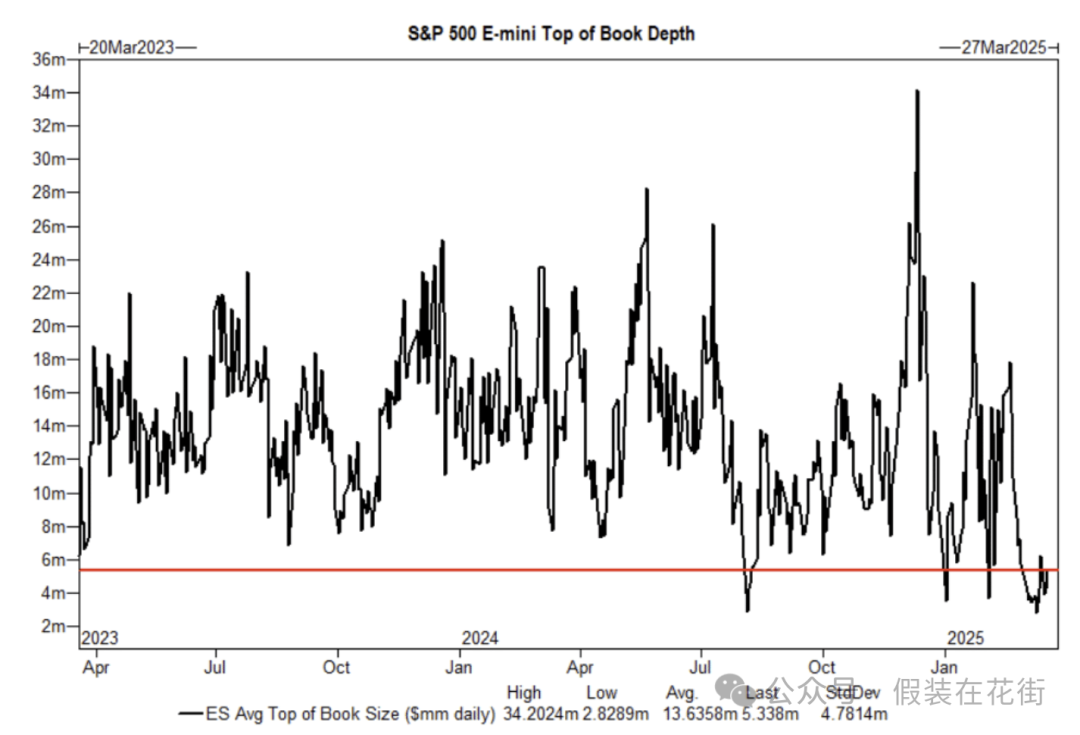

市场流动性仍然稀薄,也是为啥往往盘中波动很大的原因,要注意风险:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。