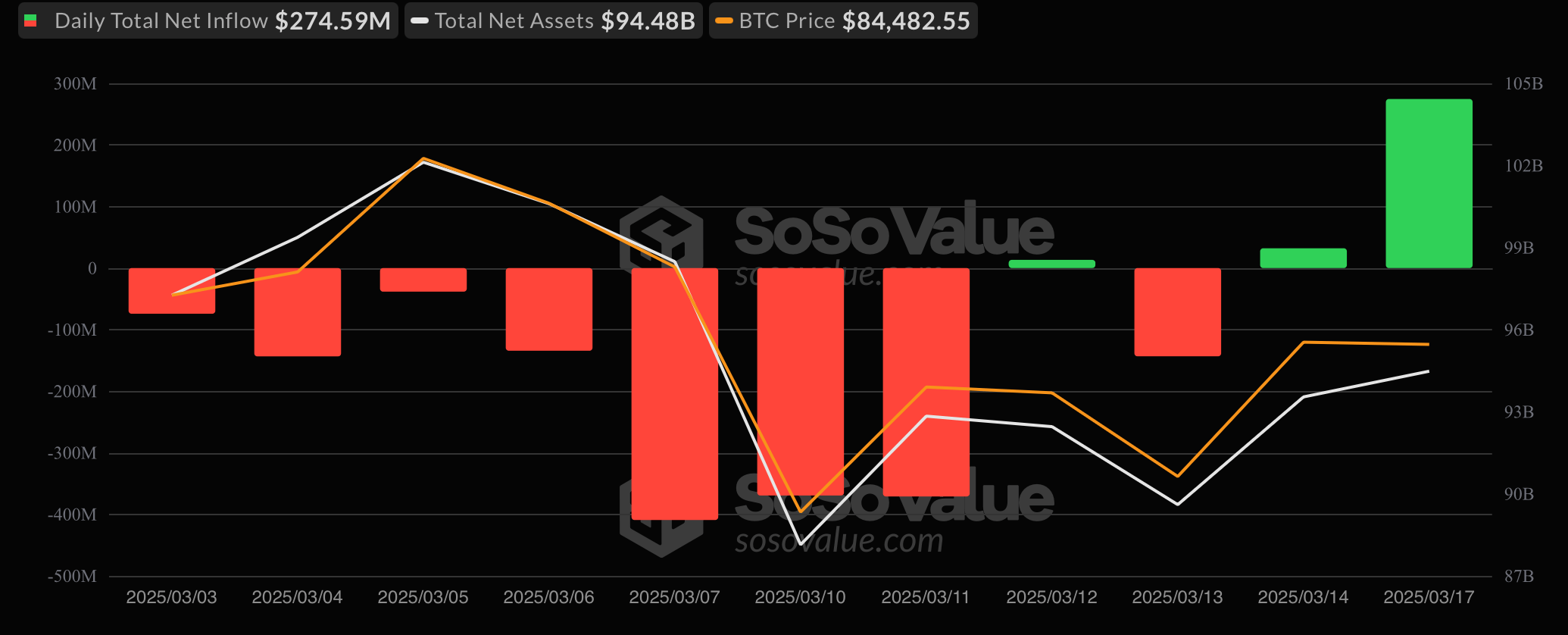

在经历了超过两周的持续资金流出后,比特币ETF在3月17日星期一迎来了显著的复苏,资金流入达到了2.7459亿美元。这一积极的资金流动标志着投资者对基于比特币的交易所交易基金的信心回升。

在资金流入中,富达的FBTC表现突出,增加了1.2728亿美元。Ark 21Shares的ARKB紧随其后,吸引了8853万美元,而黑石的IBIT则获得了4226万美元。其他贡献者包括灰度的GBTC,流入1422万美元,以及Bitwise的BITB,流入230万美元。这些集体流入使比特币ETF的总净资产达到了944.8亿美元,反映出市场情绪的回暖。

相比之下,以太坊ETF继续面临挑战,当天记录了729万美元的净流出。这标志着以太坊ETF连续第9天出现资金流出,显示出投资者的谨慎态度。唯一的流出发生在灰度的ETHE,流出金额为729万美元。

因此,以太坊ETF的总净资产仍低于70亿美元,收盘时为67.7亿美元。

比特币和以太坊ETF之间的对比趋势突显了当前市场的波动性。尽管比特币ETF正在迎来资金流入,但以太坊ETF仍在经历资金流出,反映出投资者更加谨慎的态度。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。