“One word $Doge ”— Elon Musk

Author: b12ny

Always regarded by the market as the leader of meme coins, it saw a price surge by the end of 2024 due to the Trump and Musk effect during the U.S. elections, but subsequently entered a significant correction with a drop exceeding 60%. This aligns with the overall decline of the meme coin sector, indicating that its short-term momentum is driven by market sentiment.

In terms of institutional positioning, Grayscale launched a Dogecoin Trust Fund in January 2025 (with a management fee of 2.5%), which is limited to qualified investors. Although the scale remains small (nearly $2 million AUM), its significance surpasses the numbers themselves, representing that $Doge has officially entered the realm of institutional investable assets, and is seen as a key step in Dogecoin's transition from meme-driven to institutional investment.

Meanwhile, the ETF is being pushed by Bitwise, which has submitted an application for a $Doge ETF to the SEC. If approved, it could further expand its market liquidity. However, there have been no approved cases yet, and future developments will need to observe changes in the regulatory environment.

$Doge possesses short-term speculative value and long-term application potential, with its price being highly correlated with Musk over the long term. X is actively exploring the integration of payment systems, and if $Doge is included in the X payment system, it would be the largest market catalyst since 2021.

Future development will depend on three key variables: payment applications, institutional investment, and chip dynamics.

Currently, $Doge still leans towards being a speculative asset driven by the community. If X or Tesla expands payment applications, it may bring new market demand. Additionally, the progress of ETF applications and regulatory policies will also affect institutional capital inflow, further changing the market structure of DOGE. This article will evaluate the current positioning and future potential opportunities of $Doge through a historical review, narrative economics, and in-depth analysis of chip structure.

Historical Review

$Doge was born in 2013, initially created by Billy Markus and Jackson Palmer to satirize the bubble in the cryptocurrency market, but unexpectedly developed into the highest market cap meme coin globally. The historical development of $Doge can be divided into several main stages:

2013 - 2017: Community-Driven and Charitable Culture

The Reddit community propelled $Doge to become an online tipping currency.

Sponsored the Jamaican bobsled team to participate in the Winter Olympics in 2014.

In 2015, Elon Musk publicly expressed interest in $Doge for the first time.

2018 - 2020: Low Liquidity and Market Marginalization

$Doge maintained a low price for an extended period, with no significant narrative driving the market.

Main liquidity came from community trading, with no institutional attention.

2021 - 2022: Elon Musk and the Meme Coin Wave

The GME event and Musk's posts propelled $Doge, increasing 100 times within four months.

$Doge market cap once surpassed $90 billion, becoming one of the top three cryptocurrencies.

$Doge was listed on mainstream exchanges like Robinhood, Coinbase, Binance, and OKX.

2023 - 2025: Institutional Capital Entry and Payment Process

Elon Musk's acquisition of Twitter (now X) drove the sentiment for $Doge to rise.

Tesla began accepting $Doge for payment on some products.

Trump's election as U.S. president shifted his stance to be more crypto-friendly, potentially promoting related policies.

The circulation of X Money code and related information led the market to expect support for crypto payments for $Doge.

Grayscale launched a $Doge Trust Fund, and Bitwise submitted an application for a $Doge ETF.

Narrative Economics

The market value of $Doge primarily relies on narrative-driven factors, which determine the future development and liquidity sources of $Doge, as well as influencing the capital rotation patterns of institutions and retail investors. The following are the current narratives affecting the market:

Leader of Meme Coins and POW Mechanism

Musk Effect and the Connection to $Doge

Payment Narrative (Tesla, X Money)

Institutional Investment and ETF Applications

Leader of Meme Coins and POW Mechanism

- Leader of Meme Coins

Since the birth of $Doge, it was primarily driven by the Reddit community to become an online tipping function. Since the last bull market, due to Musk's influence, it has established itself as the largest meme coin by market cap. Although it is mainly affected by overall market trends, it has also maintained a long-term correlation with other meme coins, catalyzing the emergence of other meme coins.

For example, $Shib and $Floki were born in 2021, along with the then-popular $Babydoge. It is worth mentioning that compared to other compatible/existing "meme tokens" on public chains, $Doge is the largest POW "meme coin" by market cap (second only to $BTC), with the third being $LTC.

- POW Mechanism

In the last round, a common saying was "Bitcoin is gold, Litecoin is silver, and Dogecoin is copper," because their technical architectures are all POW and the codes are similar. The biggest difference between $Doge and them is the inflation mechanism, with a fixed annual issuance of 5 billion coins, while the other two have a maximum supply limit. The table below compares the information and mechanisms of the three:

In early 2014, when the hash rate of $Ltc reached 600 GH/s, $Doge had less than 40 GH/s. This led to a low cost of network attacks on DOGE, resulting in pool attacks and the hacking of Dogecoin Wallet, causing the price to plummet by 95.26%. To enhance security, LTC founder Charles Lee suggested that the $Doge community engage in merged mining (AuxPoW) with $Ltc. This suggestion sparked intense debate, and ultimately the community chose to bind with $Ltc.

Through shared hash power, the overall hash rate of $Doge continued to grow, increasing the cost for hackers to attack DOGE and ensuring the security of the chain. Additionally, the $Doge earnings for miners became a primary source of income (early large holders of $Ltc were also significant holders of $Doge). Looking back, the merged mining indeed created a win-win situation.

Musk Effect and the Correlation with $Doge

It is well known that in 2021, the hype around $Doge surged again, with Musk being the biggest driving force behind it. Over time, the market influence of $Doge and its connection to Musk gradually expanded, including Musk's announcement on April 28, 2021, that he would appear on "Saturday Night Live" (SNL), which was broadcast live on May 8.

During the live broadcast, when asked what $Doge was, he jokingly replied, “It’s a hustle,” causing the price to drop 30% from $0.74. At that time, Grayscale's Barry Silbert even posted that he shorted $Doge with $1 million on FTX. The cyclical nature of events has now led to $Doge becoming one of the currencies in the Grayscale Trust Fund, indicating a clear shift in attitude.

In this election cycle, Musk also strongly supported Trump's administration. Last year, he even proposed a government efficiency department (abbreviated as D.O.G.E) primarily responsible for improving government efficiency and reducing costs. Initially, the market linked this move to the price of $Doge. In early January of this year, the official website briefly changed to the $Doge logo.

However, looking back from the past to the present, it is evident that the overall environment has changed. The market is no longer buying into Musk's simple slogans or tweets; expectations for price increases are now placed on Musk's ability to support $Doge through other means.

Payment Narrative (Tesla, X Money)

In 2025, X announced the upcoming launch of the payment service X Money, which is a key step for Musk in transforming X into an "all-in-one app." Based on current information, it already includes several wallets, instant transfers, QR code payments, and features with Visa, with expectations for deeper integration systems to be released soon.

However, as a trader in crypto, the more pressing concern is whether the anticipated integration of X Money with $Doge can be realized. Additionally, Tesla's existing payment methods include $Doge (limited to certain products), and some news outlets have reported that certain supercharging stations in the U.S. also support charging payments.

Here is an interpretation based on the information I currently have:

- Tesla

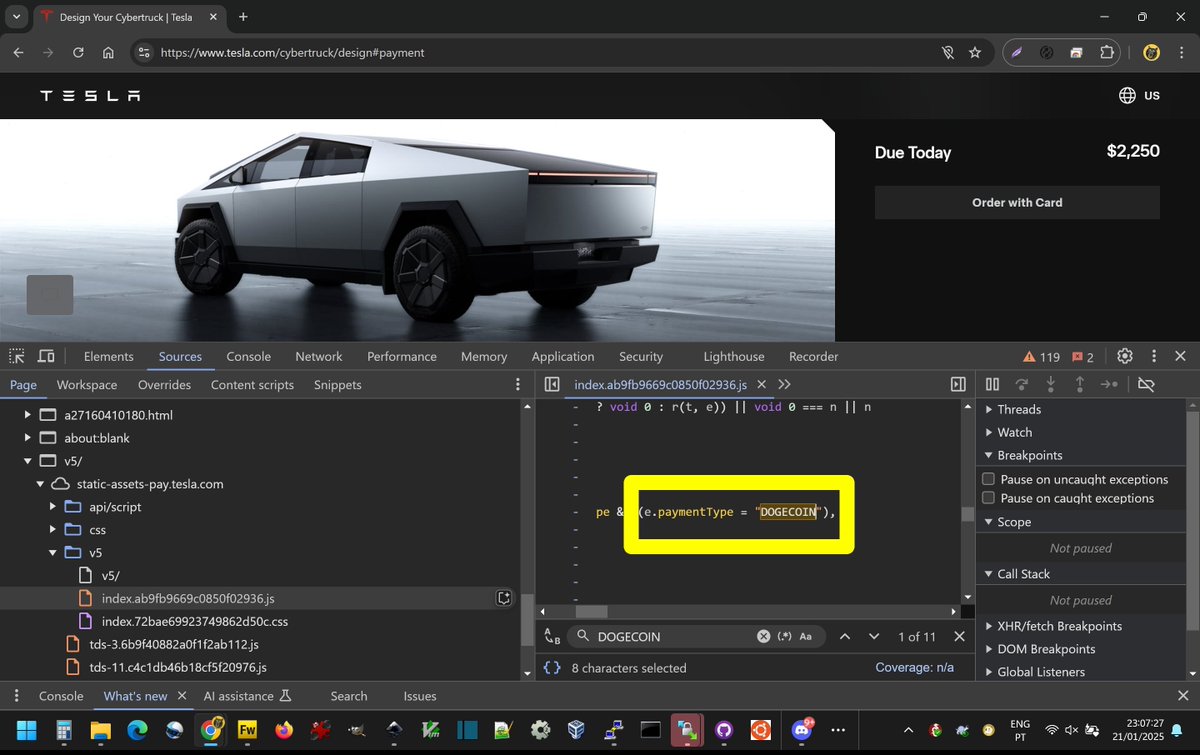

According to a query by @inevitable360, the front-end code on the Cybertruck page contains the code "DOGECOIN." During the period from 2022 to 2023, I also found related codes such as "DOGEPAY" and "DOGECOIN" through front-end code queries. Subsequently, Musk announced the official launch of the payment feature, so this information, in conjunction with the payment narrative, makes it very likely that support for purchasing vehicles with payment will be realized this year.

- X Money

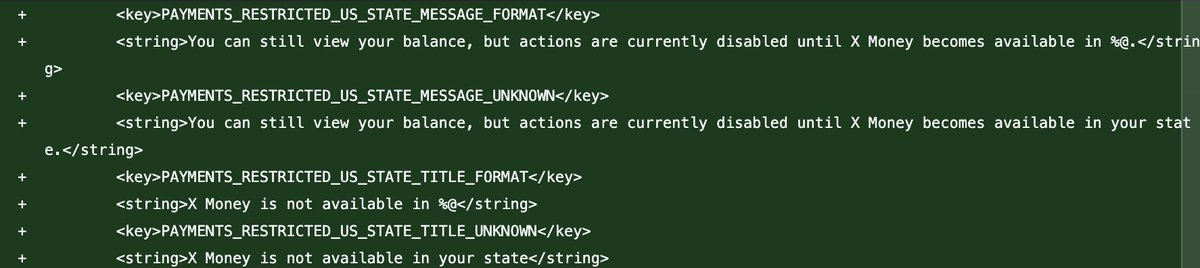

Information released by @aaronp613 indicates that X plans to launch X Money first in the U.S. Since X Money has not yet obtained full approval in all 50 states, it may choose to launch first in the 39 states that have been approved, using testing in some states for validation. Additionally, each user will be provided with a QR code, similar to scan-to-pay, allowing for mutual transfers and remittances.

Based on my past research experience and interpretation, it seems that in April 2023, Musk fulfilled his 2022 promise by changing the blue bird logo to the $Doge dog logo. This is similar to the earlier mention of D.O.G.E briefly changing the website logo to the dog logo. I believe Musk will keep his promise or joke (as with the Twitter acquisition).

On a practical level, if X Money officially supports financial services, X can test the feasibility of payment services and optimize and expand based on market reactions. Regulation will become a topic of speculation, and whether X Money can overcome regulatory hurdles may become a market focus, attracting capital to speculate on $Doge. Furthermore, $Doge could become one of the universal methods for cross-border payments.

The most notable instance was in 2022 when the largest $Doge holding address, Robinhood's CEO Vladimir Tenev, stated that if Dogecoin wants to become an asset for everyday payments and transactions in the future, it can solve the low transaction throughput issue by increasing block size and reducing block time. Both Dogecoin co-founder and Musk supported his views.

Tenev first mentioned that Dogecoin's transaction fees are already low enough to be a viable leader in electronic cash, but he believes that for broader adoption, improvements in block size and block time are essential. Therefore, if the speed issues can be resolved (I believe Musk can definitely do this), and with Tesla already implementing $Doge payment methods, the potential for scenarios integrating with X Money payment applications could significantly expand globally.

Institutional Investment and ETF Applications

- Institutional Investment

In addition to Grayscale launching a Dogecoin Trust Fund (nearly $2 million AUM) this year, which is seen as a key step for $Doge in transitioning from meme-driven to institutional investment, the Dogecoin Foundation also plays a core role in promoting and supporting the development of Dogecoin.

The foundation also announced the establishment of a "Core Development Fund" at the beginning of 2023, investing 5 million $Doge (approximately $360,000) to support the work of Dogecoin core developers. In November 2024, the foundation issued a fundraising appeal seeking support from major sponsors to promote the mass adoption of Dogecoin in 2025. The funds will be used to build a decentralized payment infrastructure called "Dogebox" to assist small and medium-sized enterprises in accepting Dogecoin as a payment method.

Additionally, the members of the foundation are also worth noting. In 2021, the foundation was restructured, and the advisory committee members include: Dogecoin co-founder Billy Markus, core developer Max Keller, Ethereum founder Vitalik Buterin, and Musk's long-time collaborator Jared Birchall. These individuals are well-known influential figures.

- ETF Applications

In early February, Bloomberg analysts James Seyffart and Eric Balchunas made predictions about the approval chances for ETFs of four major cryptocurrencies: $Sol, $Doge, $Ltc, and $Xrp:

$Doge (75%): As the largest meme coin, the 19b-4 filings submitted by Grayscale and Bitwise have been recognized by the SEC, thus the chances of approval are relatively high.

On the institutional side, Trump's policies and statements tend to reduce regulation and encourage market development, which also increases the chances of approval for the $Doge ETF. Therefore, the real question is not whether it will pass, but when it will pass.

I personally believe it must be approved by the end of this year to prevent the positive effects of the ETF narrative from diminishing due to marginal effects. Currently, the number of cryptocurrencies applying for and submitting ETFs is increasing, and it is essential to secure approval before the end of the year to raise market expectations for prices (from the perspective of liquidity and scarcity).

As the leading meme coin, if $Doge is indeed approved as expected, its status and chances of being a legitimate payment method may significantly increase. This means that whether Trump's crypto policies truly promote this will also have a critical impact on Musk's development of $Doge in the payment and financial markets.

Chip Structure

Due to the concentration of $Doge chips in a few addresses, the top 115 holders account for 65.4% of the total circulation. Even Robinhood, a single institution, holds 21.06% of the chips. Therefore, understanding and analyzing these chips' impact on price fluctuations can often reveal clues before the market begins and ends. In my past trading experience, this has been very helpful. The table below compares the past Top 20 holdings with Robinhood's holdings:

According to the analysis in "Beyond Musk: The Real Price Drivers of Dogecoin?! Chip Distribution and Price Impact at a Glance! Quickly Grasp Key Signals Before Price Surges" analyzing the top 20 holders of $Doge, particularly the on-chain transfer behaviors of smart money addresses, it can be observed that the timing of operations by these large $Doge addresses is highly correlated with price fluctuations. The table below shows addresses with a high correlation to price:

The transfer behaviors of these addresses can assist in trading strategies for buying low and selling high, as well as the selling pressure caused by large-scale outflows, which often serve as reference signals for short-term market trends. For traders, paying attention to the movements of these addresses can provide analysis and assessment of future price trends. However, market behavior shows that the participation of large smart money makes the dynamics of chips more complex.

Current Positioning of $Doge and Future Potential Opportunities

Looking at past prices and cycles, it is very likely that a relative low point will form between 0.18 and 0.2, breaking through historical highs again. I have previously stated in tweets that I am willing to make a large purchase at 0.18. If I were to give a price prediction, I believe the probability of reaching $1 in this cycle is the highest, similar to the historical significance of $100,000 for $Btc.

At this stage, $Doge still relies on market narratives and capital liquidity. In the short to medium term, it may continue to maintain high volatility in line with the overall market. If key events such as X Money and ETF approvals are realized as expected, it could genuinely transform from a meme coin to a "payment-oriented cryptocurrency."

This content reflects my deep understanding and analysis of Dogecoin accumulated over five years since entering the space. If you enjoy my content or wish to discuss further, feel free to leave a comment or like and share.

See you on the moon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。