No winners, but no endgame either.

Written by: Deep Tide TechFlow

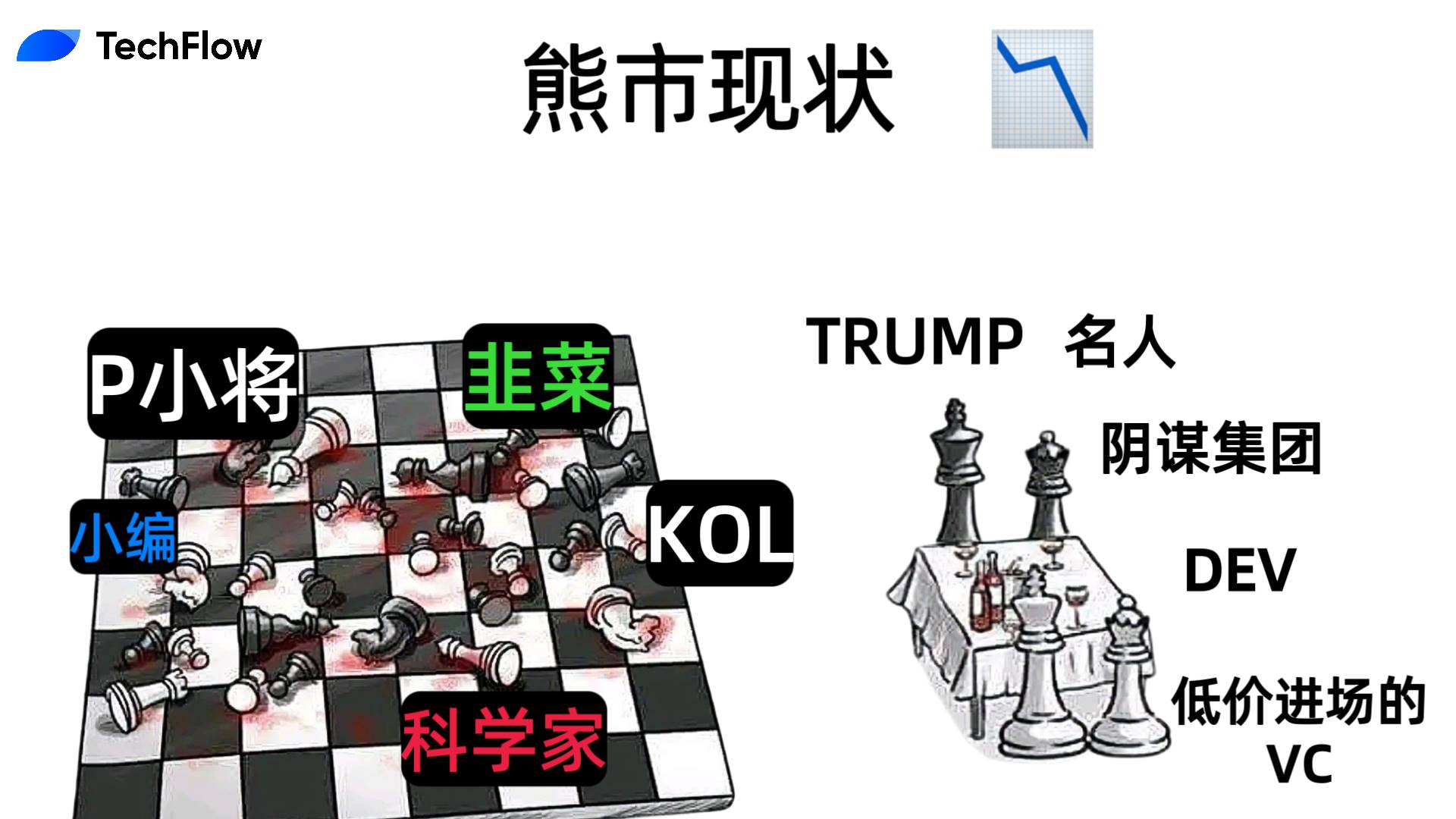

Presidential painting doors, celebrities issuing coins, double explosions in long and short positions, AI going silent… Since the beginning of the year, any one of these topics in the crypto market is enough for the vast number of retail investors to have a drink.

As a seasoned retail investor, it's hard not to indulge in these topics --- lacking sufficient information, hearing rumors, trading without discipline, and other weaknesses are magnified during Scam Season and bear markets, making losses a high-probability event.

But it's not just the retail investors who are getting hurt.

When the market declines, most people, no matter how hard they try, may not be winners, and this includes KOLs (Key Opinion Leaders).

KOLs, who have always been seen as standing on the same harvesting front as project parties, have also started to lose money and complain during this round of bull-bear transitions;

What has turned them into "big retail investors" comes from something that you once had no chance to touch, but now has become a hot potato:

KOL rounds.

KOL Rounds: From Win-Win Tool to Multi-Loss Trap

In bear markets, there is often a lot of bickering and rights protection, but it was unexpected that KOLs would also start to protect their own rights.

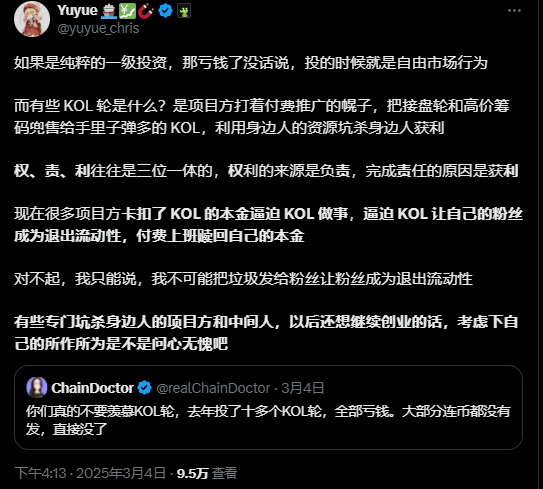

On March 4, 2025, ChainDoctor sighed: “Don’t envy KOL rounds; I invested in more than ten KOL rounds last year, and all of them lost money. Most didn’t even issue coins, they just disappeared.”

Perhaps KOLs have a higher tolerance for losses than retail investors, but that doesn’t change the fact that they are also losing money.

You can certainly view it as a performance and a plea for sympathy, but the more KOLs express their frustrations, the more it indirectly proves that they are indeed being scammed.

After this post was published, various KOL big shots in the Chinese crypto community began a collective criticism and complaint about KOL rounds. For example, well-known KOL yuyue directly condemned:

“Some KOL rounds are project parties using paid promotion as a guise to sell the takeover rounds and high-priced fundraising to KOLs, exploiting the resources of those around them to profit…”

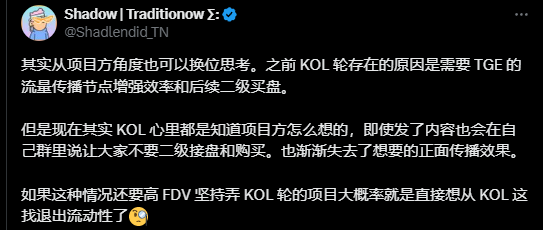

You might still doubt the logic behind KOLs losing money, but in the entire token listing chain, KOLs are actually positioned downstream in the ecosystem.

The entire chain usually includes:

Seed round (early investors like friends and family), private placement round (for venture capitalists and strategic partners), KOL round (project parties sell tokens to KOLs at a discount in exchange for promotion), public offering round (retail investors), and exchange listing (tokens listed for trading).

KOL rounds typically appear after the private placement round, where project parties sell tokens to KOLs at low or discounted prices, and KOLs use their influence on X and Telegram to promote the project, increasing its visibility.

In a bull market, KOL rounds may be a win-win tool. Project parties raise funds through KOL rounds, KOLs make money from the token's cost price and secondary price differences, and retail investors may also get a share when the market is good.

But in a bear market, the situation is not so optimistic.

With liquidity drying up, secondary market trading volume shrinking, and token prices plummeting, project parties often cash out early and run away, while KOLs are left with locked tokens—usually with a lock-up period of 3 to 6 months that prevents KOLs from selling in time, leading to token value dropping to zero.

In the aforementioned post, you can also see sharp comments:

"Now the KOL rounds are a typical case of losing both the woman and the soldiers. Project parties can’t raise money, can’t cut from the secondary market, so they target the KOLs who eat ads, meaning KOLs are putting in money, effort, and people."

This is no longer a passive phase where everyone understands each other due to poor market conditions, but rather a situation where some project parties even actively harbor ill intentions, viewing KOLs as part of the liquidity exit.

Worse still, KOLs face a situation of being squeezed from both sides: project parties know that KOLs are aware of the risks of this model, yet still exploit KOLs' greed or survival pressure (the need for traffic monetization) to push for cooperation. KOLs hope to "take a gamble," but the results often backfire.

On the other hand, retail investors' blind trust in KOLs is decreasing, and there is even a "reverse indicator" phenomenon (projects recommended by KOLs are believed to drop). The promotional effect of KOLs declines, token prices struggle to rise, further damaging their reputation.

If one does not consider cutting and running, who wouldn’t want to cherish their reputation and help everyone earn together?

From a win-win tool to a multi-loss trap, among most people standing downstream in the value chain during a bear market, perhaps there are no winners left.

Agency: The Professional Ethics of Brokers

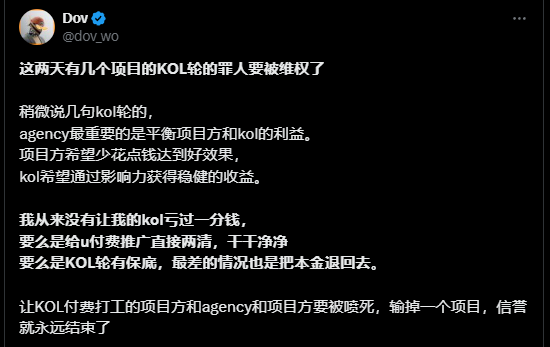

You may not know that behind the KOL rounds in the crypto market, there is another little-known role: Agency (agency firms).

In simple terms, their responsibility is to take on the promotional needs of project parties and help find suitable KOLs in the market for promotion.

But the responsibilities of an Agency go far beyond just making connections. They must balance the interests of project parties—hoping to attract maximum traffic at the lowest cost—and the demands of KOLs—hoping to obtain stable income through promotion, ensuring capital preservation or even profit.

For example, an Agency representative named Dov posted:

"I have never let my KOLs lose a penny; either I pay them directly for promotion, clearing everything, or the KOL rounds have a guaranteed minimum, and the worst case is that I return the principal."

From this, you can see that any practitioner in the crypto ecosystem has varying motives and business capabilities.

An excellent Agency will try to consider a minimum guarantee mechanism to ensure that KOLs do not lose money, such as direct cash payments or returning the principal of KOL rounds. But if an Agency lacks professional judgment and picks poor projects, KOLs may face token depreciation and lock-up risks, ultimately leading to losses.

The fate of the workers often depends on the professional ethics of the brokers.

In the chain of crypto marketing, perhaps only scammers wish to do "one-off deals." Continuously scamming people will lead to fewer and fewer business opportunities, and the path will become narrower.

After all, no one is a fool; sustainable win-win situations are the way to make money.

But perhaps everyone can be a good broker in the downstream link, yet it seems unavoidable to become a victim in the upstream link.

No winners, but no endgame either

The cruelty of the bear market lies in the fact that it not only makes ordinary investors (retail investors) feel the chill of the market but also forces KOLs, who once stood higher in the interest chain, to bow their heads and face reality.

In this cycle of bull-bear transitions, project parties, KOLs, retail investors, and even Agencies are playing different roles, but in the end, there are no winners.

KOLs' "rights protection" is actually a microcosm of the entire crypto ecosystem.

From a "win-win tool" in a bull market to a "multi-loss trap" in a bear market, the degradation of KOL rounds exposes the deep-seated trust crisis in the crypto market. The short-sighted behavior of project parties, the profit-seeking mentality of KOLs, the blind following of retail investors, and even the insufficient professional capabilities of Agencies are all magnified in this game.

When the market declines, everyone is trying to protect themselves, but it is difficult to escape the fate of being harvested.

The "being harvested" of KOLs is not merely a simple dispute over interests but a reflection of the ecological imbalance in the crypto market under bear market conditions. When liquidity dries up and funding chains break, all roles standing downstream in the value chain will become passive victims.

Looking back, the controversy over KOL rounds is essentially a growing pain in the industry's development.

When KOLs protect their rights, they are also indirectly voicing for the entire ecosystem. Perhaps only after experiencing such a bear market can everyone truly understand that in a market without rules and trust, short-term winners will ultimately become long-term losers.

But from a longer-term perspective, this may also be an opportunity for a reshuffle. The market's low point is often the starting point for ecological optimization; only through reflection and adjustment in pain can the next round of prosperity be welcomed.

Will the next bull market arrive as scheduled? Perhaps it depends on whether each participant today can truly learn from the lessons of this bear market and find a new balance of "win-win."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。