2024 年 10 月,自 AI Meme——GOAT 启动了 AI Agent 概念开始,Crypto 开始加速与 AI 融合。Game+AI、DeFAI、AIAgent 蜂巢等概念喷涌而出,几乎一周就会有一批新概念项目出现,直至今年 1 月 18 日特朗普宣布发行 MemeCoin,直接抽干市场流动性,CryptoAI 的泡沫提前被戳破。而 2 天后 DeepSeek 公布了开源 R1 模型,在几周的发酵后美股的 AI 概念股也被戳破了泡沫。

600 万美元就能做个大模型,还在抄底 6000 万美元市值的 CryptoAI 的散户被社区一度定义为「智商不足的韭菜」,此类风潮甚嚣尘上,加上美股 AI 概念集体跳水,币价自然也螺旋死亡,自此 AI 概念在 Crypto 逐渐沉寂。

一个季度后,CryptoAI 的声浪在市场中重新回归,而这次回归似乎带来了一些新的概念。

AI 生态发币平台各显神通

在 Pumpfun 的成功案例之后,Crypto 掀起了一股资产发行平台的风潮,上一波 AI Agent 风潮来袭时,框架和 AI 分销网络/LaunchPad 是 FDV 最高的两个领域。而类似于 Ai16z 的开发者社区的框架概念在发展到一定程度后,社区发现框架能做到的事情很有限,尤其是做不到 Crypto 中的价值层面捕捉,因此还活着的框架逐渐转型 LaunchPad。而 AI LaunchPad 也并不好过,究其原因就是当时的 LaunchPad 并不能满足 AI 产品的发行,为了承载下次 AI 热潮的回归,项目方纷纷开始寻找解决之道。

CryptoAI 基础设施的乐土——Bittensor

尽管在前段时间经历了有人 SN28 子网利用机制漏洞将其变为 MemeCoin,而推动 TAO 释放进入 Meme Coin 炒作,而最终被基金会中心化干预,而随着时间的推移,未来基金会将对 Bittensor 子网的控制权越来越小,这引发了社区对其未来可能变为一个「注意力网络」的泛激励项目的疑虑。而长期跟踪 Bittensor 项目的「思维怪怪」也发表文章,认为这是个骗局。

延伸阅读:《观点:为什么 Bittensor 是一个骗局,TAO 正在走向归零?》

但如果单纯从投资角度来看,Bittensor 生态系统的流动性是比其他 AI Agent 生态更好的。比如 Virtuals,因为 LP 与 Virtuals 是配对的,这会导致流动性提供者的波动性更高。在投资人投资平台内的代理代币上会有大概 3% 到 7% 的滑点。而把资金投入 dTAO 子网代币时,滑点通常为 0.05% 到 0.1%。

也正因如此 VC 或者大资金的 AI 项目参与者会更偏向于在 Bittensor 做长期投资。就在上周,前 Messari 分析员、Crucible Labs 合伙人 Sami Kassab 宣布与和他有相同工作经验的好友 Seth bloomberg 将成立一个专门为 Bittensor 提供流动性的基金.

当前 Bittensor 的「第一项目方」Rayon Labs 制作了几款产品,可以从中一瞥在 Bittensor 项目方的偏好,他们往往更「实用」且长期。

SN64「Chutes」提供无服务器的方式轻松部署 AI 的基础设施,项目方称此前 AWS 中断事件就是一个最佳案例解释了我们为什么需要「无服务器」。因为如果依赖于中心化服务提供商,一旦发生中断,AI 应用程序可能会因单点故障而宕机,而 Crypto 是个与钱强相关的产业,造成损失的概率远远大于传统 AI。

SN56「Gradients」是一款零代码部署 AI 模型的平台,用户可以在 Gradients 上训练自己的 AI 模型(针对特定用例、图像生成、自定义 LLM),最近推出的 v3,在价格上与同类产品相比更有优势。

SN19「Nineteen」是一个快速、可扩展、去中心化的人工智能推理平台。

AI Agent 协议的制定者——Virtuals Protocol

作为上个周期生态搭建与价值飞轮结合的最完善的 AI 项目之一,Virtuals Protocol 的币价随着市场的沉寂飞轮的旋转速度也放缓了,随之而来的是价值 45 亿美元市值的泡沫被戳破,跌幅超过了 90%,而发射器的参与者也大幅降低。但 Virtuals 没有放弃,在这个 AI 的熊市,他们开始 Build。

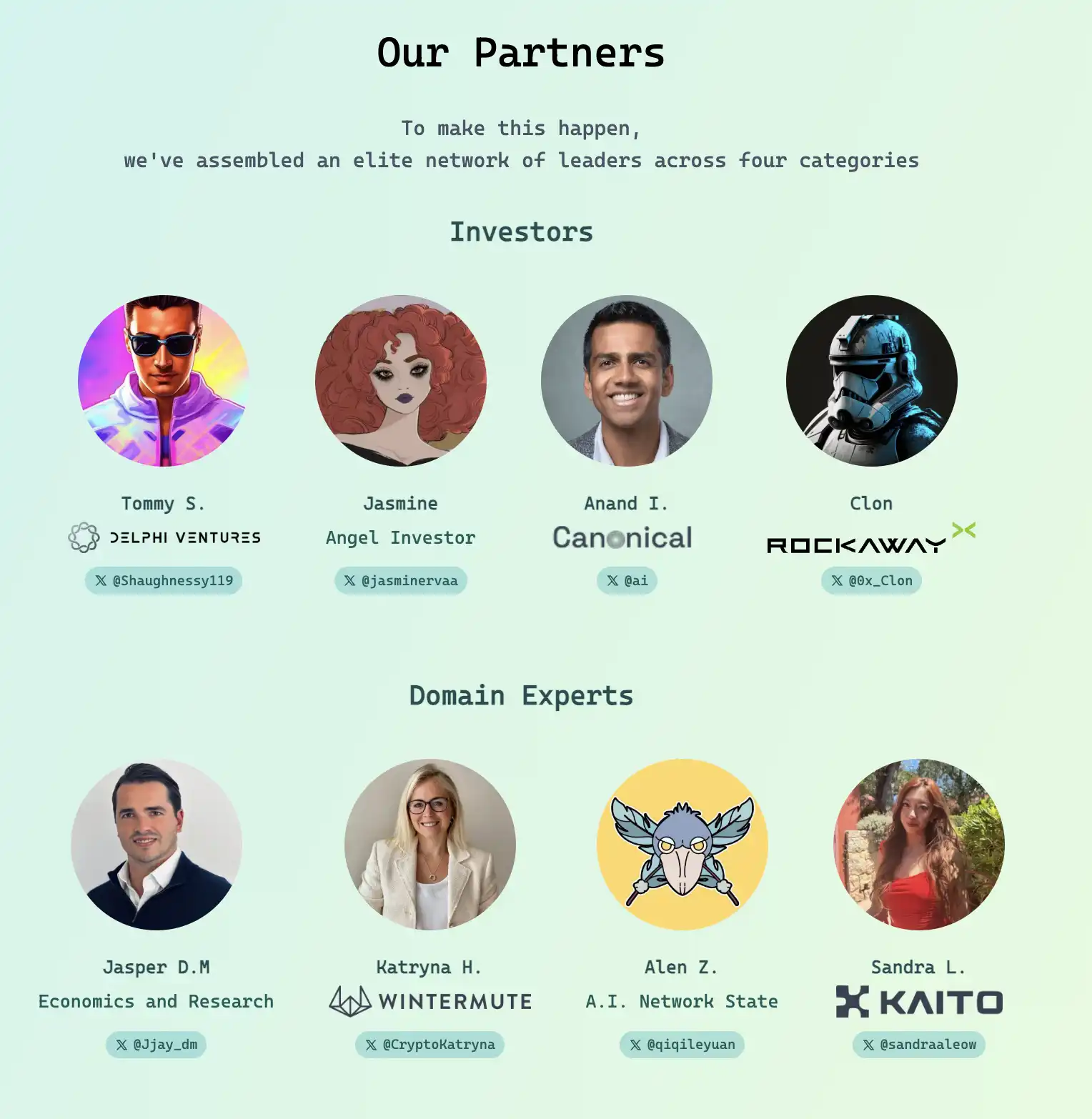

首先,Virtuals 完善了自己的项目方建设生态,发布了 VPN 计划「Virtuals Partners Network」,从一开始 Virtuals 的计划就是将更多的 AI 人从引入 Crypto,而该计划将多个生态位置相连接,包括投资人、各个领域专家、学者和开发者,几乎是只要你有一个想法,从投资人到做市商、市场营销甚至专业人才都可以从这个计划中获取资源。「一条龙服务式」的孵化器,可以说对任何想要进入 Crypto 的人才跟 Virtuals 合作是最佳选择。

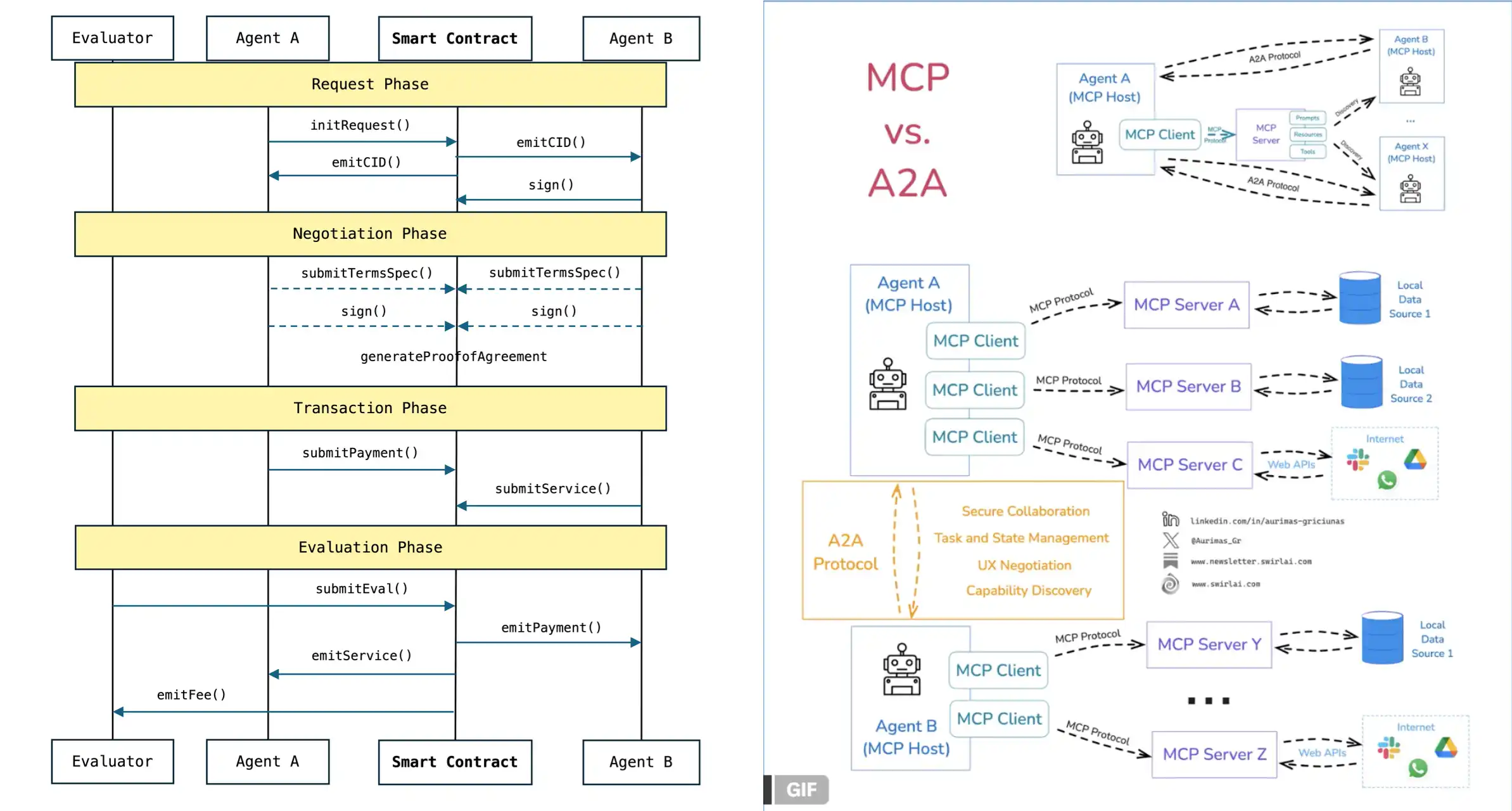

为了扩大生态体系中 AI Agent 的影响力和互动度,Virtuals 拟定了一个协议 ACP「Agent Commerce Protocol」,可以说是之前 Swarm、Ai16z 等项目的蜂巢概念的具象化版,ACP 构建了一个由 AI 代理组成的商业生态系统,对 AI Agent 来说这是一个他们可以自主交互、相互协作和交易的虚拟国家。值得一提的是,在这之后 Google 也发布了一个类似的 A2A 概念,稍微不同的点是 ACP 是由智能合约相连,而 A2A 则是由协议相连接。

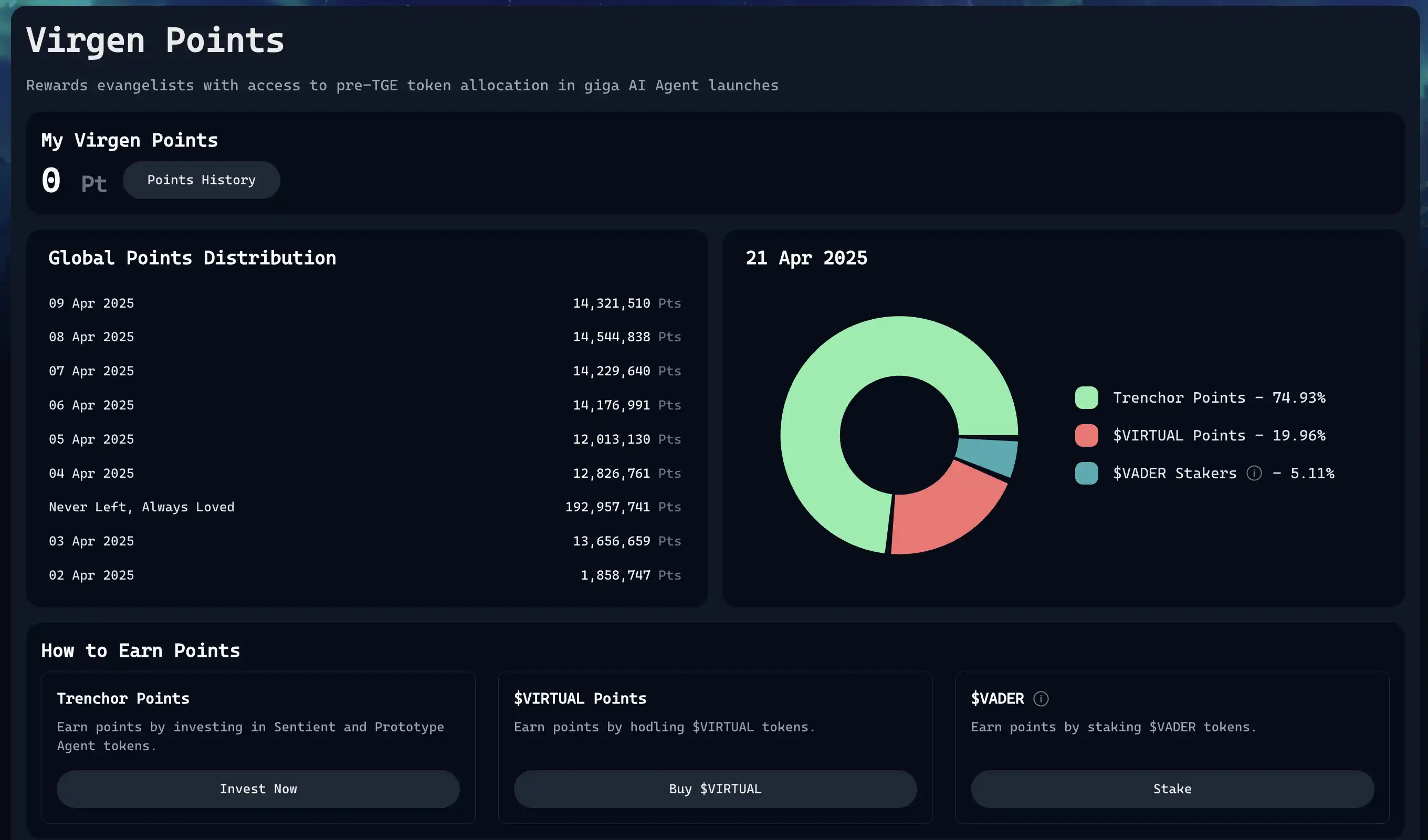

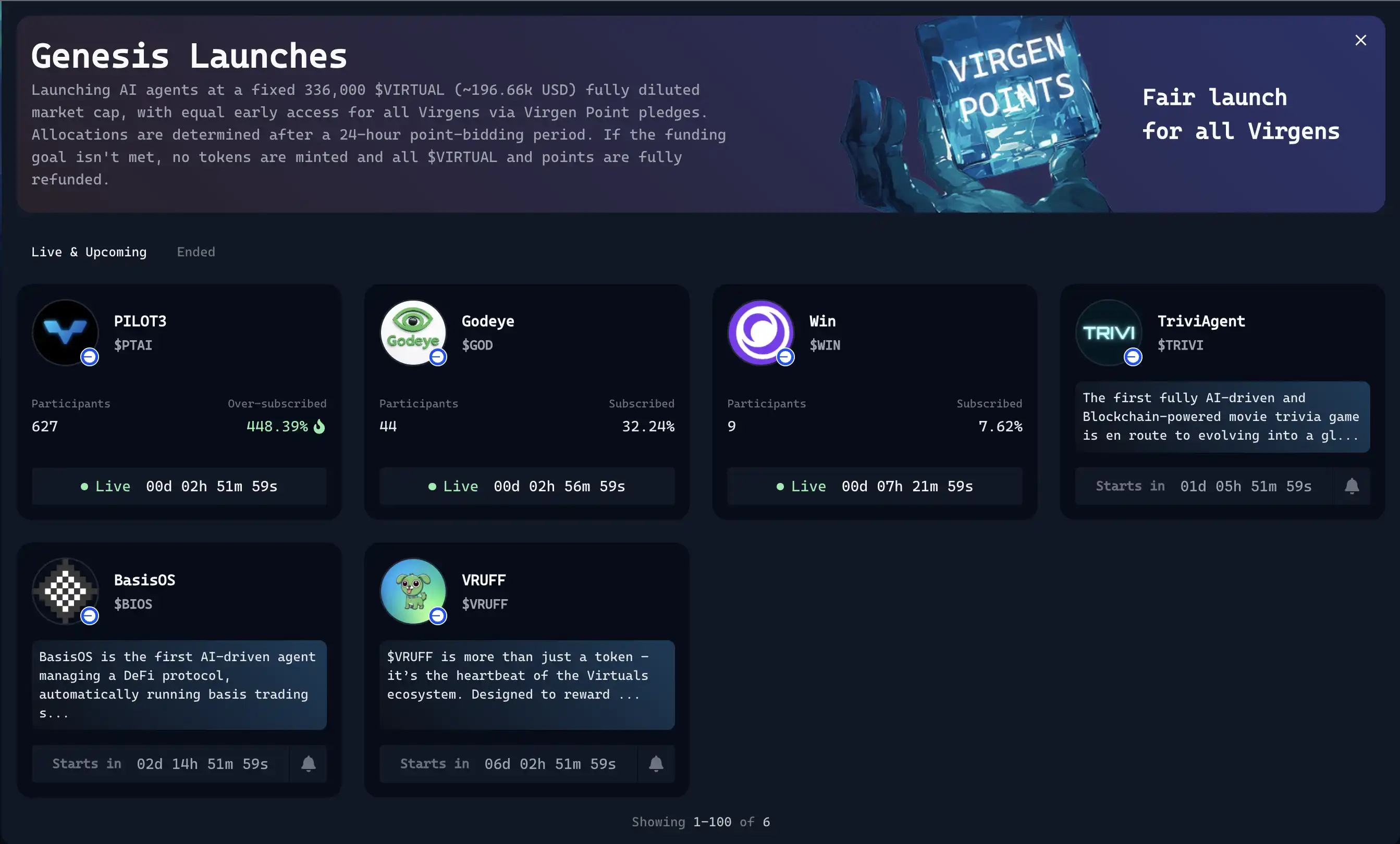

在 4 月份 Virtuals 刚刚推出了 Virgen 积分和 Genesis 发射模式的新模式,用户可以通过投资 Sentient 和 Prototype 的 Agent、持有 Virtuals、质押 VADER 等方式获取积分,而积分是参与 Genesis 发射台项目的基础。Genesis 发射台则是 IDO 模式的项目启动方式,根据用户拥有的 Points 来获取投资额度。而这种发射模式目前并非所有人都可以参与,而是需要经过 Virtuals 官方的审核。

这种模式有几个好处,第一是通过奖励来增加自己平台用户的粘着度,用创始人 Ethermage 的话来说就是「我们的原则是奖励 believoors」,质押积分获取参与 Genesis 项目的额度从而是启动更加公平,且参与者通常更加优质,让项目可以更加可持续的发展。

Virtuals Protocol的黑客松有趣的项目?

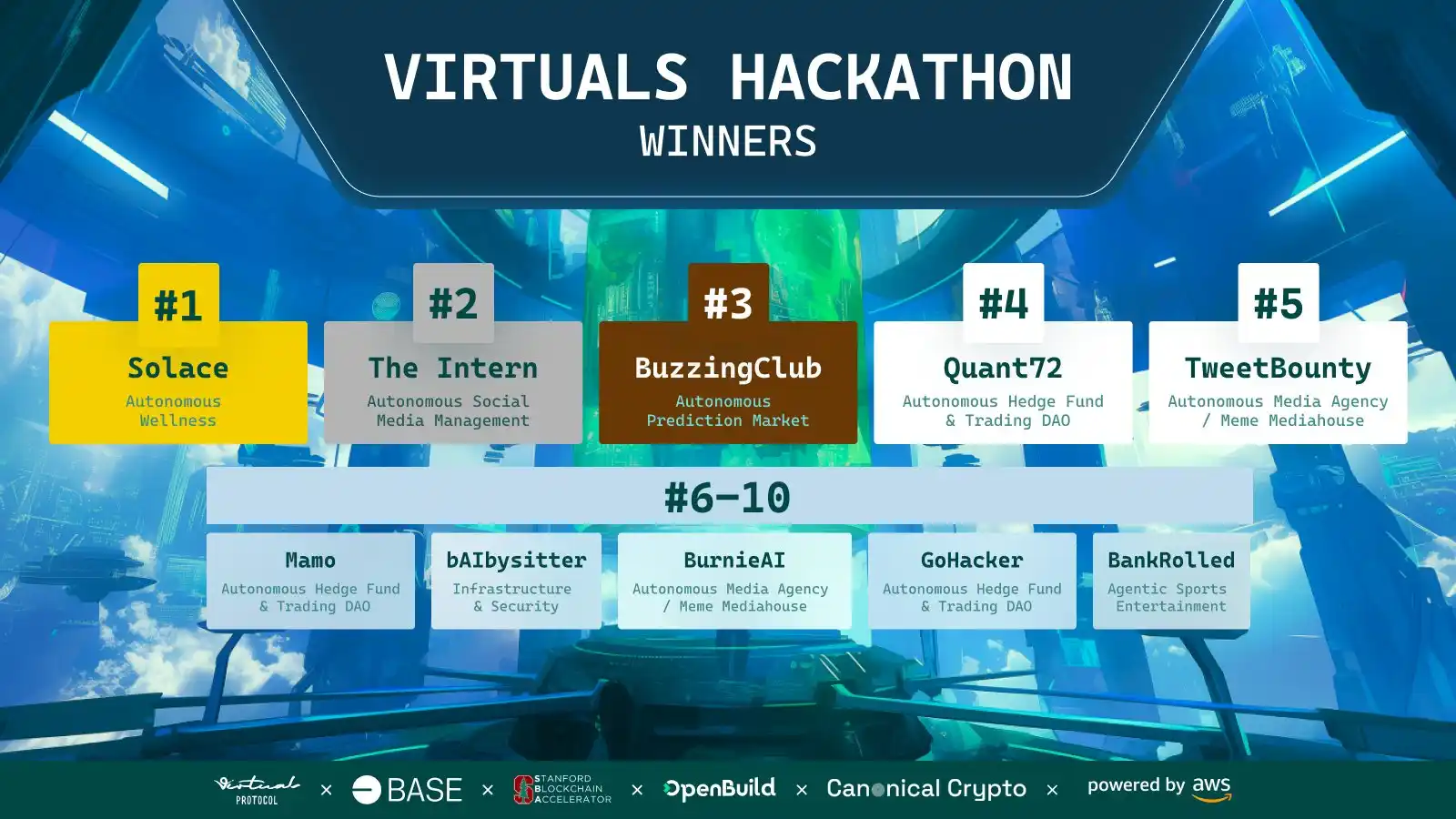

除了 Genesis 上的项目值得关注,Virtuals 在 4 月 21 日刚刚公布了本次黑客松的获奖得主,共 100 余个项目方参赛,而评审阵容也相当豪华,包括 Base 负责 AI 和 DEPIN 板块发展的 LucaCurran、创立斯坦福区块链社区的 KunPeng、Canonical Crypto 的合伙人Anand Iyer「有意思的是 Anand 在 X 上的 Tag 就是 AI」。

The Intern 是一个帮助运营的 AI,他可以做到在 X 上帮助推广,回复以及管理社区,他能够通过深入社区学习来理解社区的文化并可以使用TADA生成图片。现在与 Pudgypenguins 一起合作推出了企鹅实习生,并运营了自己的推特。从推特的运营质量来看,如果完全属于 AI 独立运营,并这种水平能够批量化的话会是个不错的产品。

BuzzingClub 是一个预测市场平台,项目方认为预测市场的未来应该掌握在参与者手中,而不是一个中心权威机构「每个人都应该能够自由地创造、分享和表达自己的意见。」,因此 Buzzing 相比其他的预测平台更为自由。

在 Buzzing 所有用户都可以创建预测市场「提出话题或题目」由 AI 生成规则,而后通过 AI 算法过滤掉一些垃圾信息和低质量的预测市场,最后通过 AI 预言机自动检索互联网搜索数据而非人工数据来做预测问题的结果判断。

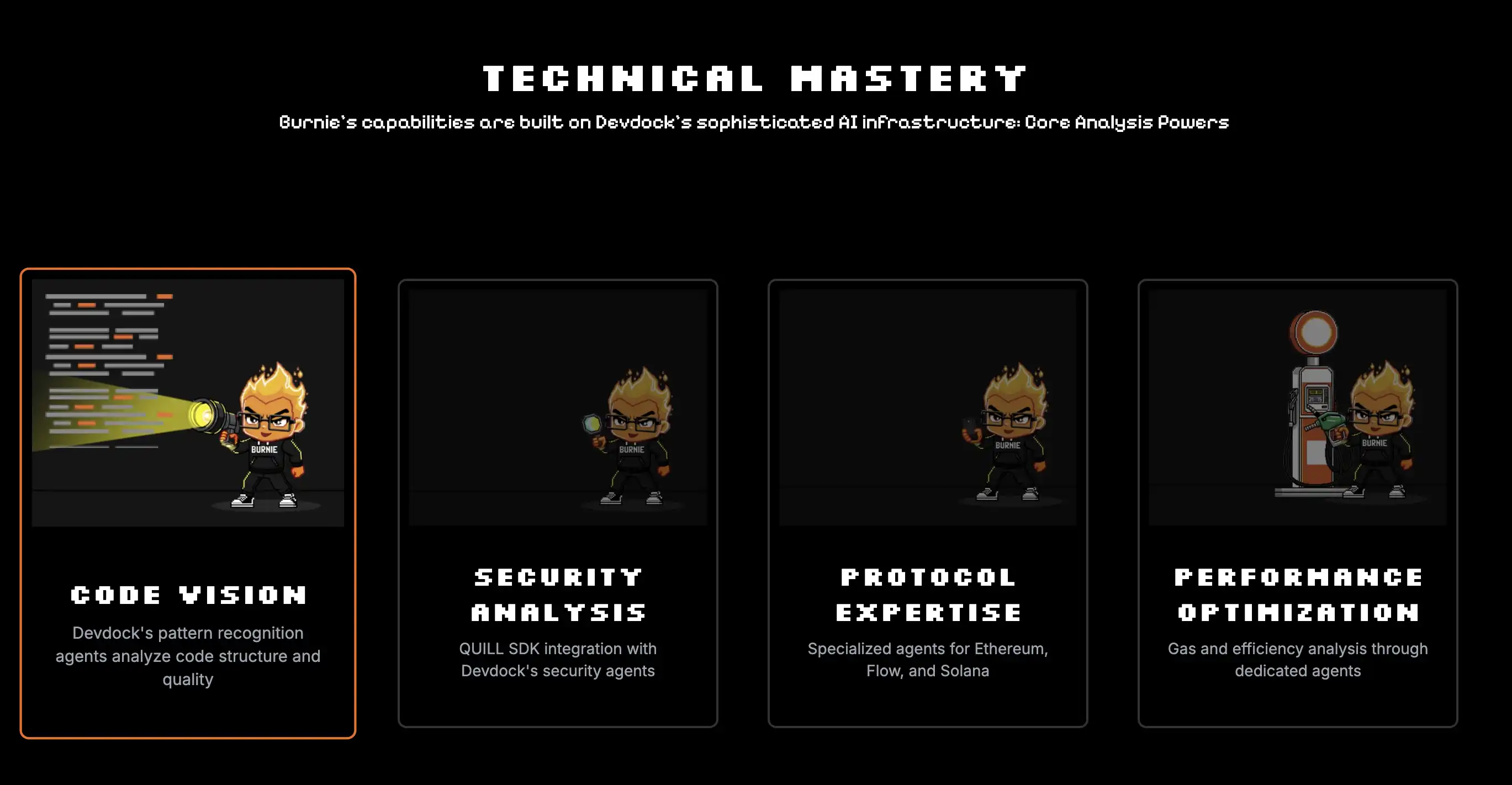

Burnie 是一个代码的学习平台可以提升想要学习代码的使用者各方面的水平,同时玩家可以通过完成他发布的任务获取奖励。

灵感即 App,后 AI 应用时代下沉市场布局

Arc 和 Ai16z 在框架发展逐渐停滞之后,也纷纷转型从变成 AI Agent 的分发平台,Arc 的发行平台 forge 上线后自从第一个产品 AskJimmy 之后便销声匿迹,而 Ai16z 的 AutoFun 在几天前上线,但当前公开支持的项目都未上线,发展如何还未可知,而从产品框架上来看 AutoFun 似乎更偏向于创建社区的 UGC 文化平台,在价值留存上来看与传统的 LaunchPad 差别不大。

而 Arc 计划上新的 Agentic App Store Ryzome,以及 Myshell 已经存在的 AIApp Store,前者还未正式上线,后者也缺乏活跃度,出现的产品大多大同小异。

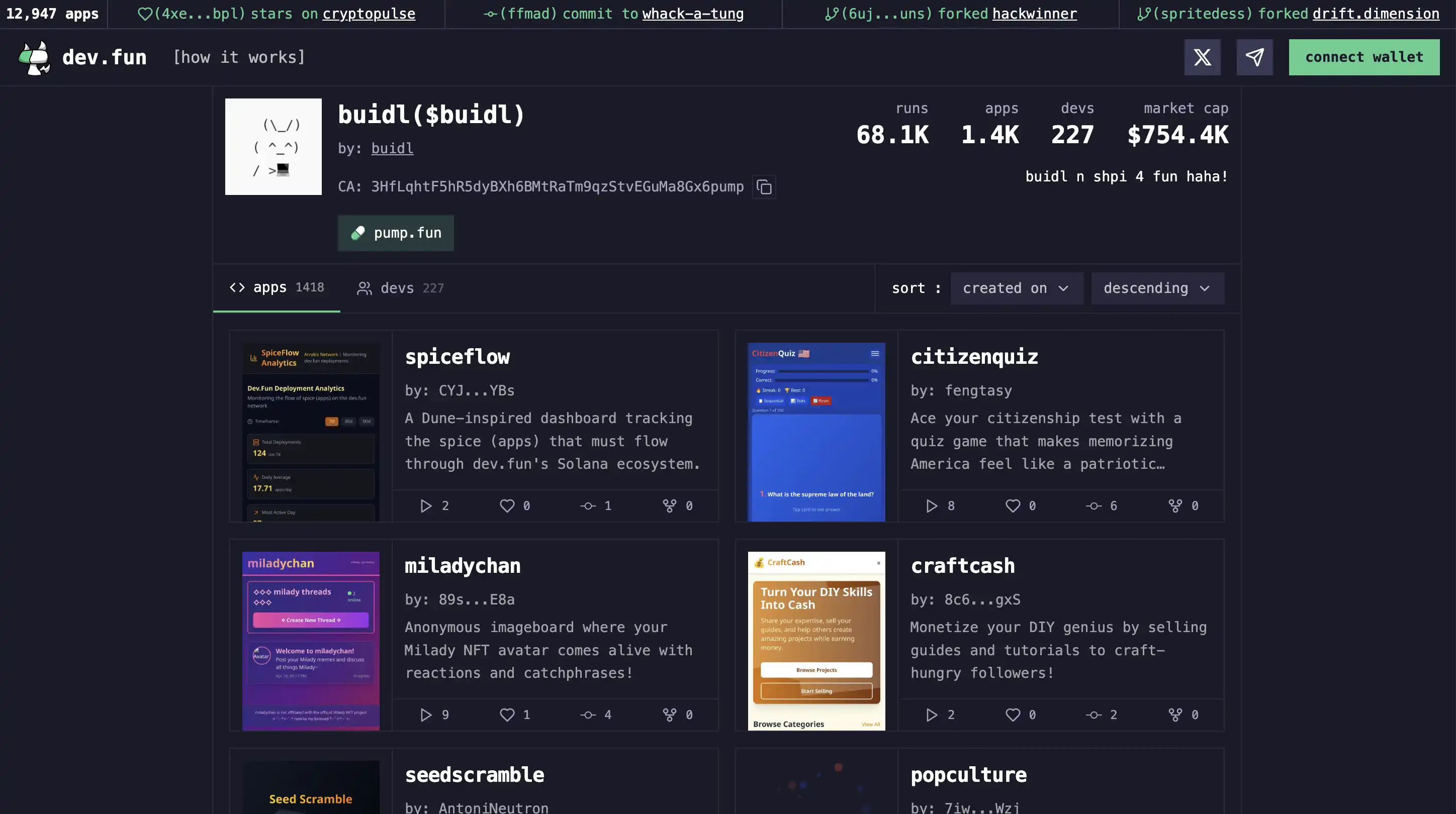

这种情况下之前就以 AppFi 概念出现的 dev.fun 则更加正统,第一眼看这个从配色到 UI 都与 Pumpfun 类似的,但似乎在某种层面来说更加具有活力。虽然从币价上来看 dev.fun 与其他 AI 项目一样在这个周期内下跌许多。令人惊讶的是,当前有接近 13000 个 App 在这个平台诞生。

dev.fun 提供了通过与 AI 聊天便能生成 App 的功能「类似之前 YC 投资的 Replit」,而用户除了可以发行项目/Meme 的 Token,也可以自行选择交易对,当前拥有最多支持者的 Buidl 目前共有 1400 个 App 并运行了将近 7 万次。

现在 Crypto 市场更偏好什么 AI?

当下市场内比较受欢迎的项目分为几类。其一是开发工具,包括框架、AI Coplit 的编程工具、MCP 基础设施。其二是消费者的 AI 应用,包括 AI Agent、游戏、DeFAI「Alpha 信号、基金、自动化 LP」、GambleFAI。其三是去中心化的 AI 基础设施,比如去中心化计算、验证、存储等。前两种通常更受散户喜爱,而第三种则是 VC 或投资人的首选,此类项目通常会需要相当高估值来承接。

开发工具

这类项目拥有更广域的使用场景以及项目概念,但许多时候也是 Scam 项目方的首选,因为对于散户来说,他不存在一个可以「看见」的产品,这类产品的反馈周期往往更长,它是否「能用」或能否产生病毒性的传播「有人用」就是关键,因此制作这类产品对一个团队的技术以及市场营销的技术要求十分高。

前两天大火的 MCP 项目 Dark 便是将两者都做的恰到好处的项目之一,在 MTN DAO 的影响力下推出 DARK,并在两周内交付了可以「看见」的游戏产品「黑暗森林」。

该领域中,现在市场里传播最广的应该就是 Solana「亲儿子」SEND AI,凭借承办之前 Solana 举办的大型 AI 黑客松而名声大噪,而 Solana Agent Kit 则在许多产品中被使用。而 ALCHEMIST AI 也持续建设,从二月份跌落至 140 万美元市值,现在也已回归 1400 万美元市值。

Autonome 是一个为开发人员和用户提供无需代码而构建、部署和分发可验证的 AI Agent 的平台,由 Rollups 协议 AltLayer 出品,自上个周期便开始活跃,至今还未发行代币。

消费者人工智能

游戏

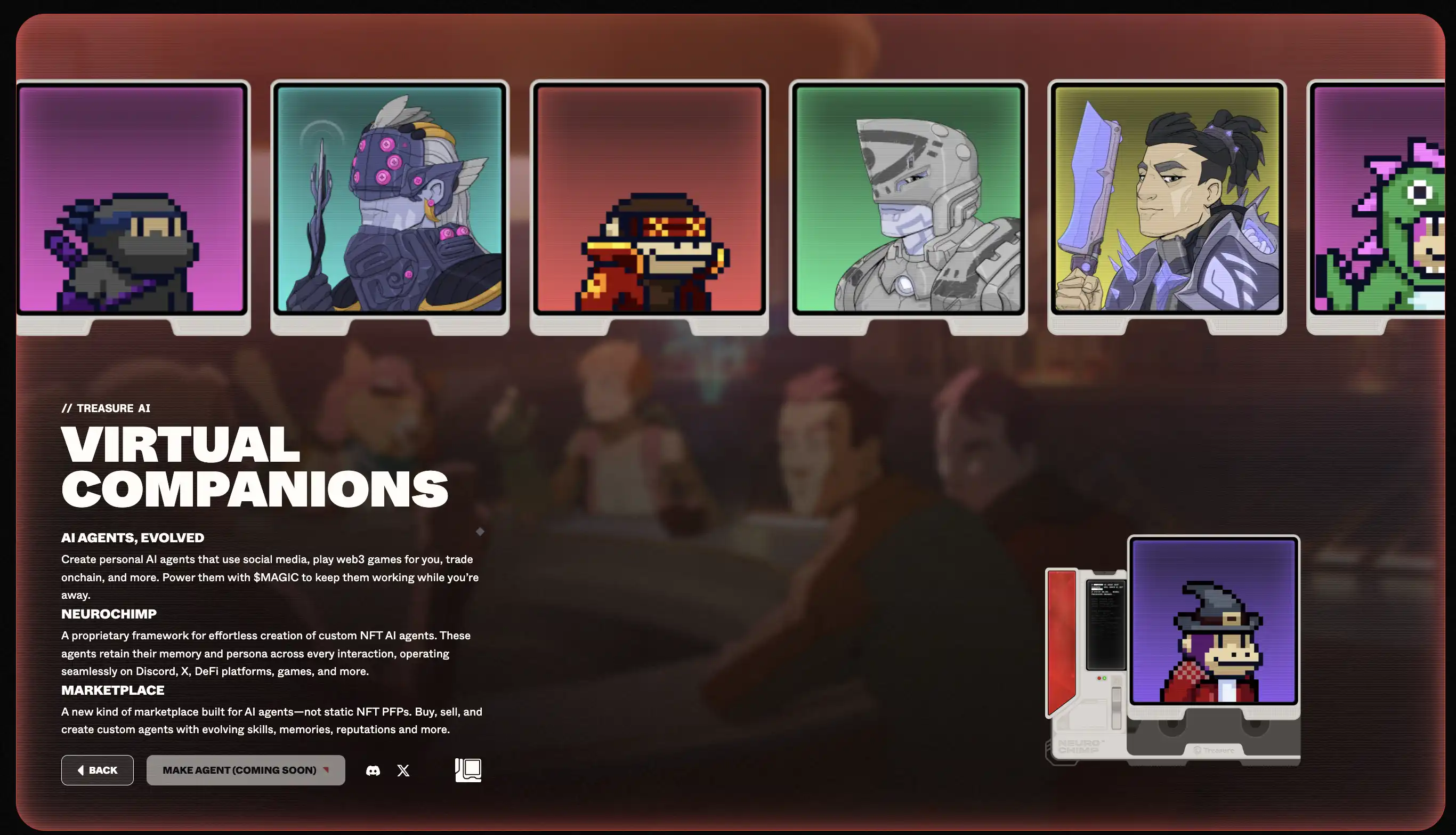

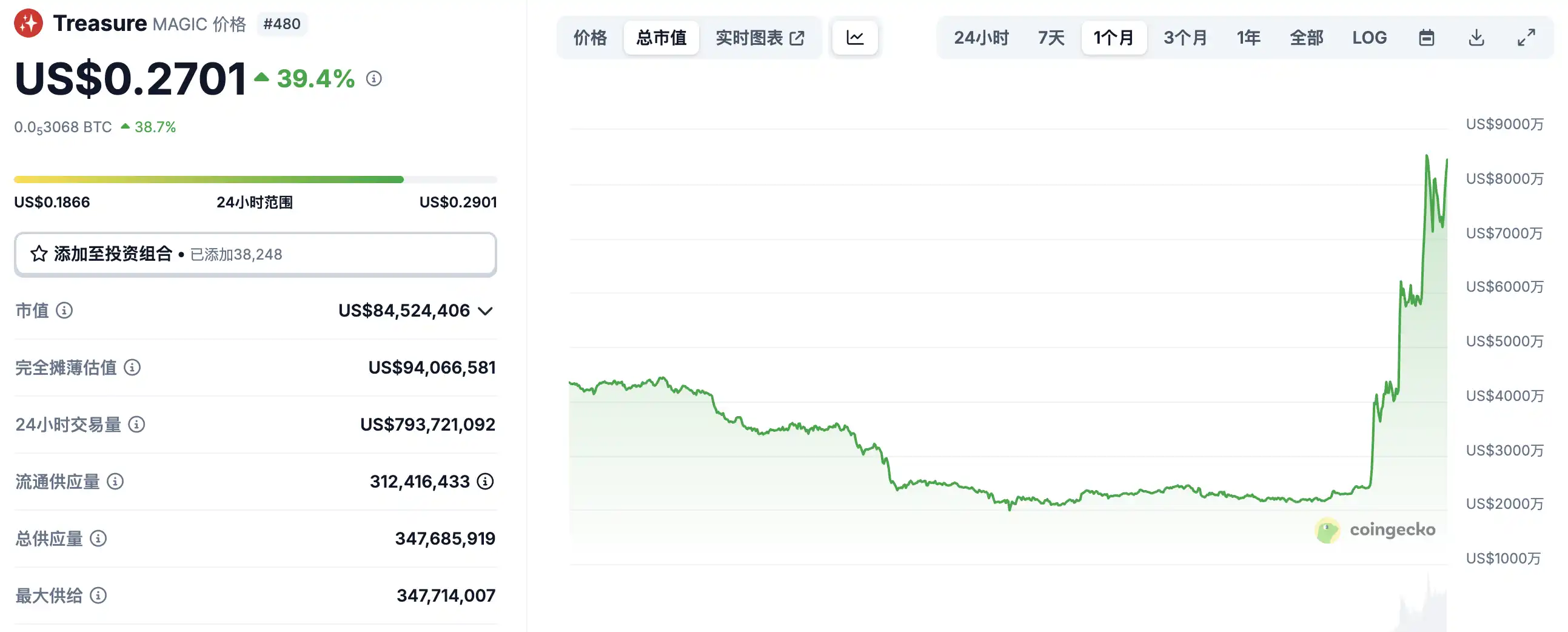

前段时间 Treasure 刚刚宣布将把项目的重心从游戏链以及游戏的运营转移到 AI+NFT 上,SMOL 在今天便给出了第一份答卷,Smol 宣布发布「Virtual Companions」功能,能够将 NFT 变成 AI Agent 并且这些 Agent 将能够使用社交媒体并自己玩 GameFi 或 DeFi,并且做了个供 AI Agent 买卖技能、记忆等资料信息的市场。

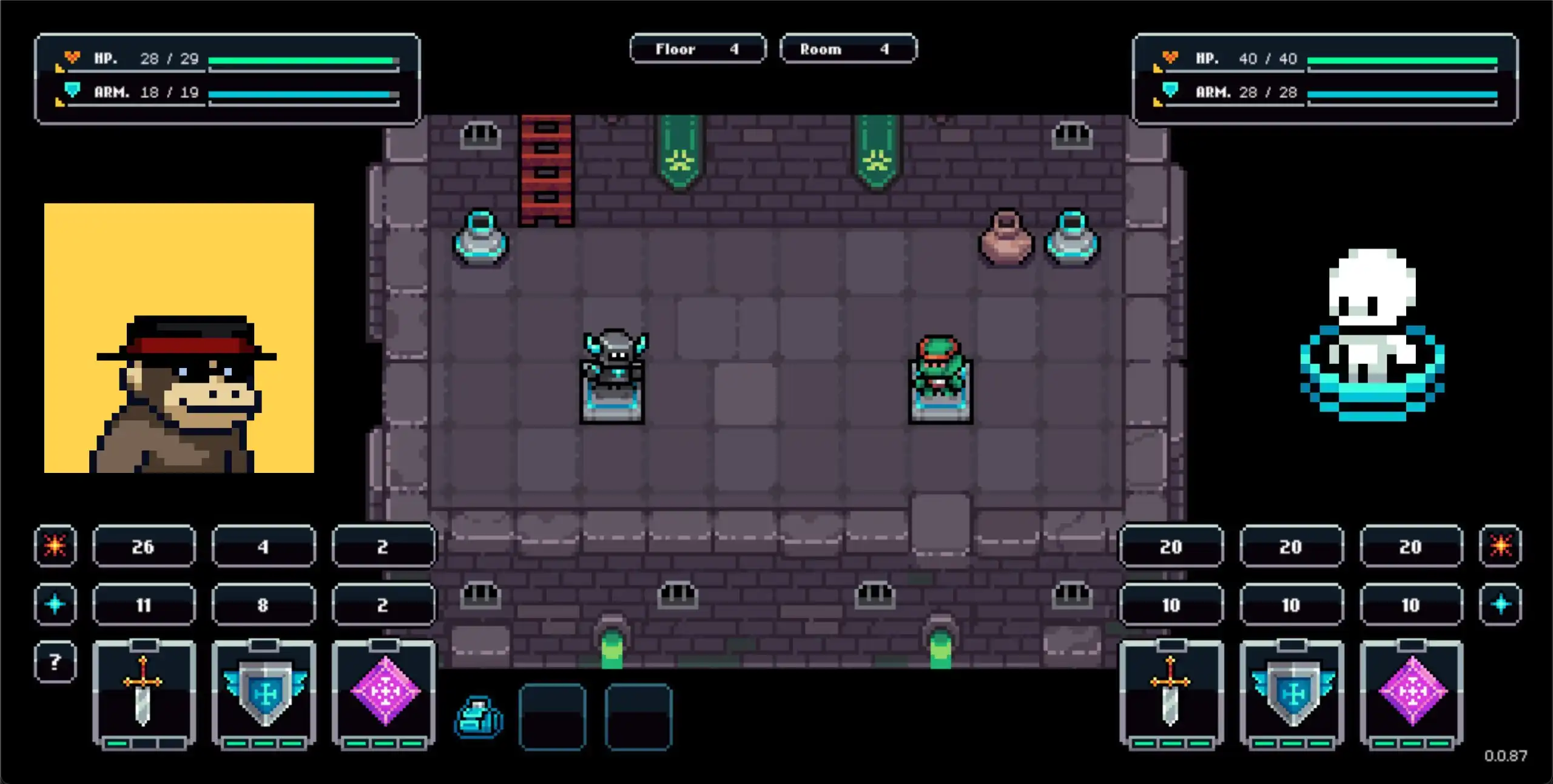

社区玩家 Fairu 的实机截图

首期上线的游戏就是 Abstract 的链上 RPG 游戏 Gigaverse,社区在尝试后普遍好评,而随之 Treasure 的币价也相应地回暖,在之前宣布退出 GameFi 业务后跌至 2000 万美元市值,而今日回到了 8000 万美元市值。相信除了对将 NFT AI 化的技术的预期外,由 AI Agent 玩 GameFi 的模式可能更加吸引人,对 GameFi 项目方来说没人玩、对玩家来说游戏不好玩的问题在未来有可能能够由资产化的 AI Agent 解决。

DeFAI

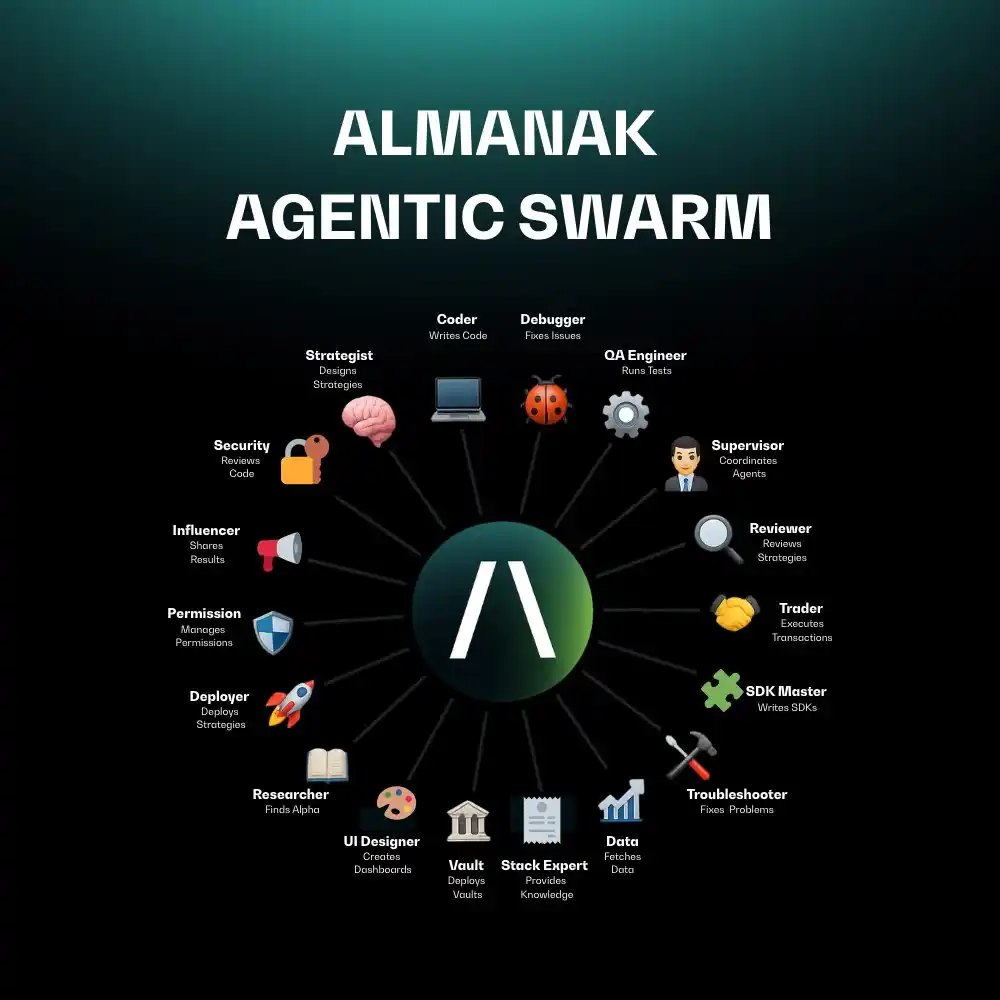

在 18 个月的沉淀后,Almanak 在上周 4 月 17 日宣布将在 2025 实行代币的 TGE,Almanak 是一个端到端平台,允许用户使用 AI 代理创建、优化和管理复杂的金融策略。包括市场数据分析、策略制定、优化和高速执行等任务功能都可以自动化。该团队得到了众多顶级风险投资公司和顾问的支持,例如 RockawayX、Delphi Labs、Hashkey、AppWorks、Matrix Partners、Bankless Ventures 等。

GambleFAI

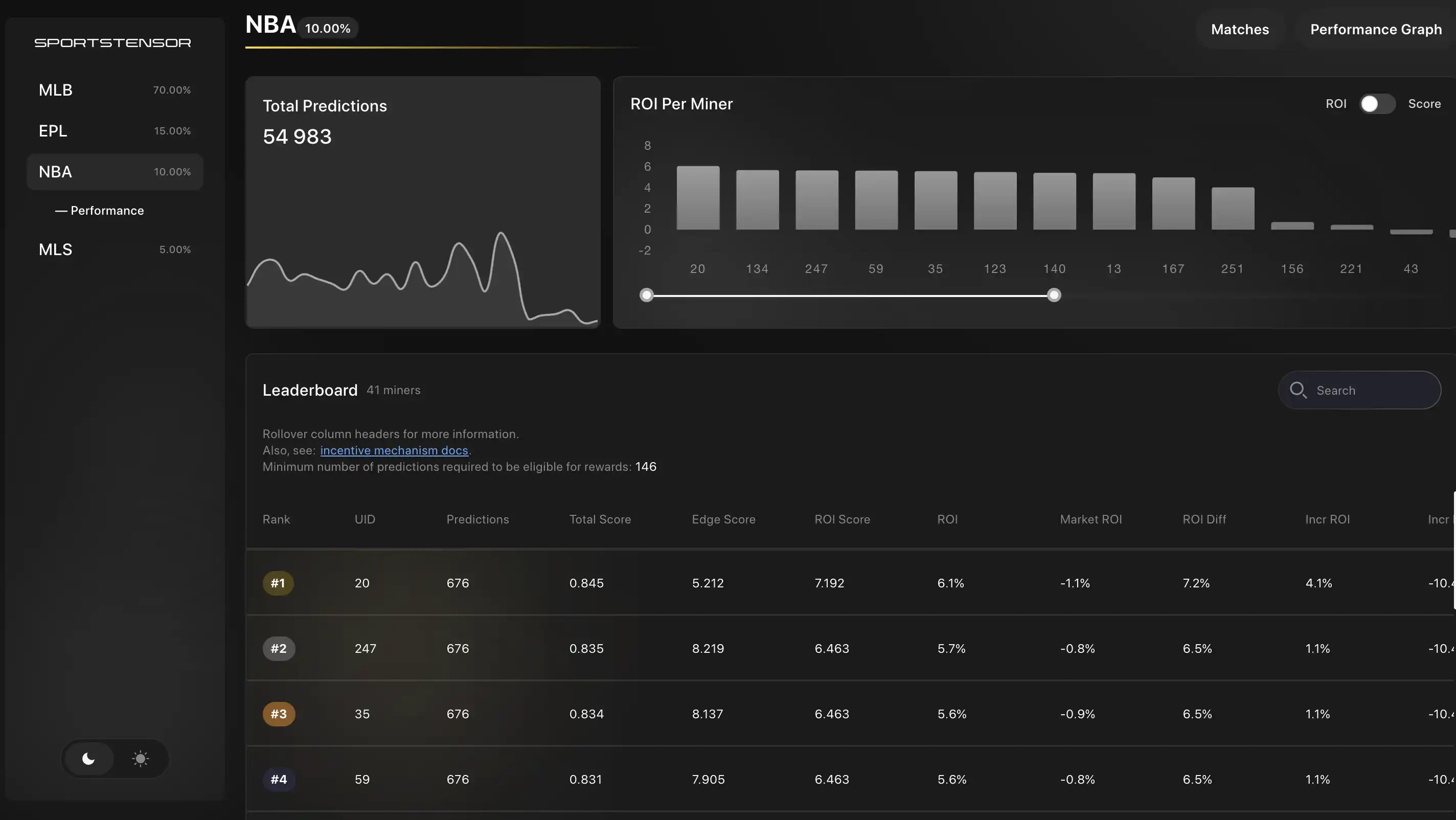

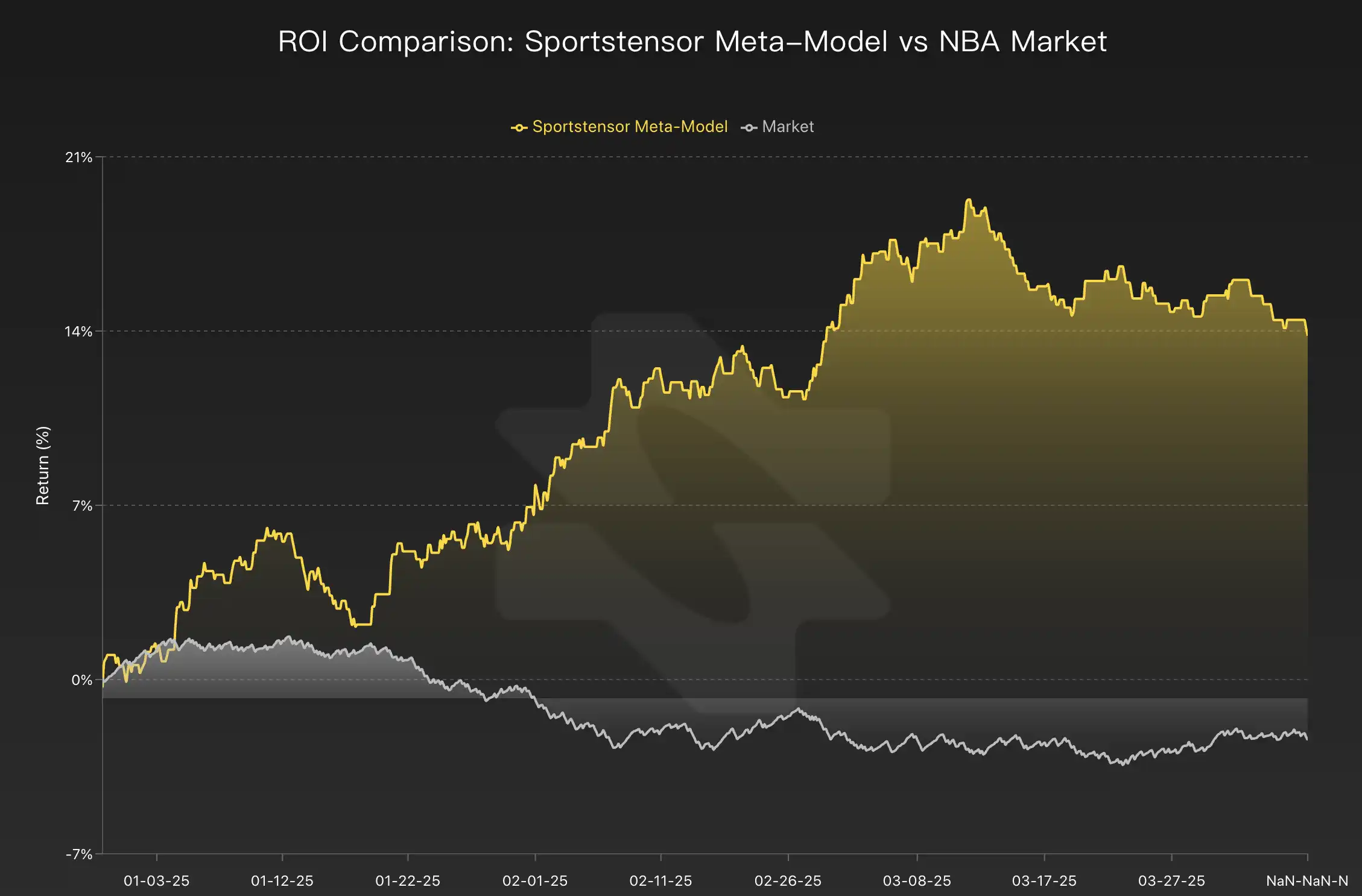

Sportstensor 是 dTAO 上的 SN41 子网,他是一个体育赛事预测的 AI 平台让参与者「矿工和验证者」协作开发和优化体育预测模型,拥有更好的模型和数据集能够预测体育比赛的结果的参与者获利。用户可以通过技术参与「开发模型」或非技术参与「使用预测结果」与项目互动。

比如一场 NBA 凯尔特人与魔术队的比赛中比率为 0.92:0.08,如果你跟随市场赔率投注凯尔特人「大众看好的球队」,你的胜率大约为 92%,即使这么高的胜率在多次投注后,大部分人的投资回报率都是为负的。虽然大众看好的球队往往胜率更高,但赔率也更高,这意味着即使预测正确,赢的钱也会更少。人们往往会把赌注押在自己看好的球队上,导致弱势球队的胜率很低,这意味着如果你押对了弱势球队,就能赚到很多钱。

这就是 Sportstensor 模型的优势,矿工使用自己的数据运行自己的机器学习模型,以获得最佳结果。然后,Sportstensor 会取其平均值/中位数,并将其作为识别市场优势的智能指标。模型预测的赔率与市场赔率的差值,长期来看就是使用者能够获利的部分。

DeAI 基础设施

该类产品几乎是最早期的 Crypto 与 AI 的融合的概念,像是 Grass 等项目,此前有数不胜数的同类产品出现,但都很难延续,去中心化算力的关键就是如何优化同步算力并在售价上低于传统算力提供商,而去中心化训练的关键则是资料传输本身的成本,在基础设施的不完善的时期很难实现,但一旦实现会是相当有潜力的下沉市场,因此备受 VC 关注。

PrimeIntellect 是由 Vincent Weisser 和 Johannes Hagemann 共同创立,此前他们都是 Desci 龙头 VitaDAO 的成员。PrimeIntellect 是一个将算力和模型商品化的平台。投资阵容相当豪华,种子轮由 CoinFund、Distributed Global 领投共融资 500 万美元,而第二轮融资则由 Founders Fund 领投共筹得 1500 万美元。其中个人投资者也不乏 Polygon 联创 Sandeep Nailwal、知名投资人以及前 CoinBase CTO Balaji 等行业影响力者。

近日,OpenAI 的知名研究员 Yaoshunyu 发布了一篇文章《The Second Half》,他表示我们正处于 AI 时代的中场,而接下来即将进入下半场,如果说上半场的 AI 解决了玩游戏和考试解答,那下半场的 AI 将通过构建智能化的有用产品来建立价值数十亿或数万亿美元的公司,而对 CryptoAI 来说,在其中也一定存在相应的机会。

所以期待吧,欢迎来到下半场。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。