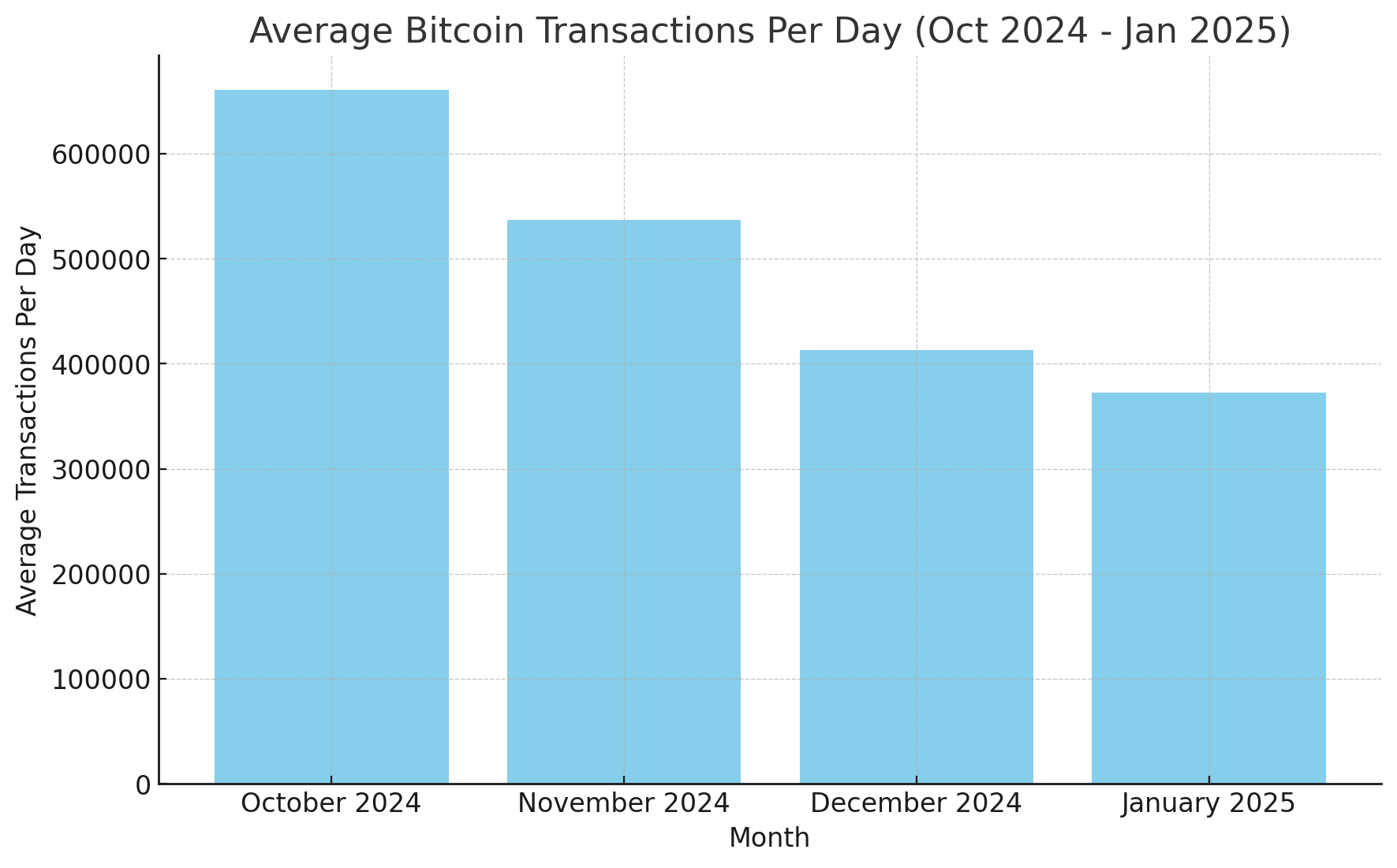

比特币的每日转账量在今年显著放缓,这与2024年创纪录的活动形成鲜明对比。去年单日交易量最高的日期是4月23日,当天处理了927,010笔转账。相比之下,2025年迄今为止最繁忙的一天是1月9日,交易量为534,013笔。自2024年10月以来,月均交易量一直在稳步下降。

在10月,比特币的日均交易量为660,682笔,11月降至536,874笔,12月降至413,021笔,1月降至372,468笔。到2月15日东部时间早上7:30,mempool.space显示,在区块高度883,885之后,仅填满了一个区块。区块883,885本身仅填满了四分之三,mempool中仅有921笔待处理转账。

2025年2月15日东部时间早上7:30,mempool.space的区块指标。

虽然区块883,886达到了满载,但区块883,887和883,888仍然不到一半满。交易费用也远低于去年。2月15日东部时间早上7:30,mempool.space显示,高优先级转账的费用大约为每虚拟字节1聪(sat/vB),即每笔交易约0.14美元。活动和费用通常在下午和傍晚增加,具体因时区而异。

比特币交易活动下降的几个因素中,最显著的一个是Ordinals和Runes的存在感减弱。截至周六早上8:00,约有8568万条Ordinal铭文,但每日铸造量已降至几乎不可察觉的水平。Runes的情况也是如此,曾被期待能在比特币上彻底改变代币铸造,但BRC20最终超越了它们。

另一个主要因素是比特币区块链上资金转账频率的降低。许多持有者在等待更有利的价格,交易所将支付整合为批量交易,保管人控制着大量未动用的BTC储备。仅美国的交易所交易基金(ETFs)自2024年1月11日以来就积累了超过100万BTC,这些持有的资产大部分静静地待在链上,可能会持续多年。

比特币网络的放缓潮流表明市场在谨慎调整,以适应投资者行为的变化和不断演变的使用案例。观察者指出,保管人的战略整合和对非同质化铭文的热情减退暗示着潜在的稳定阶段。市场和链上参与者可能很快会见证新的动态,鼓励进一步探索基础数字资产生态系统。无论你有什么感受,这一活动趋势都值得密切关注。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。