自2021年DeFi Summer以来,DeFi不断发展壮大,各领域领导者通过创新和信誉推动了生态系统的成熟,并且随着更多机构的参与,未来将进一步扩展与传统金融的融合,展示出巨大的潜力。

作者:@0xCheeezzyyyy

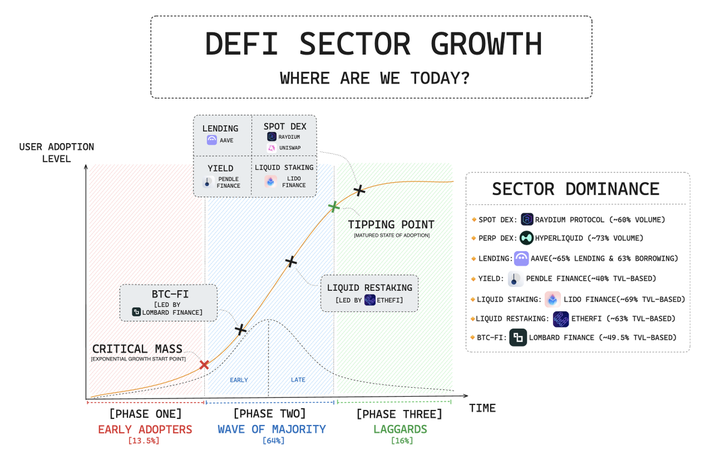

自2021年DeFi Summer以来,我们已经走过了漫长的道路。如今,DeFi已经形成了多个成熟的领域,具备了自我持续增长和活跃的能力。

不过,相较而言,这仍处于初期阶段,因为加密市场的市值大约为3.3万亿美元,而传统金融市场则高达133万亿美元。本文盘点一下关于行业主导地位平台的的一些观察发现。

DeFi的核心理念是提供一个更加创新和高效的系统,通过经过验证的产品市场契合(PMF)来解决传统金融的主要低效问题。同样,DeFi也由多个关键领域组成,这些领域通常呈现出寡头垄断结构。

那么,今天的情况如何呢?

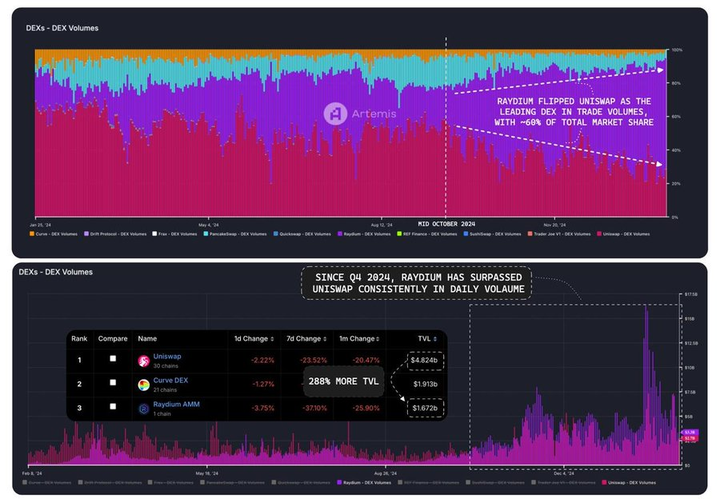

1、DEX

首先来看去中心化交易平台(DEXs):在2024年第四季度,@RaydiumProtocol凭借约61%的市场份额超越了@Uniswap,成为该领域的领导者。尽管它的总价值锁仓(TVL)仅为Uniswap的约39%。虽然这可能与@solana的memecoin热潮有关,但其长期表现仍然不确定。

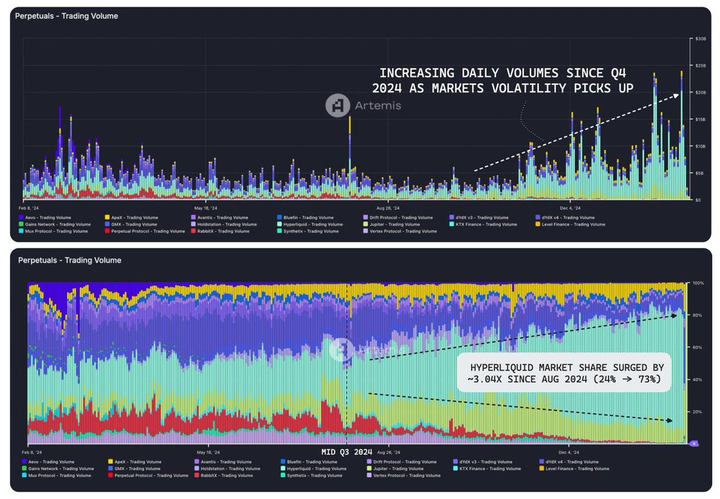

在永续合约DEX领域,我们有一个明显的赢家。

自2024年第三季度以来,@HyperliquidX的市场份额从24%攀升至73%(增长了3倍)。自2024年第四季度以来,永续合约DEX的整体交易量持续增长,目前的日交易量约为80亿美元,相比之下,当时为40亿美元。

HL(Hyperliquid) 正在逐步挑战中心化交易平台,试图成为加密市场中价格确定的主要平台。

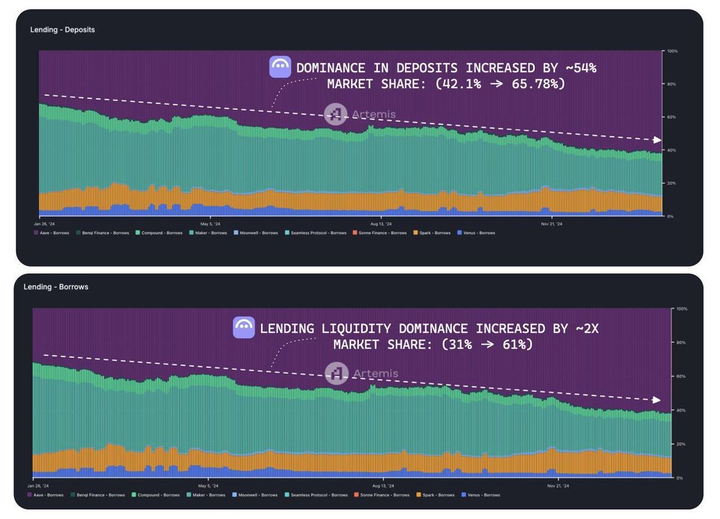

2、借代

借代领域也是如此。自2024年以来,@aave在借代和借款领域的行业主导地位愈发明显:存款:从42.1%上升至65.78%

借款:从31%上升至61%

即使没有最具吸引力的收益率,Aave依然是首选平台,因为它长期以来建立的声誉和协议的可信度。

@pendle_fi正在引领收益领域,创下了历史最高的以太坊TVL(约159万ETH)。

其独特的价值主张在于成为该领域价值发现的关键推动力,尽管DeFi市场放缓且市场情绪偏空,它依然保持着历史最高的TVL。

这清楚地证明了其强大的产品市场契合度(PMF)。

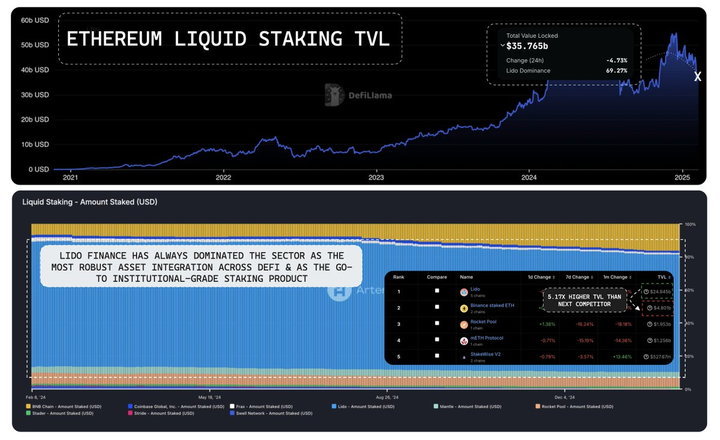

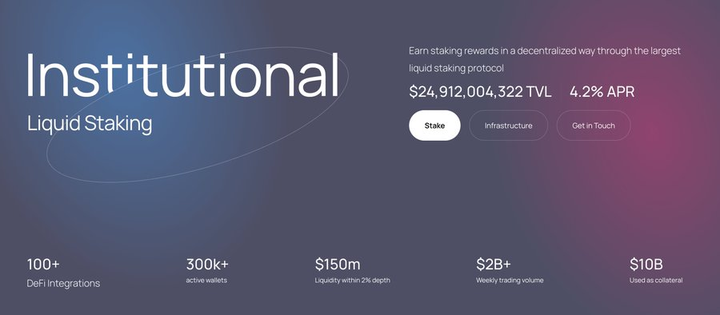

3、流动性质押平台

流动性质押(Liquid Staking)无疑是DeFi中TVL最大(约350亿美元)的领域。@LidoFinance是无可争议的主导者,掌控了约70%的市场份额,几乎垄断了LST市场。其TVL(248亿美元)是第二大竞争者@binance的$bETH(48亿美元)的5.17倍。

这种主导地位并非由质押收益推动,而是由$stETH的资产价值所驱动:

最佳资产利用:作为DeFi中最具整合性的资产。

最值得信赖的服务:成为基金和机构的首选质押解决方案。

在这里,可信度和信任是推动广泛采用的关键。

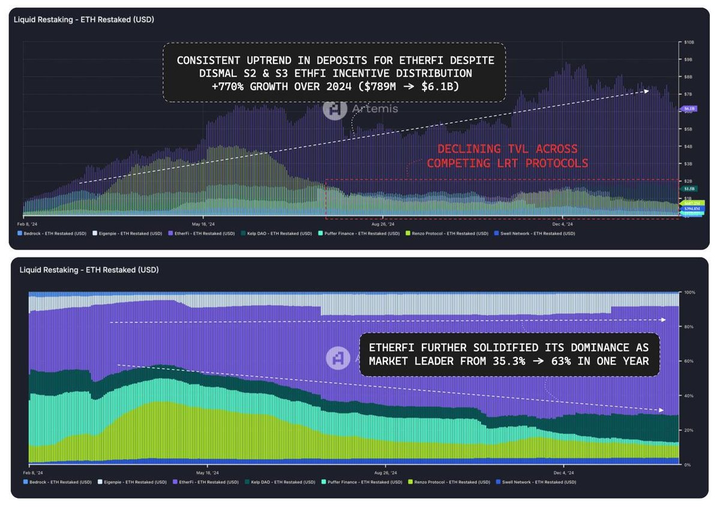

至于流动性再质押(liquid restaking),我们也看到了相似的人群趋势。

值得注意的是,@ether_fi的市场主导地位显著提升(从35.3%增至63%),其TVL在2024年增长了约770%,即使在S1和S2 stakedrop结束后仍然保持增长。

这一增长主要得益于:

- 在@eigenlayer、@symbioticfi和@Karak_Network等生态系统中的先发优势。

- 广泛的DeFi集成

- 产品套件的信任度

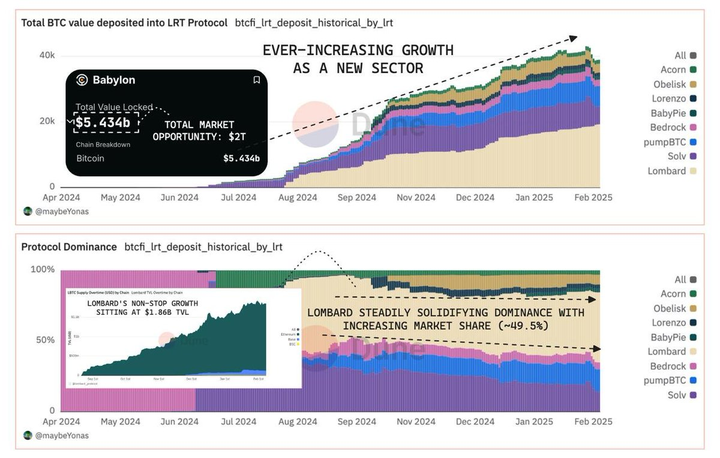

@Lombard_Finance在BTC-Fi领域的表现与LST/LRT领域的趋势高度相似,稳步上升至49.5%。

随着@babylonlabs_io的成熟(目前市值为55亿美元),作为首选加密安全资产的$BTC需求有望呈指数级增长,市场机会可达到2万亿美元。

@Lombard_Finance 已经掌握了行业主导的战略。凭借 $LBTC 作为DeFi中最广泛集成、使用并专注于安全性的LRT,Lombard 正在将其定位为机构信任和广泛采用的首选资产,类似于 $stETH 的角色。详情:https://x.com/0xCheeezzyyyy/status/1886623732770463885

总结来看,DeFi各个领域已经找到了自己的定位,相互补充,形成了一个完整的生态系统。这标志着一种新的原生金融模式的崛起,注定会颠覆中心化金融(CeFi),而我们有幸见证这一过程。

4、小结

随着我们进入扩展的下一个阶段,未来将有更多的努力拓展新的垂直领域,进入未开发的市场,甚至与CeFi进行整合:- @ethena_labs 计划将传统金融支付系统进行整合

- @Mantle_Official 的Mantle指数基金和Mantle银行计划将加密与传统金融相结合随着更多机构的关注,比如 @BlackRock 参与DeFi的 $BUIDL,以及 @worldlibertyfi 的DeFi投资组合和现货ETF,未来的潜力看起来非常有前景。

本文链接:https://www.hellobtc.com/kp/du/02/5670.html

来源:https://x.com/0xCheeezzyyyy/status/1888773047433535884

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。