1、比特币市场

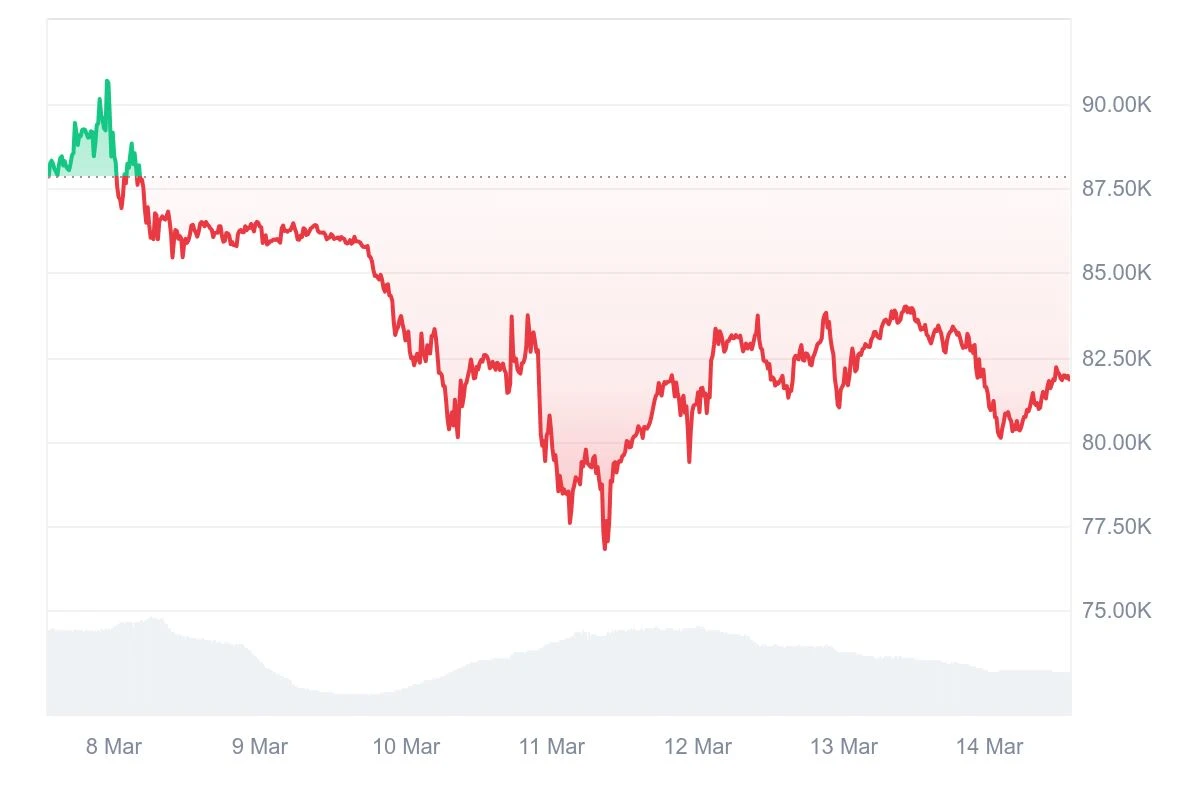

在2025年3月10日至3月14日期间,比特币具体走势如下:

3月10日:空头主导市场,跌破关键支撑位

3月10日,比特币整体呈现下行趋势,空头占据主导地位,价格跌破80,000美元关键支撑位。

当日,比特币自83,000美元附近回落至82,327美元后短暂反弹,但随后进一步下探至80,232美元。尽管市场尝试反弹,价格一度回升至83,552美元,但上行压力未能延续,比特币再度回落并跌破80,000美元关口,最低触及79,639美元。

3月11日:加速下探后快速反弹,多空激烈博弈

延续前一日跌势,比特币3月11日进一步下行,最低触及77,703美元后短暂反弹至79,642美元。然而,空头情绪仍然强势,市场快速击穿77,000美元支撑位,最低跌至76,905美元。随后,市场情绪迅速修复,比特币强势反弹至81,961美元,最终稳定在81,250美元附近。

3月12日:多空激烈争夺,短线波动加剧

3月12日,比特币价格回升至83,341美元,并在82,480美元上方维持震荡。上午10点左右,空头再度发力,推动价格自83,962美元快速下跌至80,896美元,尽管跌幅较大,但未跌破80,000美元整数关口,市场短线博弈明显。

3月13日:冲高回落,再次跌破80,000美元

3月13日,比特币迅速企稳并重启上行趋势,最高攀升至84,163美元后承压回落,随后震荡下行,再次跌破80,000美元,最低触及79,986美元,市场整体呈现冲高回调走势。

3月14日:区间震荡,新一轮趋势待确认

3月14日,比特币在80,000美元至85,000美元区间内震荡运行,并逐步开启新一轮攀升趋势。截至撰稿时,价格已上行至81,850美元,市场方向仍待进一步确认。

总结

3月14日价格企稳回升,但整体趋势尚未明朗,市场仍处于区间整理阶段,需进一步观察后续突破方向。近期市场波动较大,但下方支撑仍较稳固,长期投资者可关注低位买入机会,同时结合宏观市场及资金流向判断中长期趋势。需关注市场情绪变化,尤其是外部宏观因素对比特币走势的影响,例如美联储货币政策、市场流动性状况及机构资金动向。

比特币价格走势(2025/03/10-2025/03/14)

2、市场动态与宏观背景

资金流向

鲸鱼持仓与交易所流动:

鲸鱼在过去 一个月 内收购了约 60,000 枚 BTC,标志着近期历史上 最积极的积累阶段之一,表明市场上仍存在 强劲的机构和大额投资者需求。

与此同时,CryptoQuant 社区分析师 Darkfost 指出,币安上的鲸鱼抛售活动正在放缓,其衡量交易所 前10名流入量占比 的 交易所鲸鱼比率 正在下降,表明 鲸鱼的抛售压力正在减少,卖出的比特币数量开始减少。然而,比特币矿工可能成为 新的抛售压力来源。分析认为,矿工正经历类似于 最近一次比特币难度调整后的市场状况,通常这种情况会先于矿工的 大规模抛售(矿工投降),或将对市场产生进一步影响。

交易所资金流入:

截至2025年3月12日,加密货币市场总市值为2.74万亿美元,总交易量为1379.2亿美元,较上一交易日下降25.1%,显示市场交易活动有所放缓。

技术面分析

关键支撑与阻力:

比特币价格触及一条已维持2年4个月的长期支撑趋势线,周线图上显示出显著的下影线,表明在这些水平上有强烈的买盘兴趣,暗示可能出现看涨反转或持续上涨的潜力。

此外,BitMEX 联合创始人Arthur Hayes3月10日分享其市场观点称,比特币可能重新测试 78,000 美元支撑位,如果跌破,下一个关键支撑位在 75,000 美元。他还指出,市场存在大量期权未平仓合约(OI)聚集在 70,000 - 75,000 美元区间,如果价格进入该范围,可能引发更剧烈的市场波动。

本周整体来看,比特币在80,000美元附近多次获得支撑,表明该点位是市场的重要心理关口。而在上方,84,000美元至85,000美元区域形成较强阻力,限制了上涨空间。

指标分析:

RSI(相对强弱指数): RSI在日线图上向下倾斜,意味着比特币价格趋势的潜在动量是负面的。

MA(移动平均线): 比特币的50日移动平均线(MA)为$0.165,200日移动平均线为$0.150,均低于当前价格,表明中长期趋势看涨。

MACD(平滑异同移动平均线): MACD在中性线下闪烁红色直方图条,意味着比特币价格趋势的潜在动量是负面的。

市场情绪

3月11日,比特币价格在24小时内再次跌破8万美元,最低触及7.6万美元,市场恐慌情绪蔓延。截至2025年3月13日,比特币价格下跌3%至81,148美元,市场情绪低迷,中心化交易所交易量下降21%。

近期,比特币市场情绪趋于谨慎。技术指标显示超卖状态,衍生品市场保持韧性,ETF资金流入复苏。宏观经济压力与政策变化影响市场走势,美国政府建立比特币战略储备,或推动长期机遇。短期内需关注关键支撑位,长期投资者可聚焦政策与机构行为。

宏观背景与行业新闻

宏观经济:

美国经济数据: 2月份美国消费者价格指数(CPI)同比上涨2.8%,低于预期的2.9%,显示通胀放缓。

美联储政策: 市场预期美联储将在6月开始降息,年内可能有三次25个基点的降息。

行业新闻:

美国比特币战略储备: 美国总统特朗普签署行政命令,推进建立战略性比特币储备的计划,将比特币纳入国家储备框架。

欧盟关税影响: 分析师指出,欧盟报复性关税可能导致比特币回调至7.5万美元。

总体而言,2025年3月10日至3月14日期间,比特币价格受到资金流向、技术面因素、市场情绪、行业新闻和宏观经济背景等多重因素的影响,呈现出显著波动。

3、哈希率变化

在2025年3月10日至3月14日期间,比特币网络哈希率呈现波动,具体情况如下:

3月10日,比特币网络哈希率从827.66 EH/s下跌至782.83 EH/s,随后小幅回升至846.22 EH/s。经过短暂调整后,哈希率再次下探至753.63 EH/s,随即迅速反弹至901.00 EH/s,整体表现出剧烈波动。3月11日,算力在850 EH/s至900 EH/s区间内波动,并在短时间内突破900 EH/s,最高触及907.63 EH/s。然而,该水平未能维持,哈希率迅速回落至753.88 EH/s,随后进入新一轮的上升通道。3月12日,哈希率延续前一日回升的趋势,首先回升至约800 EH/s,并快速上涨至918.26 EH/s。随后,算力短暂维持在910 EH/s附近,之后回落至834.06 EH/s,并在该区间内保持相对稳定。3月13日,哈希率攀升至923.34 EH/s,短暂回落至835.68 EH/s后反弹至879.06 EH/s,随后开启下行趋势。3月14日,延续前一日下行趋势,哈希率回落至854.78 EH/s后继续下降,最终逼近800 EH/s。整体来看,哈希率在该期间表现出显著的波动,反映出网络的算力变化较为频繁。

比特币网络的哈希率数据

4、挖矿收入

在2025年3月10日至3月14日期间,比特币矿工的收益受到多重因素影响,包括比特币价格波动、挖矿难度调整以及市场情绪等。

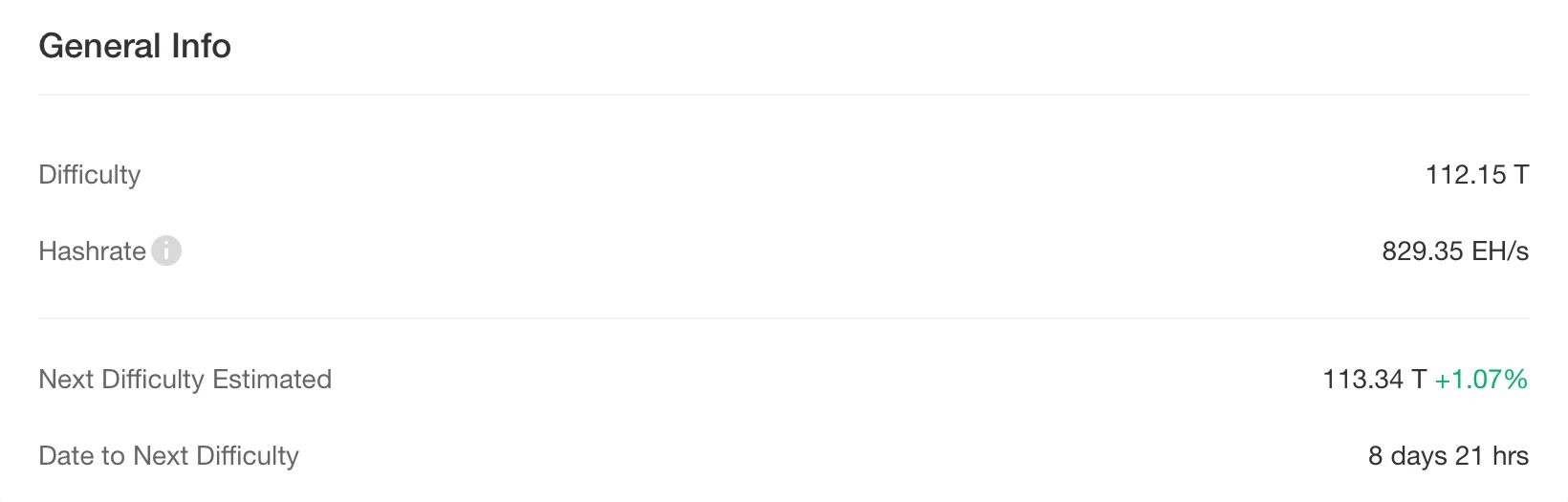

比特币网络难度调整

根据CloverPool的数据,比特币挖矿难度在区块高度887,040处(北京时间2025年3月9日23:58:46)上调1.43%至112.15T,接近历史高点(114.17)。根据Hashrate Index的数据,目前全网近七天平均算力为834.27 EH/s。

挖矿难度的增加意味着矿工需要投入更多的计算能力才能获得相同的比特币奖励,这可能导致单位算力的收益下降。然而,随着部分高成本矿工可能因利润下降而退出市场,网络算力可能会有所降低,进而在未来的难度调整中使挖矿难度下降,为剩余矿工提供一定的缓解。

比特币价格走势

截至2025年3月14日,比特币价格在76,500美元至85,000美元之间波动。比特币价格的下跌直接影响矿工的美元计价收入,导致利润空间缩小,可能导致部分运营成本较高的矿工面临亏损风险。

矿工的应对策略

面对价格波动和利润压力,部分矿工选择囤积比特币,以期在价格回升时出售,从而实现更高收益。例如,美国的比特币矿工在利润空间缩小的情况下,选择囤积加密货币,以应对资源竞争加剧的局面。

此外,矿工还可以通过提高设备效率、降低电力成本等方式来维持盈利能力。值得注意的是,长期持有者在过去一个月中增加了131,000 BTC,这显示了对比特币未来价值的信心。

总体而言,2025年3月10日至3月14日期间,比特币价格的下跌和挖矿难度的上升对矿工收入产生了负面影响。然而,矿工通过调整策略和优化运营,仍有机会在市场波动中保持盈利能力。未来,市场情绪和宏观经济因素将继续影响比特币价格走势,矿工应密切关注市场动态,以制定有效的应对策略。

5、能源成本和挖矿效率

根据CloverPool的数据,比特币挖矿难度在区块高度887,040处(北京时间2025年3月9日23:58:46)上调了1.43%,达到112.15T,接近历史高点(114.17T)。这一调整反映了比特币网络算力的持续增长,网络上的矿工为了竞争更多的区块奖励,投入了更多的算力。直到3月14日撰稿时,比特币全网算力已经达到约829.35 EH/s,而当前的挖矿难度为112.15T。根据当前趋势,预计在下次难度调整时(约在8天后),比特币挖矿难度将进一步上调约1.07%,达到113.34T。

根据 MacroMicro 最新数据估算,比特币当前的生产总成本约为 84,690.49 美元,挖矿成本与市价比值(Mining Cost-to-Price Ratio)为 1.01,这意味着矿工每生产一个比特币所需要的成本与市场价格几乎持平,从而造成矿工的盈利空间相对较小。此比值反映了矿工的运营压力,尤其是在比特币价格波动较大的情况下,矿工的盈利情况变得更加敏感。

在这样的背景下,矿工不仅需要不断提高挖矿效率,还需要优化能源使用,以确保在激烈的竞争中保持盈利。未来,比特币网络的算力预计会持续增长,矿工可能需要更多依赖先进的冷却技术、太阳能等可再生能源,以减少其碳足迹和能源成本,从而在长期竞争中获得优势。

比特币挖矿难度数据

6、政策和监管新闻

美国各州比特币储备立法进展

德克萨斯州:

德克萨斯州参议院以 25 比 5 通过了 SB-21 法案,允许州政府投资比特币,并成立比特币储备咨询委员会,确保投资的透明度。此外,州议会还引入了 HB 4258 法案,允许州审计长将不超过 2.5 亿美元的经济稳定基金投资于比特币或其他加密货币,同时允许地方政府投资最多 1000 万美元的比特币。该法案预计将在 2025 年 9 月 1 日生效。

犹他州:

犹他州州参议院通过了比特币法案,但删除了原计划建立州级比特币储备的关键条款,仅保留了比特币托管保护等内容。

参议员 Cynthia Lummis:

重新提出《比特币法案》:3月11日,卢米斯重新提交了《比特币法案》,计划在五年内购买 100 万枚比特币,建立战略比特币储备。与之前的版本相比,新法案将每年购买 20 万枚比特币的计划从“最多”改为“必须”,并强化了在持有期内不得出售比特币的规定。

审议稳定币相关法案:3月13日,卢米斯作为参议院银行业数字资产小组委员会主席,主持了由哈格提(Hagerty)参议员提出的 GENIUS 法案的最终审议。该法案旨在明确定义支付型稳定币,为寻求发行稳定币的机构建立明确的程序,并促进负责任的创新,同时保护消费者权益。

众议员 Nick Begich:

众议员 Nick Begich 宣布将在众议院重新提出《2025 年比特币法案》,该法案提议美国获取 100 万枚 BTC,并强调个人自我托管权利。

其他州的立法进展:

截至目前,已有 24 个州考虑建立数字资产储备,将其视为对抗通胀的工具。然而,由于比特币的高波动性等因素,蒙大拿州、怀俄明州、北达科他州、南达科他州和宾夕法尼亚州等五个州已否决了相关提案。

美民主党高层向财政部施压,要求其停止特朗普的战略比特币储备计划

3月14日消息,美国众议院监督和政府改革委员会民主党领袖Gerald Connolly敦促美国财政部停止创建战略加密货币储备的计划,此前唐纳德·特朗普总统追求建立国家比特币储备和个人加密货币储备。

周四,这位弗吉尼亚州民主党议员在致财政部的一封信中指出,特朗普推动设立储备金存在“明显的利益冲突”。Gerald Connolly表示,特朗普没有咨询国会,也没有“寻求国会授权”来设立储备金。 信中表示:“建立战略加密货币储备将以牺牲美国纳税人的利益为代价,让总统及其最亲密的盟友致富。我敦促停止所有建立战略加密货币储备的计划,并要求向监督和政府改革委员会的工作人员提供简报。”

韩国金融专家和在野党议员呼吁考虑建立比特币储备

3月10日消息,韩国金融专家和在野党政治人士于上周三在一场由主要反对党民主党在国会举办的研讨会上,敦促韩国将比特币纳入国家储备并开发韩元支持的稳定币。据韩国先驱报最初报道,此次研讨会分析了对美国建立以比特币为中心的国家储备举措的潜在应对方案。这场讨论恰在特朗普总统于周四签署行政令建立比特币储备和加密货币储备之前举行。

区块链公司xCrypton首席执行官Kim Jong-seung在周三的活动上表示:"韩国需要以明确的政策作出回应。"除比特币储备外,研讨会专家还强调创建韩元支持稳定币的重要性。Kim警告称,如果美元稳定币主导数字经济,韩国可能会失去"货币主权"。他表示:"我们需要开发一个连接美元稳定币和韩元稳定币的模式用于贸易交易。"

民主党政策筹备委员会负责人Kim Min-seok议员表示,如果该党重新执政,将重塑韩国的加密货币监管框架。新加Presto Research分析师Min Jung表示:"韩国总体上比大多数国家慢,我们刚刚批准企业账户用于加密货币,而比特币和以太坊ETF仍不允许交易。看起来韩国只是在试图赶上进度。"

相关图片

英国财政部表示“没有计划”引入美国式比特币储备

3月10日消息,市场消息:英国财政部表示“没有计划”引入美国式比特币储备。波动性使比特币不太合适作为英国的储备资产。

美国内布拉斯加州签署比特币ATM监管法案

3月13日消息,美国内布拉斯加州州长 Jim Pillen 于本周三正式签署 LB609 法案,对比特币 ATM 及其他电子交易终端实施监管,以防止诈骗、保护消费者权益。该法案要求比特币 ATM 运营商清晰披露所有使用条款,并向用户提供醒目的反欺诈警示。此外,若用户在 90 天内向运营商和执法部门报告欺诈行为,可获得全额退款。

美财政部与三家加密公司会谈,讨论比特币储备托管方案

3月14日消息,知情人士透露,美国财政部本周与三家加密托管公司高管会面,商讨如何保管国家战略比特币储备。Anchorage Digital 是参与会议的机构之一。Anchorage CEO Nathan McCauley 表示,财政部官员就比特币国家储备及数字资产托管的最佳实践进行了详细询问,并探讨了托管如何影响稳定币和市场结构。

国会消息人士表示,财政部目前处于研究阶段,尚未形成明确立场,但正积极向业内人士征询意见。当前倾向于由第三方机构托管政府比特币储备,长期目标则是政府最终实现自我托管。至于政府掌控的各类被扣押数字资产,可能仍需长期依赖第三方托管。美国财政部对此未予置评。

7、矿业新闻

网络安全公司Kaspersky:黑客勒索YouTube博主推广加密挖矿木马

3月12日消息,网络安全公司Kaspersky(卡巴斯基)发现黑客利用版权投诉威胁YouTube内容创作者,迫使其在视频描述中添加加密挖矿木马SilentCryptoMiner。该恶意软件基于XMRig,用于挖掘Ethereum、Ethereum Classic、Monero、Ravencoin等加密货币,并通过比特币区块链控制僵尸网络。

黑客的主要目标是提供Windows Packet Divert驱动安装教程的YouTuber,他们先对视频发起虚假版权投诉,再联系创作者声称自己是驱动的开发者,要求其添加恶意链接。目前已知一名6万粉丝的YouTuber受害,导致40,000多人下载受感染文件,Kaspersky估算至少2,000台设备已被感染。

Kaspersky安全研究员Leonid Bezvershenko警告称,黑客正在利用YouTuber与观众之间的信任,此类威胁或将扩散至Telegram等平台。他建议用户不要轻信要求关闭杀毒软件的教程,并在下载任何文件前核验来源,以防感染加密挖矿木马。

一小型矿工凭借3.3TH算力独立挖出比特币区块,概率低于百万分之一

3月12日消息,据ckpool开发者Dr -ck称,一名矿工仅凭3.3TH算力,使用480GH Bitaxe矿机,在solo.ckpool.org成功挖出了比特币区块887212(区块哈希:000000000000000000006414aea39be567cf1d5ff6cbf2d77254fe7c714b0d81)。

该矿工地址bc1qaxccz85rx6ywy2xw6ugtm6u37mvew6qqn7lgtd,理论上每日发现区块的概率低于百万分之一,通常需要3500年才能找到一个区块。

美特拉华州法院裁定比特币矿机托管商不得阻止租户访问其矿机

3月14日消息,特拉华州一家法院已暂时批准宾夕法尼亚州比特币矿业公司针对其托管公司提出的临时限制令,该托管公司因付款纠纷而阻止了对其矿机的访问。该限制令禁止托管服务提供商阻止访问并以其他方式接管该矿工在该物业中的21,000台矿机。

副校长摩根·祖恩(Morgan Zurn)于3月12日批准了比特币矿工Consensus Colocation和系统所有者Stone Ridge Ventures针对Mawson Hosting提出的临时限制令,后者为比特币矿工提供托管和主机托管服务。这些公司在所谓的未付费用、协议条款以及Consensus的搬迁计划上存在分歧,据称这导致Mawson阻止矿工人员进入现场。

这些公司还声称,自2月28日以来,在阻止Consensus进入场所后,Mawson一直在为自己的利益运营这些矿机。然而,Mawson声称,根据其与Consensus的协议条款,他们有权使用这些矿机,并且他们对其搬迁计划拥有优先购买权。

8、比特币相关新闻

全球企业与国家比特币持仓动态(本周统计)

澳大利亚 Monochrome:截至 3 月 7 日,Monochrome 比特币现货 ETF(IBTC)持仓降至 303 枚 BTC,较前日减少 17 枚,持仓价值约 4253.4 万美元。

Strategy(原 MicroStrategy):比特币持仓市值跌破 400 亿美元,目前持有 499,096 枚 BTC,按当前 79,998.5 美元计算,总价值约 399.7 亿美元。

萨尔瓦多:近两日增持 6 枚比特币,均价 82,308 美元,目前持仓达 6,112.18 枚,总价值 4.916 亿美元。过去 30 天累计增持 41 枚 BTC,尽管 IMF 施压,该国仍持续积累 BTC。

StarkWare:宣布建立“战略比特币储备”,计划未来持有更多 BTC,但未透露具体持仓数据。该公司估值 80 亿美元,近年投入大量资源研究比特币。

明成集团(Lead Benefit):香港子公司 2 月 28 日斥资 2,700 万美元购入 333 枚比特币,均价 81,555 美元。此前 1 月 9 日曾购入 500 枚 BTC,总投资 4,700 万美元。

Metaplanet:计划发行 20 亿日元(约 1,350.6 万美元)无息普通债券用于购入比特币。此外,公司新增购入 162 枚 BTC,总持仓增至 3,050 枚,总价值 384.52 亿日元。

Ark Invest:增持 8260 万美元比特币(来源:BITCOINLFG,3 月 13 日)。

灰度研究主管:比特币进一步升值无需依赖美国加密战略储备

3月10日消息,美国总统特朗普已签署行政命令决定建立战略比特币储备和单独的数字资产储备,对此Grayscale Investments研究主管Zach Pandl认为比特币不需要美国的战略储备就能在今年进一步升值,他预计随着采用率的增加比特币的价格将被推高,同时比特币将在今年开始作为价值储存手段发挥作用,特别是在担心特朗普的关税政策可能导致通胀再次升温的情况下。

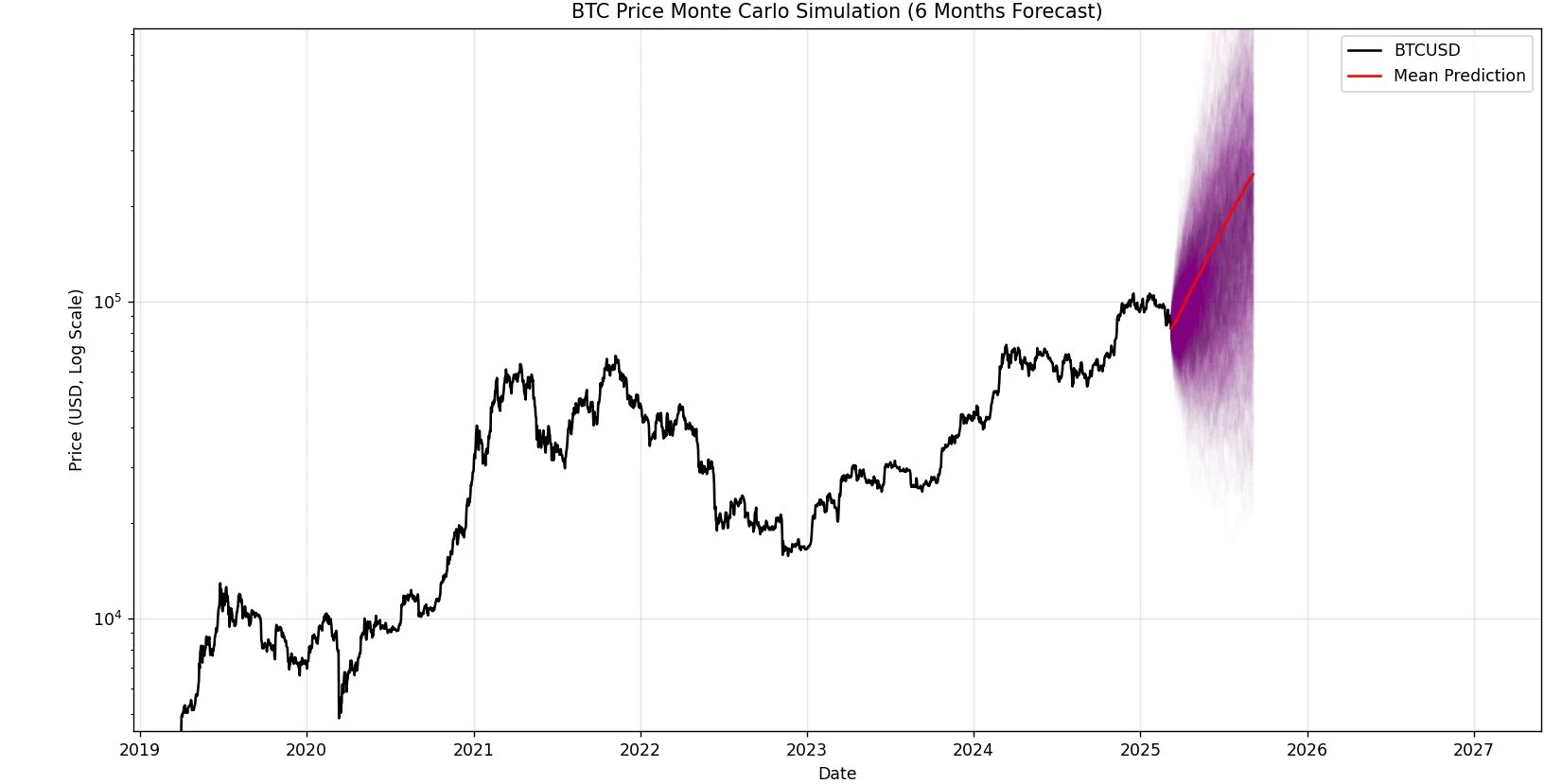

分析:蒙特卡洛模型预测6个月内比特币价格将达到71.3万美元的峰值

3月10日消息,据Cointelegraph报道,尽管3月10日的加密货币恐惧与贪婪指数继续显示“极度恐惧”,但一项比特币市场模拟仍然预测2025年下半年将呈现看涨趋势。加密货币研究员Mark Quant利用蒙特卡洛模拟对比特币价格进行了分析,并为该加密资产提供了为期六个月的预测。蒙特卡洛模型是一种计算方法,通过随机抽样模拟价格预测并评估风险。它可以根据波动性、市场趋势等可变因素生成多种可能情景。基于82,655美元的初始价格,该研究估计比特币到2025年9月底的平均最终价格为258,445美元。然而,从更广泛的角度来看,比特币价格预计将在51,430美元(即第5百分位回报率)至713,000美元(第95百分位回报率)之间波动。

然而,重要的是要注意,蒙特卡洛模型在很大程度上依赖于几何布朗运动(GBM)模型,该模型假设资产价值遵循具有恒定漂移参数的随机路径。在本分析中,比特币固有的波动性被纳入模型,捕捉了长期历史表现和模式,同时适应了未来的变化。本质上,蒙特卡洛分析就像“掷骰子”一样具有不确定性。上周,Quant还强调了总加密货币市值与全球流动性指数之间的相关性,这表明总市值可能在2025年第二季度达到4万亿美元以上的新高。

相关图片

Nansen:比特币回撤到7万美元区间是牛市“宏观调整”的一部分

3月12日消息,加密分析平台Nansen首席研究分析师Aurelie Barthere表示,目前大多数加密货币都突破了关键支撑位,因此很难估计下一个关键价格水平,对于比特币来说,下一个水平可能是71,000美元至72,000美元,即特朗普选举前的交易区间顶部,尽管投资者情绪有所下降,但加密货币和全球市场仍处于牛市的“宏观调整”中,市场仍处于牛市中的调整阶段,股票和加密货币已经实现并正在定价,美联储也没有采取任何措施。

渣打银行分析师:比特币近期下跌与风险资产整体疲软相关,长期仍看涨至20万美元

3月12日消息,渣打银行数字资产研究主管Geoff Kendrick表示,比特币近期价格波动与“美股七巨头”等风险资产表现一致,而非加密货币自身问题。他指出,比特币的下跌主要受整体市场情绪影响,未来反弹可能依赖两大催化剂:风险资产整体复苏或比特币的利好消息(如美国或其他国家的主权购买)。若美联储快速转向降息(如5月降息概率从50%升至75%),可能推动比特币反弹;但若下跌趋势持续,比特币可能跌破76,500美元并测试69,000美元支撑位。

尽管短期面临压力,Kendrick对比特币的长期前景依然乐观,预计2025年底将达到20万美元。他强调,当前的市场波动增加了美联储降息的可能性,进一步巩固了他的长期看涨观点。与此同时,特朗普的关税政策和美联储的利率决策将继续影响市场情绪,为比特币走势带来不确定性。

分析师:比特币正接近筑底,预计将在第二季度迎来反弹

3月12日消息,LMAX Digital的Joel Kruger认为,目前加密市场的疲软“更多是新闻兑现后的抛售效应和技术上的超期调整,而不是其他因素导致的。”但当然,还有更多因素在起作用。由于美国经济前景的不确定性,引发了市场的避险情绪。

尽管如此,Kruger仍认为,比特币正接近筑底,预计将在第二季度迎来反弹。而在69,000美元至74,000美元之间的前阻力区间,比特币“应该会得到极强的支撑”。Kruger早前曾表示,比特币的“价值储存”叙事可能有助于其摆脱与传统风险资产之间的「误导性」相关性。

Ark Invest:对比特币长期前景仍然看好,当前市场情绪过于悲观

3月12日消息,尽管3月份市场大幅下跌,但CathieWood的投资公司ArkInvest对比特币仍持乐观态度。周二,ArkInvest在一份报告中表示:Ark对比特币的长期前景仍然乐观,相信人工智能和机器人等领域的政策变化和技术突破将重新激发支出并提高生产力。

ArkInvest还指出,放松监管和减税是比特币从当前市场混乱中复苏的潜在主要驱动因素。市场对当前的宏观经济和地缘政治情绪已经变得过于悲观。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。