比特币在去年超越了大多数资产类别,但现在却落后于黄金,因为投资者在日益增长的地缘政治紧张局势中纷纷寻求稳定。

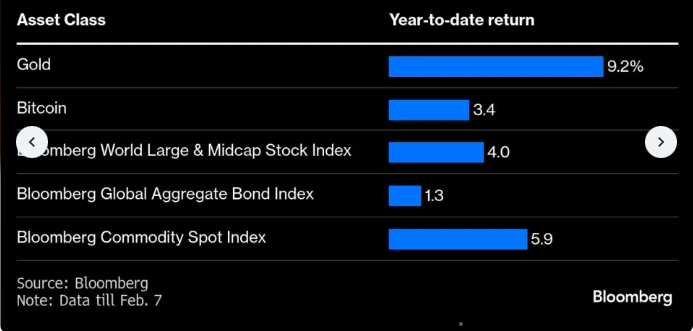

根据最近的一篇彭博社文章,美国与中国的贸易战、关税威胁以及特朗普最近的外交政策言论推动了黄金的上涨,使其价格达到了每盎司2882美元的历史新高。尽管黄金年初至今上涨了9%,比特币仅上涨了3%,仍比其峰值低10%。

尽管比特币具有内在的稀缺性,但它未能表现出作为真正的价值储存资产的特性。与传统上在经济不确定时期蓬勃发展的黄金不同,比特币的价格走势仍与科技股相关联。

Moneta Group LLC的高级投资顾问Aoifinn Devitt解释说,比特币仍被视为一种风险资产,而不是对法定货币的真正对冲。“随着时间的推移,它将具有与市场分开运作的特性,但在这一点上,它表现得仍然是最具风险的风险资产。”

然而,比特币的支持者仍然保持乐观。Wincent的高级董事Paul Howard认为,现货比特币ETF将有助于稳定价格波动,使比特币逐渐演变为真正的价值储存,类似于黄金的长期表现。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。