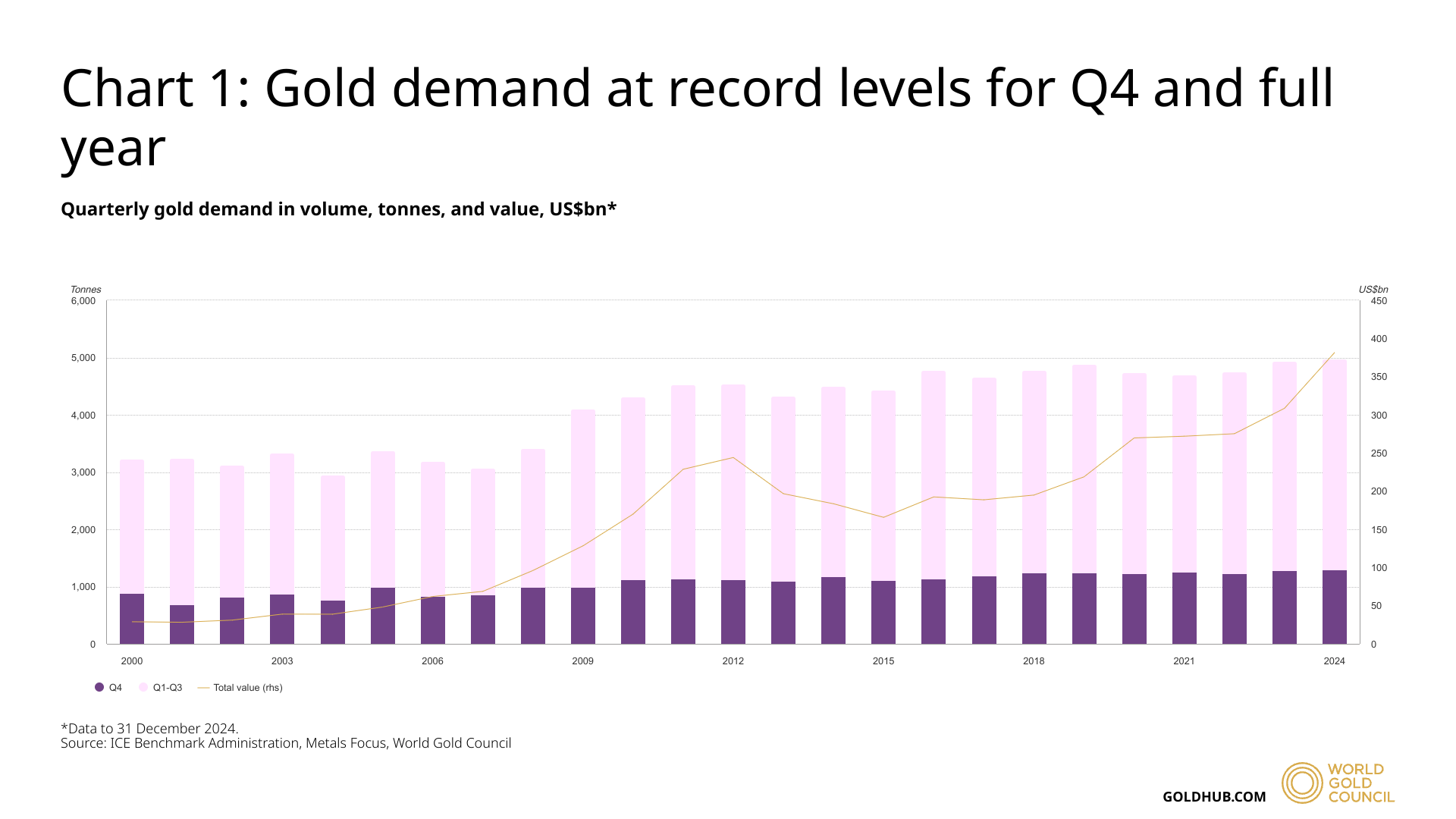

Overall annual gold demand, including over-the-counter (OTC) transactions, climbed to 4,974 tonnes, eclipsing earlier records. The World Gold Council (WGC) report indicates that the total value of gold demand also reached $382 billion, as prices registered 40 record highs throughout the year.

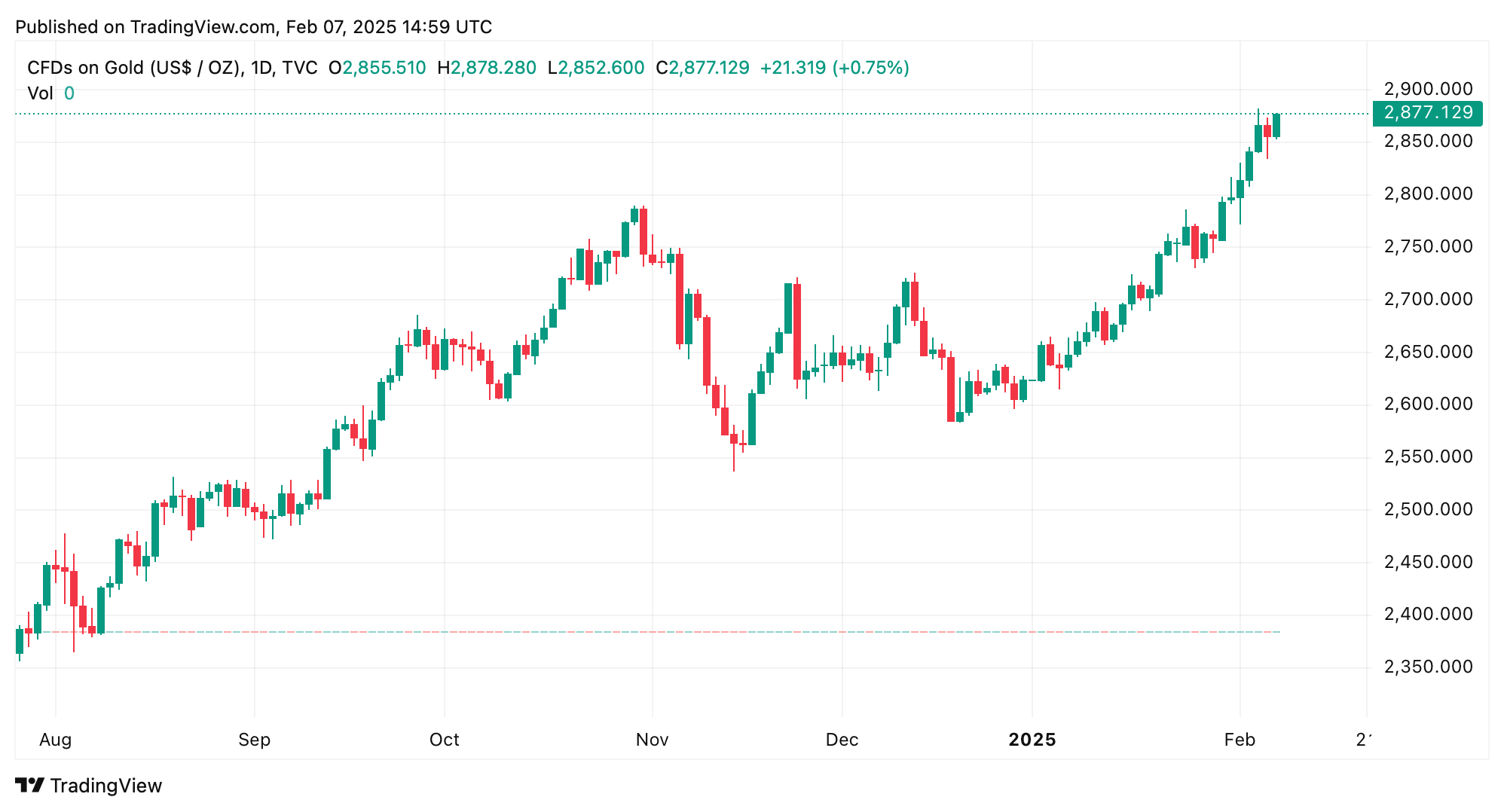

Gold price on Feb. 7, 2025.

Central banks worldwide continued to serve as a primary catalyst for demand, purchasing over 1,000 tonnes for the third consecutive year, with buying activity intensifying in the fourth quarter. Gold investment experienced significant growth in 2024, with global investment demand rising 25% year-over-year to 1,180 tonnes.

A revival in gold-backed exchange-traded funds (ETFs) also played a role, marked by net inflows for two consecutive quarters. Meanwhile, demand for bars and coins held constant at 1,186 tonnes, mirroring 2023 levels. The elevated price environment dampened jewelry consumption, which declined 11% to 1,877 tonnes.

Source: WGC report.

This downturn was most pronounced in China, where demand fell 24% year-over-year. Conversely, India’s gold jewelry market proved relatively sturdy, recording only a 2% decrease despite record-high prices. In the technology sector, gold demand enjoyed its strongest quarter since late 2021, reaching 84 tonnes in Q4.

An uptick in gold utilization in artificial intelligence (AI) and electronics contributed to a 7% annual increase, elevating total technology-related demand to 326 tonnes. At the same time, total gold supply expanded 1% year-over-year to a record 4,794 tonnes, supported by higher mine production and recycling. Looking forward, the World Gold Council anticipates that central banks will keep spurring demand in 2025, with ETF investors possibly assuming a more significant role if interest rates fall.

Nonetheless, elevated prices and economic strains could further limit jewelry demand. Geopolitical uncertainties and macroeconomic influences, such as central bank policies and elections, are projected to mold gold’s course in the coming year. At press time, an ounce of .999 fine gold is trading for 2,873 per unit.

“In 2025, we expect central banks to remain in the driving seat and gold ETF investors to join the fray, especially if we see lower, albeit volatile interest rates,” remarked Louise Street, the senior markets analyst at the World Gold Council.

The WGC analyst added:

On the other hand, jewelry weakness will likely continue as high gold prices and soft economic growth squeeze consumer spending power. Geopolitical and macroeconomic uncertainty should be prevalent themes this year, supporting demand for gold as a store of wealth and hedge against risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。