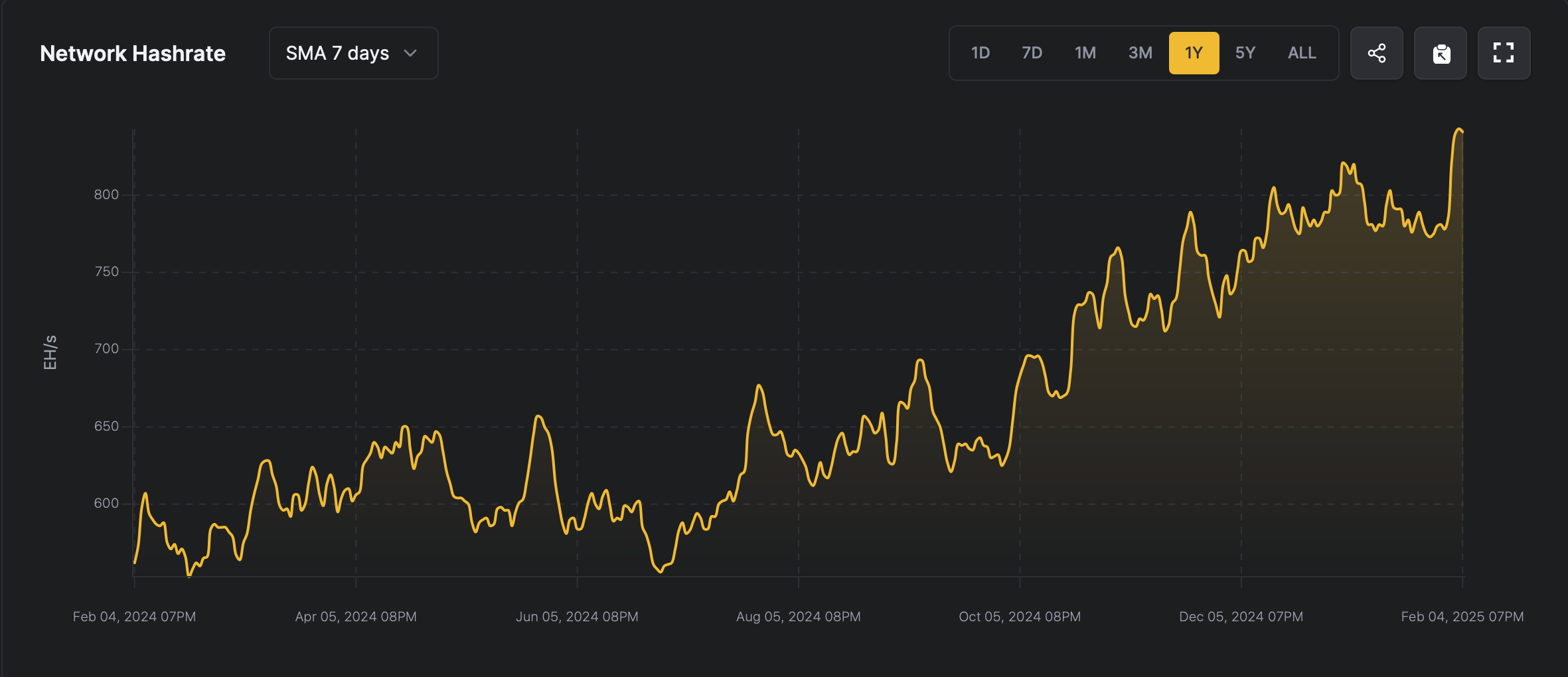

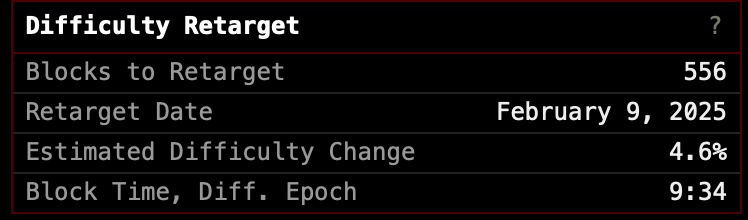

截至2025年2月5日,区块创建的节奏已稳定在平均9分钟36秒。如果这种快速的节奏持续下去,协议的自我调整机制将在2月9日实施4.6%的挖矿难度上调——这一变化目前的估计被认为是可能的。值得注意的是,来自hashrateindex.com的数据表明,比特币的七天简单移动平均(SMA)在前一天达到了844 EH/s的历史高峰,突显了网络的动态适应能力。

来源:hashrateindex.com

截至美国东部时间周三下午1:20,比特币的交易队列中有12,957个待确认交易——这相当于大约八个区块的积压。矿工目前每个每日每个拍哈希每秒(PH/s)获得57.56美元的哈希价格,这一数字较近期的月高点略有回落,但仍然舒适地超过了1月5日的基准。同时,高优先级费用保持在每个虚拟字节4聪(sat/vB),反映出网络压力较小。

四个矿业集体主导着计算领域:Foundry以260 EH/s(占总产出的32.4%)居于首位,其次是Antpool(20.21%)、Viabtc(14.85%)和F2pool(10.73%)。Secpool、MARA Pool、Spider Pool、SBI Crypto、Luxor和Braiins Pool则完成了这一层级。比特币的生态系统在平衡中蓬勃发展:矿工根据波动的奖励调整努力,而交易需求则低声细语而非高声喧哗。当前费用压力的减轻和哈希价格的温和滑动显示出网络处于短暂的休息状态。

来源:bitcoin.clarkmoody.com/dashboard/

即将到来的难度提升,无论其导致什么结果,都将压缩矿工的利润空间,激励效率升级或退出。更高的门槛要求增加计算投资,重塑竞争层级,同时强化比特币的自我调节架构。如果比特币价格保持低位而网络难度飙升,这将不是一件好事。

尽管比特币最近的区块节奏保持在9分钟36秒,但最近出现了一个奇怪的异常:区块882,331和882,332之间有一个缓慢的88分钟间隔。来自Dune Analytics的数据表明,2025年2月出现了四个超过60分钟的缓慢间隔——在其他节奏正常的加密时钟中出现的怪异现象。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。