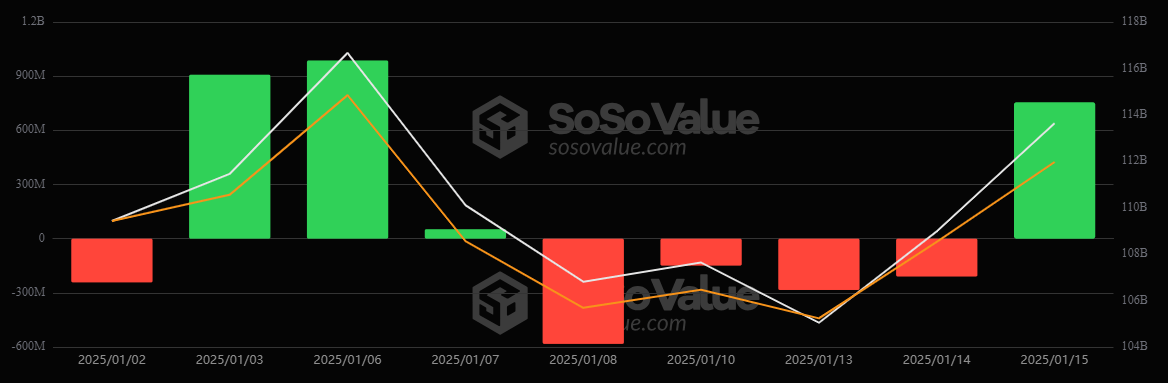

比特币交易所交易基金(ETF)在四天内经历了一系列资金流出,12只美国现货比特币ETF共流出12.2亿美元。然而,根据Sosovalue的数据,这一趋势在1月15日(星期三)被逆转,755亿美元流入了各类ETF。

显著资金流入的一个关键触发因素是消费者物价指数(CPI)报告略低于预期,以及围绕特朗普总统可能的加密政策变化的猜测。这使得比特币迅速回升至10万美元以上。

富达的FBTC引领了这次大规模流入,基金流入了4.63亿美元。Ark Invest的和21shares的ARKB紧随其后,流入了1.3881亿美元,Grayscale的GBTC和Blackrock的IBIT分别流入了5054万美元和3186万美元。

Bitwise的BITB和Vaneck的HODL分别带来了3269万美元和1698万美元的流入。这一显著的流入使得总净资产达到了1136.4亿美元,占比特币总市值的5.76%。

以太坊ETF继续积极恢复,迎来了另一天的资金流入。此前,它们也经历了为期四天的流出,总额为3.5404亿美元。然而,1月14日的微小净流入115万美元在另一天的5978万美元流入的推动下进一步增加。

富达的FETH流入了2932万美元,Blackrock的ETHA、Grayscale的ETH和Vaneck的ETHV分别带来了1985万美元、809万美元和253万美元的流入。其他以太坊ETF保持中性,没有资金流入或流出。

目前,九只以太坊ETF共同管理的净资产为122.5亿美元,相当于以太坊市值的2.96%。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。