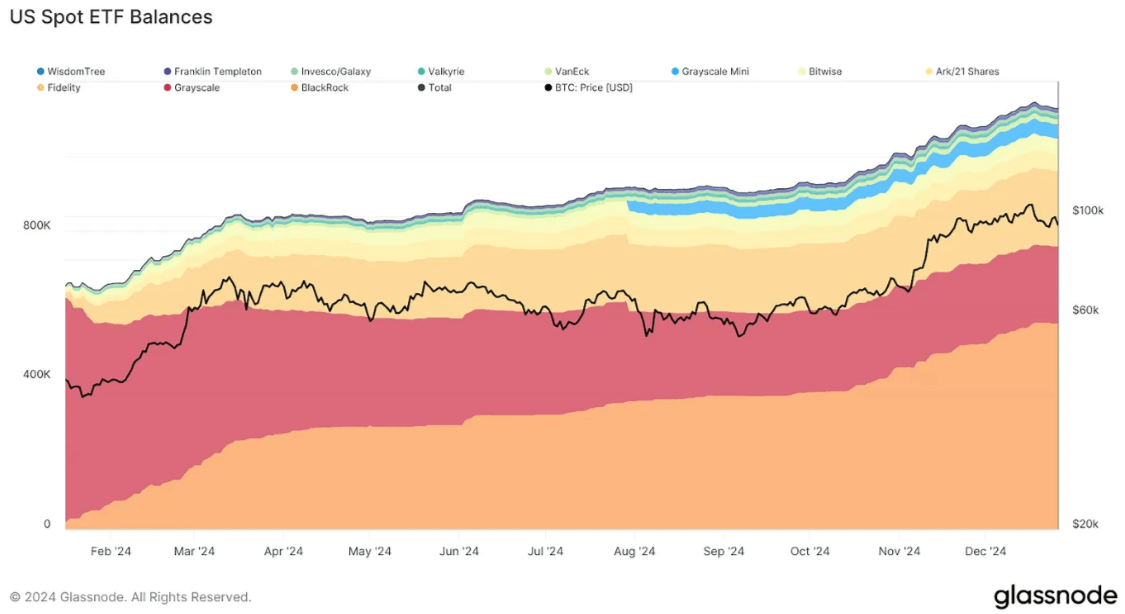

Bitmart Research 预测,到 2025 年,比特币现货交易所交易基金(ETF)的净流入可能超过 500 亿美元,管理资产(AUM)预计将超过 1500 亿美元。该预测基于美国停止降息、政府债务扩张以及特朗普总统对加密货币的看涨立场。

报告估计,资金流入比特币 ETF 将扩展到以太坊 ETF,并且在 2025 年批准 Solana ETF 的可能性很大。

预计在这一市场周期中,迷因币将继续发挥关键作用,用户参与受到 Solana 低成本和高性能的驱动。其他二层链如 Base 和 Sui 预计将受益于迷因币增长的溢出效应。

人工智能(AI)项目的增长将继续,AI 迷因由代理支持,继续发行许多迷因代币。基于市场需求的扩展和有利的监管,稳定币市场价值预计将超过 2500 亿美元。

预计现实世界资产(RWA)市场也将快速增长,可能在 2025 年达到 400 亿美元的价值。随着传统金融机构更多地参与加密市场,特别是在美国国债、企业债务和房地产方面,传统资产将焕发新生。

去中心化金融(DeFi)将受益于更宽松的监管环境,通过在利率下降期间提供高收益,吸引传统金融机构的兴趣。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。