Among the top ten stablecoins, tether (USDT) and ethena usd (USDE) recorded significant outflows, collectively amounting to nearly $4 billion, or precisely $3.98 billion. Tether faced the most substantial decline, losing $3.79 billion from its peak valuation of just over $141 billion. As of Jan. 6, 2025, USDT’s market capitalization stands at $137.21 billion.

Ethena’s USDE, a yield-bearing stablecoin, similarly peaked on Dec. 19, 2024, the same day as USDT, with a market cap exceeding $6 billion. It has since decreased by $190 million, leaving the current market valuation of USDE at $5.81 billion. Meanwhile, two other stablecoins, USD0 and USDX, are climbing the rankings as their supplies expand.

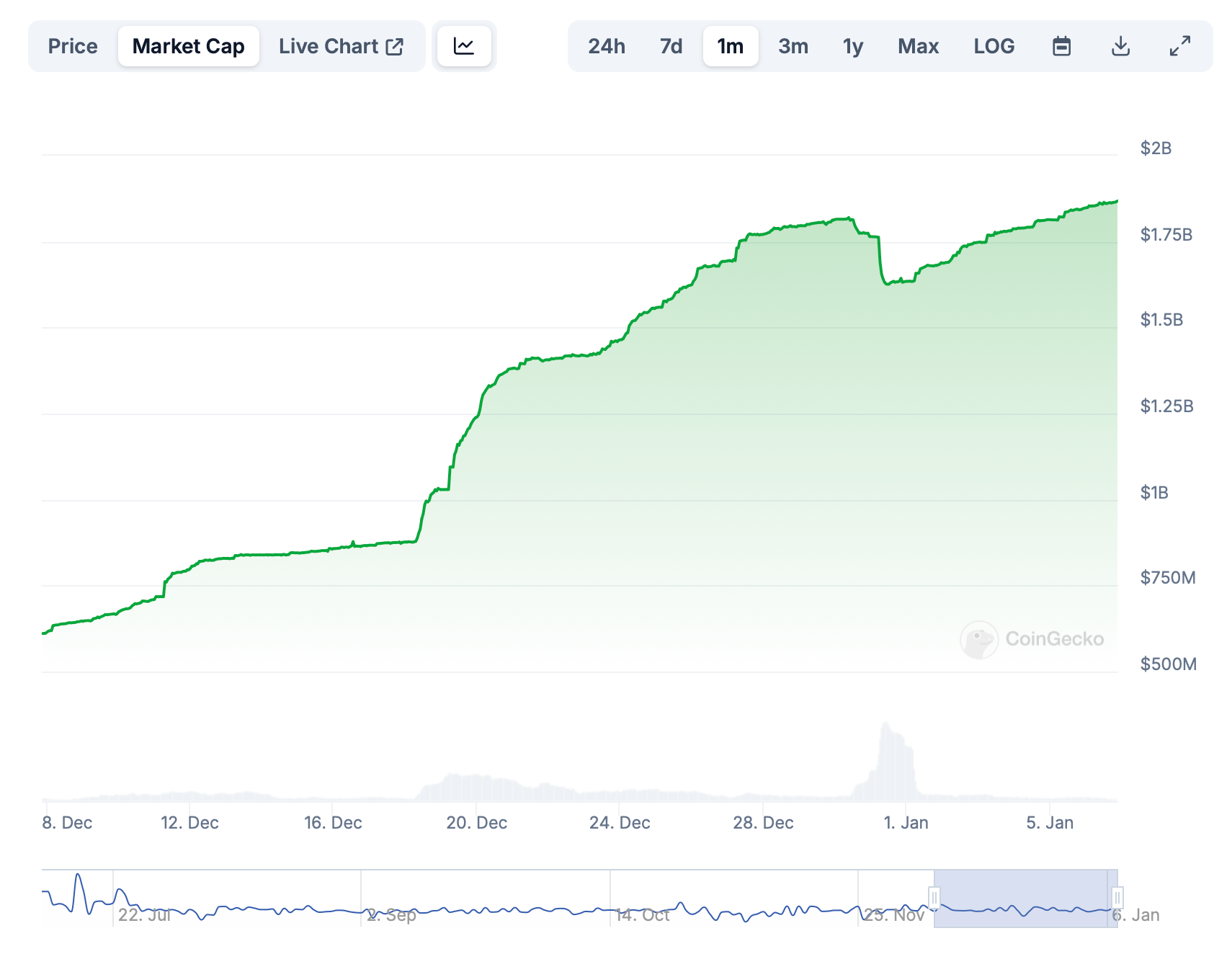

Usual USD0’s market cap growth over the last 30 days.

Usual’s USD0 now ranks as the fifth-largest stablecoin by market capitalization, currently valued at $1.864 billion. On Dec. 31, 2024, USD0’s market cap stood at $1.62 billion, reflecting an inflow of $244 million. Issued by Usual Money, USD0 is fully backed 1:1 by real-world assets (RWAs), primarily ultra-short-maturity U.S. Treasury Bills. It is actively traded on decentralized exchange (dex) platforms such as Curve and Uniswap.

Similarly, Usdx Money’s USDX has demonstrated considerable growth. Now the ninth-largest stablecoin, it holds a market valuation of $585.23 million. Just a month ago, USDX’s market cap was $184 million, with $70 million of that growth occurring in 2025. The most active exchanges swapping USDX today include Uniswap and Pancakeswap’s Stableswap app.

The stablecoin sector has seen a reshuffling of rankings over the past year, with players rising and falling. Despite tether shedding $3.79 billion, its dominance still remains unmatched, with a market valuation nearly three times that of its closest competitor, USDC. Nevertheless, the $3.79 billion contraction marked one of the most significant supply reductions for USDT in over a year within such a condensed timeframe.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。