迈克尔·巴尔(Michael Barr),美联储理事会理事及监管副主席,昨日在给总统乔·拜登的信中提出辞职,距离唐纳德·特朗普的就职典礼仅几天,具体情况在一份新闻稿中披露。

作为监管副主席,巴尔负责确保美国银行系统的完整性,但最近,他因其强烈的反加密货币立场而被一些人称为“首席去银行化者”,尽管他曾是加密支付公司Ripple的顾问。

在12月,《华尔街日报》的社论委员会发表了一篇题为《一个值得被解雇的美联储监管者》的意见文章,副标题为“特朗普通过解除迈克尔·巴尔的监管副主席职务将传达一个有用的信息”,现在看来,巴尔读懂了形势,主动辞职,但将继续担任美联储理事会的理事。

“担任美联储理事会的监管副主席是一种荣幸和特权,”巴尔说。“对这一职位的争议风险可能会分散我们使命的注意力。在当前环境下,我认为我在理事的角色中为美国人民服务会更有效,”巴尔补充道,暗示他辞职的理由是为了避免与特朗普的潜在对抗。

根据Custodia银行首席执行官凯特琳·朗(Caitlin Long)的说法,巴尔因在关闭支持加密货币的银门银行(Silvergate Bank)中的角色而获得了“行动窒息点”(Operation Choke Point)关键设计者之一的声誉。银门银行在2023年3月自愿清算,此前人们对其在FTX崩溃后保持偿付能力的能力表示担忧,但朗表示,该机构从未面临破产危险,而是被美联储在巴尔的要求下迫使关闭。

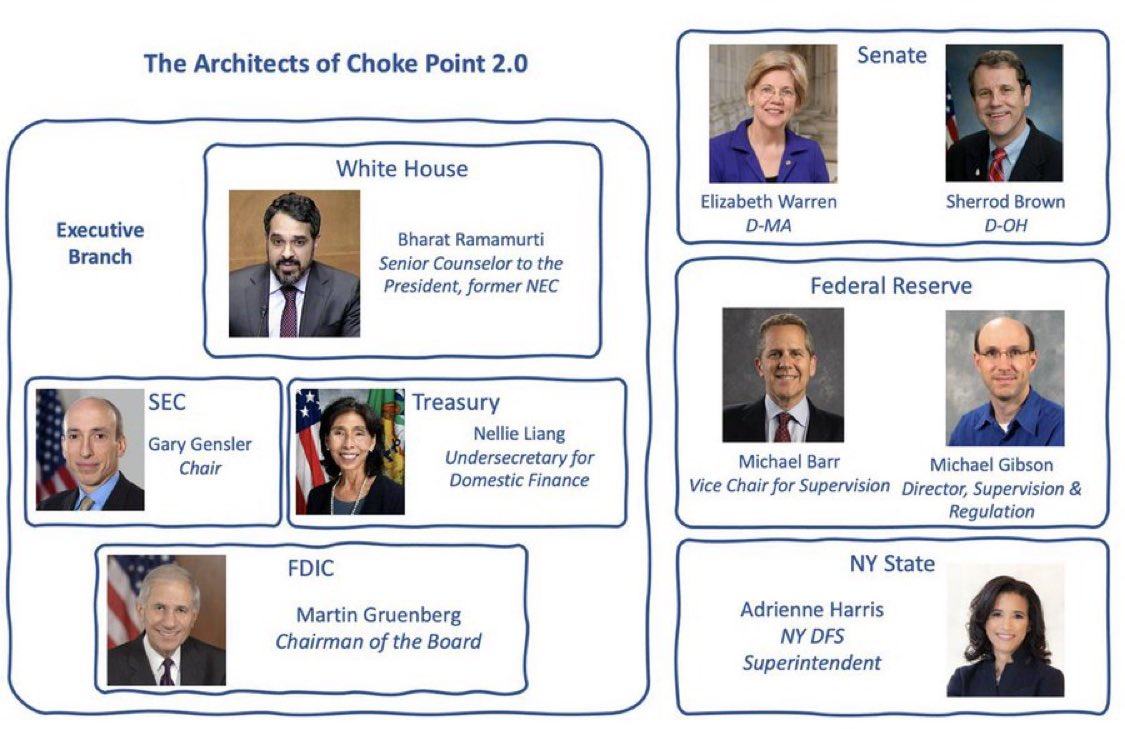

(行动窒息点2.0的关键设计者 / 凯特琳·朗)

“几个月前我们了解到,美联储(即迈克尔·巴尔)在2023年3月施压银门银行‘自愿清算’,”朗在X平台上发布。 “就在第二天,系统性银行挤兑开始了。”

在特朗普在11月的压倒性胜利后,其他一些主动辞去职务的反加密货币监管者包括证券交易委员会(SEC)主席加里·根斯勒(Gary Gensler)和前SEC执法主任古尔比尔·格雷瓦尔(Gurbir Grewal)。

周五,提供存款保险并直接监管超过5000家美国银行的联邦存款保险公司(FDIC)发布了数十封秘密信件,揭露了政府所谓的反加密货币政策。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。