美国现货比特币和以太坊交易所交易基金(ETF)在2025年1月6日(星期一)继续强劲开局,合计流入11亿美元。

在2025年1月2日(星期四),即2025年的第一个交易日,这两只ETF合计流出2.779亿美元。然而,1月3日(星期五)带来了显著的流入,两个ETF共流入9.6689亿美元。持续的兴趣显示出投资者愿意在加密ETF上大举下注。

在这11亿美元的流入中,现货比特币ETF获得了9.87亿美元,而现货以太坊ETF获得了1.287亿美元。

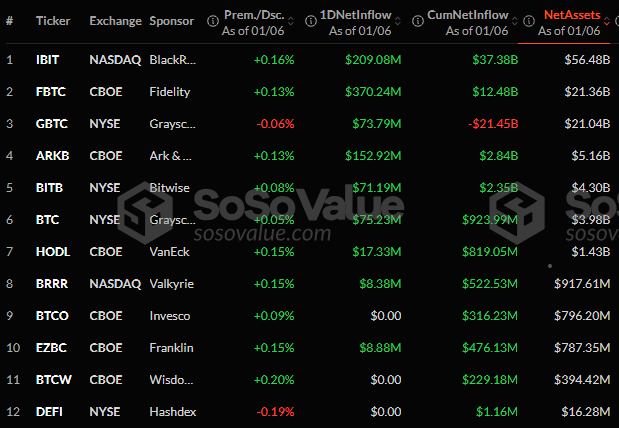

Sosovalue的数据表明,富达的FBTC、黑石的IBIT以及Ark & 21 Shares的CBOE基金占据了流入的最大份额,分别为3.7024亿美元、2.0908亿美元和1.5292亿美元。

资金流入还扩展到其他比特币ETF,Grayscale的BTC和GBTC分别吸引了7523万美元和7379万美元,而Bitwise的BITB则带来了7119万美元。现货比特币ETF目前持有价值1166.7亿美元的BTC,占比特币总市值的5.77%。

以太坊专注的基金流入主要由黑石的ETHA主导,流入1.241亿美元,富达的FETH则带来了462万美元。其他基金表现中性。

总体而言,九只以太坊ETF持有134.7亿美元的ETH,占以太坊总市值的3.03%。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。