On Dec. 25, amidst the holiday festivities, someone using an account linked to the crypto exchange HTX funneled 125,000 ETH, valued at $417 million, into Aave. This defi protocol lets users lend and borrow digital currencies, offering features such as overcollateralized loans and flash loans. Aave spans across 13 different blockchain networks.

Source: Intotheblock.com’s @LucasOutumuro on X.

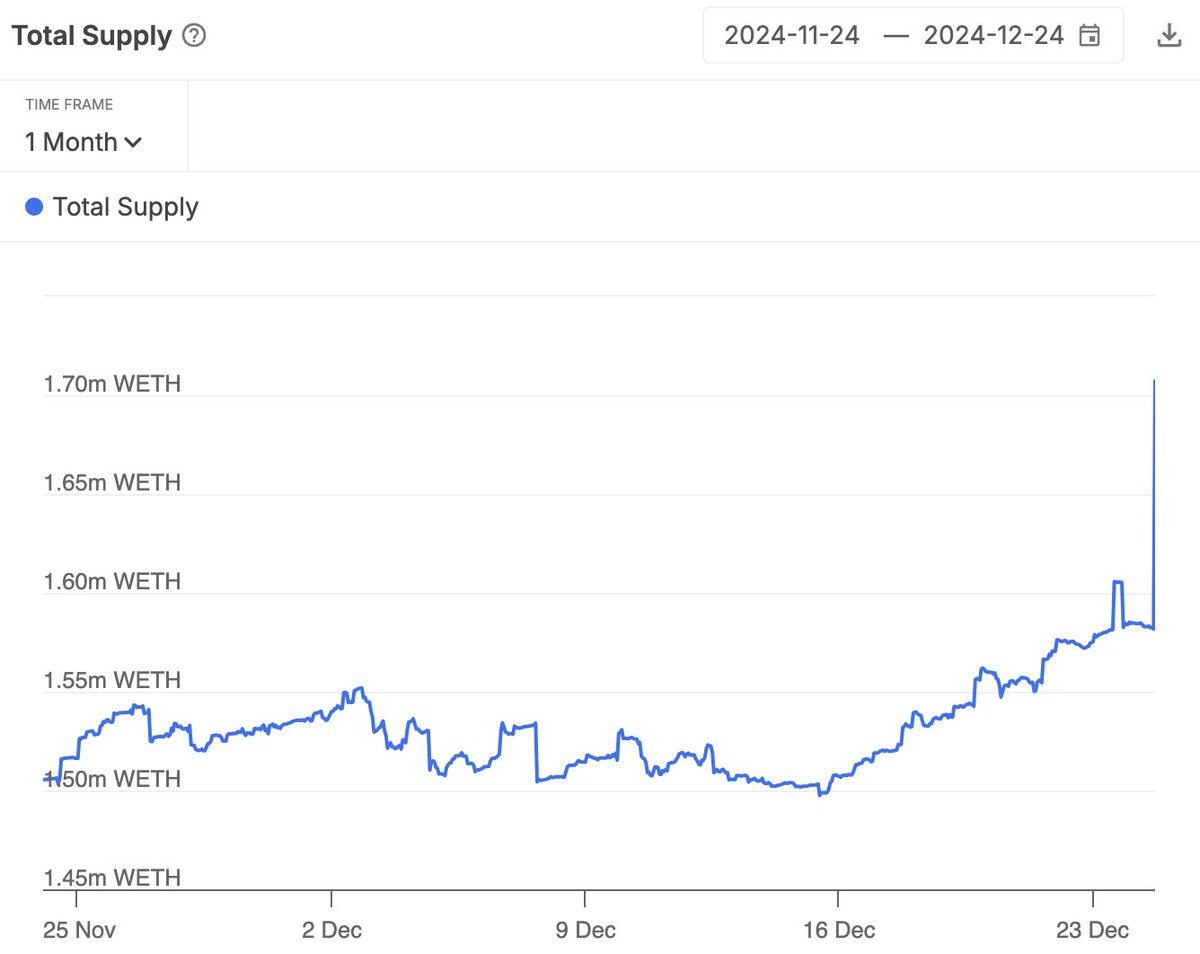

The colossal ethereum deposit was unearthed by Lucas Outumuro, the Head of Research at Intotheblock.com, who pointed out that the funds bore an HTX address. Aave has been bustling with activity lately, thanks to several pivotal updates and influences. Notably, the crypto project tied to U.S. President-elect Donald Trump saw World Liberty Financial snap up $1 million worth of the aave (AAVE) token.

Moreover, Aave has woven Chainlink’s Smart Value Recapture (SVR) oracle into its system, and with the launch of Aave version 3, it rolled out enhancements like better capital use, cross-chain liquidity shifts, and lower gas fees. Currently, Aave’s total value locked (TVL) is at $20.483 billion, boasting the highest monthly percentage growth (12.43%) among the top five defi platforms by TVL.

Meanwhile, Aave’s stablecoin GHO has seen its supply dwindle by 14.5% over the last 30 days. GHO’s market cap on Dec. 26 stands at $147.13 million. The hefty Ethereum deposit into Aave on Christmas Day showcases a savvy play, perhaps anticipating expansion or capitalizing on new protocol features. This move mirrors a wider trend of funds pouring into defi in recent months, propelled by tech innovations and political nods (especially from Trump), suggesting an ecosystem ripe for growth.

The researcher also revealed that this same user has poured a whopping $1 billion into the lending platform altogether. As Intotheblock.com’s Outumuro said on X, “Defi doesn’t sleep.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。