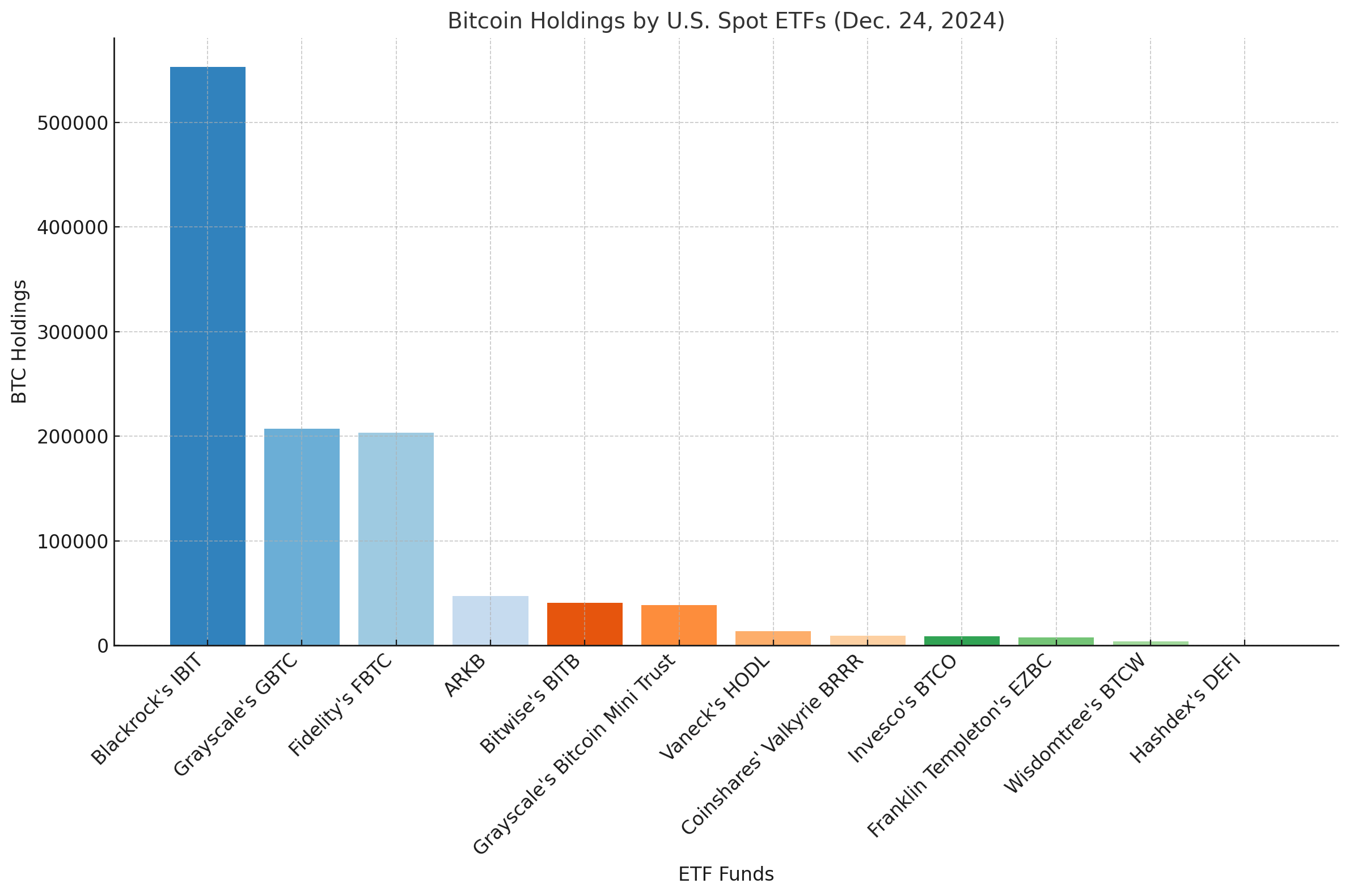

The launch of these spot bitcoin ETFs was a groundbreaking event, with ten funds instantly jumping into the fray, although eleven had received the go-ahead. Hashdex’s DEFI fund had to pivot from a futures ETF to a spot bitcoin fund, not making the switch until the end of March. Similarly, Grayscale’s Bitcoin Mini Trust didn’t see the light of day until the end of July. As of Dec. 24, 2024, these funds collectively hold an impressive 1,132,727.50 BTC, according to their respective websites.

Blackrock stands tall as the titan among these funds, clutching 553,055.27 BTC, which is valued at roughly $54.4 billion today. This colossal holding represents a whopping 48.82% of the 1.13 million BTC shared among the twelve funds. Next up, we’ve got Grayscale’s GBTC, which as of Dec. 24, boasts an impressive 207,100.18 BTC, valued at approximately $20.3 billion. Blackrock’s IBIT trades on the Nasdaq, whereas GBTC does its dance on the New York Stock Exchange (NYSE).

Over at Cboe, Fidelity’s FBTC takes the third spot, commanding 203,194.05 BTC, which translates to a cool $20 billion. It’s absolutely mind-blowing that Blackrock’s IBIT and Fidelity’s FBTC have amassed such a stash this year, and even more fascinating is that about 400,000 BTC have vanished from GBTC’s treasure chest since the year kicked off. Before it went public on the NYSE, GBTC was an OTC darling with over 600,000 BTC.

Despite this outflow, with GBTC and FBTC neck-and-neck in their BTC reserves, there’s no comparison to the colossal size of these three giants. However, IBIT has zoomed past them both. Next in line, in terms of bitcoin holdings, is Ark Invest’s and 21shares’ ARKB fund, which has gathered 47,013 BTC, equating to $4.6 billion today – a figure that pales in comparison to the $20 billion of GBTC and FBTC, and the massive $54.4 billion of IBIT.

Following closely, Bitwise’s BITB holds 40,909.86 BTC, and Grayscale’s Bitcoin Mini Trust secures 38,275.49 BTC. Together, ARKB, BITB, and Grayscale’s Bitcoin Mini Trust form their own elite club with their hefty reserve sizes. Vaneck’s HODL isn’t far behind, with 13,716.827 BTC, valued at around $1.3 billion. Just a notch below, Coinshares’ Valkyrie BRRR holds 9,069.3 BTC, amounting to $892 million. Invesco’s BTCO claims around 8,780 BTC, and Franklin Templeton’s EZBC sits at approximately 7,624.52 BTC, while Wisdomtree’s BTCW holds a steady 3,841 BTC.

Lastly, Hashdex’s DEFI rounds up the list with a modest 148 BTC, worth $14.5 million. This historic accumulation of over a million bitcoins by U.S. spot ETFs within their first year signals a seismic shift in cryptocurrency investment accessibility. The dominance of three major players – Blackrock, Grayscale, and Fidelity – controlling over 85% of the total holdings demonstrates both the concentrated nature of institutional crypto adoption and the competitive dynamics shaping these emerging financial vehicles.

The stark contrast between the top-tier funds and smaller players suggests a potential consolidation trend in the bitcoin ETF space, while simultaneously highlighting how traditional financial powerhouses have quickly established dominance. As these funds continue to evolve, their collective holdings represent a significant portion of Bitcoin’s circulating supply, potentially influencing future market dynamics and institutional adoption patterns going forward.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。