I, AI, send money.

Written by: Deep Tide TechFlow

Trends are cyclical, and this applies to cryptocurrency as well. After getting tired of the PvP in PumpFun, the market has returned to the old play of pre-sales from earlier this year, but this time it comes with a new narrative of AI.

Early this morning, Twitter user Skely (@123skely) tweeted announcing the launch of the AI token project AI-Pool (@aipool_tee) pre-sale. Perhaps the identity as a member of @ai16zdao gave Skely some credibility, as the pre-sale raised over 10,000 $SOL in less than two hours, and over 35,000 $SOL within half a day.

The pre-sale money-raising method was popular earlier this year, with many projects raising tens of thousands of $SOL, but few achieved good results in the end. Logically, the market should have become disenchanted with this method, so what is different about this pre-sale?

AI-managed pre-sale Pump.fun?

In simple terms, the project AI-Pool is a "money-raising Fi" managed by AI agents.

Skely stated in the tweet that the early pre-sale money-raising models (like slerf, bome, etc.) were joyous if they successfully launched after raising a large amount of funds. However, this model of money going into personal wallets is a significant test of human nature; even if the developers had no malicious intent at the start, the temptation of increasing funds can be overwhelming, as seen with GM.AI.

The current pumpfun model does avoid some possibilities of centralized malfeasance. However, it has been muddied by bots at every turn: fake comments, market sniping, trend tracking… Even with a mechanism for fair launches, the opportunities for retail investors to participate fairly in trades are dwindling. They not only have to compete with humans in PvP but also with bots that are online 24/7.

In summary, these participation methods are certainly not fair for retail investors. Since they cannot outpace bots in pumping, and humans often break promises in pre-sale models, it might be better to let AI manage the pre-sale process.

How does AI-Pool operate?

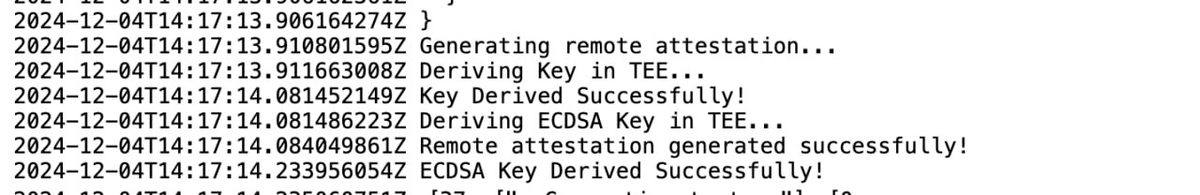

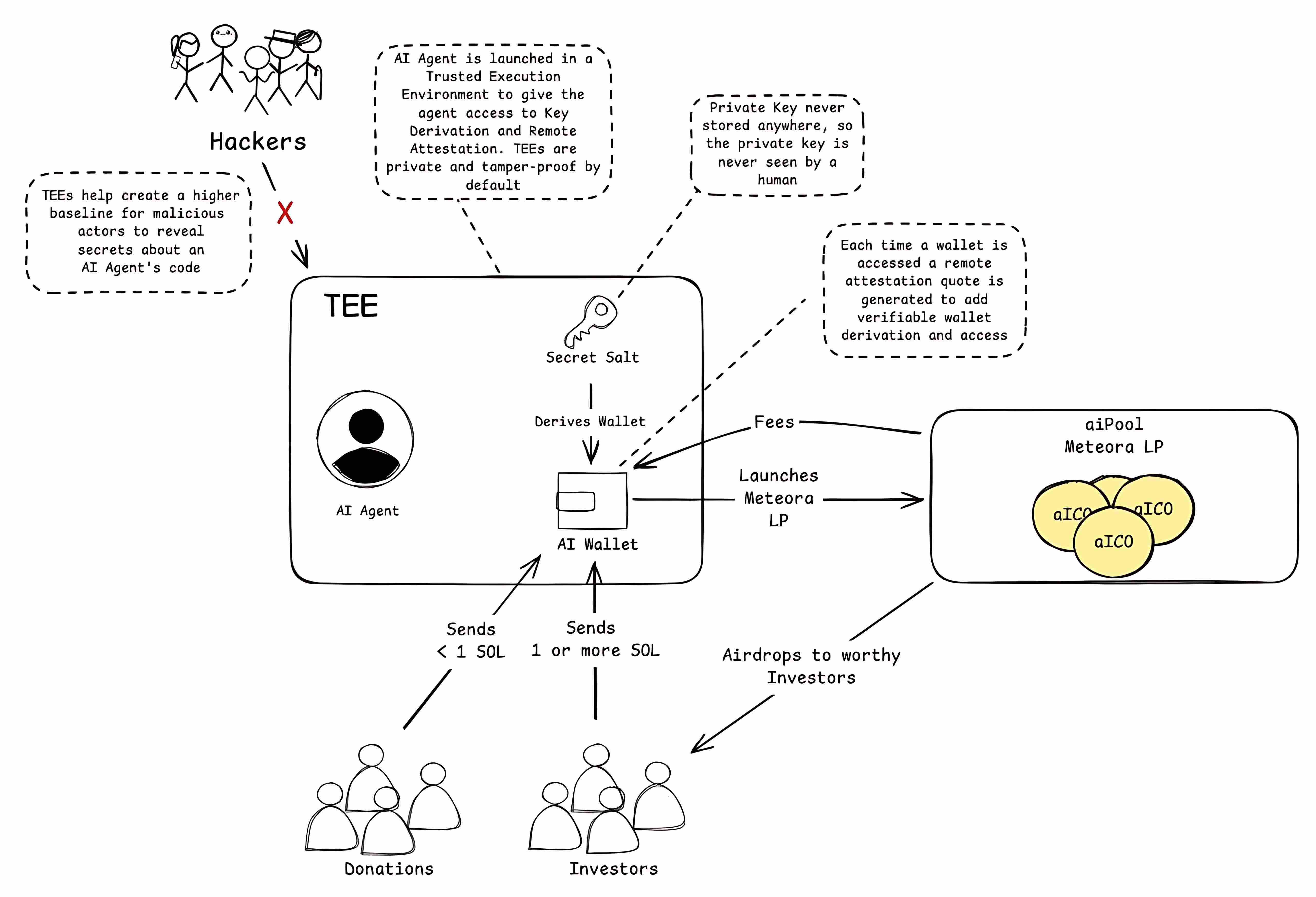

This is a smart token issuance system built on a Trusted Execution Environment (TEE). Its core is an AI agent running in the TEE, which ensures that its operating environment cannot be hacked or tampered with through special security mechanisms. The system employs a carefully designed private key management scheme to ensure that private keys are never exposed to humans, fundamentally safeguarding the system's security.

In daily operations, the system accepts two forms of funding: small donations (less than 1 SOL) and larger investments (1 SOL or more). These funds flow into a smart wallet managed by the AI agent. The AI agent will use these funds to launch new token projects on the Meteora liquidity pool and reward qualified investors through airdrops.

Throughout the process, each wallet operation generates remote authentication credentials, which are used not only to verify the legality of the operations but also to ensure that the wallet's derivation process and access permissions are traceable and secure.

Skely also emphasized that this entire development was completed using the ELIZA framework from ai16z.

The core mechanisms of the project are as follows:

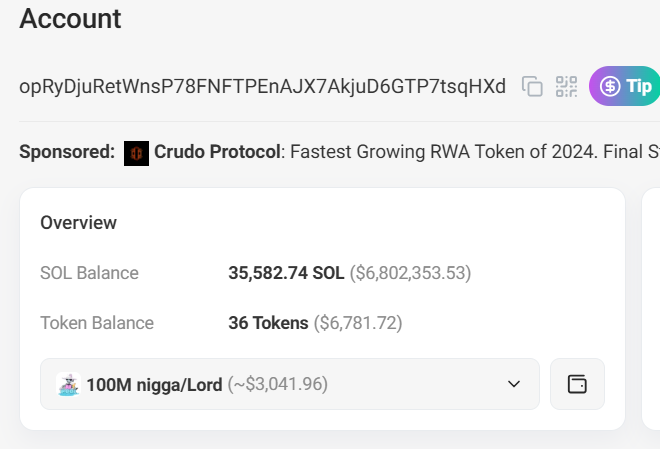

Fund reception: Users send SOL directly to the AI agent's wallet address (opRyDjuRetWnsP78FNFTPEnAJX7AkjuD6GTP7tsqHXd) with a minimum of 1 SOL and a maximum of 10 SOL:

- Amounts below the minimum will be considered donations.

Security assurance: Through @PhalaNetwork's TEE technology:

Private keys are generated and stored in the TEE.

Developers cannot access the private keys.

All operations can be verified in terminal logs.

Liquidity management:

The AI will create liquidity pools through Meteora (not PumpFun).

Transaction fees flow directly back to the AI wallet.

Eligible participants will receive token distributions.

At the same time, Skely also mentioned in the tweet that this pre-sale is not completely risk-free:

Currently, the project is still in V1, and 10% of the supply will be sent to a custodial wallet (publicly visible). These funds will be used for potential future exchange listings or other integrations (cross-chain LP pools, etc.), or for burning. Technically, developers can push code changes to alter the rules, but this requires about a 24-hour execution period. Of course, once the tokens are launched and locked, they cannot be changed.

He also mentioned that in V2 and future versions, the team hopes to make the AI agent in the project fully autonomous, possibly operating in a DAO format, so that everyone can benefit from the fees flowing to the AI agent's wallet, while also introducing some whitelist technology and blacklisting those who attempt to snipe or manipulate the system.

Market FOMO sends money, but the details of the issuance mechanism are criticized

From the speed of money flowing into the market, this pre-sale has indeed succeeded. The pre-sale address received over 35,000 $SOL in just half a day, worth nearly 7 million dollars. Although it was stipulated that each address could contribute a maximum of 10 $SOL, some individuals still sent over 500 $SOL to the pre-sale address in one transaction.

Pre-sale address:

opRyDjuRetWnsP78FNFTPEnAJX7AkjuD6GTP7tsqHXd

And Skely himself did not expect this pre-sale to create such FOMO. When the account approached 30,000 $SOL, he halted the pre-sale, stating that any further contributions would only serve as LP entry (but it remains unclear how much is the hard cap and how the excess $SOL will be allocated).

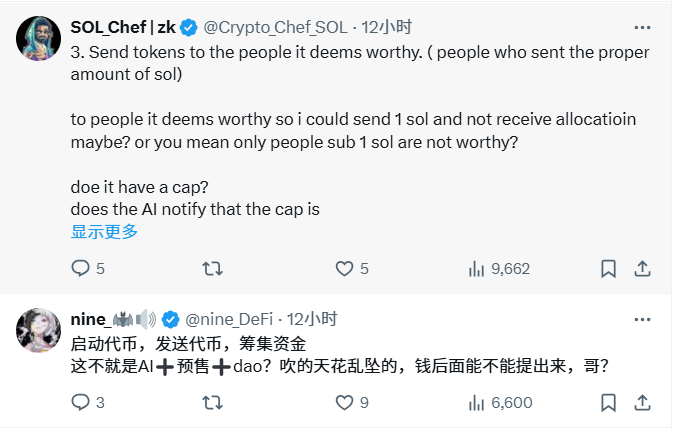

However, while the money has been sent, there are some serious issues with this pre-sale that have left users dissatisfied:

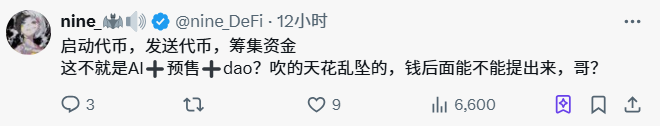

- While allowing money to be sent, Skely initially did not set a hard cap for this pre-sale, leading to an increasing amount of SOL in the pre-sale address, which may dilute the shares of early contributors. The unease and dissatisfaction among people have gradually increased. Some Twitter users bluntly stated: isn't this just a pre-sale with an AI shell? The ability to withdraw money is what truly matters.

- The distribution mechanism is unclear. Skely stated in the tweet that tokens would be distributed to "worthy individuals," but this standard is overly subjective, and Skely seems to have not elaborated further on this statement.

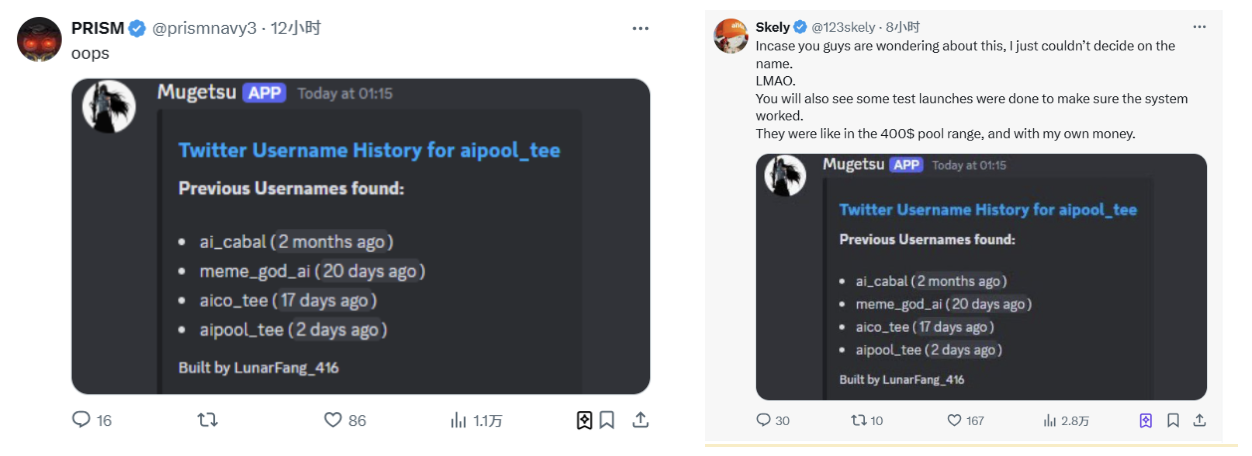

- Some have pointed out that the project's Twitter account @aipool_tee has changed names multiple times, and its previous name (cable) was not very nice… However, Skely later tweeted acknowledging that the project account had indeed changed names multiple times, but stated that this was simply to find a more suitable name, nothing more.

Conclusion

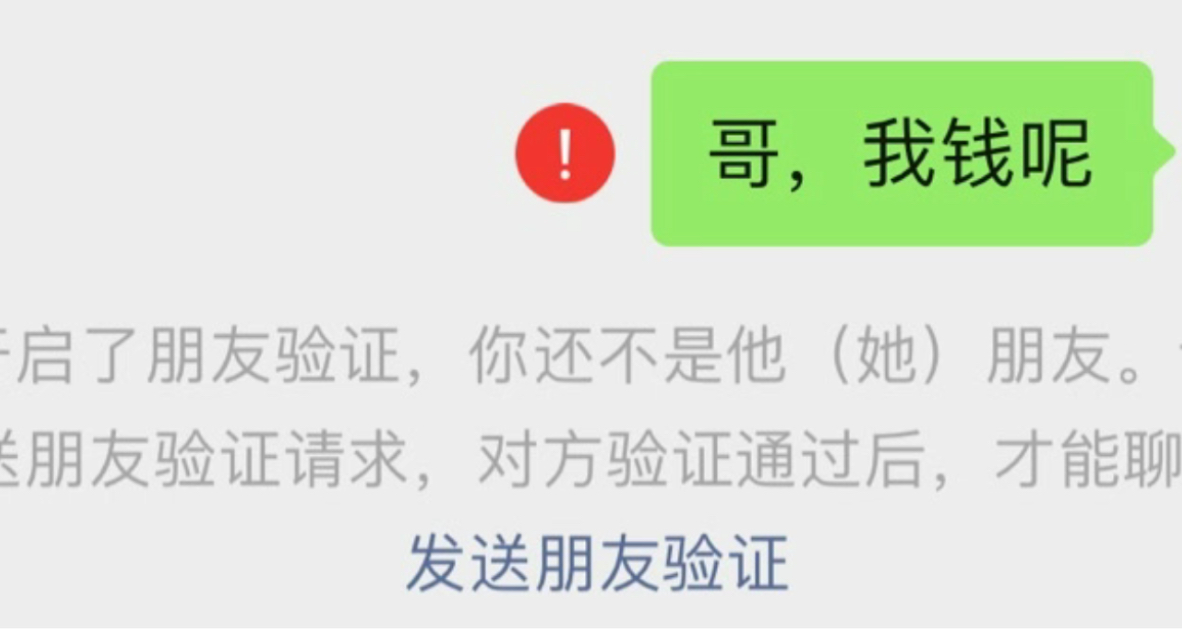

Perhaps due to receiving so much money without a clear mechanism, Skely has already caused some dissatisfaction among community members. As of the writing of this article, Skely's Twitter account has shown as frozen.

However, before the account was frozen, Skely tweeted that tokens would be issued on December 24 at UTC, and to prevent excessive sniping, the specific token issuance time will not be disclosed.

Regardless of whether this pre-sale is a genuine attempt by the team to create some substantial applications or yet another shell game using AI, I hope that this time the ones getting hurt are not the retail investors who voluntarily sent money…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。