最近几周,XRP取得了显著进展,这得益于对美国监管环境更加友好的猜测以及RLUSD在主要交易所的首次交易。然而,这种加密资产也反映了市场的整体下滑,本周下跌8.2%后,XRP的价格为每单位2.18美元。

XRP/USD于2024年12月22日。

即使在这次回调中,XRP与30天前相比仍上涨了50.4%。自12月17日以来,该资产每个币大约下跌了0.50美元。12月21日星期六,价值7089万美元的3000万XRP从韩国交易所Upbit提取。值得注意的是,韩国占XRP交易量的22%。

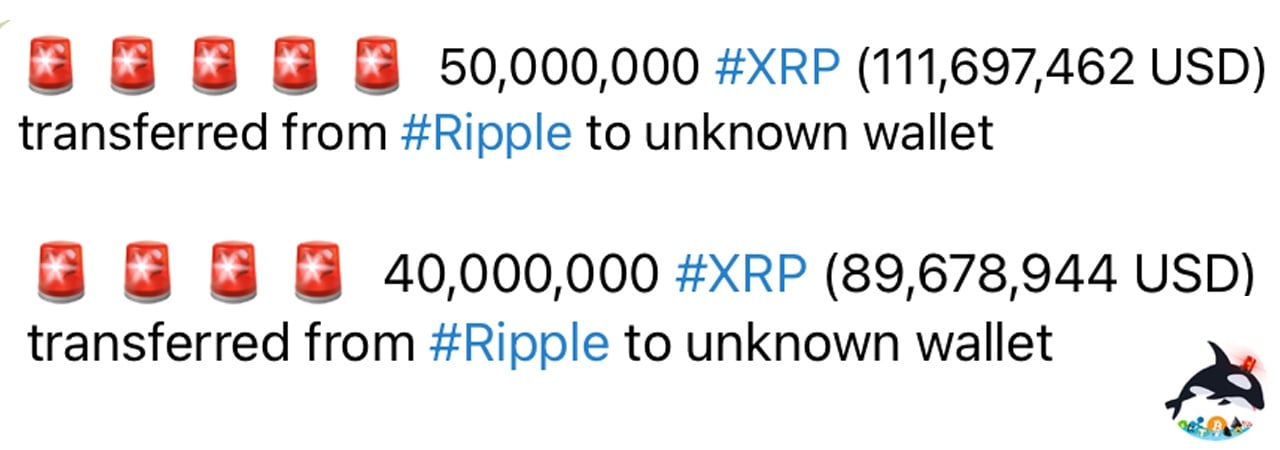

这一转账被Whale Alert的区块链监测系统检测到,该系统同一天还标记了Ripple自身发起的两笔大额交易。该公司分两次转移了9000万XRP:5000万XRP价值1.1169亿美元,4000万XRP价值8967万美元,资金被转向未识别的钱包。

来源:whale-alert.io

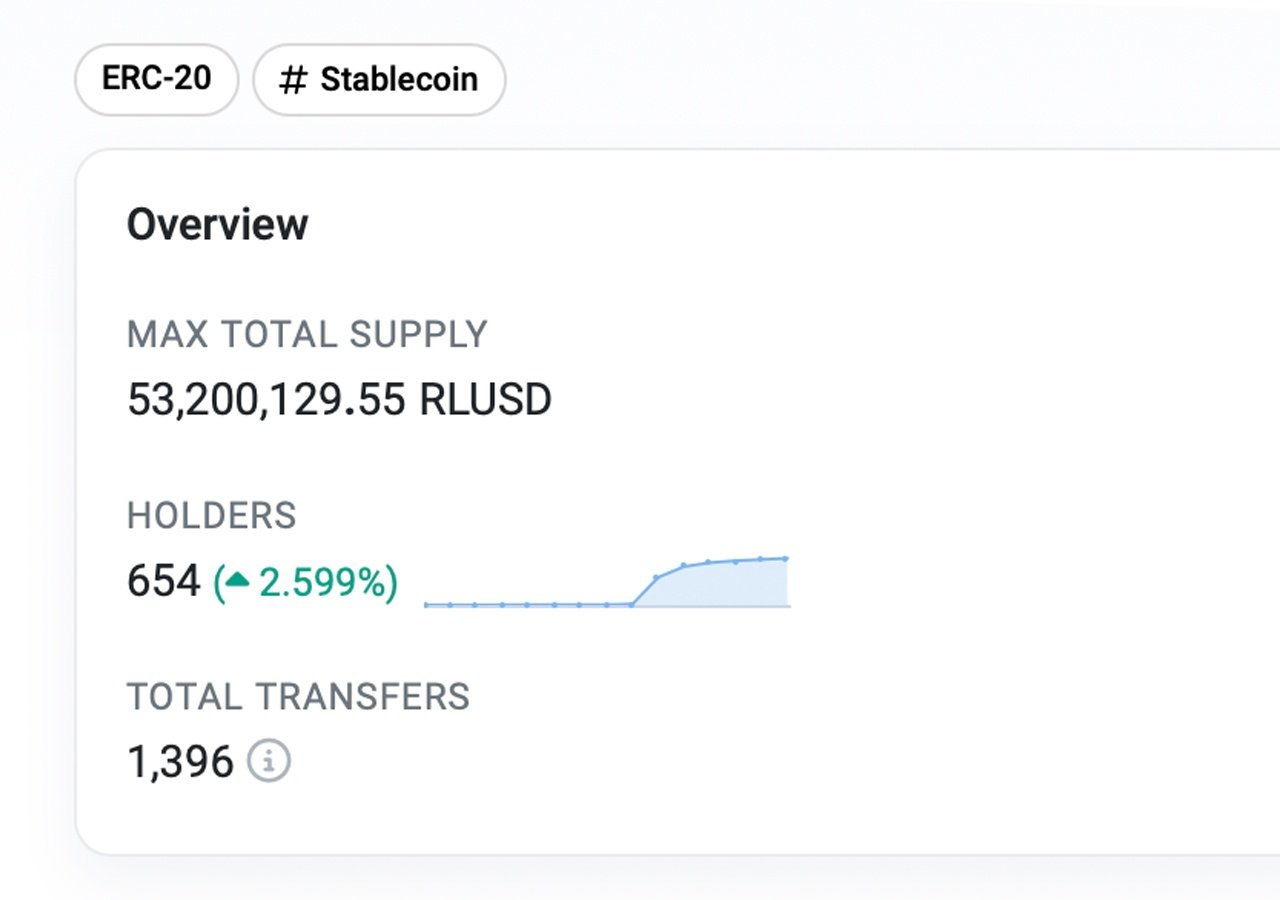

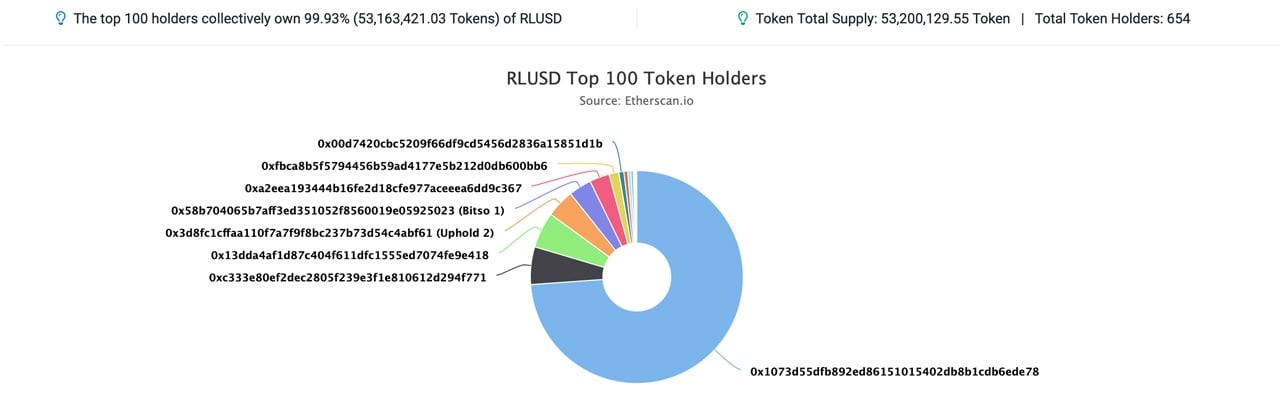

另一个吸引爱好者关注的焦点是Ripple的法币支持加密代币RLUSD。来自coinmarketcap.com和etherscan.io的数据表明,目前以太坊区块链上有5300万RLUSD代币。Ripple Deployer钱包持有大部分,拥有39,298,912.01 RLUSD,占供应的73.87%。

来源:etherscan.io

第二大持有者是B2C2集团,一家机构流动性提供商,拥有3,039,391 RLUSD(5.71%)。一个未知钱包排名第三,持有2,899,910 RLUSD,随后是Uphold,持有228万RLUSD和另外305,295 RLUSD在另一个钱包中,使其成为第四大持有者。位于墨西哥的交易所Bitso则是第五大RLUSD持有者。

Etherscan.io显示,前100大持有者共持有99.93%(53,163,421.03个代币)的RLUSD。

截至目前,RLUSD在以太坊区块链上已进行1396次链上转账。Coinmarketcap的数据表明,大部分交易活动来自Bitso和Mercado Bitcoin,后者是巴西最大的加密货币交易所。RLUSD的市值为5300万美元,在稳定币中排名第37,与收益型稳定币astherus(USDF)并列。要进入前10名,RLUSD还有很长的路要走,目前Paypal的PYUSD位列第十。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。