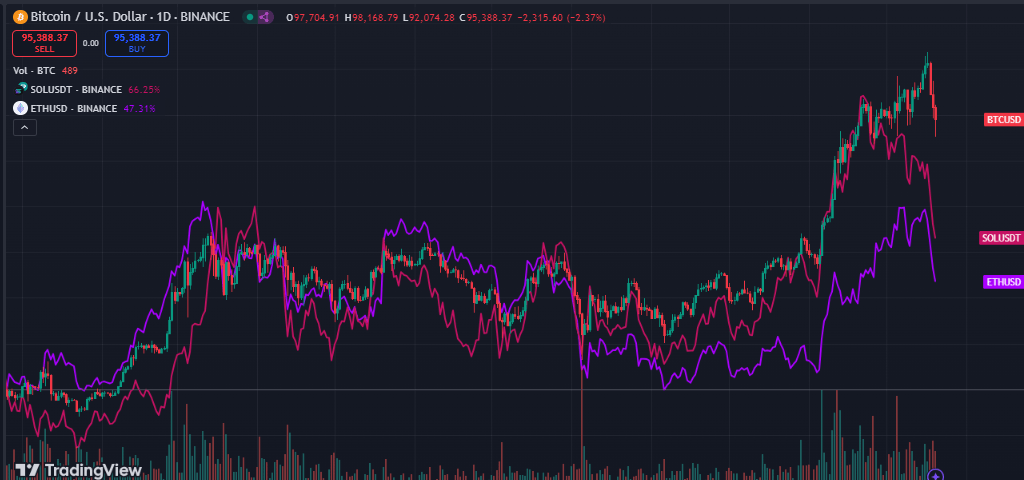

比特币的价格修正延续至12月20日星期五,作为第一大加密货币,它继续失去近期的涨幅。在过去的48小时内,比特币(BTC)下跌超过13%,从历史最高点108,364美元跌至92,118美元,随后略微反弹,交易价格为95,800美元。

此次显著的市场修正主要受到美国联邦储备委员会最近“鹰派”0.25%降息的影响,以及投资者纷纷逃向更安全的投资资产。

山寨币也跟随比特币出现了显著的修正。以太坊(ETH)从4,032美元下跌18%,至3,115美元。同样,XRP从2.6美元暴跌至1.96美元,跌幅为21%;BNB从736美元下跌至620美元,跌幅为16%;而SOL则以20%的跌幅从225美元降至177美元,成为前四大加密货币之一。

在期货市场,根据Coinglass的数据,超过400,000名加密货币交易者的14亿美元的多头和空头头寸被强制平仓。这导致全球加密市场市值在过去一天内下降了12%,目前市值为3.2万亿美元。然而,总体加密市场交易量上升了31.47%,达到了339.8亿美元,比特币的市场主导地位略微上升至57.95%。

尽管市场下滑,主要加密货币仍继续在关键心理水平之上交易。这表明加密市场的韧性更强,主要受到机构投资者的兴趣和看涨市场情绪的推动。因此,这次价格崩溃可能是预计将持续到2025年的牛市周期中的一次暂时回调。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。