撰文:深潮 TechFlow

之前 CZ 发推表达出对区块链应用的看重,引发市场一系列反响的同时也让市场对 Binance Labs 的下一步动向一直保持关注。

昨日,Binance Labs 宣布投资 Solana 生态去中心化的稳定币协议 Perena,从投资层面贯彻注重基建应用的理念。据 Coindesk 透露,本次 Perena 从种子轮融资中筹集了约 300 万美元。

Solana+DeFi 基建应用,两个版本 BUFF 叠加的 Perena 究竟是什么?又是如何受到 Binance Labs 认可的?

我们盘了盘 Perena,为你带来此篇项目轻解读。

轮辐式架构,解决 DeFi 资金低效

从 Perena 的自我介绍中称,由于当前稳定币方案太多造成的流动性碎片化问题,大量独立的流动性池让资本流转效率过低,用户体验也不好。其定位是为了解决这些问题,也想做“统一流动性”的工作。

核心产品 Numéraire

为了流动性整合的目标,Perena 推出项目核心产品 Numéraire,一个专门为稳定币设计的互换协议。通过可组合、可扩展的流动性池设计,显著降低了传统 AMM 中的闲置资金问题,也是 Solana 生态首个原生集成利息收益代币(IBTs)的稳定币互换协议。

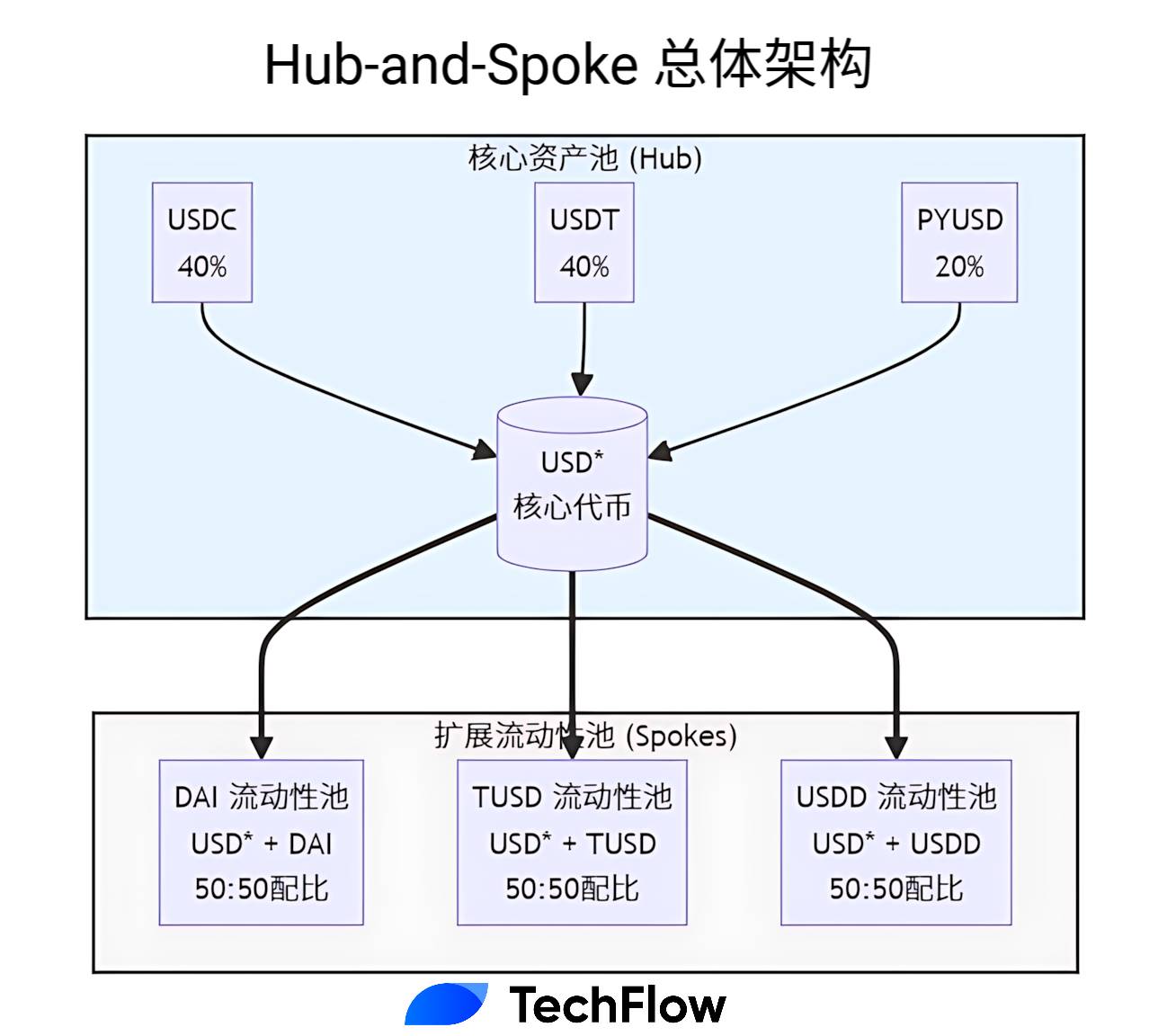

Hub-and-Spoke —— 轮辐式架构

Numéraire 的核心特点在于采用 Hub-and-Spoke 轮辐式架构。这种架构通过 Seed Pool(中心池)和 Growth Pools(成长池)的双池设计,解决资金效率与风险控制的平衡问题。

在这个体系中,Seed Pool 作为核心流动性中心,由 USDC、USDT、PYUSD 等主流稳定币构成,并发行 Perena 自己的流动性代币 USD*(USD Star)。USD* 不仅能够获取互换费用收入,还能通过自动复利机制实现价值持续增长。

Growth Pools 则通过与 USD* 配对的方式,为新兴稳定币提供流动性支持。这种设计要求所有交易必须通过 USD* 进行中转,形成了一个双跳互换机制,这可以:

-

有效隔离 Seed Pool 风险

-

最大化协议 TVL 利用率

-

USD* 持有者可同时获取 Seed Pool 和 Growth Pools 收益

所以说 Perena 的“统一流动性”不是将所有流动性物理上集中在一个池子,而是通过 Hub-and-Spoke 架构实现逻辑上的统一。

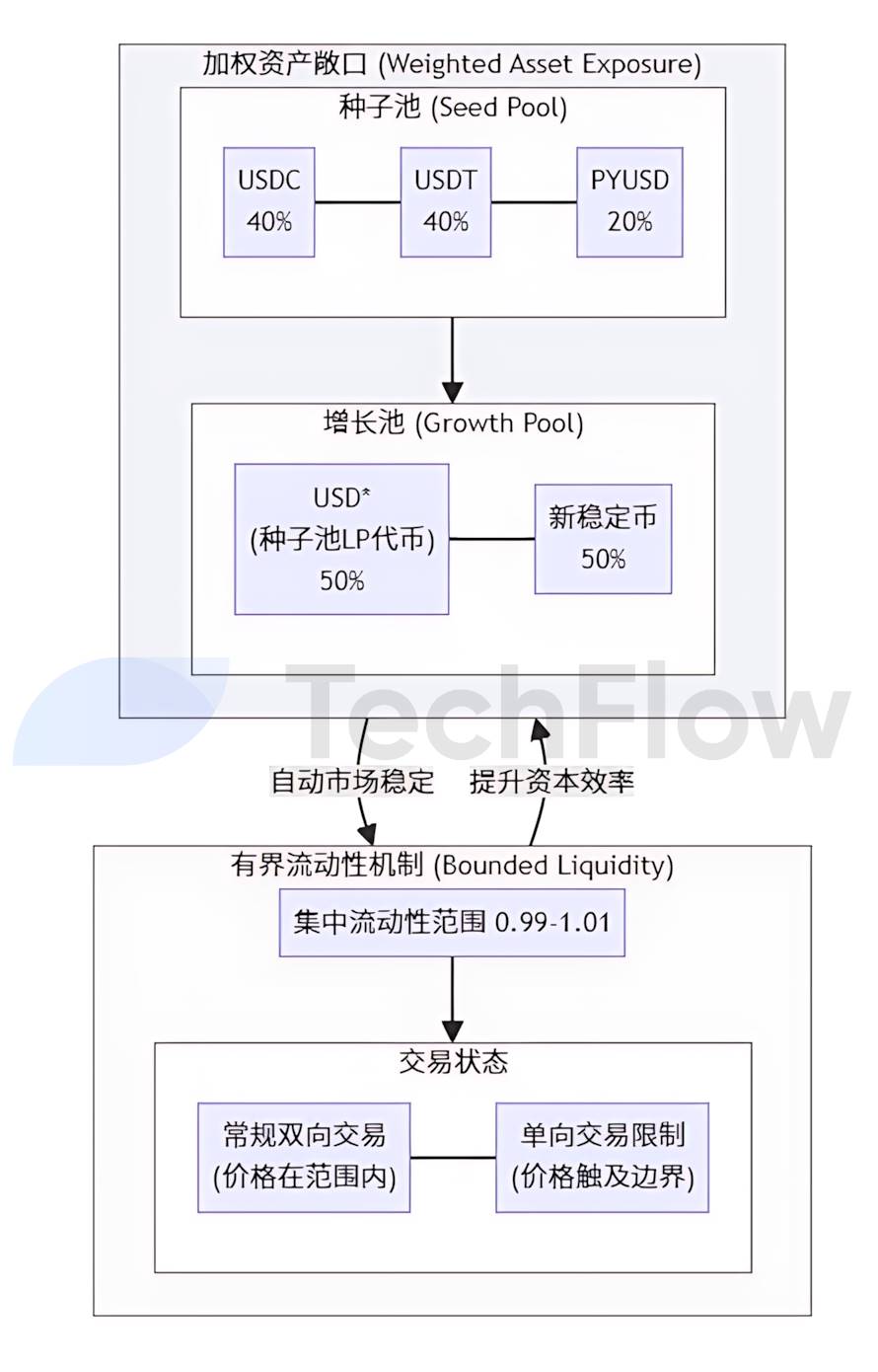

而整个 Hub-and-Spoke 架构围绕稳定币 USD* 服务,为协同架构确保 USD*真正稳定运行,协议还引入了有界流动性和加权资产机制。

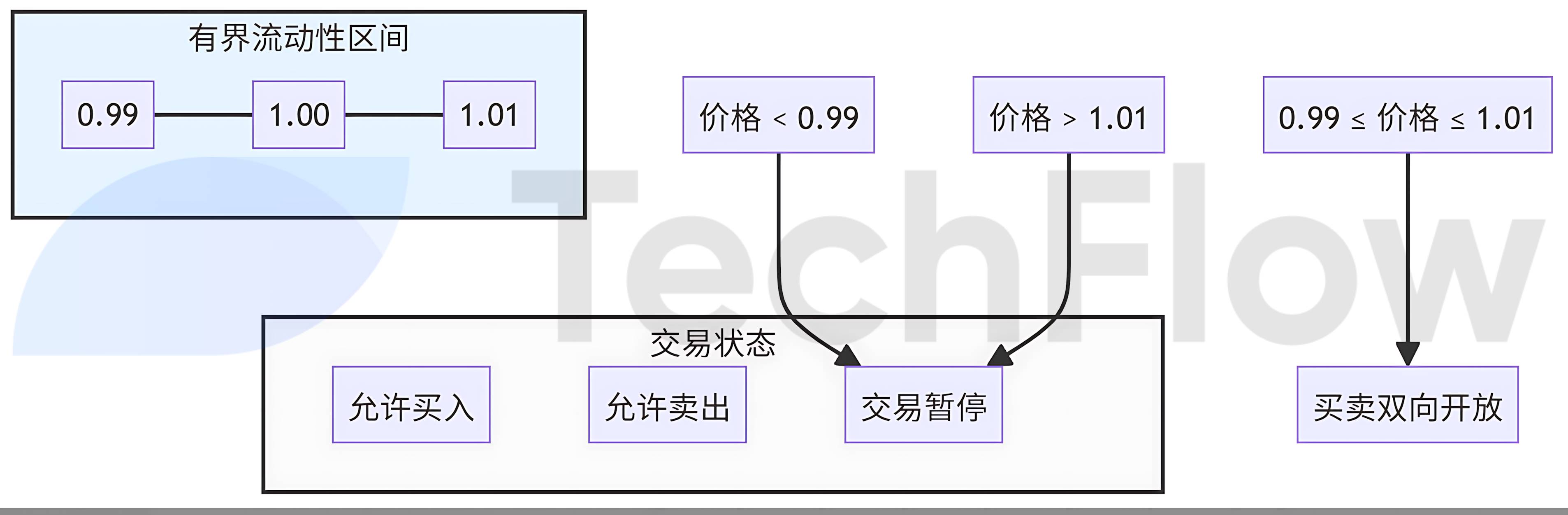

有界流动性机制将资金集中在适合稳定币交易特性的「0.99-1.01」的窄幅价格区间内,当价格触及边界时,系统会限制交易方向,直到价格回归合理区间。

加权资产机制采用不变量方程建立价格锚点,通过可配置的资产权重分配流动性。当资产比例偏离目标权重时,系统会自动调整兑换率产生价差,从而形成套利空间,引导市场力量将资产比例恢复至预设目标。简单来说,就是通过设定目标比例,然后利用价格调节和套利机制,让市场通过系统自己去维持平衡,不需要人工干预。

例如将种子池的构成比例定位 40% USDC、40% USDT、20% PYUSD 的目标权重,在增长池采用 USD*与新稳定币 50/50 的权重。

如何参与

目前 Perena 还在测试阶段,已经可以通过 Solana 钱包进入应用。

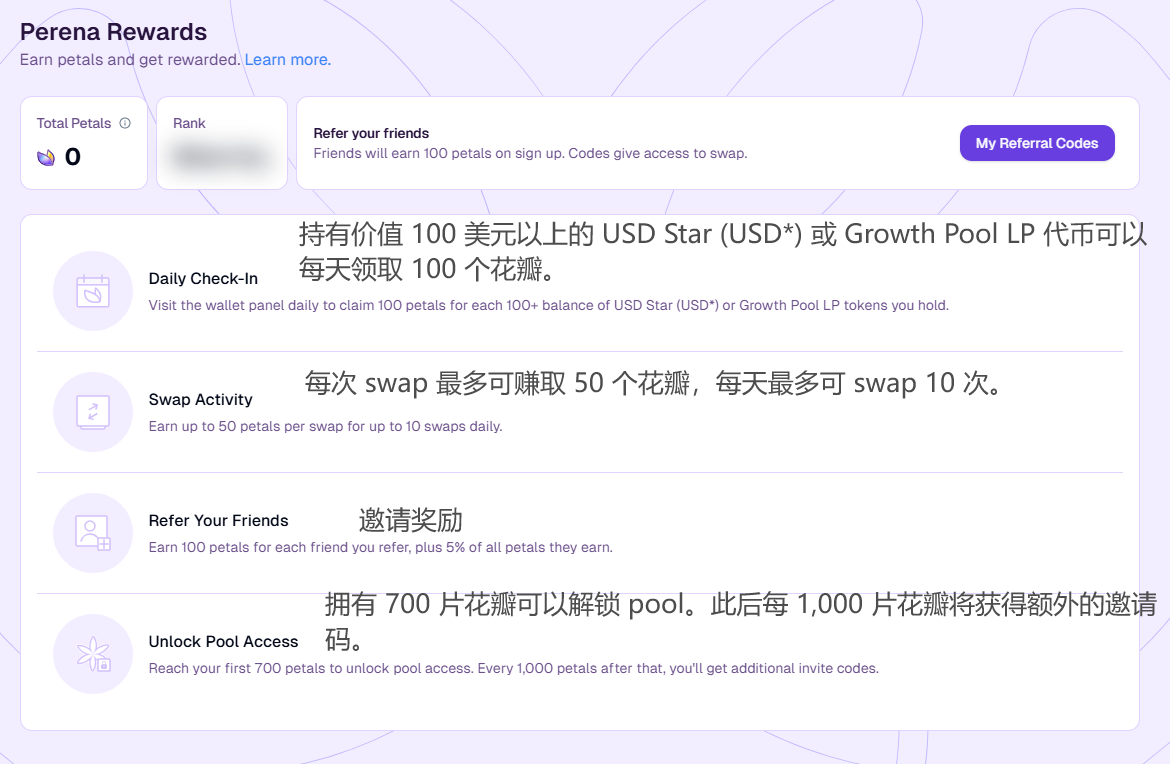

如果你是新人用户,在没有特殊邀请码的情况下还只能体验基础的 swap 功能,获得 700 积分可以解锁 Perena Pools,提供流动性。

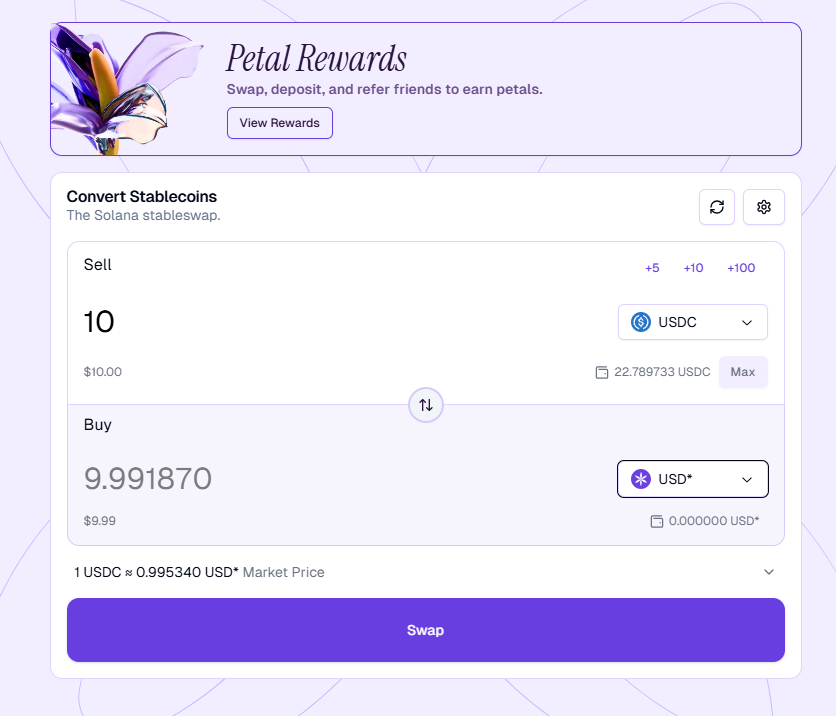

根据规则每美元的交易量获得 0.1 积分,每次 swap 最高获得 50 个积分,每天可以 swap 10 次,这里交易了 10 USDC 兑换为 9.99 USD*,获得 1 积分。

除了通过 Swap 获得积分,还有每日签到、邀请奖励可以获得积分。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。