加密货币在周四大幅上涨,比特币(BTC)接近64,000美元,因为美联储的大幅降息刺激了各类资产的风险偏好。

比特币在过去24小时内上涨了近6%,从周三的振荡下跌至60,000美元以下,交易员们正在消化美联储决定将基准利率下调50个基点的举措,许多观察人士表示这可能标志着美国央行宽松周期的开始。这种最大的加密货币在美国交易时间内达到了本月最高价63,800美元,然后停滞并回落至63,000美元以上。

以太坊的以太(ETH),市值排名第二的加密货币,从其关键的200周简单移动平均线反弹,并在同一时期上涨了超过7%。

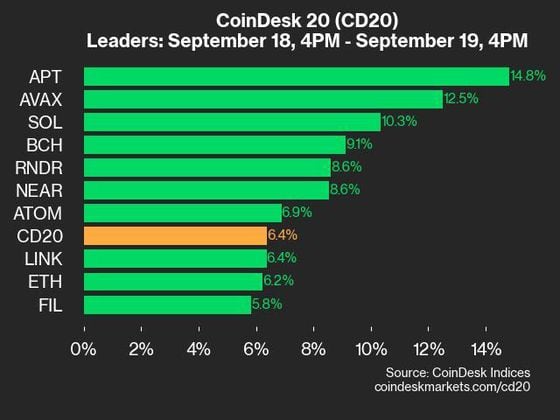

广义的加密货币基准CoinDesk 20指数在上涨8%的情况下,表明其他代币带领市场上涨,Solana(SOL)、Avalanche(AVAX)和Aptos(APT)的本地代币上涨了10%-15%。该指数的20种资产今天都上涨了,突显了此次涨势的广度。

以加密货币为重点的股票和上市的比特币矿工也大幅上涨,MicroStrategy(MSTR)和TeraWulf(WULF)领涨该行业,涨幅达10%。

过去24小时内,加密货币的涨势超过了大多数传统金融资产类别。与比特币最近相关的两个股票指数标普500和纳斯达克分别上涨了1.7%和2.5%。

这可能是因为像比特币或黄金这样的无息资产通常在利率较低时被偏好投资,TJM机构服务的董事总经理兼《期货边缘》播客主持人吉姆·伊乌里奥表示。

他说:“这些资产更喜欢相对于当前经济状况应有的利率更低的环境。它们在可能重新点燃通货膨胀的环境中表现良好。”

美联储在周三降息后,美国10年期国债收益率上升,这表明通胀仍然令人担忧。伊乌里奥补充说,同样,比特币价格的上涨可能表明美联储降息的决定可能过早,并可能导致美元走弱。

比特币的涨势在64,000美元关键水平面临重要障碍,这是上个月的本地高点,由于日元融资交易的加强,比特币在8月初的暴跌后反弹。这种领先的加密货币应该创造更高的高点,以打破自3月份73,000美元高点以来连续创造较低低点的熊市趋势。

根据比特币的日常周期模式,备受关注的交易员和分析师鲍勃·洛卡斯表示:“周期的简单部分几乎已经完成。”周期理论认为价格波动以大致规律的周期性发生。他补充说:“很快比特币将不得不为收益努力。”

即使可能出现回调,期权交易员也预期下个月比特币价格将上涨,进入这一资产历史上看涨的时期。

加密货币衍生品交易所Deribit上2024年10月25日到期的期权数据显示,70,000美元行权价处存在重要利益,名义价值为1.3亿美元,CoinDesk分析师詹姆斯·范斯特拉滕指出。

总持仓量为34,199 BTC,看跌/看涨比率为0.55,反映了市场上强劲的看涨情绪,他补充说。

自2013年以来,9月份一直是比特币表现最差的月份,平均亏损为-4%,但从10月开始的年末时期通常为该资产带来最大的回报,CoinGlass数据显示。10月的平均月回报率为23%,而第四季度的总计为88%的增益。 CoinGlass数据显示。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。