就在一天前,Bitcoin.com报道了美国债券市场收益率曲线上升趋势,并分享了分析师对最新就业报告的看法。最近,警告信号难以忽视——美国正面临着经济增长放缓、通胀持续、利率高企、就业忧虑加剧以及消费者信心下降等问题,而这一切都发生在波动的金融市场背景下。

X网站的用户对当前情绪有很多看法。Ross Hendricks评论道:“股市崩盘是因为仍有数万亿美元的套利交易待解除、即将到来的衰退,还是整个人工智能幌子正在崩溃?我认为,这三者都有可能。” 他分享了一张图表,突显了chatgpt每月访问量的急剧下降。

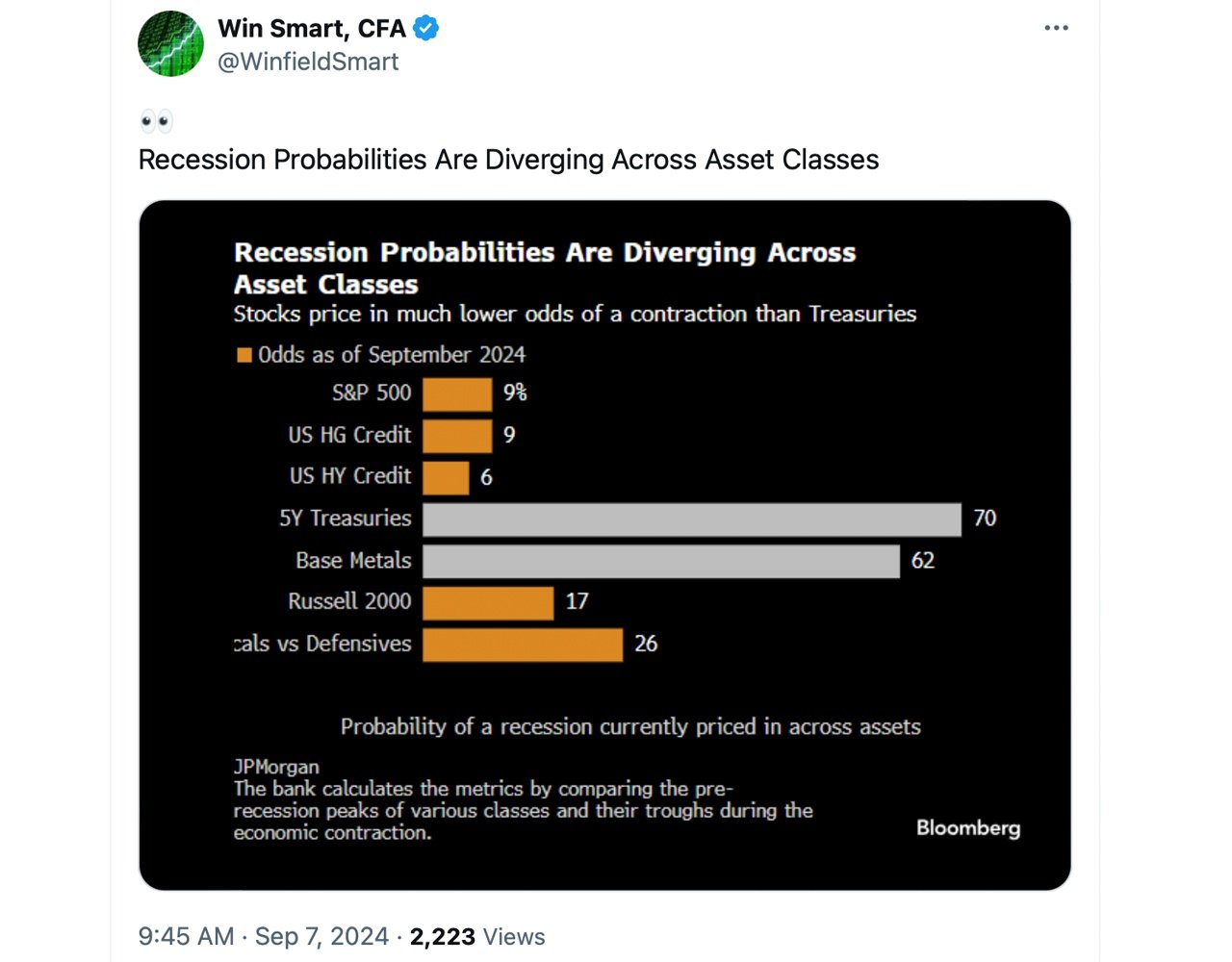

CFA Michael Gayed强调:“更艰难的经济时期即将到来。那些幸存下来的人应该得到更高的倍数。我们很快就会陷入衰退。” 投资者兼首席财务官Robert Sterling以及许多其他人坚信衰退已经到来。“我们正处于衰退中,” Sterling在X网站上发帖说。“宏观经济数据可能还没有反映出来,但衰退已经到来。每个人都知道。滞后指标只需要时间来赶上。”

经济学家Daniel Lacalle也加入了讨论,并写道:

更多的债务和赤字支出掩盖了国内生产总值并不重要。美国经济已经陷入私营部门衰退。

此外,许多人认为选举结果不会改变太多,因为无论如何经济都将陷入衰退。随着对衰退的担忧不断增加,X网站上的讨论揭示了从怀疑到确定的各种观点。随着市场波动和经济压力持续存在,未来几个月可能会提供更多的清晰度,但目前,辩论仍然受到金融和社交领域的数据、情绪和猜测的混合影响。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。