以太坊现货交易所交易基金(ETF)在首周出现负净流入,因为现有的 Grayscale 以太坊信托基金(ETHE)的大规模流出压倒了对竞争产品的兴趣。

与此类似,比特币基金在一月份首次亮相时,在头四天吸引了10亿美元的净流入,尽管之前已存在的 Grayscale 基金也遭受了大规模的流出。

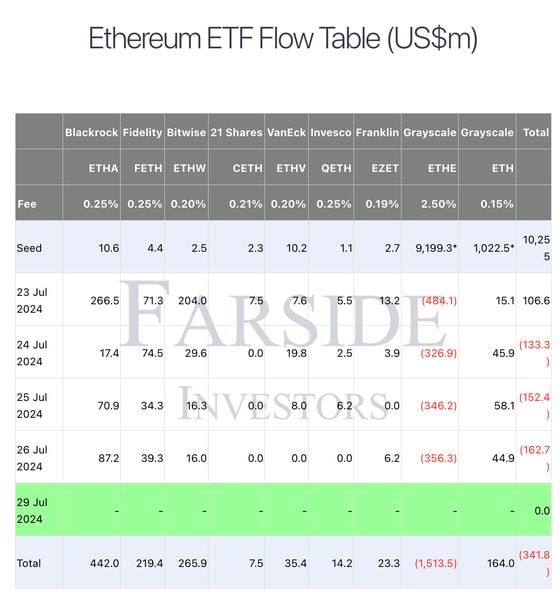

总体而言,现货以太坊 ETF 遭受了3.4亿美元的净流出,而 Grayscale 信托基金中流出的资金超过了15亿美元,根据 Farside Investors 的数据。

价格走势似乎反映了乏善可陈的 ETF 行情,以太坊上周下跌了5%,而比特币则上涨了2%。

除去 Grayscale 的 ETHE,其他新上市的以太坊 ETF 产品上周吸引了115亿美元的流入,其中包括来自 BlackRock、Bitwise 和 Fidelity 的产品。

尽管目前 ETHE 的资金流出速度意味着该基金将在接下来的四周内耗尽资产,分析师们预计这种流出速度可能早在本周就开始减缓。

数字资产对冲基金 Lekker Capital 的创始人 Quinn Thompson 指出,ETHE 在比特币在一月底的 ETF 抛售后找到了当地底部时已经流出了相同数量的资产。比特币在两周内下跌了15%,跌至39000美元以下,然后开始了一轮新的历史高点的涨势。

Steno Research 的高级加密货币分析师 Mads Eberhardt 指出,GBTC 的资金流出在第十一个交易日后显著减少,并预测 ETHE 可能会走上同样的道路。

“以太坊 ETF 的净流出尚未减少,但很可能会在本周发生,” Eberhard 在周一的 X 文章中 表示。“一旦发生,情况只会变得更好,” 他说。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。