资产管理公司VanEck是比特币(BTC)和以太坊(ETH)ETF的发行者,表示如果克服了一些相当高的障碍,到2050年,BTC的价格可能会达到290万美元。

根据VanEck在周三的一份报告中的假设,随着地缘政治紧张局势的上升和不断膨胀的债务服务成本侵蚀当前体系,比特币将在未来几十年内成为国际货币体系的重要组成部分。

“当我们看着现在的世界时,我们看到巨大的经济不平衡,对现有机构的不信任不断上升,以及持续的去全球化,” VanEck数字资产研究负责人Matthew Sigel在周三接受CNBC采访时表示。

“我们认为,这些扭曲很多源自于……自全球金融危机以来,G7政府滥用印钞机,将借来的钱花在不可能实现的目标上,导致资本的大规模错误配置,” Sigel解释道。

“比特币……是对这种不断上升的财政荒唐行为的终极对冲,” Sigel说。

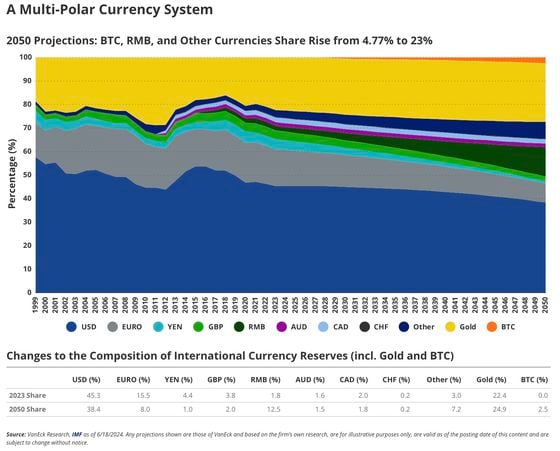

在报告的基本情景中,BTC将成为本地和全球贸易的重要交换媒介,代表国际贸易结算的10%,GDP的5%。

同时,它还将成为全球储备资产,以牺牲美元、欧元、英镑和日元这四大外汇储备货币,占据国际货币储备的2.5%权重。

如果VanEck的设想成真,比特币的价格将增长44倍,从目前的不到65000美元每枚,每年增长16%。其市值将飙升至61万亿美元。

报告称,第二层网络的普及将在克服比特币区块链的瓶颈和扩展问题方面发挥关键作用,这些问题阻碍了BTC成为有用的交换媒介。到2050年,该领域的总价值可能达到7.6万亿美元,采用与以太坊第二层相同的估值框架。

VanEck还警告称,可能会有潜在风险阻碍比特币的扩张。

矿工对能源的不断增长需求将需要创新,同时,来自处理交易的收入必须大幅增长,以取代逐渐减少的挖矿奖励(每四年通过减半减半)。这样才能激励矿工维持网络。世界各国政府共同努力限制或禁止比特币也构成威胁。

报告中还强调了其他风险,包括来自其他加密货币的竞争以及大型金融机构施加过多控制。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。