汉密尔顿(Hamilton)是一家专门从事现实世界资产(RWA)数字化的初创公司,于2024年7月4日启动了在比特币第二层解决方案——Stacks、Core和BoB上对美国国债进行数字化的工作。这一努力突显了将传统金融工具与比特币的安全性和透明度相结合的关键一步。

该数字化项目旨在使政府支持的资产在比特币的去中心化金融生态系统内更易获取和交易。汉密尔顿告诉Bitcoin.com News,通过利用比特币的L2解决方案,他们旨在提高可扩展性、降低成本,并增强这些资产的流动性。汉密尔顿进一步强调了波士顿咨询集团的一份报告,显示RWA市场预计到2030年将达到16万亿美元,突显了这一举措的潜在影响。

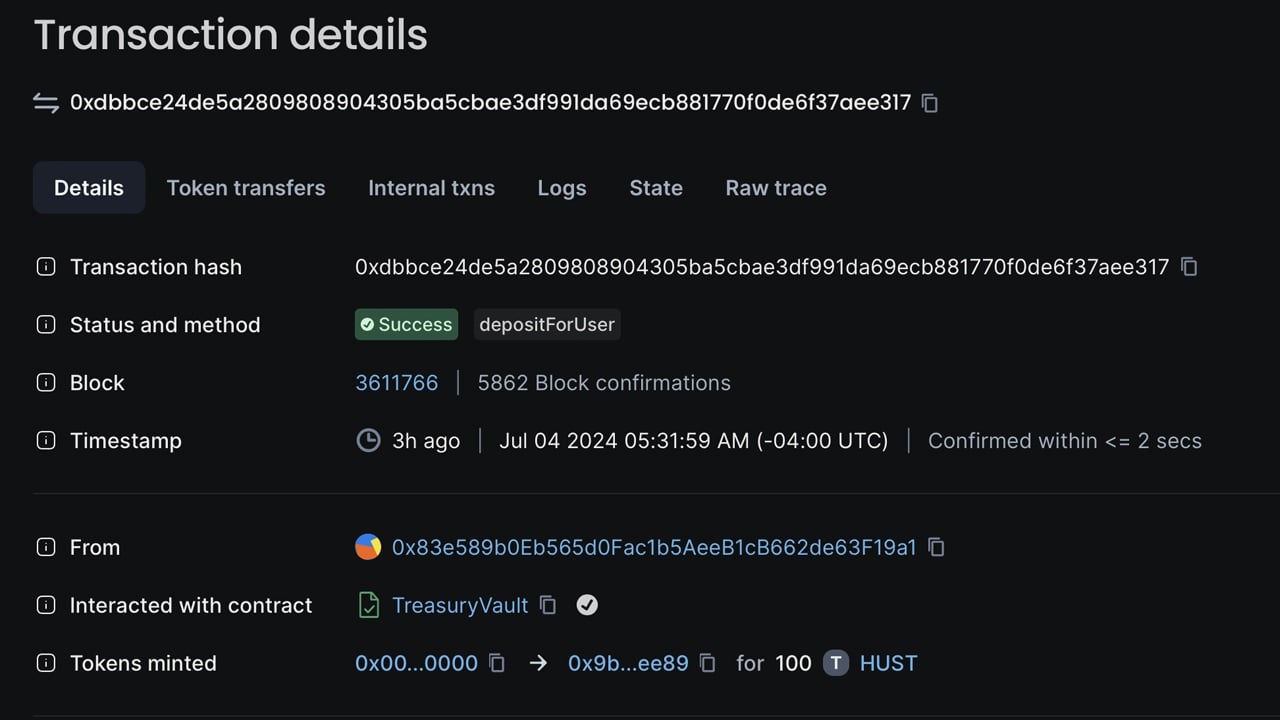

汉密尔顿在BoB上的国债转移。

Core DAO的最初贡献者Brendon Sedo表示,在Core链上对美国国债进行数字化是一个重要的里程碑,利用比特币的安全性和Core的可扩展性来弥合传统金融和Web3之间的鸿沟。BoB的联合创始人Alexei Zamyatin强调,这种数字化利用了比特币和以太坊的优势来推动金融创新。

“在BoB上对美国国债进行数字化,利用了比特币和以太坊的综合力量来推动金融创新和流动性,”汉密尔顿的首席执行官兼联合创始人Kasstawi表示。

数字化的国债将很快在汉密尔顿的平台上可用,周四的公告详细介绍了这一消息。Kasstawi告诉Bitcoin.com News,将比特币的安全性与数字化的国债相结合是“迈向金融独立的历史性一步”。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。