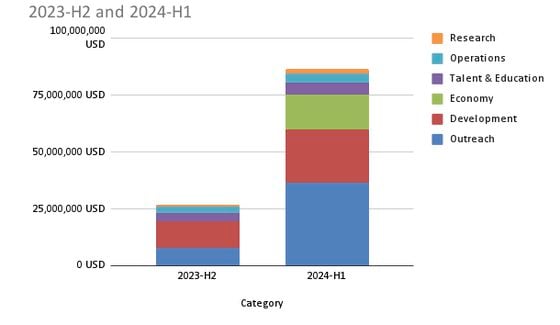

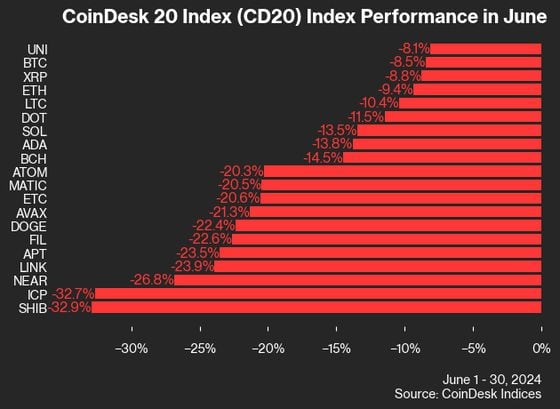

June proved to be an incredibly ugly month in crypto markets (see our blood-red chart below), but wasn't completely devoid of decent blockchain tech stories. One obsession of crypto twitterati during the past week was poring over the line items in Polkadot's treasury transparency report. The $6.8 million to sponsor a "prestigious soccer club" was just one of many expenses held up to public scrutiny.

ALSO:

Polkadot's spending more than doubled from the prior six months' clip. (Polkadot)

BURN RATE: At the very least one has to give Polkadot credit for transparency. On Tuesday the blockchain project released a lengthy report, including spreadsheets and copies of invoices, detailing its spending over the past six months. No good deed goes unpunished, however, and right on cue, twitterati tore into the project's multimillion-dollar spending on activities like marketing, advertising, sponsorships, events and influencers. At the highest level, the project spent $87 million worth of its own DOT tokens on various activities during the first half of 2024, a pace that would exhaust the $245 million currently in the treasury within roughly two years, as relayed by CoinDesk's Shaurya Malwa. But it was the green-eyeshade details that left the report's readers agog – $4.9 million for influencers, $1.9 million to sponsor the race car driver Conor Daly, $1 million for digital ads on CoinMarketCap, $490,000 to the press-release website Chainwire, $180,000 for "private jet brandization," $6.8 million for a "deal with a prestigious soccer club," as the report termed it. (Lionel Messi's team, Inter Miami?) Snarky posters on X remarked that, for all the spending, the influencers seemed strangely inactive – while others joked that the report was finally bringing Polkadot the publicity it coveted. Polkadot officials noted that the spending went further than expected, thanks to this year's mostly-up crypto markets: "We can observe a huge jump in spending, as proposals got more ambitious in scope and ask size recently," the report read. "The good news is that the average DOT price has gone up this half-year, resulting in more bang for the DOT, highlighted by the fact that DOT spending went up by 2.4x, but the USD-equivalent value is up 3.2x in the same timeframe."

NOT SOL FAST! Hey, Bitcoin got ETFs earlier this year, and now Ethereum appears headed in that direction, possibly bringing in billions of dollars within months, based on Galaxy Digital research. So what about an ETF for Solana, seen as one of the most promising blockchains? Probably not anytime soon, experts are saying. The speculation kicked off last week as the investment manager VanEck filed for a Solana ETF, sending the project's native token, SOL, up 8%. Another firm, 21Shares, put in a request a day later. But as reported by CoinDesk's Helene Braun, "Solana hasn't cleared a prerequisite for the Biden administration's Securities and Exchange Commission: a well-established regulated derivatives market. Both bitcoin and ether have had that, in the form of CME Group's cryptocurrency futures contracts." Another possible hurdle is that the SEC, in some of its legal cases, has alleged that SOL is an unregistered security – and that cloud might have to clear before an ETF sees any sunlight. "It is unlikely that there will be a decision on this in the near future," as Coinbase Institutional analysts put it in a weekly research report.

ALSO:

Top picks of the past week from our Protocol Village column, highlighting key blockchain tech upgrades and news.

Montage from the website singer-songwriter Ainsley Costello, whose music can be heard on the Bitcoin Lightning Network-friendly music platform Wavlake. (ainsleycostello.com)

1. Developer teams behind the Tezos blockchain unveiled "Tezos X," a set of technological upgrades they say could bring a "huge boost in performance, composability and interoperability." The roadmap, setting out a development plan for the next two years, calls for splitting off transaction execution into a separate "canonical rollup" that would support "atomic transactions across smart contracts written in different programming languages." The main Tezos blockchain would serve as a base layer for consensus and settlement.

2. Igloo Inc., Pudgy Penguins’ parent company, on Monday announced the acquisition of the Frame team. "Frame co-founders and notable blockchain developers Cygaar and Beans will contribute towards building a new Ethereum L2, Abstract, designed to take on the consumer crypto opportunity," according to the team.

3. Worldcoin has announced that it is partnering with Alchemy to provide reliable infrastructure for World Chain, a new blockchain designed for humans, according to the team.

4. Blockchain startup Obol Labs has formed a new industry group that aims to advance the growing field of distributed validator technology – at the heart of the latest push by developers to eradicate single points of failures within decentralized networks like Ethereum. The Obol Collective includes a consortium of Ethereum ecosystem players "dedicated to the security, resiliency and decentralization of Ethereum consensus," according to a blog post Wednesday from Obol Labs. Early participants in the collective include EigenLayer, Lido, Figment, Bitcoin Suisse, Nethermind, Blockdaemon, Chorus One, DappNode and ETH Stakers.

5. Wavlake, a music and podcast distribution platform, has partnered with ZBD to revolutionize creator payments. According to the team: "Unlike Spotify and Apple Music, which pay meager royalties, Wavlake empowers independent musicians and podcasters. Through Wavlake, creators can upload content distributed across platforms like Fountain.fm. Listeners can tip artists using the Bitcoin Lightning Network, enabling instant microtransactions. Ainsley Costello earned over $700 in Bitcoin for a single track, outperforming Spotify."

Fundraisings

CEO of Pi Squared Grigore Rosu (Pi Squared)

Data and Tokens

Regulatory, Policy and Legal

Leaders and laggards alike got crushed by crypto markets in June, with bellwether bitcoin (BTC) falling 8.5% – and this week dipping below $60,000, well off the all-time high above $73,000.

All members of the CoinDesk 20 Index were losers during the month. Uniswap's UNI turned in the least ugly performance, down 8.1%. XRP slid 8.8% and Ethereum's ETH lost 9.4%.

The dog-themed meme coin SHIB produced the biggest decline in the index, at 32.9%, barely edged out by the 32.7% loss for Internet Computer (ICP).

(Pallavi Chintam/CoinDesk Indices)

July 8-11: EthCC, Brussels.

July 11: TezDev 2024, Brussels.

July 25-27: Bitcoin 2024, Nashville.

Aug. 19-21: Web3 Summit, Berlin.

Sept. 19-21: Solana Breakpoint, Singapore.

Sept. 1-7: Korea Blockchain Week, Seoul.

Sept. 12-13: Global Blockchain Congress, Southeast Asia Edition, Singapore

Sept. 30-Oct. 2: Messari Mainnet, New York.

Oct. 9-11: Permissionless, Salt Lake City.

Oct. 21-22: Cosmoverse, Dubai.

Oct. 23-24: Cardano Summit, Dubai.

Oct. 30-31: Chainlink SmartCon, Hong Kong.

Nov 12-14: Devcon 7, Bangkok.

Nov. 20-21: North American Blockchain Summit, Dallas.

Feb. 19-20, 2025: ConsensusHK, Hong Kong.

May 14-16: Consensus, Toronto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。