2024年,比特币(BTC)再次令金融界震惊,打破了2021年的最高价69,000美元,于2024年3月中旬创下新纪录,达到73,737美元。然而,前方的道路可能会出现三重顶形态,比特币可能接近但未能达到10万美元的标志。比特币的价格波动一直是一个备受关注的话题。数字货币能够突破重要阻力水平,证明了其实力和持有者的看涨情绪。

2024年3月14日,BTC突破了2021年的最高点,达到73,737美元,显示了市场的坚定信心。然而,历史模式表明,在取得如此显著的收益之后,比特币通常会面临强大的阻力。目前,BTC距离历史最高点还有17%,12个月的图表显示,比特币多次突破了70,000美元的水平。2024年,比特币已经有14天收盘价达到或超过70,000美元。自2013年以来,BTC的先前历史最高点都是短暂的,这表明这一趋势可能也是短暂的。

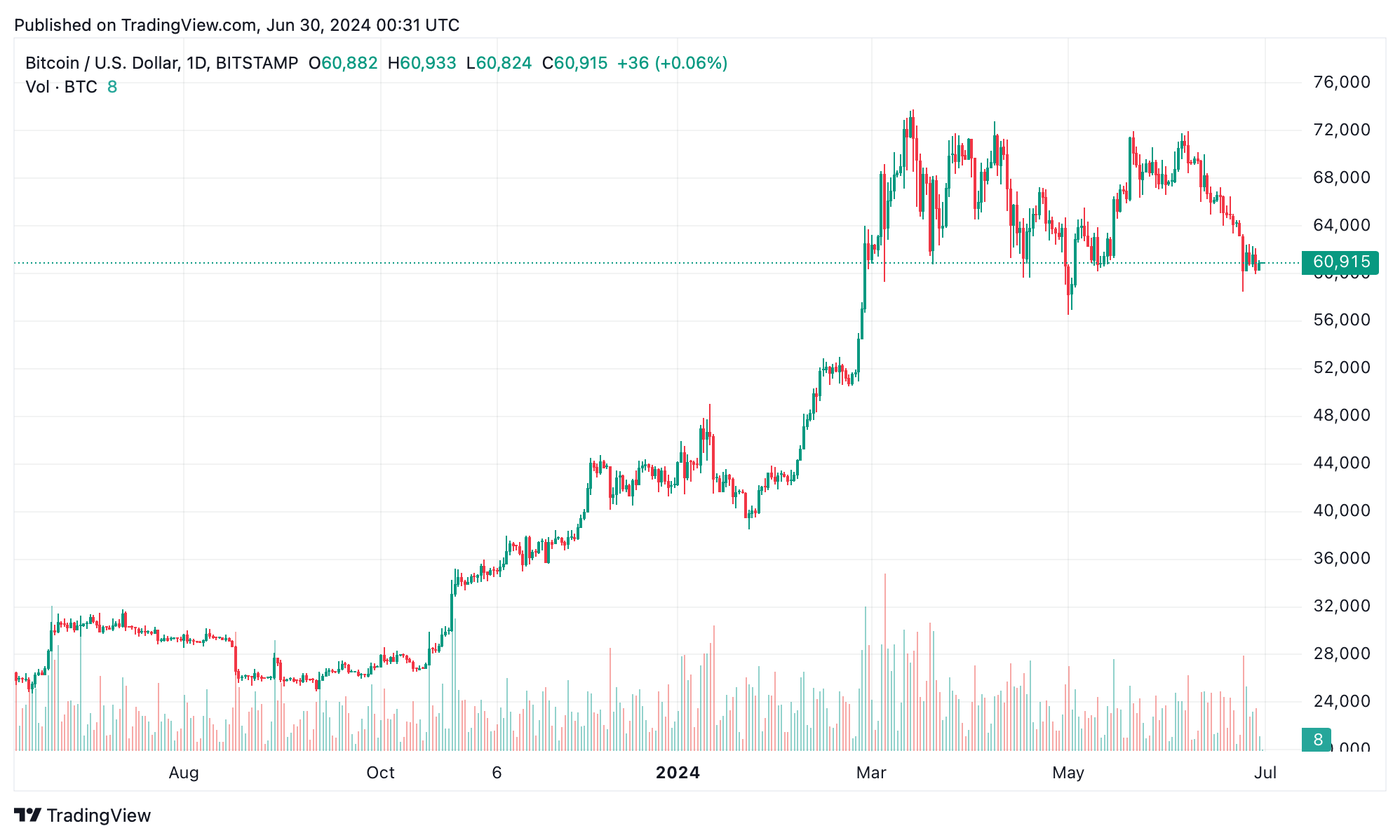

比特币从2023年6月30日到2024年6月30日。东部时间周日上午9:45,BTC的盘中最高价超过了61,500美元。

心理因素在比特币的价格波动中起着至关重要的作用。预期比特币达到10万美元创造了心理障碍。世界上很少有资产能够拥有六位数的价格标签。此外,这一里程碑不仅仅是一个数字;它代表了一个重大成就和一个主要的阻力水平。随着比特币接近这一数字,获利行为可能会显著加剧。以较低价格买入的人可能会开始抛售以锁定利润,导致价格调整。

比特币的市场周期历史上表现出快速增长后的调整期。当前的看涨阶段可能是更大市场周期的一部分,其中显著的收益后面跟着整固。许多分析师和影响者预测BTC将超过10万美元,有些人预计到2025年,这种加密资产将远远超过这个范围。然而,很少有人谈论价格可能在接近六位数标志附近波动而未能完全达到的可能性。

此外,宏观经济事件可能阻止BTC达到这一价格阈值。通货膨胀率、利率和地缘政治紧张局势等因素显著影响投资者情绪和市场稳定性。Covid-19大流行表明,黑天鹅事件也可能影响价格。仅仅因为比特币接近10万美元的范围并不意味着它会在预期时达到这一标志。要实现这一里程碑可能需要更长时间,对一些人来说,略高于90,000美元的价格可能是可以接受的。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。