随着币安智能链(BSC)和Polygon等新区块链占领了defi市场,碎片化流动性和互操作性成为了紧迫的问题,挑战着去中心化金融的未来。

介绍

在2020年的defi夏季,我们见证了defi的迅猛崛起。以太坊是defi领域无可争议的主导网络,拥有大部分用户和资金。以太坊的生态系统充斥着数十个新颖的去中心化应用(dapps),吸引了数十亿美元的流动性和大量用户。然而,这段兴奋的时期并非一帆风顺,以太坊上的gas费用飙升,交易的最终确认时间也减缓到了几分钟的速度。随着这些令人望而却步的高昂gas费用达到数百美元,仅仅完成一次简单的代币交换,我们看到了迅速出现的解决方案,为那些因经济原因无法与蓬勃发展的defi空间互动的用户提供了一个家园。

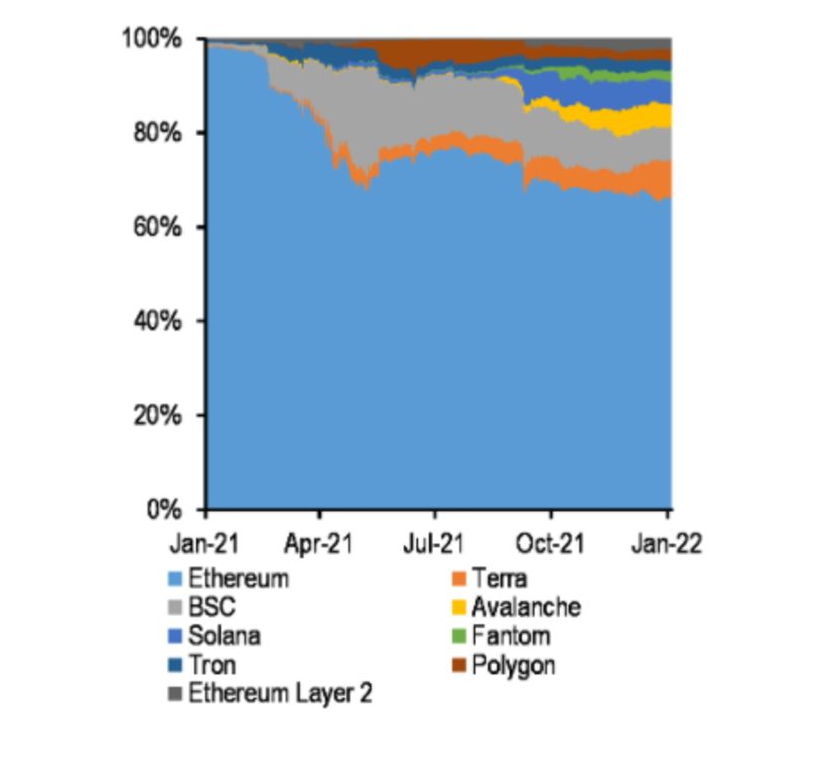

一个典型的例子就是新的区块链——即领先交易所币安的中心化Geth分叉,币安智能链,其几乎免费的gas费用和闪电般快速的交易最终确认时间。BSC并非以太坊的唯一竞争者,还有以太坊侧链Polygon,以及Layer 2(L2)Rollups的承诺。这些新的精简网络迅速从以太坊曾经主导的控制中夺取了大量市场份额——以太坊对defi总锁定价值(TVL)的控制从2020年的95%下降到了2021年的50%。还有许多新的网络发布,受到了极大的欢迎,如Fantom、Solana、Cosmos、Avalanche、Optimism等等…然而,随着一个问题得到解决,我们现在的多链世界中出现了一个更大的问题——缺乏互操作性。

区块链上的互操作性指的是区块链与其他区块链进行通信的能力。缺乏互操作性意味着用户(和流动性)被困在由数百个链条组成的孤立岛屿上——这是不可取的!为了解决在这些链条之间转移资金的新需求,桥梁被创建,使用户能够将他们的资金从一条链转移到另一条链。用户希望将他们的资金转移到这些新的链条上,以便与具有独特功能集的新颖生态系统进行互动。

尽管桥梁似乎是解决这个问题的完美方案,但它们在提供安全和无摩擦的方法让用户安全快速地转移资金方面显然失败了,在defi中占据了超过一半的黑客攻击,仅在2022年就造成了36亿美元的损失,疼啊。桥梁也仍然很慢,就像在L2 <> Layer 1(L1)桥梁中需要用户等待数周甚至更长时间才能在以太坊上收回他们的资金一样。桥梁通常还会收取费用或在移动用户流动性时引入滑点,并且通常会发行“IOU”,比如在Avalanche上的USDC.e,这进一步隔离了流动性。

为什么碎片化流动性很重要?与传统金融系统相比,defi的流动性严重分割,这显著降低了资本效率。资本效率与资产的生产力有关。在defi中,例如以太坊上的USDC流动性无法与Avalanche上的USDC流动性共享,导致更高的滑点、费用,最重要的是,大幅降低了收益。想象一下,如果像ETH这样的资产流动性可以在其存在的所有链条之间共享,这将导致资本效率和用户收益成倍增加。稍后会详细介绍。

当前的defi景观是一个由数百个不同的区块链组成的多链世界,每个区块链都具有独特的特征和dapp生态系统。defi中领先的dapp通常在特定的区块链上运行,并且仅限于让用户与dapp基础区块链上的本地资产进行交易。一些dapp尝试通过在许多链上部署其代码库的隔离版本来扩展规模,但这并没有解决用户面临的任何问题,比如流动性碎片化和用户体验的破碎。这些流动性隔离严重损害了资本效率(您的收益)。

Defi的基石

尽管defi的基石一直是Makerdao、Aave和Compound等借贷市场,它们目前单独占据了defi总锁定价值(TVL)的30%(150亿美元),而defi的总TVL为520亿美元。在基础层面上,这些基础层应用程序旨在充当非托管和去中心化的银行系统,这是defi的重要基石。然而,问题在于这些应用程序通常已经过时,在本来快节奏的defi生态系统中几乎没有创新。其次,这些主要应用程序一直停留在以太坊上,或者在“替代链”上提供了其代码库的隔离部署。最重要的是,它们都缺乏互操作性。解锁互操作性将大大提升用户体验和用户的收益流!这是当务之急。

总的来说,自Aave V1、Compound V1和多年前的Liquity以来,在借贷的基石领域中几乎没有提供多少创新。当我们看到像Euler、Alchemix、Gearbox和Abracadabra这样的dapp发布了“第二代”借贷产品时,它们能够通过渐进式改进获得大规模采用。我们还没有看到defi货币市场的全面下一代。

当新的链出现时,通常会迅速涌入大量用户和流动性,开发人员会迅速复制这些极其过时的代码库(Aave V1和Compound V1)以满足需求,这只会带来严重的安全问题。例如,Metis有一个名为Agora的Compound分叉,损失了8000万美元。Gnosis有一个名为Agave的Aave分叉,损失了1100万美元。币安智能链有一个名为Venus的Compound分叉,被黑客攻击了2亿美元。Celo的Moola Markets是Aave的分叉,被黑客攻击了800万美元。Polygon的Easyfi是Compound的分叉,被黑客攻击了6000万美元。Avalanche的Blizz Finance是Aave的分叉,被黑客攻击了800万美元。可以说,复制三年前脆弱的代码库并不是一个好的做法。然而,用户需要在新链上访问这些重要的基石dapp,而隔离的多链部署需要太长时间才能在新链上得到适当的开发以满足需求。

2023年,借贷市场几乎没有提供用户在货币市场中想要的功能集,比如高效杠杆、无需许可的借贷、长尾和LP代币支持。然而,最重要的是需要支持跨链借贷机会。

代币经济的困境

另一个主要问题是协议吸引用户和流动性所采用的机制,即流动性挖矿。流动性挖矿在短期内表现出了有效性,但对于希望获得市场份额的defi应用程序来说,不久之后就会带来灾难性的问题。

不可避免地,雇佣资本提供者将其资本租给流动性挖矿dApp,只要激励措施仍然有价值。问题在于当你免费提供某物时,它的价值很快就变成了“免费”(零)。一旦激励措施的数量减少,或者更普遍地说,价值急剧下降,流动性提供者就会离开,转移到下一个流动性挖矿热点,导致协议经济上瘫痪。

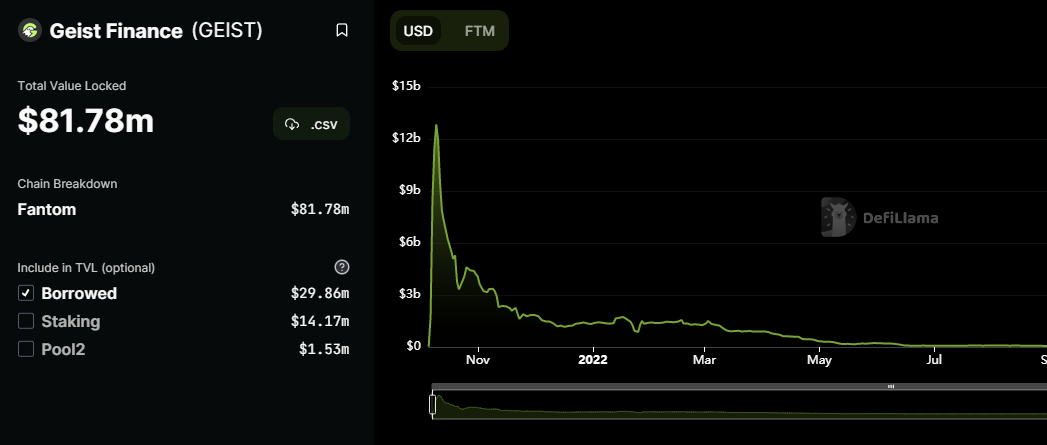

一般来说,Aave V1/Compound V1的分叉采用了更加不合逻辑的超通胀流动性挖矿计划来弥补其过时的功能(就像Fantom的Geist和Avalanche的Blizz一样)。就Geist而言,曾经有120亿美元的TVL,现在不到1亿美元。Geist从这场流动性挖矿盛宴中获得了什么?什么也没有。正如杰罗姆·鲍威尔深知的那样,超通胀并不具有长期效果。正如Tapioca在其传奇性的“流动性挖矿的死亡”Mirror文章中指出的那样,TVL代表“总锁定价值”- 但它并没有被锁定,其“价值”是相当主观的。因此,下一代defi协议需要一个新的经济增长模型。

信息:https://defillama.com/protocol/geist-finance

整个流动性挖矿范式使协议陷入了一个无法承受的境地,需要永久的通货膨胀来保持其租用的流动性。除了Olympusdao的Olympus Pro债券计划之外,几乎没有提出其他解决方案。当将流动性挖矿发行视为支出,将费用和POL视为DAO的资产负债表时,可以明显看到流动性挖矿已经失败。

如今的用户已经看穿了“70000%的年化收益率”这种虚假的收益,现在要求真正的收益。真正的收益运动得到了用户的强烈支持,他们不再想担心他们获得的收益中有多少是“虚假的”,或者来自激励措施,而不是复利他们提供的基础资产。

真正的跨链互操作性,当与defi的借贷市场基石和新的代币经济模型(以及去中心化的全链稳定币)结合时,将创造:

- 在大量资产上提供更广泛的收益机会-因此资本效率更高,进而获得更高的实际收益-无需依赖激励措施虚假的收益。

- 从链到链的资金无摩擦传输-消除了当前稳定币所提供的安全隐患、滑点和等待时间。

- 无缝体验,消除了defi目前所定义的许多摩擦。借出、杠杆交易,并且无需一开始就需要桥接就可以对所有资产进行借贷。

- 通过对defi代币模型进行全面改革实现可持续增长,这将更好地协调投资者、流动性提供者和协议本身的利益。

这就是全链未来所提供的,而未来并不遥远,让我们一起探索吧!

介绍Tapiocadao

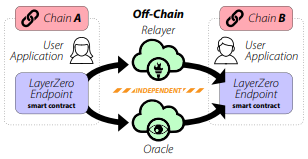

Tapiocadao是第一个由Layerzero提供支持的全链货币市场。Layerzero提供了一个高度可定制的消息传递网络,目前连接了20多个EVM和非EVM区块链。一旦部署了Layerzero端点,该链就可以与具有端点的任何其他链无缝交互。这允许完全无缝和最小化信任的互操作性。这是在没有中间链或中间件协议的情况下实现的。

Tapiocadao利用Layerzero的消息传递网络支持20条链,随着端点的部署,这个数字还会增加,这有助于消除流动性碎片化并最大化资本效率。Tapioca计划支持的一些链包括:Arbitrum(作为其主机网络)、以太坊、Optimism、Polygon、币安智能链、Zksync、Starknet、Avalanche、Celo、Gnosis、Fantom、Aptos、Sui、Cosmos、Berachain、Solana等等。

有关Layerzero如何运作的更多信息,您可以阅读Blocmate的指南。

Tapioca如何支持这么多条链呢?嗯,为了支持新的链,Tapioca只需要部署小型代理合约,这些合约可以与Arbitrum上的Tapioca智能合约发送和接收消息。这使得Tapioca可以支持数百条链,而无需进行大量开发,也没有固有的安全风险。这本身就非常创新,并使Tapioca在迅速支持最新热门网络方面领先于竞争对手,但创新并不止于此。

这种设计为用户提供了无缝的体验,可以从许多不同的网络借贷资产,不再有流动性孤岛,更多的借贷机会,以及更高的资本效率(更多的实际收益)。有什么不喜欢的呢?

首先,让我们看一个假设的例子,以更好地理解Tapioca在实践中是如何运作的:

再次强调,defi遍布各地的货币市场-例如;Avalanche上的Benqi,BSC上的Venus,Fantom上的Geist,Optimism上的Sonne Finance。有趣的是,这些都是Compound V1的分叉。

还有像Aave V3这样的多链货币市场,它在多条链上部署,每条链只有一个实例,这意味着Aave V3的每个部署上的所有流动性都是相互隔离的。想象一下,如果你可以在Avalanche上抵押资产,但在Fantom上借出代币,或者在以太坊上借出资产,同时在十几条链上获得收益。Tapioca有效地连接了defi世界的碎片化,而这种创新带来的机会实际上是无限的。

Tapioca不仅是第一个跨链货币市场,还创造了第一个全链稳定币。Tapioca的usd0可以在各链之间进行铸造和销毁,没有滑点、等待时间等,完全去中心化和抗审查。这意味着Tapioca的usd0不是由USDC和其他中心化代币支持的。

从增长的角度来看,这非常有趣,因为市场上真正去中心化、抗审查的稳定币一直存在巨大的空白。在当前的“去中心化稳定币”市场上,FRAX的抵押品是USDC,DAI目前主要是由法定货币支持(这是Maker创始人Rune的终极提案的原因),MIM是通过多重签名铸造的,并且有着吸纳贫困抵押品的历史(以及中心化代币),最后,Liquity的LUSD仍然与以太坊紧密相连。

然而,最重要的是前面提到的usd0将是第一个跨链稳定币,这意味着您的流动性现在可以跨链传输。您根本不需要使用桥梁。usd0实际上可以在各链之间进行铸造和销毁,就像在以太坊上的两个钱包之间转移代币一样。这为稳定币这个非常重要的领域带来了全新的可组合性水平,Tapioca有效地通过协议本身和usd0填补了最大的市场需求。产品市场契合度或“PMF”甚至不是一个问题。

最后,Tapioca最有趣的组成部分之一是其全新的代币经济模型,它将去中心化金融发展到前所未有的全新水平-专注于可持续性和POL(协议拥有的流动性)的创建。

虽然Tapioca拥有大量创新功能,让我们从涉及的代币部分开始。

代币

Tapioca DAO有四种代币:

$TAP 充当协议的支柱。TAP可以与Curve的CRV相提并论,因为它的真正力量(和丰厚的收益)只有在锁定后才能释放。TAP根本不会发行-没有流动性挖矿、奖励,什么都没有。因此,TAP将通过这种完全新颖的代币经济体系保持非常强大的价值保留,这需要每个人都购买-TAP永远不会免费发行。TAP在锁定时也具有非常强大的效用,这使得它(在我们的观点中,可能会有偏见)成为有史以来发布的最强大的协议代币之一,具有长期的通胀计划。根据Tapioca的文档,可能需要超过10年的时间才能达到总量的90m TAP(TAP还具有固定供应)。虽然FDV或“全面稀释估值”可能看起来很高,可能会损害其上涨,但我们相信聪明的资金会看到机制和可持续的通胀并加入。

twTAP 是一种创新的托管代币模型,利用了Tapioca的时间加权平均幅度锁定(twAML)系统,是一种全链NFT,这意味着它是可转让的!解释twTAP的最佳方式是,如果用户通过veCRV控制时间价值,而twTAP在锁定期间也不像veCRV那样衰减。

想象一下,如果在Curve Wars的高峰期,参与者必须锁定超过四年才能获得最大奖励(每锁定1个CRV获得1个veCRV),而在当前熊市期间的时间较短。这本身就确保了TAP将被大量锁定,更不用说twTAP锁定者将获得平台费用的所有协议收入,这些费用是从用户在20多条链上进行借贷产生的。是的…

最有趣的是,锁定者还将获得Tapioca DAO拥有的LP交易对产生的一半收益,这些交易对使用Arrakis Finance的Uniswap V3 Vaults;这些锁定者的双重收益流(在我们的观点中)可能是有史以来最具吸引力的代币锁定激励之一,特别是随着Uniswap V3 DAO LP收益共享的推出-用户交易Tapioca的usd0(和TAP)支付给锁定者是相当不错的。twTAP还提供选项规则来控制每个市场分配的总选项。这可能会引入类似于Jones DAO、GMX、Benqi等协议的“Curve War”效应,它们会激励自己资产的市场,因为它们会激励它们的借贷市场保持高流动性。

oTAP 是一种全链NFT,借款人在锁定其借出资本一段时间后每周都会收到。oTAP简单地是TAP的美式看涨期权,或者购买TAP低于其市场价值的权利(但不是义务)。

$TAP 充当协议的支柱。TAP可以与Curve的CRV相提并论,因为它的真正力量(和丰厚的收益)只有在锁定后才能释放。TAP根本不会发行-没有流动性挖矿、奖励,什么都没有。因此,TAP将通过这种完全新颖的代币经济体系保持非常强大的价值保留,这需要每个人都购买-TAP永远不会免费发行。TAP在锁定时也具有非常强大的效用,这使得它(在我们的观点中,可能会有偏见)成为有史以来发布的最强大的协议代币之一,具有长期的通胀计划。根据Tapioca的文档,可能需要超过10年的时间才能达到总量的90m TAP(TAP还具有固定供应)。虽然FDV或“全面稀释估值”可能看起来很高,可能会损害其上涨,但我们相信聪明的资金会看到机制和可持续的通胀并加入。

twTAP 是一种创新的托管代币模型,利用了Tapioca的时间加权平均幅度锁定(twAML)系统,是一种全链NFT,这意味着它是可转让的!解释twTAP的最佳方式是,如果用户通过veCRV控制时间价值,而twTAP在锁定期间也不像veCRV那样衰减。

想象一下,如果在Curve Wars的高峰期,参与者必须锁定超过四年才能获得最大奖励(每锁定1个CRV获得1个veCRV),而在当前熊市期间的时间较短。这本身就确保了TAP将被大量锁定,更不用说twTAP锁定者将获得平台费用的所有协议收入,这些费用是从用户在20多条链上进行借贷产生的。是的…

最有趣的是,锁定者还将获得Tapioca DAO拥有的LP交易对产生的一半收益,这些交易对使用Arrakis Finance的Uniswap V3 Vaults;这些锁定者的双重收益流(在我们的观点中)可能是有史以来最具吸引力的代币锁定激励之一,特别是随着Uniswap V3 DAO LP收益共享的推出-用户交易Tapioca的usd0(和TAP)支付给锁定者是相当不错的。twTAP还提供选项规则来控制每个市场分配的总选项。这可能会引入类似于Jones DAO、GMX、Benqi等协议的“Curve War”效应,它们会激励自己资产的市场,因为它们会激励它们的借贷市场保持高流动性。

- oTAP 是一种全链NFT,借款人在锁定其借出资本一段时间后每周都会收到。oTAP简单地是TAP的美式看涨期权,或者购买TAP低于其市场价值的权利(但不是义务)。

为了简化,锁定资本的借款人将获得以低于市场交易价格购买TAP的能力。这提供了“保证”的利润,或者您可以用它来获得更多的twTAP,从而每周获得更多的协议收入。这种折扣可以根据借款人的锁定期限和当前的“AML”(稍后详细介绍)而变化,范围从5%到50%。

巧妙之处在于使用看涨期权而不是债券为TAP创造了价格底线。这些折扣并非恒定不变。如果具有50%折扣的借款人在TAP为2美元时收到oTAP,他们可以以1美元购买TAP。如果TAP跌至1.50美元,他们的期权仍然是1美元。

如果TAP的价格下跌足够多,这些期权将变得虚值或无利可图,因此将到期。其次,oTAP通过用户赎回看涨期权创建POL。Tapioca将这些POL提供给其Arrakis UniV3 LP交易对,这是Tapioca在许多链上使其资产流动的方式。说到它的资产…

- usd0 是Tapioca的非算法和超抵押CDP(抵押债务头寸)稳定币,可以与Abracadabra的MIM相提并论,因为两个平台都使用Bentobox和Kashi。然而,usd0显然已经注意到了MIM的错误和不足之处,并且还实施了一些全新的功能。

与MIM不同,没有多签发行usd0-相反,当提供抵押品时,它是不断地无需信任地发行的。usd0也是通过网络代币和流动权益衍生品发行的,例如ETH、AVAX、MATIC等,以及Lido stMATIC和Rocket Pool的rETH。这使usd0具有抵制审查的特性,因为它不是由像USDC这样的中心化代币支持,而且通过使用更高质量的抵押品,可以保护它免受MIM在LUNA、wMEMO和FTT方面遇到的短缺情况的影响。

usd0也不是以固定利率发行,而是以弹性利率发行-Tapioca认为ETH是最具吸引力的抵押品,因此所有抵押品都具有与ETH的“债务比率”。如果usd0以1亿美元的ETH作为抵押,当MATIC债务达到5000万美元时,MATIC的利率将达到最大值(1:2债务比率)。

最重要的是,usd0(和TAP)使用Layerzero OFT20代币超标准,使其具有本地可组合性-在代币合约内部即时在链之间传输,无需费用或滑点。因此,这是第一个真正的跨链去中心化稳定币。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。