作者:Ignas,Stacy

编译:Luccy,BlockBeats

编者按:这个周期里,degen 最活跃的领域在空投挖矿和 meme 币,与之相对应的是似乎灭亡的 DeFi 代币。但在质押叙事下,Pendle 仍然保险良好,在同一时期内上涨了约 750%,且 Uniswap 的费用开关可能成为其他 DeFi 协议效仿的转折点。

DeFi 研究员 Ignas 和 Stacy 就近期趋势做了讨论,他们认为目前还没有达成任何改变游戏规则的山寨币季节。但 Ignas 仍然看涨 DeFi,BlockBeasts 将原文编译如下:

DeFi(去中心化金融)领域的 OG 代币似乎已经死了。

但市场即将迎来一次重大转变,一波新的 FOMO 浪潮即将涌向 DeFi。以下是 DeFi 即将上涨的原因:

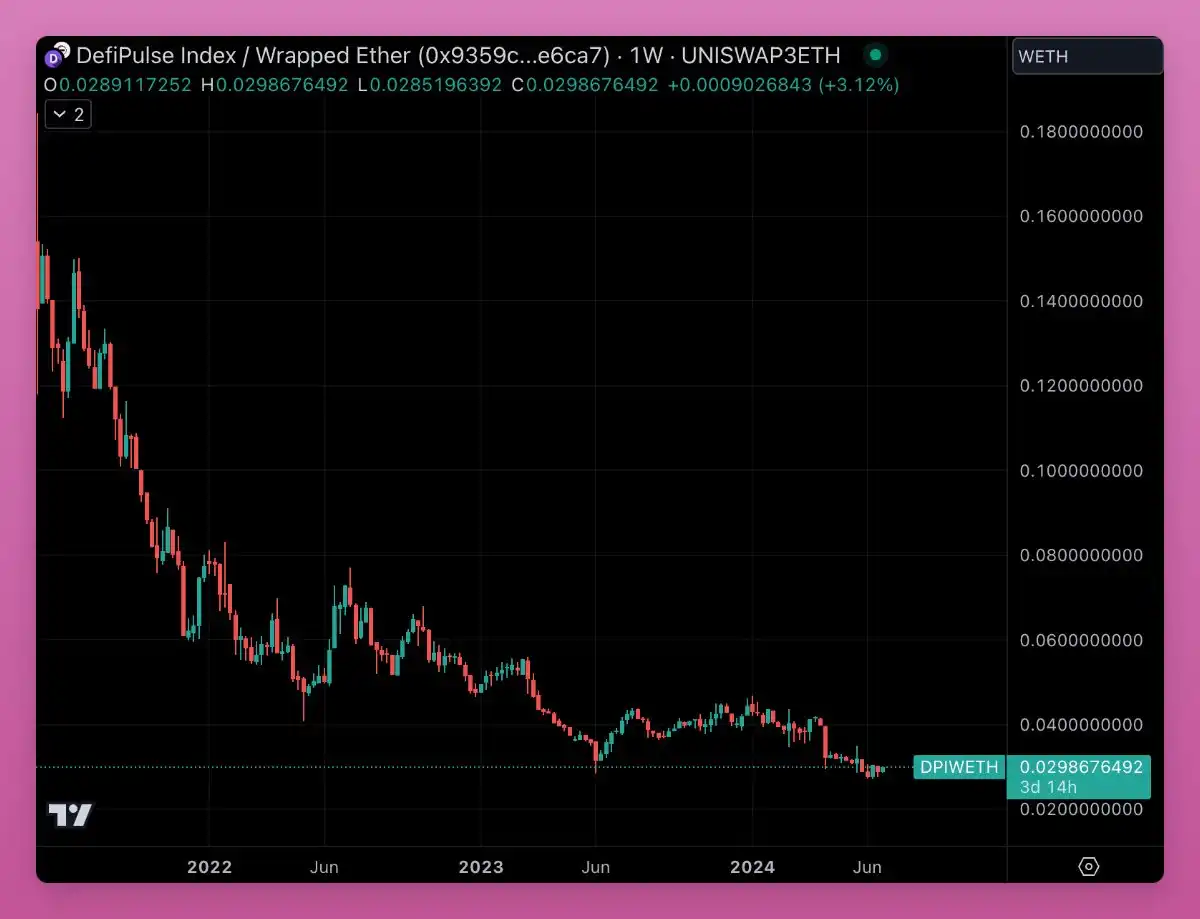

DeFi 代币的表现远远落后于 ETH。DeFi Pulse 指数(DPI)已经连续三年相对于 ETH 下滑。而在这个周期中,ETH 本身的表现也落后于 BTC。DPI 包括 UNI、MKR、LDO、AAVE、SNX、PENDLE 等代币。

唯一的例外是 PENDLE,在同一时期内上涨了约 750%。

为什么是 Pendle?答案是多方面的。他们在 points meta 期间成功找到了一个强大的产品市场契合度(PMF)。

空投挖矿和 meme 币是这个周期里 degen 最活跃的领域。

空投挖矿达到了一个转折点:低流通量的项目启动是抛售空投事件,而高 FDV 意味着更多的代币将不断被抛售到市场上。但没有人想买这些代币!而且,每一个成功的 meme 币背后都有 99 个走向归零。

DeFi OG 代币是空投挖矿和 meme 币的对立面:

首先,大量的 DeFi OG 代币已经在市场上流通。以市值/全面稀释估值(MC/FDV)比率为例:

- SNX - 1

- MKR - 0.95

- AAVE - 0.93

- LDO - 0.89

- UNI - 0.75

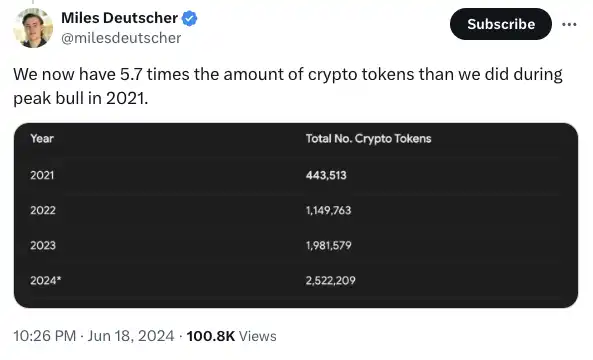

这样对持有者的抛售压力更小。对立面在代币发行中继续:在短短 6 个月内,我们已经铸造了超过 54 万个新代币。交易者的关注和资本被分散得很薄。然而,只有少数几个 DeFi OG 代币拥有稳固的业务和收入来源。如果资金开始流入。

meme 币在金融虚无主义和压制性的监管环境中蓬勃发展。但是,监管明确性可能带来最大的牛市,由以下因素驱动:

- 从叙述转向产品市场契合度(PMF)

- 成功的明确指标

- 更容易获得资金

- 繁荣的并购(M&A)市场

参考阅读 Hartmann Capital 管理合伙人 @FelixOHartmann 的推文。如果监管明确,数字资产市场可能会以开启迄今为止最大的牛市的方式进行转型。有几个预测很突出:

· 从叙事到产品市场契合度的转变

由于目前加密资产没有合规地计值的途径,因此大多数加密资产发行人甚至懒得创造能够获取价值的产品。具有讽刺意味的是,获取价值的能力是一个很好的试金石,可以确定产品本身是否真正需要足够的资金,让消费者放弃他们辛苦赚来的钱。取而代之的是,加密货币创始人经常构建消费者很少关心的东西,他们不得不向用户支付代币才能使用它们。所以发生了一些事情。建筑质量提高了,而且......

· 项目将有更明确的指标来衡量成功

目前,许多数字资产估值似乎是纯粹基于情绪和补偿的自由浮动数字。虽然大多数市场肯定效率不高,因为即使是股票的交易也往往与其收益相去甚远,但股票市场确实在将奶油提升到顶峰方面做得相当不错。因此,具有最实质性产品市场契合度和收益的代币可能会开始更频繁地主导对话和投资组合。这反过来又导致...

· 数字资产融资环境更宽松

数字资产的资金主要偏向于私募市场,而代币发行后筹集资金的能力往往会根据创始人所处的市场制度而变成掷骰子。这导致了「另类」的周期性上升和下降,每个新周期都会带来一批新项目,这些项目在私人融资时筹集了精彩的一轮融资,并且经常耗尽资金或未能适当地利用下一个熊市,有时即使他们实际上构建了一个很好的产品。然后,私募市场轮换到下一个队列。通过这种轮换,有相当多的重复成本和价值被丢弃。因此,更强大的基本面将使协议能够更容易地筹集资金,同时使......

· 蓬勃发展的并购市场

在整个 2022-23 年,我们目睹了许多 DeFi 项目被搁置一旁,这些项目本可以成为资金更充足的 DeFi 项目的主要收购目标。例如,资金雄厚的 Uniswap 或资本相当雄厚的 AAVE 可能会通过收购链上永续合约和期权市场中许多运作良好但资本不足的参与者中的一些来扩大其产品并成为 DeFi 超级应用程序,或者通过促进与领先的现实世界资产(RWA)协议之一的代币交换来更实质性地进入现实世界的资产,这些协议的交易价格约为 Uniswap 市值的 1%。加密资产个体和整个市场的成熟可能会为真正精明的交易者和运营商打开大门,以我们以前在数字资产中从未见过的方式建立价值,并实质性地加速产品开发和创新,这反过来又使我们更接近采用。例如,一些 Layer 1 区块链可能会利用并购来获取非常需要的产品,并将其转化为公共产品。这将降低用户的成本,同时增加链本身的使用和燃料支出,推动网络代币的价值(胖协议论点表达了它的问津)。

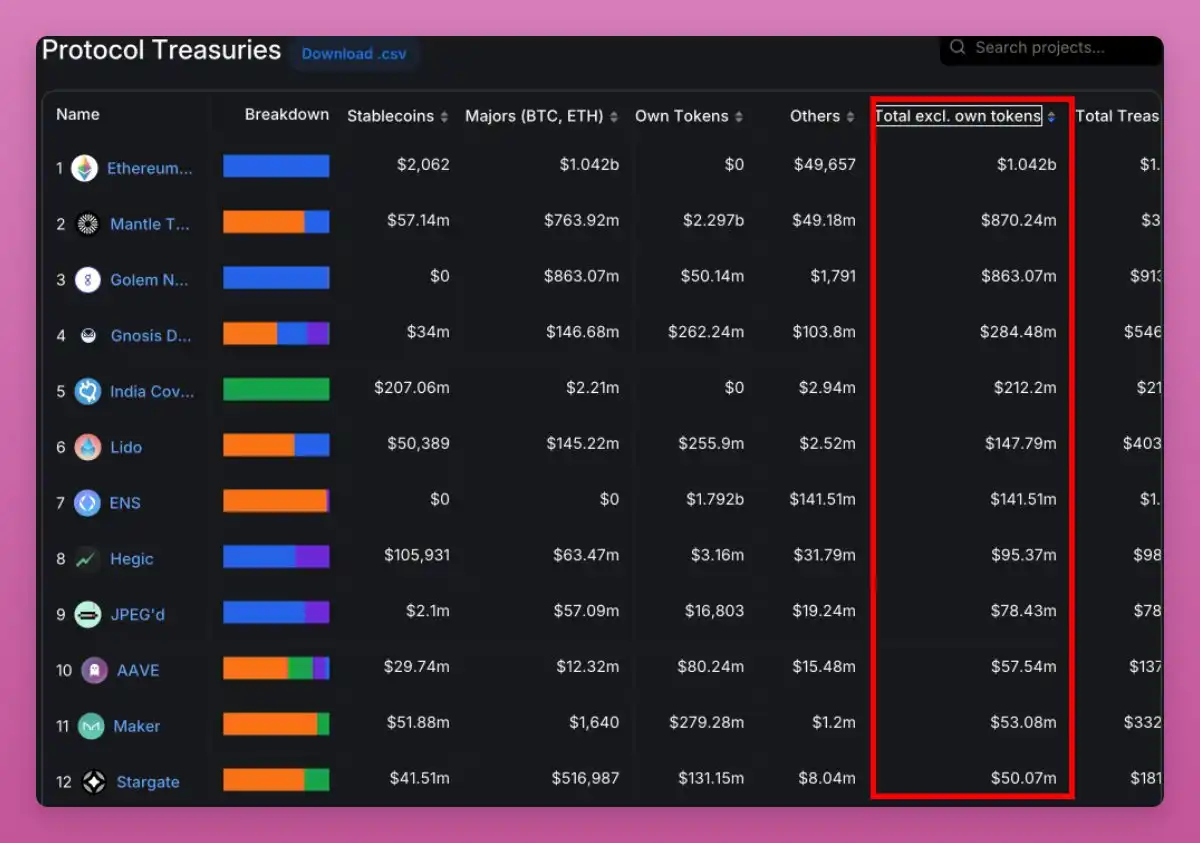

DeFi 在加密领域有着最明确的产品市场契合度(PMF):我们在去中心化交易所(DEX)进行交易,在借贷市场进行借贷,使用 DeFi 稳定币或 LST 作为抵押品等。此外,老牌 DeFi 团队拥有大量的资金储备——他们可以在不抛售代币的情况下,持续多年进行开发建设。

DeFi 代币的问题在于它们缺乏实际用途。然而,这一情况开始有所改变:Uniswap 的费用开关可能成为其他 DeFi 协议效仿的转折点,UNI 在这一消息传出后大涨。此外,监管明确性可能加速收益共享的趋势。

另一个问题是,DeFi 1.0 太无聊了。但只要价格上涨,新鲜事物总是有趣的。然而,DeFi 代币经受住了时间的考验。它们经历了 2020 年的新冠疫情崩盘和 2022 年的中心化金融(CeFi)崩溃。正如 @sourcex44 所说,「唯一真正的审计是经受住时间的考验」。

我相信 DeFi 代币现在是反向交易的好选择。目前持有原始 DeFi 代币的人很少,这就像我们在熊市期间积累 ETH,却看到 SOL 上涨一样。所以如果趋势改变,只有少数 OG 代币能吸引资金流入。

时机非常关键。我们正处在一个转折点,厌倦了新的 L2、名人币,并在等待下一步会是什么。也许「下一步」会是老牌的 DeFi 代币?我认为它们有很大的爆发潜力。

这篇帖子是对 Stacy 关于 DeFi 代币问题的回应。这些代币大多数都很无聊,但如果拥有稳固的业务、良好的财务状况,且在监管明确和代币实用性提高的情况下,DeFi 有可能再次崛起。

DeFi 代币有错吗?你可以将投资组合价值下降归咎于 Mt. Gox、矿工奖励或任何其他黑天鹅事件。但它们只是噪音,真正的问题更根本在于以下几个方面:

每个市场都代表着在其参与者之间重新分配的某种价值。在某些点上,不同的市场会趋同。ETH 和 BTC 现货 ETF 就是一个典型的例子。新的资本流入,但并没有走得更远;交易 ETF 的资本收益留在传统交易所。

与此同时,现有的加密货币用户受益于流入现货 ETF 的新资本,他们的收益通常会被再投资,从逻辑上讲,这应该会导致山寨币季节——但这一次,情况有所不同。

自 2024 年 3 月以来,我们看到了几个主要趋势:

• 来自顶级协议的一系列空投和积分计划

• Tier-2 协议急于宣布其代币销售和 TGE

• 模因币成为主要元之一

• TON 在其生态系统中加入规范

少数表现出良好增长的 DeFi 协议显然与上面列出的趋势有关。现在,我们有了这个设置:

• 比特币和以太坊的收益仅部分结算在加密货币中。

• 鉴于元,这些收益大多再投资于新的代币或模因币,或用于刷点数(锁定在新协议中)。

• 其他 DeFi 协议没有经历任何价格走势,持有者开始失去希望。

• 在 TGE 之后,很少有新协议有上升趋势,部分原因是空投接受者的抛售压力和缺乏新资金。

• Alts 不断出血。

• 模因币的狂热不断吸引着越来越多的投资者,再次分散了 DeFi 代币的潜在新资金。

• 比特币和以太坊受到的影响最小,因为现货 ETF 投资者。

• TON 凭借其规范的入职工作和迷你应用程序袖手旁观。它的生态系统还不是更广泛的 DeFi 的一部分。

同时,DeFi 中没有下一个大元。用户体验的改善和效率的修复都很重要——但它们并不能吸引新用户,类似于早期的 DeFi、NFT,甚至是 GameFi。

• 空投并不新鲜。

• 稳定币收益率并不新鲜。

• GameFi 并不新鲜。

• 大多数 Web3 协议的 FDV 已经相当公平,但每天都有新的 dApp 出现,这些 dApp 的条款更有利可图,这增加了协议的供应,但没有刺激新的需求。

当以太坊现货 ETF 开始交易时(可能是 7 月初),我们将看到一些新资金涌入以太坊,加密原生 ETH 持有者可能会开始将收益再投资到 DeFi 中——但整体情况不会有太大变化。新资金将进入趋势元(AI、RWA、DePIN、模因币),而 DeFi OG 将难以至少与 ETH 竞争。

没关系。新赛季有自己的新英雄。是什么让 DeFi 再次伟大?基本上是两件事:新的(全新的)叙事和营销。

DeFi 的总市值为 900 亿美元,包括 stETH 等 LST(32 亿美元)和 DAI 等 DeFi 稳定器(50 亿美元)。相比之下,ETH 的市值为 4040 亿美元。

与传统金融相比,DeFi 有很多优势,包括更有利可图的被动收益场景。但是你有没有看到任何广为人知的 DeFi 应用程序向 Web2 用户推广他们的收益产品?

当使用 DeFi 就像使用经典银行应用程序一样简单,并且 DeFi 开始被提升为常态时——我们最终将看到一个新的 DeFi 季节。或者,我们需要一个新的元,它将为 DeFi 注入新的资金——类似于早期的 GameFi、NFT,甚至是 DeFi 本身。

这个新的元将获得最多的关注,一部分资本将流向更广泛的 DeFi。类似于仓鼠快打或 Notcoin 的狂热如何推动 TON 更广泛的生态系统。但是我们现在有类似的东西吗?最近,我和 Ignas 聊了聊,我们讨论了当前的趋势。我们之前有没有达成任何改变游戏规则的山寨币季节?没有。

我知道这篇文章可能会令人失望。看涨内容在 CT 上获得最多关注,因为人们愿意相信他们的口袋会赚钱,我知道这种感觉。

我的投资组合中有很多 DeFi 代币正在流血,但我想现实一点。我怀疑 DeFi 代币今年是否会达到他们的 ATH。如果我错了,我会很高兴。

对标题党行为表示抱歉,我确实相信 DeFi 有机会迎来一个大的复兴。加密领域的叙述变化很快,资本的轮动会让很多人处于旁观状态。

目前,meme 币正处于聚光灯下,你可能会笑话我对 DeFi 持乐观态度。然而,基本面是稳固的。重要的是其他人开始相信它的重要性,而这种信念可能会比你想象的更快恢复。只要 DeFi 在一段时间内表现优于其他代币,其他人就会出现 FOMO。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。